Clinical Trials Management System Market Size is valued at 2.0 billion in 2024 and is predicted to reach 7.3 billion by the year 2034 at a 13.7% CAGR during the forecast period for 2025-2034.

The market is anticipated to rise due to the rapidly expanding healthcare IT industry, demand for decentralized clinical trials, activities by significant companies, and an increasing number of clinical studies. The WHO estimates that 65,409 clinical trials were conducted globally in 2020, and this amount was significantly more than the 60,543 trials completed in 2019. It is predicted that this will increase demand for CTMS solutions.

The Clinical Trials Management System (CTMS) market was greatly affected by the COVID-19 pandemic. These included problems with clinical trials, difficulties finding patients, and postponed or cancelled investigations. However, the detrimental effect was eventually lessened by several strategic steps taken by authorities, governing bodies, and market participants to guarantee the continuation of R&D. Decentralized clinical trials were more widely used due to the requirement to create vaccinations against the coronavirus. To immediately advance COVID-19 vaccine equity, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) published guidelines. The IFPMA announced that 14 additional members were in the clinical development stage and that 5 of its members had gotten permission for COVID-19 vaccines.

The Clinical Trials Management System market is segmented by solution type, delivery mode, component, and end user. The market is segmented as Enterprise and Site based on solution type. By the delivery mode, the market is segmented into Web & Cloud-based, and On-premise. By component, the market is segmented as Software and Services. By end user, the market is segmented as Pharmaceutical and Biotechnology Firms, Medical Device Firms, CROs & Others.

Many systems were web and cloud-based, which has advantages like remote data access and few technical problems. These CTM systems are the most popular ones, and they assist in reducing expenses related to system security, backups, upgrades, and uptime reliability. Additionally, web- and cloud-based systems enable the centralization of data, which makes it easier to access data from any location, as well as store enormous volumes of data. Growth is anticipated to be fueled by these factors over the predicted period.

In terms of components, the software sector held the largest market share for Clinical Trials Management Systems (CTMS). On the other hand, the services sector is anticipated to expand at the fastest rate in the upcoming years. The programme assists in carrying out crucial tasks such as thorough trial planning, monitoring operations, regulatory processes, supply management, and financial management. They are often installed at the corporate or site level via subscription. Frequent software updates and additions could also boost sales.

North America's Clinical Trials Management System (CTMS) market has the most significant revenue share. The presence of essential corporations and the growing use of technology in R&D can be blamed for the North American region's significant market share. Its regional expansion is also attributable to favourable regulatory policies and rising pharmaceutical company investment. Leading provider of clinical endpoint technology, ERT, combined with Bioclinica in November 2021 to establish Clario. This made it possible for the business to offer technologically based therapeutic area solutions to fulfil the goals of clinical trials.

|

Report Attribute |

Specifications |

|

Market size value in 2024 |

USD 2.0 Bn |

|

Revenue forecast in 2034 |

USD 7.3 Bn |

|

Growth rate CAGR |

CAGR of 13.7% from 2025 to 2034 |

|

Quantitative units |

Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

|

Historic Year |

2021 to 2024 |

|

Forecast Year |

2025-2034 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

|

Segments covered |

Solution Type, Delivery Mode, Component, And End User |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

|

Competitive Landscape |

IQVIA Inc.; Medidata (Dassault Systèmes); Oracle; DATATRAK International, Inc.; Clario; SimpleTrials; Calyx; RealTime Software Solutions, LLC; Laboratory Corporation of America Holdings; Veeva Systems; Wipro Limited; PHARMASEAL International Ltd. |

|

Customization scope |

Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing and available payment methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Clinical Trials Management System (CTMS) Market Snapshot

Chapter 4. Global Clinical Trials Management System (CTMS) Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Solution Type Estimates & Trend Analysis

5.1. by Solution Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Solution Type:

5.2.1. Enterprise

5.2.2. Site

Chapter 6. Market Segmentation 2: by Delivery Mode Estimates & Trend Analysis

6.1. by Delivery Mode & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Delivery Mode:

6.2.1. Web & Cloud-based

6.2.2. On-premise

Chapter 7. Market Segmentation 3: by Component Estimates & Trend Analysis

7.1. by Component & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Component:

7.2.1. Software

7.2.2. Services

Chapter 8. Market Segmentation 4: by End-user Estimates & Trend Analysis

8.1. by End-user & Market Share, 2024 & 2034

8.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-user:

8.2.1. Pharmaceutical and Biotechnology Firms

8.2.2. Medical Device Firms

8.2.3. CROs & Others

Chapter 9. Clinical Trials Management System (CTMS) Market Segmentation 5: Regional Estimates & Trend Analysis

9.1. North America

9.1.1. North America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Solution Type, 2021-2034

9.1.2. North America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Delivery Mode, 2021-2034

9.1.3. North America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Component, 2021-2034

9.1.4. North America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by End-user, 2021-2034

9.1.5. North America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.2. Europe

9.2.1. Europe Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Solution Type, 2021-2034

9.2.2. Europe Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Delivery Mode, 2021-2034

9.2.3. Europe Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Component, 2021-2034

9.2.4. Europe Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by End-user, 2021-2034

9.2.5. Europe Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.3. Asia Pacific

9.3.1. Asia Pacific Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Solution Type, 2021-2034

9.3.2. Asia Pacific Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Delivery Mode, 2021-2034

9.3.3. Asia-Pacific Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Component, 2021-2034

9.3.4. Asia-Pacific Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by End-user, 2021-2034

9.3.5. Asia Pacific Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.4. Latin America

9.4.1. Latin America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Solution Type, 2021-2034

9.4.2. Latin America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Delivery Mode, 2021-2034

9.4.3. Latin America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Component, 2021-2034

9.4.4. Latin America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by End-user, 2021-2034

9.4.5. Latin America Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

9.5. Middle East & Africa

9.5.1. Middle East & Africa Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Solution Type, 2021-2034

9.5.2. Middle East & Africa Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Delivery Mode, 2021-2034

9.5.3. Middle East & Africa Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by Component, 2021-2034

9.5.4. Middle East & Africa Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by End-user, 2021-2034

9.5.5. Middle East & Africa Clinical Trials Management System (CTMS) Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 10. Competitive Landscape

10.1. Major Mergers and Acquisitions/Strategic Alliances

10.2. Company Profiles

10.2.1. IQVIA Inc.

10.2.2. Medidata (Dassault Systèmes)

10.2.3. Oracle

10.2.4. DATATRAK International, Inc.

10.2.5. Clario

10.2.6. SimpleTrials

10.2.7. Calyx

10.2.8. RealTime Software Solutions, LLC

10.2.9. Laboratory Corporation of America Holdings

10.2.10. Veeva Systems

10.2.11. Wipro Limited

10.2.12. PHARMASEAL International Ltd.

10.2.13. Other Prominent Players

Clinical Trials Management System Market By Solution Type-

Clinical Trials Management System Market By Delivery Mode-

Clinical Trials Management System Market By Component-

Clinical Trials Management System Market By End User-

Clinical Trials Management System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

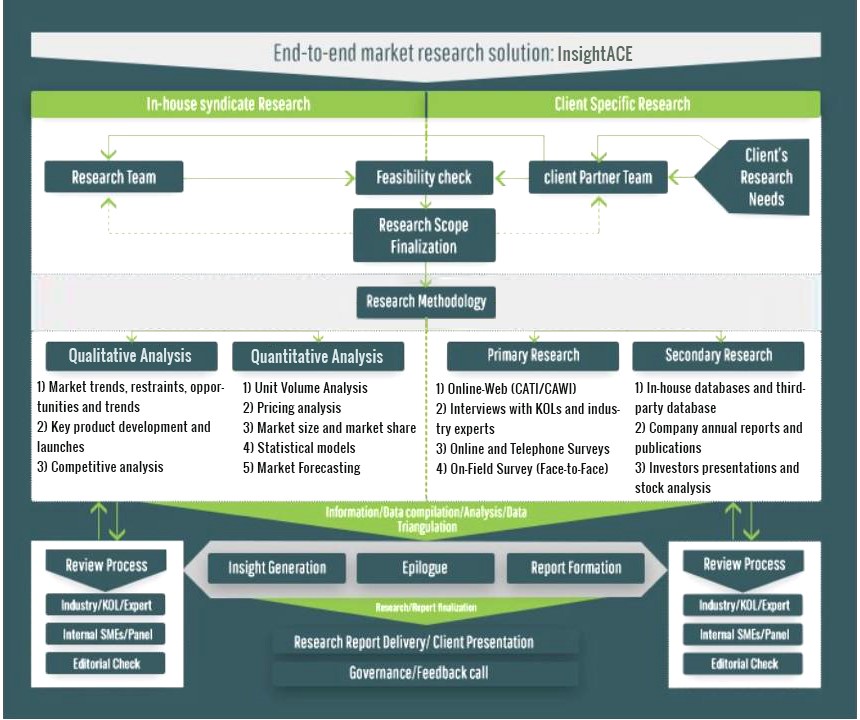

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.