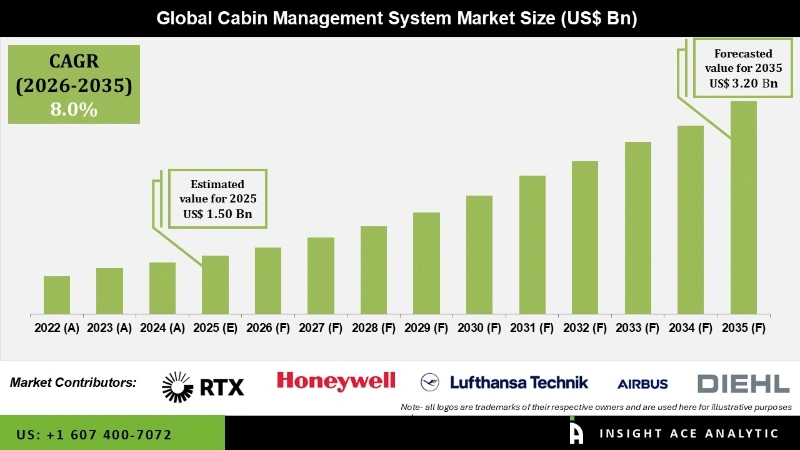

Cabin Management System Market Size is valued at USD 1.50 Bn in 2025 and is predicted to reach USD 3.20 Bn by the year 2035 at a 8.0% CAGR during the forecast period for 2026 to 2035.

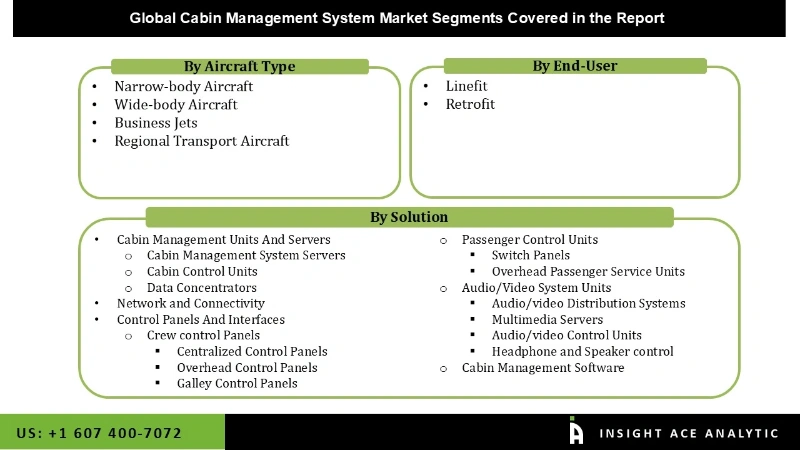

Cabin Management System Market Size, Share & Trends Analysis Report By Aircraft Type (Narrow-body Aircraft, Wide-body Aircraft, Business Jets, Regional Transport Aircraft), By Solution (Cabin Management Units and Servers, Network and Connectivity, Control Panels and Interfaces, Passenger Control Units, Audio/Video System Units, Cabin Management Software), By End-User, By Region, And By Segment Forecasts, 2026 to 2035.

A Cabin Management System is a sophisticated, user-friendly system that centralizes control over cabin-related functions, such as lighting, temperature, entertainment, and communication systems. It serves as the backbone for managing the passenger experience, enabling both crew and passengers to customize the cabin environment. CMS are designed to be intuitive, scalable, and adaptable to various aircraft types, from small private jets to large commercial airliners. They integrate advanced technologies like touchscreens, mobile device compatibility, and high-definition (HD) displays to deliver a premium in-flight experience.

The combination of digital communication technologies and the Internet of Things (IoT) is one of the main drivers propelling the CMS market's growth. Through the use of a centralized control system, IoT allows objects in the cabin to connect, allowing passengers to customize their experience. Additionally, the use of artificial intelligence (Al) and the Internet of Things (IoT) in cabin management systems has led to technological developments that have a significant impact on industry expansion.

The market will likely see more innovation as a result of the move toward next-generation aircraft, such as electric and hybrid models, which will raise demand for cabin management systems that are Al-driven and loT-integrated. However, the high initial investment costs are a significant barrier, particularly for small as well as medium-sized enterprises looking to enter the industry. Supply chain disruptions, like raw material shortages and logistical constraints, can also hinder market expansion and increase operating costs.

The Cabin Management System market is segmented based on aircraft type, solution, and end-user. Based on aircraft type category, the market is segmented into narrow-body aircraft, wide-body aircraft, business jets, and regional transport aircraft. By solution, the market is segmented into cabin management units and servers [cabin management system servers, cabin control units, data concentrators], network and connectivity, control panels and interfaces [crew control panels (centralized control panels, overhead control panels, galley control panels), passenger control units (switch panels, overhead passenger service units)], audio/video system units [audio/video distribution systems, multimedia servers, audio/video control units, headphone and speaker control], and cabin management software. By end-user, the market is segmented into linefit and retrofit.

The business jets category is expected to hold a major global market share in 2024 because of the growing emphasis on the in-flight experience and passenger comfort. Demand for business aircraft with CMS features, including voice-activated assistants, touchless controls, smart lighting, and high-speed connectivity, is still being driven by government leaders, high-net-worth individuals, and corporate executives. As private aviation expands globally, businesses are integrating next-generation CMS to give passengers more comfort and convenience, which will further propel market expansion. Furthermore, the use of cutting-edge CMS systems in both new and existing business jets is being driven by the growing trend of fleet modernization and refit initiatives in the business aviation industry.

The growing production of business and commercial aircraft equipped with cutting-edge cabin technology is expected to propel the linefit segment to dominate the cabin management system market over the forecast period. For better operations, connectivity, and passenger experience, aircraft manufacturers are merging new-generation CMS technologies with their current models. Because factory-installed CMS lowers installation costs and facilitates integration with installed aircraft systems, airlines are increasingly requiring it. The demand for air travel is likely to rise globally, particularly in emerging regions, and new aircraft deliveries are anticipated to fuel strong growth in the linefit CMS market.

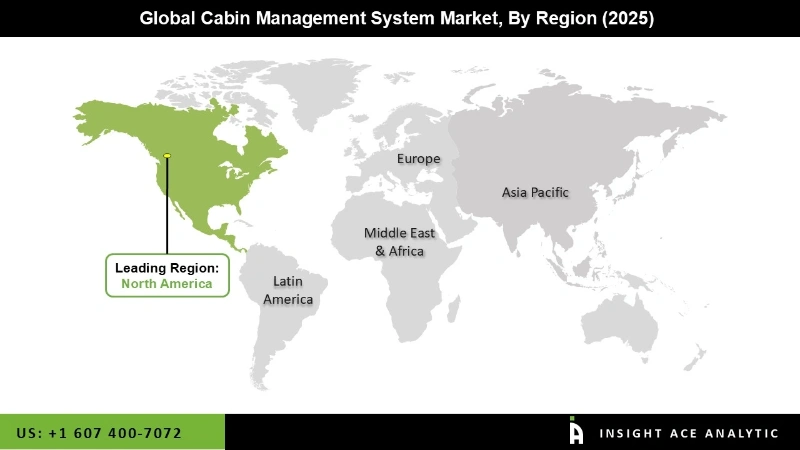

The North American Cabin Management System market is expected to register the highest market share in revenue in the near future as a result of rising air travel and North American carriers' growing investments in upscale in-flight amenities. Another motivating element is the existence of significant CMS suppliers and avionics companies that are constantly innovating in cutting-edge cabin management technologies, including automation driven by AI, intelligent cabin controls, and enhanced connectivity options. Additionally, a growing number of wealthy people and businesses are purchasing business aircraft and require sophisticated CMS, which is driving the region's market expansion.

In addition, Asia Pacific is projected to grow rapidly in the global Cabin Management System market due to a combination of rising passenger demand, fleet expansion, and upgrading of the ageing fleet. Asia Pacific airlines are making significant investments in next-generation CMS systems to modernize their fleets, boost in-flight connectivity, and improve passenger comfort as domestic and international travel increases. To maintain their competitive service offers, premium carriers are investing, while several low-cost carriers in the area are transitioning to next-generation technology. Future investments in integrated cabin management systems are increasing as a result.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.50 Bn |

| Revenue Forecast In 2035 | USD 3.20 Bn |

| Growth Rate CAGR | CAGR of 8.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Aircraft Type, Solution, And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | RTX, Honeywell International Inc, Lufthansa Technik, Airbus, IDAIR GmbH, Donica Aviation Engineering co ., LTD, Panasonic Corporation, Diehl Stiftung & Co. KG, DPI Labs, Inc., Cabin Management Solutions, LLC (CMS), BAE Systems, Astronics Corporation, Heads Up Technologies, Rosen Aviation, LLC., and Other Market Players |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Cabin Management System Market By Aircraft Type-

Cabin Management System Market By Solution-

Cabin Management System Market By End-User-

Cabin Management System Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.