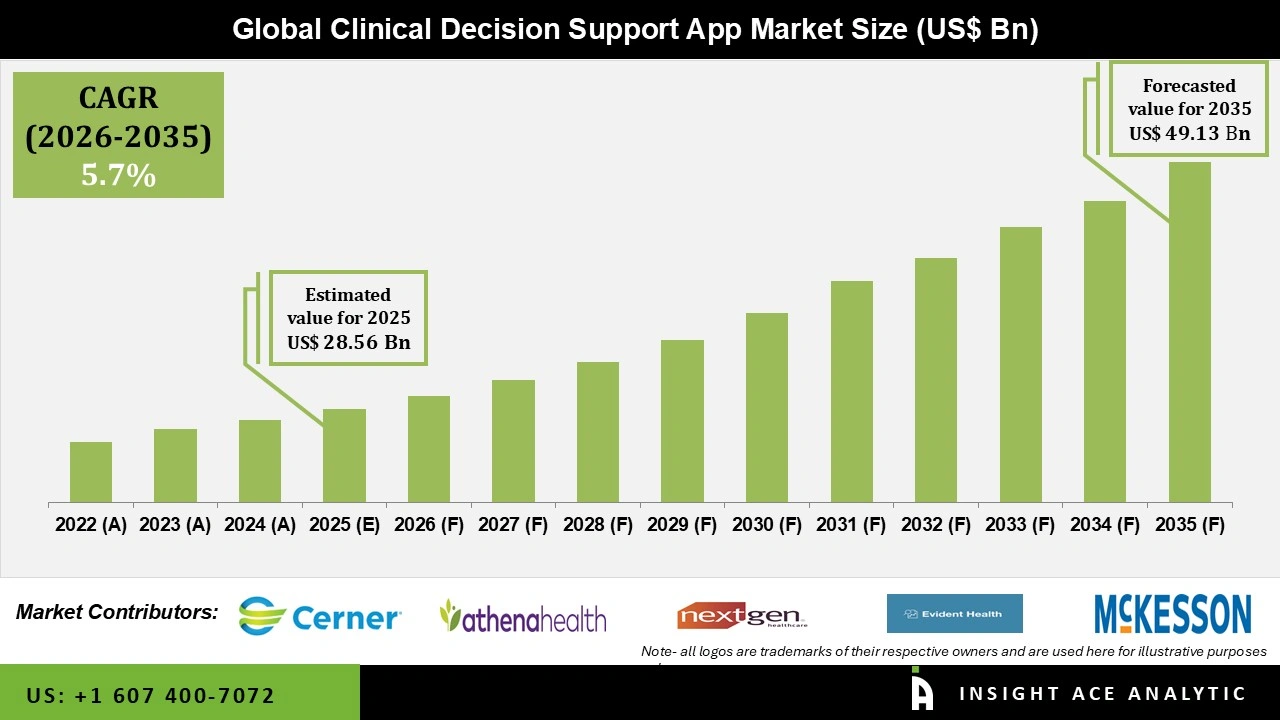

Global Clinical Decision Support App Market Size is valued at USD 28.56 Bn in 2025 and is predicted to reach USD 49.13 Bn by 2035 at a 5.7% CAGR during the forecast period for 2026 to 2035.

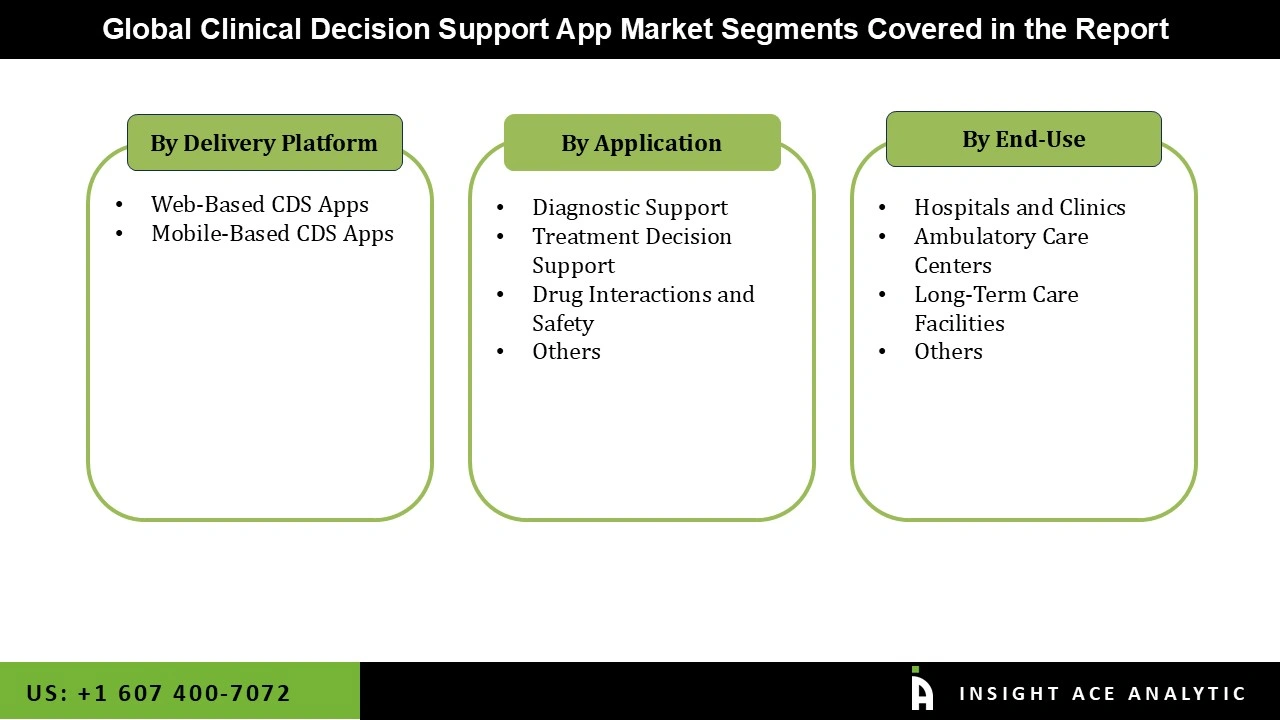

Clinical Decision Support App Market Size, Share & Trends Analysis Report By Delivery Platform (Web-Based CDS Apps, Mobile-Based CDS Apps), By End User (Hospitals And Clinics, Ambulatory Care Centres, Long-Term Care Facilities), By Application, By Region, and By Segment Forecasts, 2026 to 2035.

Clinical decision support (CDS) apps provide real-time, evidence-based information to physicians to improve patient care. They provide ideas, alerts, and instructions based on integrated health data and optimum approaches to reduce healthcare errors and improve decision-making.

Clinical decision assistance applications are increasing rapidly due to the adoption of digital health technologies, focus on patient safety, advancements in healthcare infrastructure, strong regulatory frameworks supporting innovation and data privacy, and the development of specialized and patient-centric CDS Solutions. Establishing clear data-sharing policies, fostering interoperable electronic health records, and funding for digital health advances are crucial. These efforts are expected to improve the use of clinical decision support systems globally. However, data privacy and security concerns and inadequate interoperability for patient management solutions are expected to hinder market growth.

The clinical decision support app market is segmented based on delivery platform, end user, and application. Based on the delivery platform, the market is segmented as web-based CDS apps and mobile-based CDS apps. By end user, the market is segmented into hospitals and clinics, ambulatory care centres, long-term care facilities and others. The market is segmented by application into diagnostic support, treatment decision support, drug interactions, and safety.

The drug interactions and safety category is expected to hold a major share of the global clinical decision support app market in 2024. Drug allergy warnings are crucial interventions because limiting adverse drug reactions (ADRs) and allergic responses to drugs might harm patient well-being. Healthcare facilities strive to safeguard the well-being and security of their patients and hence rely on CDSS, which offers effective drug allergy warning features that may mitigate the risk of medication-related injury. Moreover, drug allergy continues to be a common phenomenon since it is observed that over 33% of patients have some allergic response to medications.

The web-based CDS apps segment is projected to grow at a rapid pace in the global clinical decision support app market due to its accessibility and scalability. These can be accessed from any device with internet access, are easy to update and maintain, and are integrated with other web-based systems. Thus, HCPs can access critical selection support equipment and individual information, facilitating seamless collaboration, faraway consultations, and continuity of care.

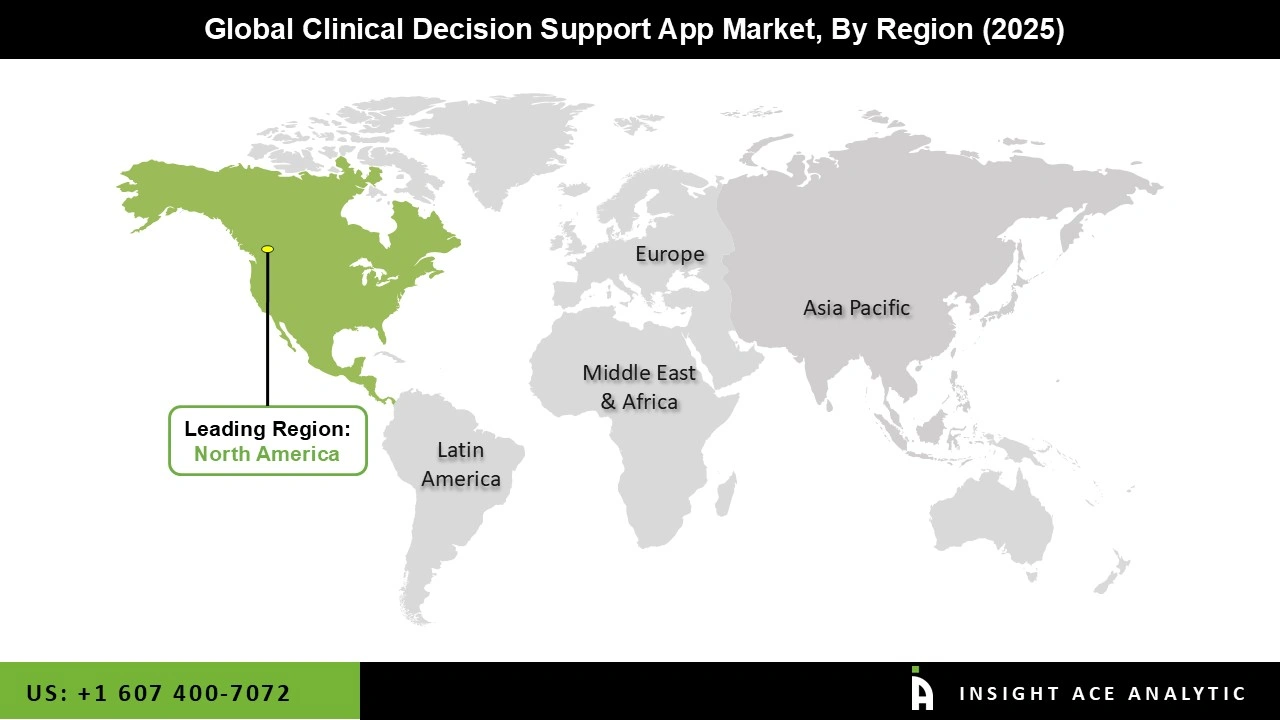

The North American clinical decision support apps market is leading the way, mainly because of the substantial demand for healthcare IT solutions, the presence of key players, rising significant investments in HCIT solutions, and the focus on providing high-quality healthcare services. In addition, the Asia Pacific region is estimated to grow rapidly in the clinical decision support apps market.

The expansion is propelled by a vast population base and rising investments in healthcare, AI, analytics, and healthcare innovation, as well as healthcare providers' adoption of CDS apps to improve diagnostic accuracy and provide personalized patient care.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 28.56 Bn |

| Revenue Forecast In 2035 | USD 49.13 Bn |

| Growth Rate CAGR | CAGR of 5.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Delivery Platform, End-users, Applications, |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Epic, Cerner, Athenahealth, NextGen Healthcare, Evident Health, eClinicalWorks, DrChrono, McKesson, Wolters Kluwer, IBM Watson Health, Nuance, Philips, GE Healthcare, Siemens Healthineers, and Eclipsys Solutions (NTT DATA) |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.