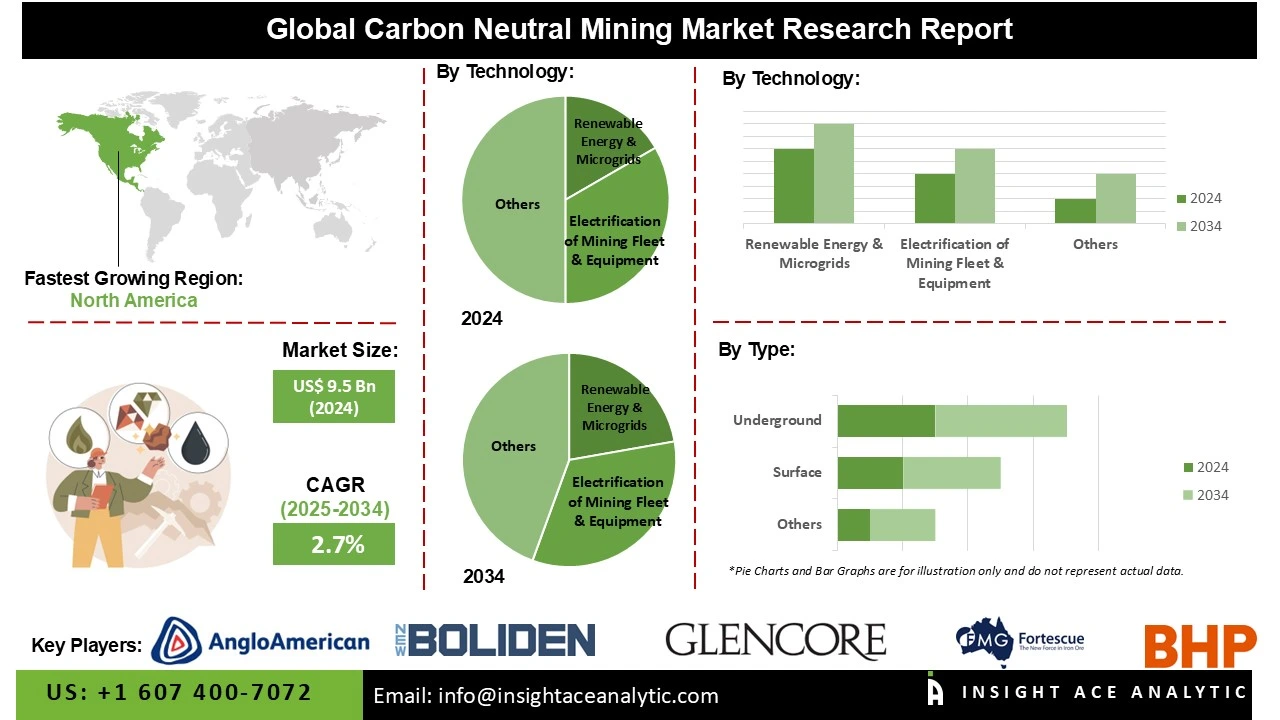

Global Carbon Neutral Mining Market Size is valued at US$ 9.5 Bn in 2024 and is predicted to reach US$ 12.1 Bn by the year 2034 at an 2.7% CAGR during the forecast period for 2025-2034.

Carbon-neutral mining has emerged as a critical response to the mining industry's environmental impact, representing a fundamental shift from traditional extraction methods to sustainable operations. This transformative approach integrates renewable energy microgrids, innovative carbon capture technologies, and verified emission offset mechanisms to dramatically reduce ecological impact while enhancing operational efficiency and energy security.

The sector is demonstrating tangible progress through equipment electrification, with companies progressively deploying battery-electric vehicles and piloting green hydrogen applications for heavy machinery and processing operations.

The global market for carbon-neutral mining solutions is experiencing accelerated growth, encompassing a comprehensive ecosystem of technologies and services specifically designed to help operations achieve net-zero emissions across their value chain. Major industry players including BHP Group and Barrick Gold have established measurable benchmarks, with BHP transitioning approximately 50% of its purchased electricity to renewable sources and Barrick achieving a 16% reduction in greenhouse gas emissions by 2023. This strategic shift is propelled by converging regulatory requirements, evolving investor expectations, and the compelling economic case for sustainable energy integration.

Beyond emissions reduction, leading operators are implementing comprehensive environmental strategies including carbon mineralization, advanced land restoration, and biodiversity enhancement programs. This emerging sector represents not merely an environmental imperative but a fundamental restructuring of mining economics and operational philosophy, creating new standards for responsible resource development. Despite challenges including substantial capital requirements and technical complexities in remote locations, the market presents substantial opportunities through continued technological innovation positioning carbon-neutral mining as an essential component in securing sustainable supplies of critical minerals for the global clean energy transition.

Some of the Key Players in Carbon Neutral Mining Market:

The carbon neutral mining market is segmented by technology and mine type. The technology segment includes renewable energy & microgrids, electrification of mining fleet & equipment, energy storage & charging infrastructure, low-carbon fuels, carbon capture, utilization & storage, emission monitoring & digital solutions, and others. By mine type, the market is segmented into surface, underground, and others.

The mobile applications category led the carbon neutral mining market in 2024. This convergence is fueled by the need to limit carbon emissions and lessen their reliance on diesel generators. Mining corporations are progressively using solar, wind, and hybrid microgrid systems. In remote mining zones with limited grid connectivity, these renewable-based systems maintain an uninterrupted power source while substantially lowering operating expenses. Leading nations in the integration of renewable microgrids in large-scale mining operations include Chile, Australia, and Canada. F.

The largest and fastest-growing Mine Type is Surface. This trend is Due to its large-scale operations, greater production output, and simpler integration of renewable energy sources; the surface mining segment dominates the worldwide carbon-neutral mining industry. Large mining companies in places like South Africa, Chile, and Australia have been increasingly transitioning to surface operations driven by renewable energy, which has significantly reduced Scope 1 emissions. Surface mining is the best choice for incorporating renewable energy into and carrying out large-scale electrification projects due to its space availability and excellent environmental circumstances..

North America dominated the carbon neutral mining market in 2024. The United States is at the forefront of this expansion. This is due to robust legislative backing, cutting-edge technologies, and increasing ESG commitments throughout the mining industry; the North American carbon-neutral mining market continues to dominate the worldwide market. In addition, a larger clean energy and net-zero strategy is also supporting the carbon-neutral mining business in the region. Low-emission fleet technologies, carbon capture systems, and renewable microgrids have become more popular because of federal incentives such as the Inflation Reduction Act (IRA).

Europe has emerged as the fastest-growing region in the carbon neutral mining market, demonstrating exceptional growth driven by substantial investments and regulatory leadership. The region's expansion is particularly propelled by the European Union's stringent environmental mandates and comprehensive Green Deal framework, which have accelerated the adoption of sustainable mining practices across member states. With both governmental bodies and private enterprises heavily investing in renewable-based mining solutions and low-emission technologies, Europe has placed itself as a global leader in the transition toward green mining. The region's commitment is further evidenced by major mining companies operating in Europe rapidly implementing carbon reduction strategies, aligning with the continent's ambitious climate targets, and creating a robust ecosystem for carbon-neutral mining innovation and implementation.

Carbon Neutral Mining Market by Technology-

· Renewable Energy & Microgrids

· Electrification of Mining Fleet & Equipment

· Energy Storage & Charging Infrastructure

· Low-Carbon Fuels

· Carbon Capture, Utilization & Storage

· Emission Monitoring & Digital Solutions

· Others

Carbon Neutral Mining Market by Mine Type-

· Surface

· Underground

· Others

Carbon Neutral Mining Market by Region-

North America-

· The US

· Canada

Europe-

· Germany

· The UK

· France

· Italy

· Spain

· Rest of Europe

Asia-Pacific-

· China

· Japan

· India

· South Korea

· Southeast Asia

· Rest of Asia Pacific

Latin America-

· Brazil

· Argentina

· Mexico

· Rest of Latin America

Middle East & Africa-

· GCC Countries

· South Africa

· Rest of the Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.