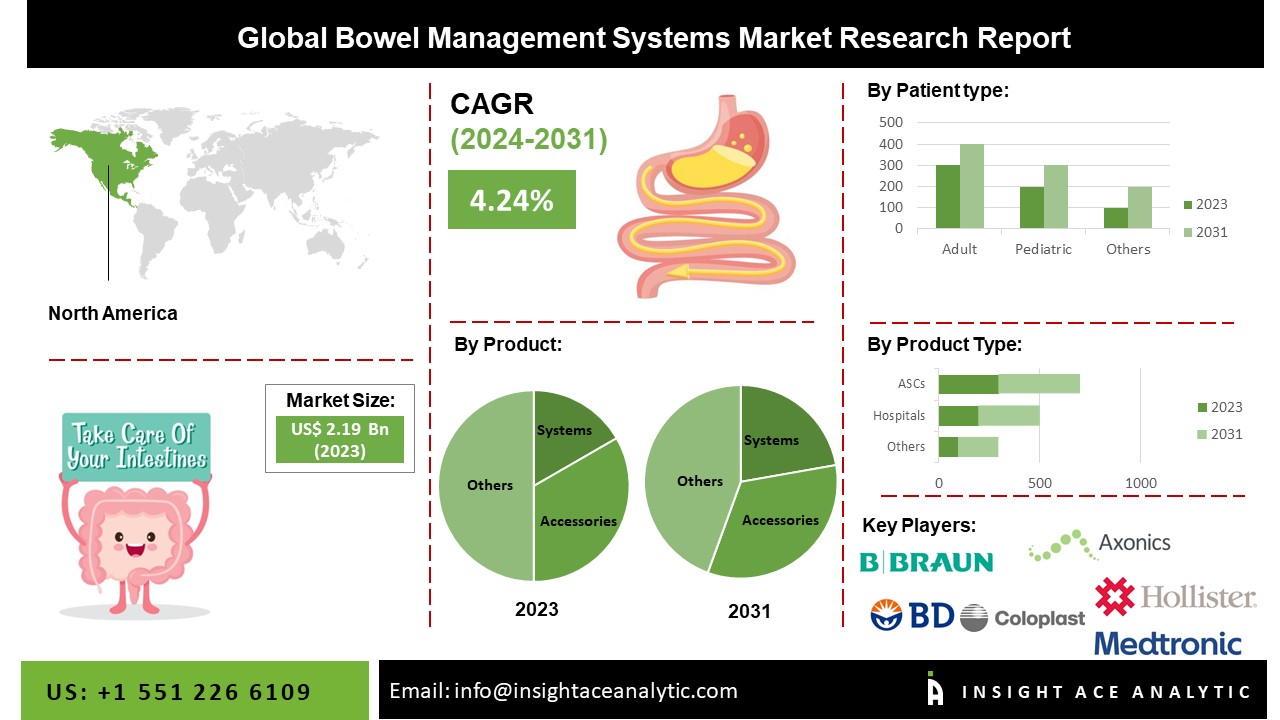

The Bowel Management Systems Market Size is valued at USD 2.19 Billion in 2023 and is predicted to reach USD 3.02 Billion by the year 2031 at a 4.24 % CAGR during the forecast period for 2024-2031.

Bowel management systems control the containment of liquid or semi-liquid stools. It is applied to people with fecal incontinence to protect their skin from pollutants and moisture that could lead to skin damage. Containing infected body waste in a closed system decreases the spread of infection. Furthermore, it offers protection by supporting the sacral and perianal pressure points. The chance of unintentional stool leakage and constipation can be greatly reduced by using bowel management systems or devices such as colostomy bags, irrigation systems, and others. Due mainly to the availability of technologically cutting-edge bowel management devices, the market for bowel management systems is anticipated to rise significantly throughout the forecast period.

Additionally, the market is growing due to the ageing population and an increase in diseases like irritable bowel syndrome linked to fecal irregularity. Irritable bowel syndrome incidence has markedly increased in recent years, with reports from around the world. For instance, the American College of Gastroenterology estimates that between 10% and 15% of adults in the U.S. experience symptoms of IBS.

However, a surge in government R&D expenditures in the healthcare industry fuels the market for bowel management systems. The market isn't growing, though, because there aren't enough qualified specialists and patients find these gadgets uncomfortable to use. Contrarily, it is anticipated that developing healthcare R&D facilities and introducing numerous new devices would open up lucrative chances to expand the bowel management system market.

The bowel management systems market is segmented by product, patient type and end user. Based on the product, the market is segmented into systems (colostomy bags, irrigation systems, sacral neuromodulation systems and others) and accessories (plugs, catheters, implants, anal sphincters, stool bags and others). Based on the patient type, the market is segmented into adult and pediatric. Based on the end user, the market is segmented into hospitals, ambulatory surgical centres and home care settings.

The system category dominated the market in 2021 because more complex bowel management methods are being approved. For instance, in 2020, the U.S. FDA approved Medtronic's InterStim Micro neurostimulator, and InterStim SureScan MRI leads to treating bladder and bowel control issues. Colostomy bags, a subsection of the system category, have a more significant share than the others; nevertheless, people are becoming more aware of their availability and advantages. Additionally, it is predicted that the market will grow throughout the projection period due to developed regions having well-organized reimbursement systems for colostomy goods. However, government entities in developed areas are introducing programs to support people with stomas by enhancing access to the most suitable and therapeutically relevant stoma-related products.

The adult category dominated the market in 2021 because adult people are more likely to experience fecal irregularity problems. Additionally, elderly persons require additional aid and consideration when managing consistency. Therefore, increasing the world's older population supports the market's expansion. It affects roughly 1 in 12 adults, or 18 million people, in the United States, making it a common illness among adults.

The North American bowel management systems market is expected to register the highest market share. The considerable rise in the number of older adults in this area accounts for this. The dominance of the United States in the North American market is expected to remain constant over the projection period. Irritable bowel syndrome is more common in this area, which is the cause of this. For instance, the International Foundation for Gastrointestinal Disorders estimates that 25 and 45 million Americans suffer from IBS. Additionally, a key trend in the North American market for bowel management systems is ongoing R&D for creating cutting-edge bowel management devices for fecal management. The increase in older adults in this area also helps the industry flourish. In addition, Asia Pacific is projected to grow rapidly in the global bowel management systems market due to rising healthcare infrastructure demand, an increase in hospitals in developing nations, rapid R&D sector expansion, a rise in healthcare reforms, and technical developments in the industry. Additionally, the market is expected to be driven by the enormous unmet clinical needs and the urgent need for better therapy.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 2.19 Billion |

| Revenue Forecast In 2031 | USD 3.02 Billion |

| Growth Rate CAGR | CAGR of 4.24 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product, Patient Type, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Axonics Inc., Becton, Dickinson and Company, B. Braun Melsungen AG, Coloplast Group, ConvaTec Group, plc, Consure Medical, Hollister Incorporated, Laborie Medical Technologies, Corp., ProSys International Ltd., Renew Medical, Inc., Welland Medical Limited, Qufora A/S, Medtronic, Wellspect HealthCare and TG Eakin. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Product-

By Patient Type-

By End User-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.