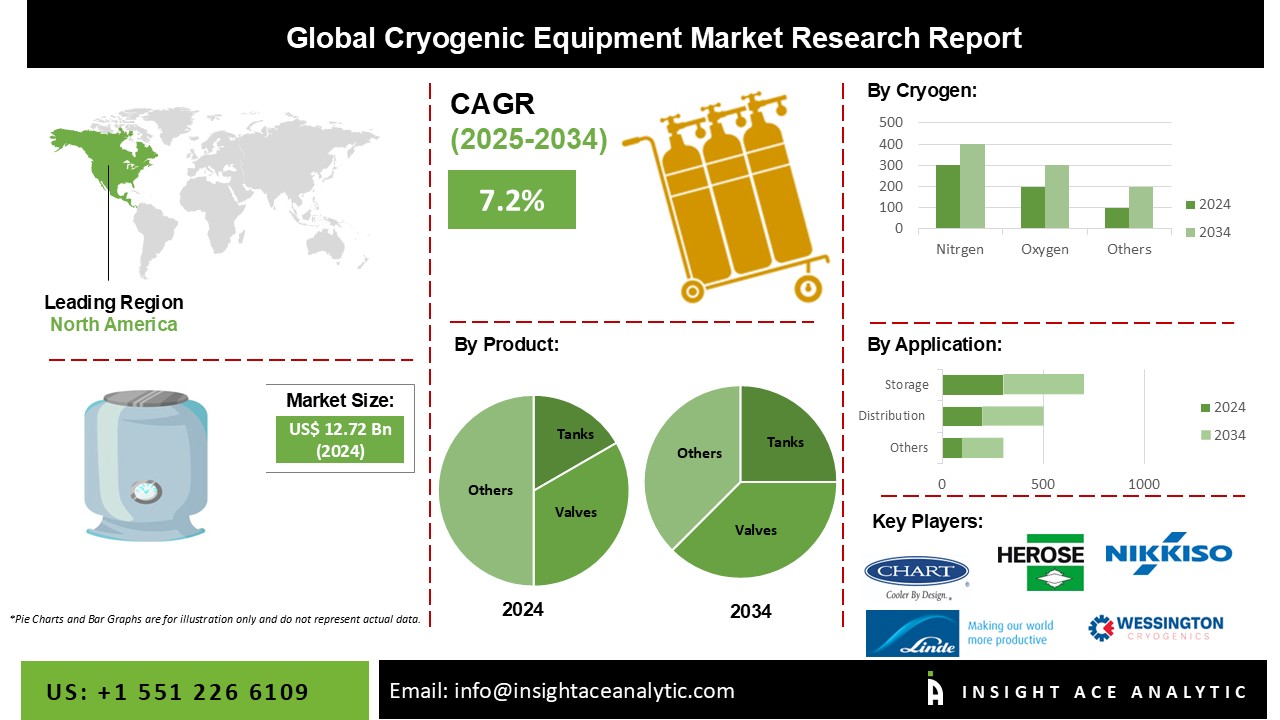

The Global Cryogenic Equipment Market Size is valued at USD 12.72 billion in 2024 and is predicted to reach USD 25.25 billion by the year 2034 at a 7.2% CAGR during the forecast period for 2025-2034.

Liquefied natural gas (LNG) and industrial gases are primarily transported and stored using cryogenic equipment in the oil and gas sector. The industrial sector's growth is essential for economic development and raising public awareness of the importance of producing sustainable energy sources. These attributes have a significant impact on the market's expansion.

Rising investments in LNG-based power plants and rising demand for the transportation and storage sectors also drive the market. With their inert nature, cryogenic gases are ideal for keeping samples from space, and rising spending on space and satellite missions is predicted to fuel demand for these products. Cryogenic equipment has a huge opportunity to develop its market due to the growth of LNG-based power plants as a clean energy source due to the depletion of coal supplies.

However, the global industry has been significantly impacted by the COVID-19 pandemic. During the pandemic, several industries stayed shut down, which reduced the demand for several gases and hampered industry expansion. Nonetheless, there remained a significant need for liquid oxygen for medical uses.

The Cryogenic Equipment Market is segmented based on equipment, cryogen, end-user industry, system type, application. Based on equipment, the market is segmented as valves, vaporizers, pumps, other equipment. The cryogen segment includes nitrogen, argon, oxygen, LNG, hydrogen, other cryogens. Based on the end-user industry, the market is segmented into metallurgy, energy & power, chemical, electronics, transportation, other end-user industries. The system type segment includes storage system, handling system, supply system, others. Based on the application, the market segmented into Casu (Cryogenic Air Separation Unit), Non-Casu (Non-Cryogenic Air Separation Unit).

Based on equipment, the market is segmented as valves, vaporizers, pumps, other equipment. The pumps segment is a major contributor to the cryogenic equipment market. Cryogenic pumps are crucial for transferring cryogenic fluids such as liquid nitrogen, oxygen, and argon under high pressure and extremely low temperatures. They are widely used across various industries, including healthcare for liquid oxygen supply, as well as in energy, metallurgy, and LNG (liquefied natural gas) sectors. These pumps play a vital role in storage, transport, and distribution systems, with common types including centrifugal, reciprocating, and diaphragm cryogenic pumps. In addition to pumps, valves are essential for controlling the flow and pressure of cryogenic gases and liquids, serving a critical role in safety and regulation, though they generally hold a lower market value and volume. Other cryogenic equipment, such as tanks, hoses, compressors, and cold boxes, is often customized and capital-intensive, contributing a smaller but stable share to the overall market.

The cryogen segment includes nitrogen, argon, oxygen, LNG, hydrogen, other cryogens. The increase in LNG demand in emerging markets is primarily to blame for the sector growth. This enormous expansion and, subsequently, the cryogenic equipment business are projected to be aided by ongoing improvements in LNG storage technologies. The most important element for many businesses to carry out a number of essential applications is oxygen, an oxidizer. It is anticipated that the rapidly expanding metal processing sector would increase demand for liquid oxygen for cast iron furnace blasts while lowering exhaust gas emissions. Oxygen is crucial for welding in the automobile industry, medical and healthcare fields, and rocket fuels.

Asia Pacific's cryogenic equipment market is expected to register the highest market share in revenue in the near future. The availability of raw supplies, increasing industries, and affordable labor are the key variables determining regional growth. Furthermore, increased demand for gas-fired power plants due to increased renewable energy awareness and significant growth in power demand is projected to help the industry. North America is also expected to contribute significantly to revenue. Growing concerns over natural gas resources and increased construction activity are driving the regional economy forward. Increasing favorable regulatory conditions for the development of low-emission elements are predicted to enhance their use.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 12.72 Bn |

| Revenue forecast in 2034 | USD 25.25Bn |

| Growth rate CAGR | CAGR of 7.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2024 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | By Equipment, Cryogen, End-User Industry, System Type, Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia; |

| Competitive Landscape | Linde plc, Air Liquide S.A., Air Products and Chemicals Inc., Chart Industries Inc., Parker-Hannifin Corp., Flowserve Corp., Nikkiso Co. Ltd., Inox India Ltd., Taylor-Wharton, Emerson Electric Co., Wessington Cryogenics Ltd., Sulzer Ltd., Acme Cryogenics Inc., SHI Cryogenics Group, Fives SAS, Cryofab Inc., Herose GmbH, Cryostar SAS, Shell-N-Tube Pvt. Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cryogenic Equipment Market- By Equipment

Cryogenic Equipment Market - By Cryogen

Cryogenic Equipment Market - By End-User Industry

Cryogenic Equipment Market - By System Type

Cryogenic Equipment Market - By Application

Cryogenic Equipment Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.