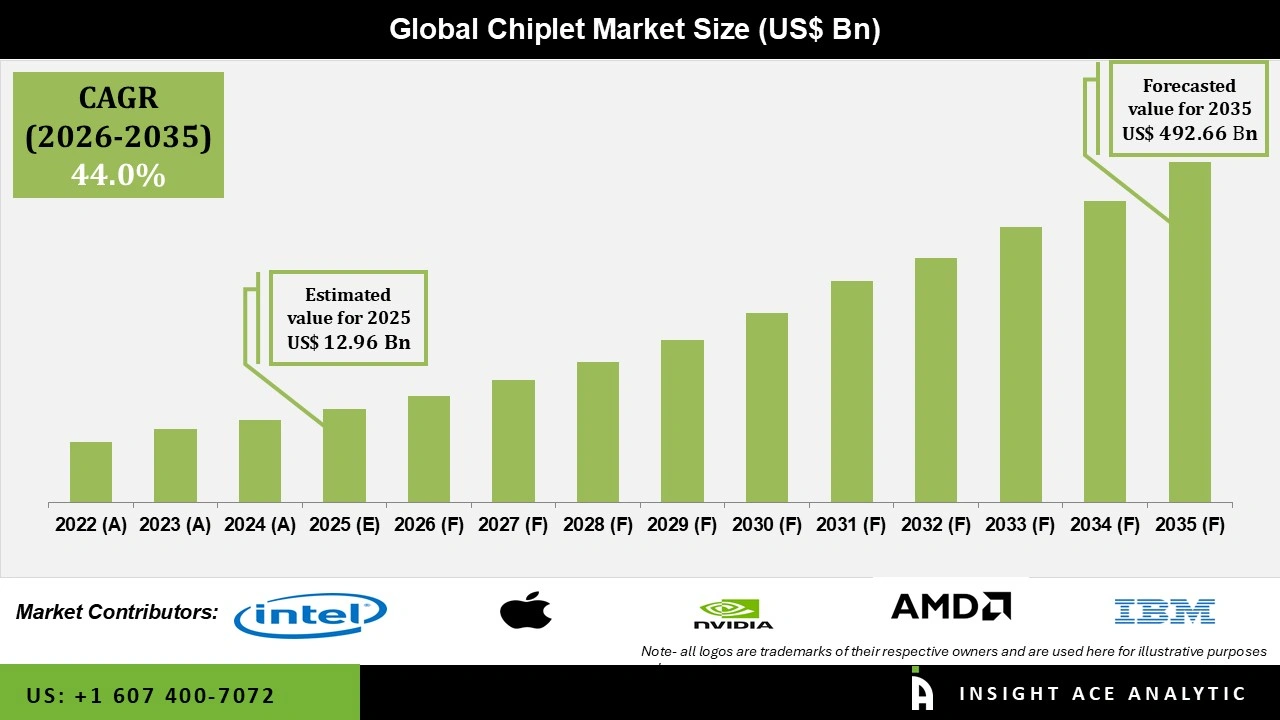

Global Chiplet Market Size is valued at USD 12.96 Bn in 2025 and is predicted to reach USD 492.66 Bn by the year 2035 at a 44.0% CAGR during the forecast period of 2026 to 2035.

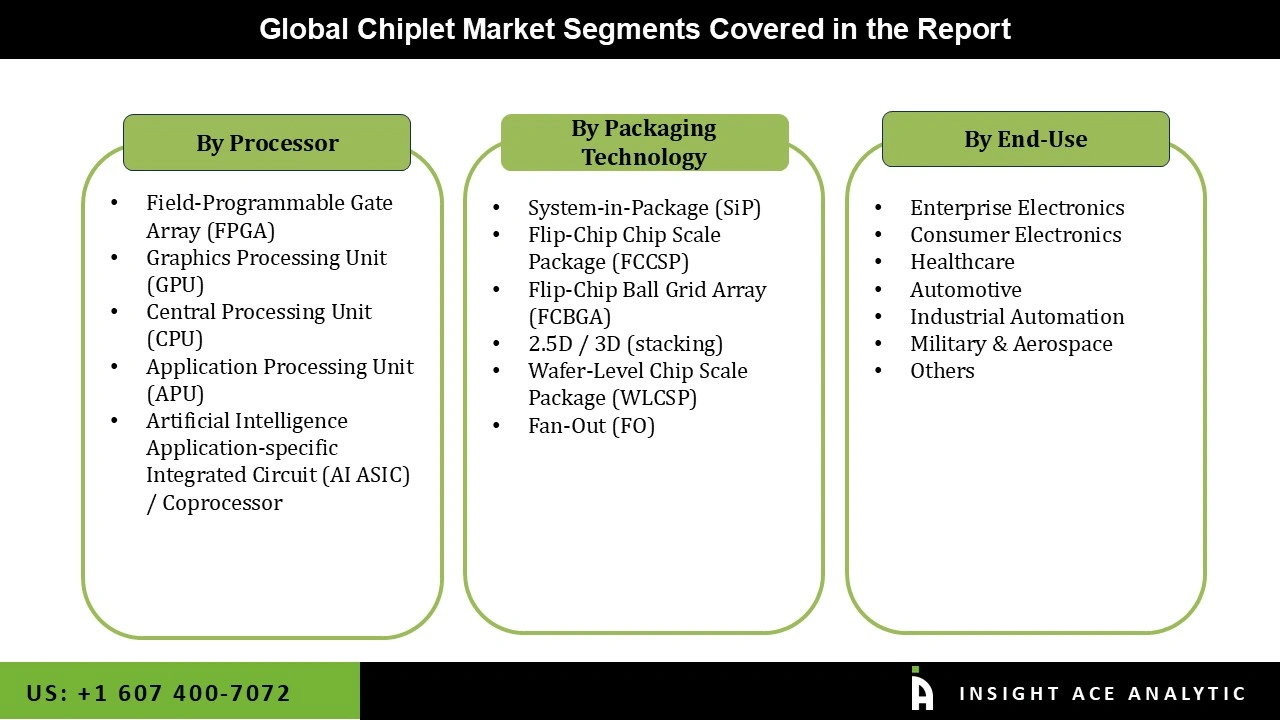

Chiplet Market Size, Share & Trends Analysis Report By Processor (Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application Processing Unit (APU), Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) / Coprocessor), By Packaging Technology (System-in-Package (SiP), Flip-Chip Chip Scale Package (FCCSP), Flip-Chip Ball Grid Array (FCBGA), 2.5D / 3D (stacking), Wafer-Level Chip Scale Package (WLCSP), Fan-Out (FO), By End Users, By Region and By Segments Forecasts 2026 to 2035.

Chiplets, discrete semiconductor elements that may be integrated to form more complex systems, offer a versatile and scalable solution perfectly suited to the trend of shrinking and increasingly sophisticated electronic devices.

The Chiplets market is expanding rapidly due to numerous causes, including rising need for improved performance and efficiency across a range of applications and a growing hunger for cutting-edge semiconductor technology. This growth in Chiplet market revenue is a direct consequence of increased investments by semiconductor manufacturers and technology firms in research and development (R&D) initiatives aimed at pioneering advanced Chiplet technologies. The market is taking notice of noteworthy technological advancements, such as 2.5D and 3D Chiplet packaging, which promise superior performance, increased power efficiency, and reduced form factors.

Furthermore, the surge in the power electronics sector's demand for Chiplets is attributed to the escalating focus on sustainability and energy efficiency. In this context, the desire for electronic devices to be more compact and feature-rich plays a pivotal role in propelling Chiplets market revenue growth.

The chiplet market is segmented on the basis of Processor, packaging technology and end-user. Based on the processor, the market is segmented as Field-Programmable Gate Array (FPGA), Graphics Processing Unit (GPU), Central Processing Unit (CPU), Application Processing Unit (APU), Artificial Intelligence Application-specific Integrated Circuit (AI ASIC) Coprocessor. By packaging technology, the market is segmented into System-in-Package (SiP), Flip Chip Chip Scale Package (FCCSP), Flip Chip Ball Grid Array (FCBGA), 2.5D/3D, Wafer-Level Chip Scale Package (WLCSP), Fan-Out (FO. By End Users, the market is segmented as enterprise electronics, consumer electronics, healthcare, automotive, industrial automation, military and aerospace and others.

The microprocessors category is expected to hold a major share of the global Chiplet market in 2022. Microprocessors as Chiplets can be more cost-effective. Instead of designing an entire system-on-chip (SoC) for each application, manufacturers can reuse microprocessor Chiplets in different products, reducing development costs. With the growing need for AI and machine learning capabilities, microprocessors designed for AI acceleration are being incorporated as chiplets in data centres, edge devices, and more, reflecting the market's evolving needs. Overall, the rising significance of microprocessors in the Chiplet market is driven by their ability to enhance performance, optimize power efficiency, and provide flexible, cost-effective solutions across a range of applications. This trend will likely to continue as technology advances and the demand for efficient and powerful computing solutions grows.

The automotive segment is estimated to grow rapidly in the global Chiplet market. The demand for high-performance chips is on the rise in applications such as autonomous driving, entertainment systems, and vehicle connectivity, primarily due to the increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles (EVs), and connected cars. Chiplets play a crucial role in enabling expedited data processing, enhanced sensor fusion, and improved communication capabilities within the automotive sector, leading to overall enhancements in vehicle performance, comfort, and safety.

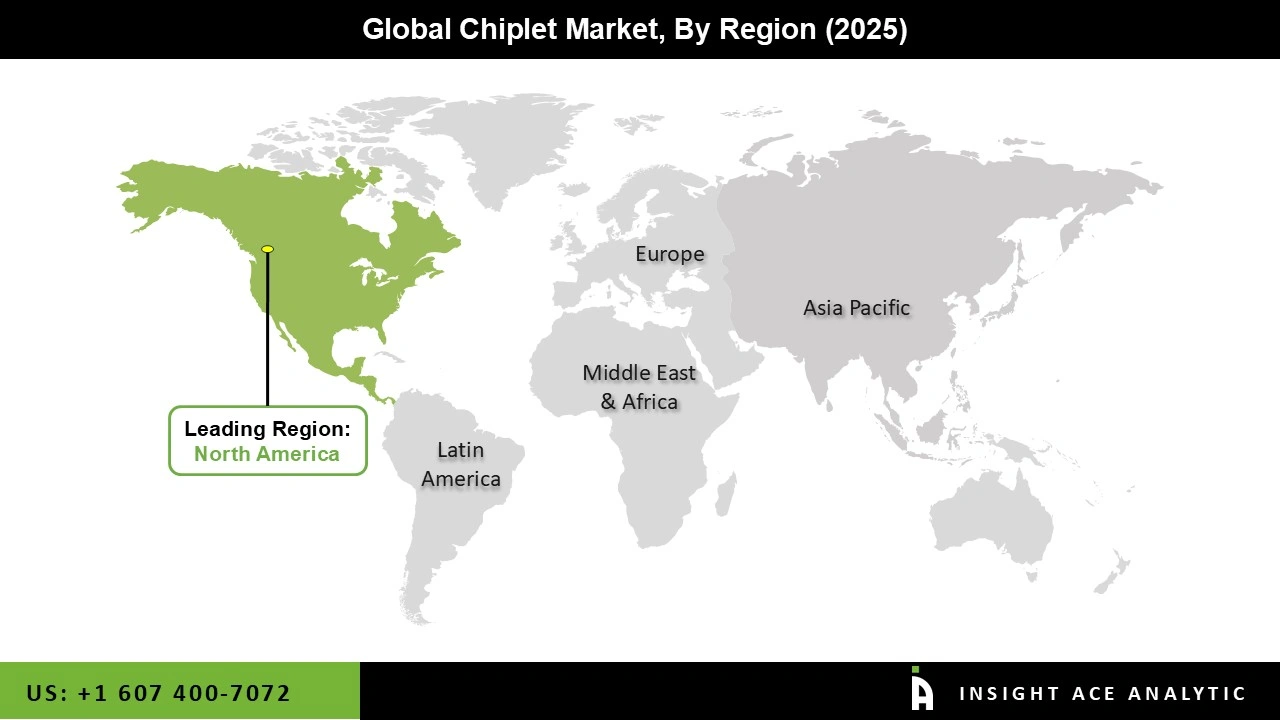

The Asia Pacific Chiplet market is expected to record the highest market revenue share in the near future. The surge in Chiplet demand is propelled by the increasing appetite for electronic devices in the region, driven in part by the burgeoning economies of China and India. The proliferation of smartphones, tablets, and other electronic gadgets in these countries is attributed to the growing affluence of the middle class and escalating temperatures, thus fostering the expansion of the Chiplet market. Additionally, the ready availability of cost-effective packaged and individual chiplets in the Asia-Pacific region contributes to the uptick in sales. The rapidly expanding e-commerce sector in the Asia Pacific has led to numerous online marketplaces offering promotions and discounts on electronics, further stimulating the demand for Chiplets.

In addition, North America is projected to grow at a rapid rate in the global Chiplet market.This can be credited to the strong focus on the environment in the region, with the notable adoption of Chiplet in different industries, such as food & beverages, automotive, personal care, packaging, and others. Also, the chemical industry in the region is focusing on producing Chiplet to develop sustainable and environmentally friendly solutions. Growing necessity for bio-based components across industries and the widespread adoption of Chiplet in the production of intermediate chemicals.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 12.96 Bn |

| Revenue Forecast In 2035 | USD 492.66 Bn |

| Growth Rate CAGR | CAGR of 44.0 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Processor, Packaging Technology and End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Intel Corporation, Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation, Apple Inc., IBM Corporation, Marvell Technology, Inc., MediaTek Inc., TSMC (Taiwan Semiconductor Manufacturing Company), Samsung Electronics Co., Ltd., Cadence Design Systems, Inc., Synopsys, Inc., Arm Holdings plc, TCS (Tata Consultancy Services Limited), Arteris, Inc., Enosemi, BoS Semiconductors Co., Ltd., EdgeCortix Inc., Silicon Box Pte Ltd, Omni Design, Inc., MSquare Technology, Xilinx, Inc. (now part of AMD), Lattice Semiconductor Corporation, AnalogX, zGlue Inc., NanoMatter, VerticalCompute, Persimmons, Lace Lithography, Rebellions Co., Ltd., TACHYUM Inc. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.