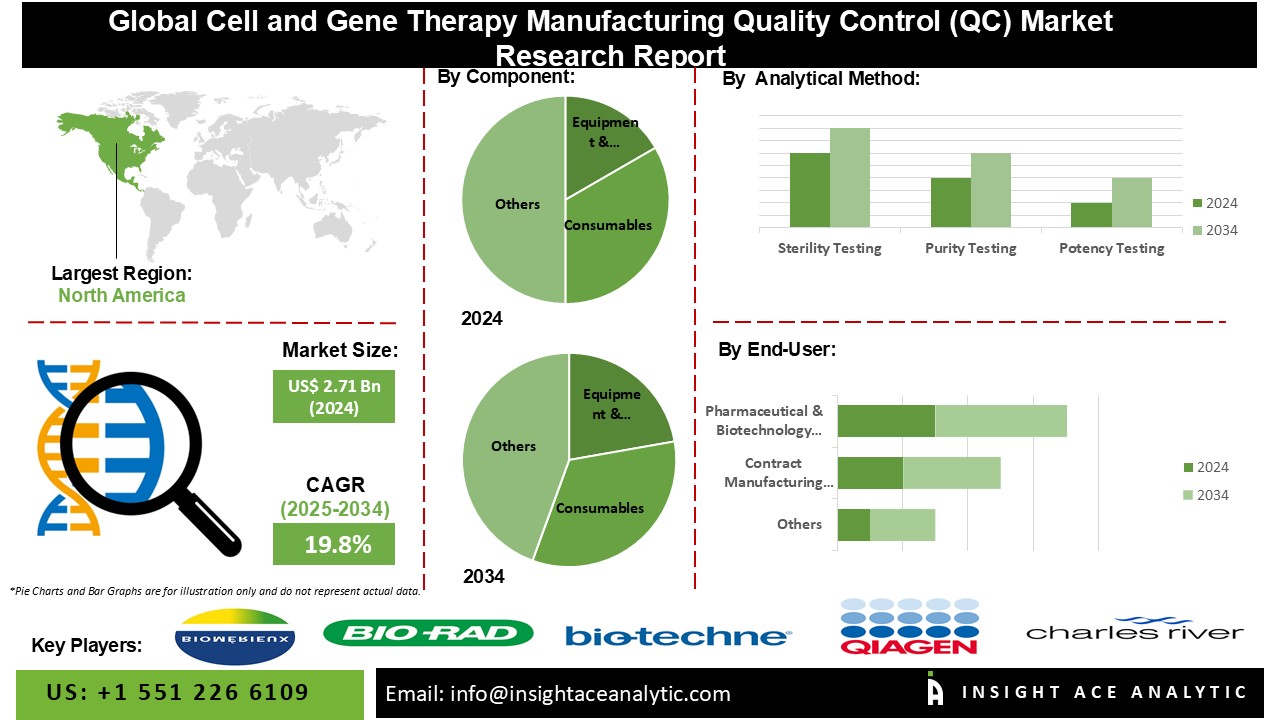

Cell and Gene Therapy Manufacturing Quality Control (QC) Market Size is valued at USD 2.71 Bn in 2024 and is predicted to reach USD 16.32 Bn by the year 2034 at a 19.8% CAGR during the forecast period for 2025-2034.

A crucial element in the production of cell and gene therapies, quality control (QC) guarantees the advanced therapeutic products' safety, potency, integrity, and efficacy prior to their administration to patients. Considering the intricate characteristics and individualized approach of cell and gene therapies, quality control procedures are rigorous and specialized, incorporating an extensive array of analytical methodologies and regulatory benchmarks.

Additionally, the broader spectrum of medical conditions targeted by cell and gene therapies necessitates extensive manufacturing and QC processes, further contributing to market expansion. Moreover, the escalating pipeline of cell and gene therapy candidates, addressing a wide array of diseases ranging from genetic disorders to cancers and rare diseases, is amplifying the requirement for cell and gene therapy manufacturing quality control (QC).

Furthermore, the rising incidents of chronic diseases and genetic disorders are an additional catalyst for market growth. Moreover, continuous advancements in cell and gene therapy technologies have spurred the development of innovative therapeutic approaches for various diseases, consequently increasing the demand for quality control measures. As the field continues to progress, an escalating need emerges for stringent quality control processes to ensure the safety, efficacy, and consistency of therapeutic products.

The Cell & Gene Therapy Manufacturing Quality Control (QC) the market is segmented on the basis of component, process, application and end-user. As per the Component, the market is categorised into Equipment & Accessories, Consumables, and Others. The Application comprises Sterility Testing, Purity Testing, Potency Testing, Identity Testing, and Others (stability, viability, etc.). As per the Process segment, the market has Upstream Processing, Downstream Processing, and Packaging. At last, the End-User segment consists of Pharmaceutical & Biotechnology Companies, and Contract Manufacturing Organizations.

The Downstream processing category is expected to hold a major share of the global Cell and Gene Therapy Manufacturing Quality Control (QC) market. Firstly, as the field of cell and gene therapy continues to advance, there is an increasing focus on optimizing downstream processing techniques to purify and isolate therapeutic products efficiently. Downstream processing plays a significant and important role in the manufacturing workflow by separating and purifying the desired therapeutic molecules from cell cultures or genetic material, ensuring the production of high-quality and potent therapies.

Moreover, with the expanding pipeline of cell and gene therapy candidates targeting a wide range of diseases, there is a growing need for robust downstream processing methodologies to scale up production and meet the rising demand for these therapies. Downstream processing enables the isolation of therapeutic products in sufficient quantities while maintaining their purity and biological activity, thereby facilitating large-scale manufacturing and commercialization efforts. Furthermore, advancements in downstream processing technologies and techniques are driving innovation in this segment. Novel purification methods, chromatography systems, and filtration technologies are being developed to enhance the efficiency, yield, and cost-effectiveness of downstream processing, addressing the specific requirements of cell and gene therapy manufacturing.

The Potency testing segment is projected to grow rapidly in the global Cell and Gene Therapy Manufacturing Quality Control (QC) market. This surge can be because of several factors driving demand and adoption. Firstly, as the field of cell and gene therapy expands, there is a growing emphasis on ensuring the efficacy and potency of these therapies. Potency testing plays a crucial role in assessing the therapeutic effectiveness of cell and gene therapy products, thus becoming increasingly vital for quality control purposes. Moreover, with the increasing number of approved cell and gene therapies targeting a diverse range of diseases, there is a heightened need for accurate and reliable potency testing methods to validate the therapeutic potency of these products.

The North American Cell and Gene Therapy Manufacturing Quality Control (QC) market is expected to register a tremendous market share. Expansion is fueled by multiple elements, such as the increasing uptake of advanced therapies, rising investments in the biotechnology and pharmaceutical sectors, and the availability of a proficient workforce. Consequently, the Europe market for quality control in cell and gene therapy manufacturing is primed for significant expansion in the foreseeable future, playing a crucial role in advancing healthcare solutions across the region. Additionally, the escalating prevalence of chronic diseases in the area has hastened the need for cutting-edge cell and gene therapies, prompting the implementation of rigorous quality control measures. Europe nations are vigorously engaged in research and development endeavours, facilitating partnerships with biotech firms.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 2.71 Bn |

| Revenue Forecast In 2034 | USD 16.32 Bn |

| Growth Rate CAGR | CAGR of 23.89% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, Process, Application And End-User. |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | bioMérieux SA, Bio-Rad Laboratories, Inc., Bio-Techne Corporation, QIAGEN, Charles River Laboratories International, Inc., Lonza Group AG, Merck KGaA, Intertek Group pl, Thermo Fisher Scientific, Inc., Eurofins Scientific S.E. and F. Hoffmann-La Roche Ltd., Catalent, Wuxi AppTec, Takara Bio Inc, Oxford Biomedica plc, Cell and Gene Therapy Catapult, FUJIFILM Holdings Corporation, Danaher (Cytiva), Sartorius AG, AGC Biologics, Eurofins Scientific |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cell and Gene Therapy Manufacturing Quality Control (QC) Market By Component

Cell and Gene Therapy Manufacturing Quality Control (QC) Market By Application

Cell and Gene Therapy Manufacturing Quality Control (QC) Market By Process-

Cell and Gene Therapy Manufacturing Quality Control (QC) Market By End-User-

Cell and Gene Therapy Manufacturing Quality Control (QC) Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.