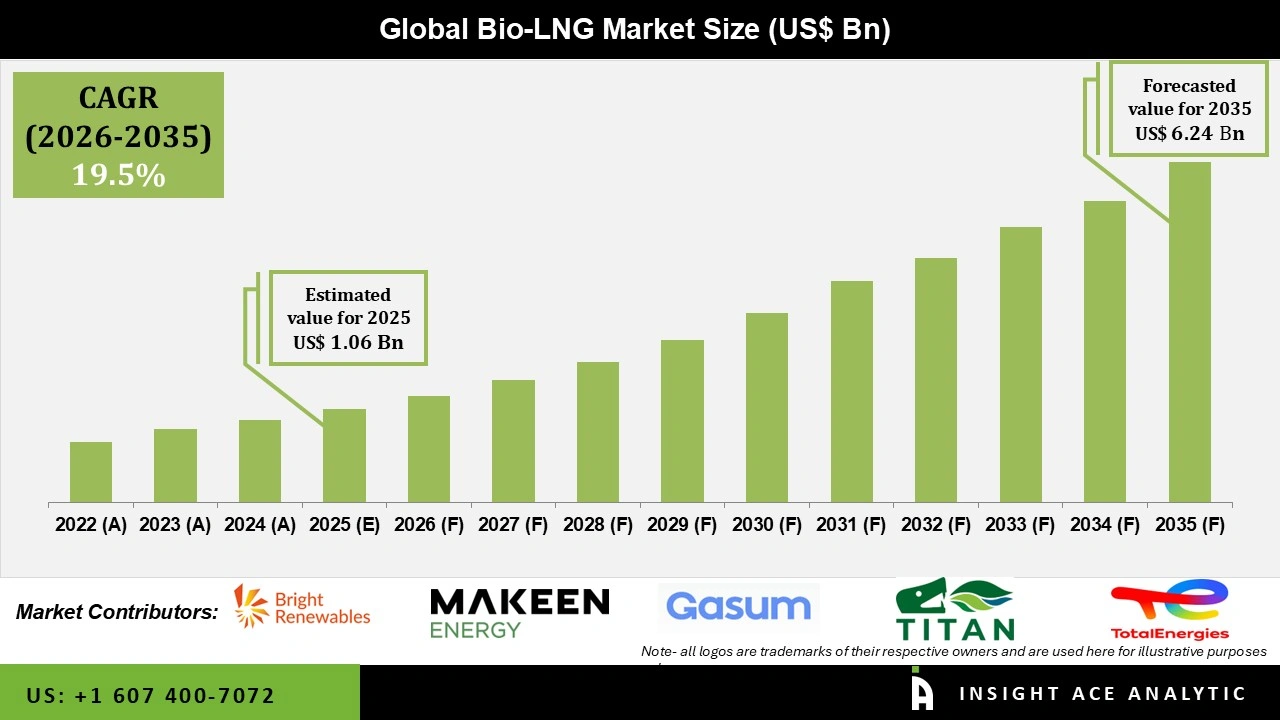

Global Bio-LNG Market Size is valued at USD 1.06 Billion in 2025 and is predicted to reach USD 6.24 Billion by the year 2035 at a 19.5% CAGR during the forecast period for 2026 to 2035.

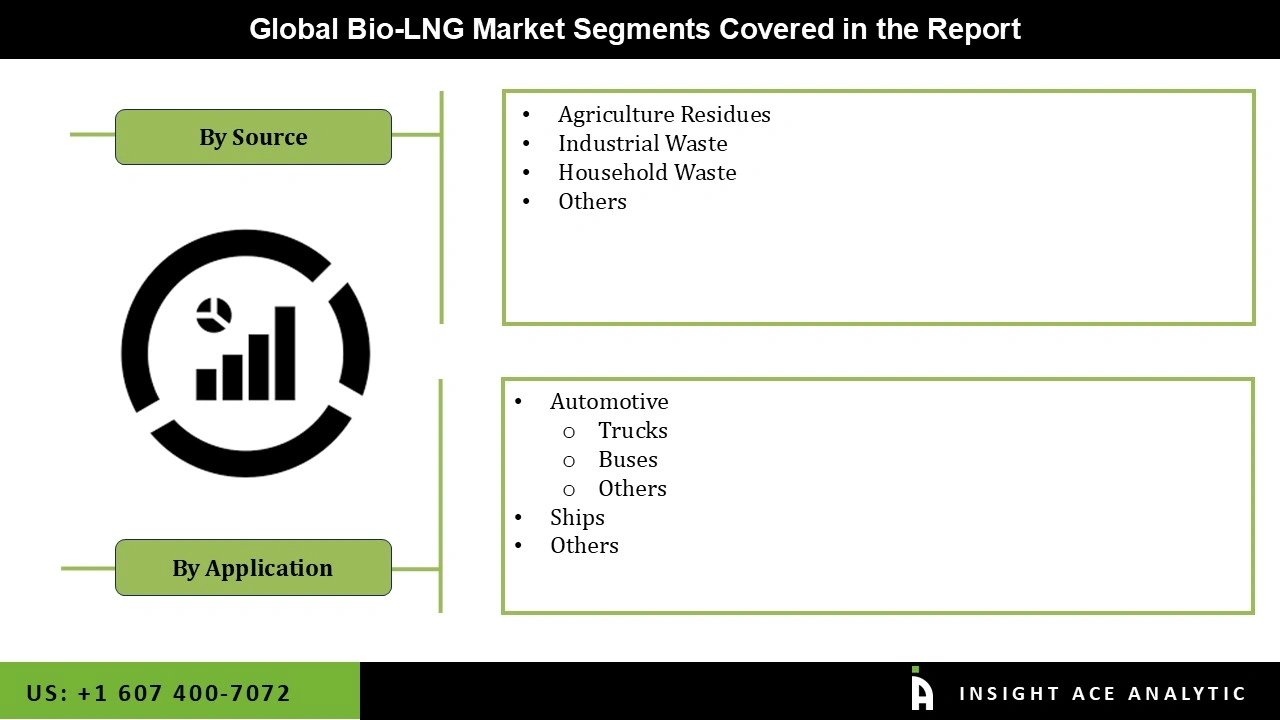

Bio-LNG Market Size, Share & Trends Analysis Report by Application (Automotive, Ships, And Others), Source (Agriculture Residues, Industrial Waste, Household Waste, And Others), Region And Segment Forecasts, 2026 to 2035

Bio-LPG, also known as bio-liquefied petroleum gas, is an ecologically friendly alternative to conventional LPG. It is made from biomass, such as agricultural waste, food industry waste, and energy crops. The bio-LNG (liquefied natural gas) sector has seen rapid expansion and shifting dynamics in recent years. With a growing global emphasis on lowering greenhouse gas emissions and shifting to greener energy sources, bio-LNG has emerged as an appealing option.

Bio-LNG is made from organic waste, agricultural residues, and other biomass, giving it a renewable and sustainable alternative to fossil-fuel-based LNG. Tax breaks, subsidies, and renewable energy standards are pushing demand for bio-LNG and creating a favorable market climate for its expansion. Technological advancements in bio-LNG production, including anaerobic digestion, gasification, and upgrading procedures, have enhanced efficiency and raised the commercial viability of bio-LNG. These innovations are boosting market growth and attracting investments from both established and new companies.

However, the COVID-19 pandemic has had an impact on the bio-LPG sector, both positively and negatively. During the pandemic, the bio-LPG market, like many others, encountered supply chain interruptions due to lockdown measures, travel restrictions, and a reduced workforce. This caused bio-LPG production, distribution, and availability to be delayed.

The Bio-LNG market is segmented on the basis of application and source. The market is segmented as automotive, ships, and others. based on application. The market is segmented by source into agriculture residues, industrial waste, household waste, and others.

The hips category is expected to hold a major share in the global Bio-LNG market in 2022. Due to the low pollution created by the fuel, demand for bio-LNG has been increasing in the transportation fuel and power generating segments. Bio-LNG is a low-carbon fuel that emits far fewer greenhouse gases (GHGs) than either diesel or petrol. It can cut GHG emissions by up to 90% when compared to diesel, making it an appealing option for businesses and governments seeking to minimize their carbon footprint. Certain corporations are investing in specialized bio-LNG production and delivery infrastructure to promote bio-LNG use.

The household waste segment is projected to grow at a rapid rate in the global Bio-LNG Market. The rise of this category can be linked to government incentives and tax breaks granted by many countries to encourage the use of renewable energy and the conversion of organic waste to energy. There are various advantages to using home garbage to make bio-LNG. It aids in the diversion of waste from landfills, lowering the environmental effect and emissions connected with its disposal.

Bio-LNG production contributes to the circular economy and supports sustainable waste management practices by transforming garbage into renewable energy. The adaptability of organic industrial waste as a feedstock in the bio-LNG market is outstanding. It includes a wide range of organic elements, including food waste, agricultural wastes, and organic byproducts of industrial processes.

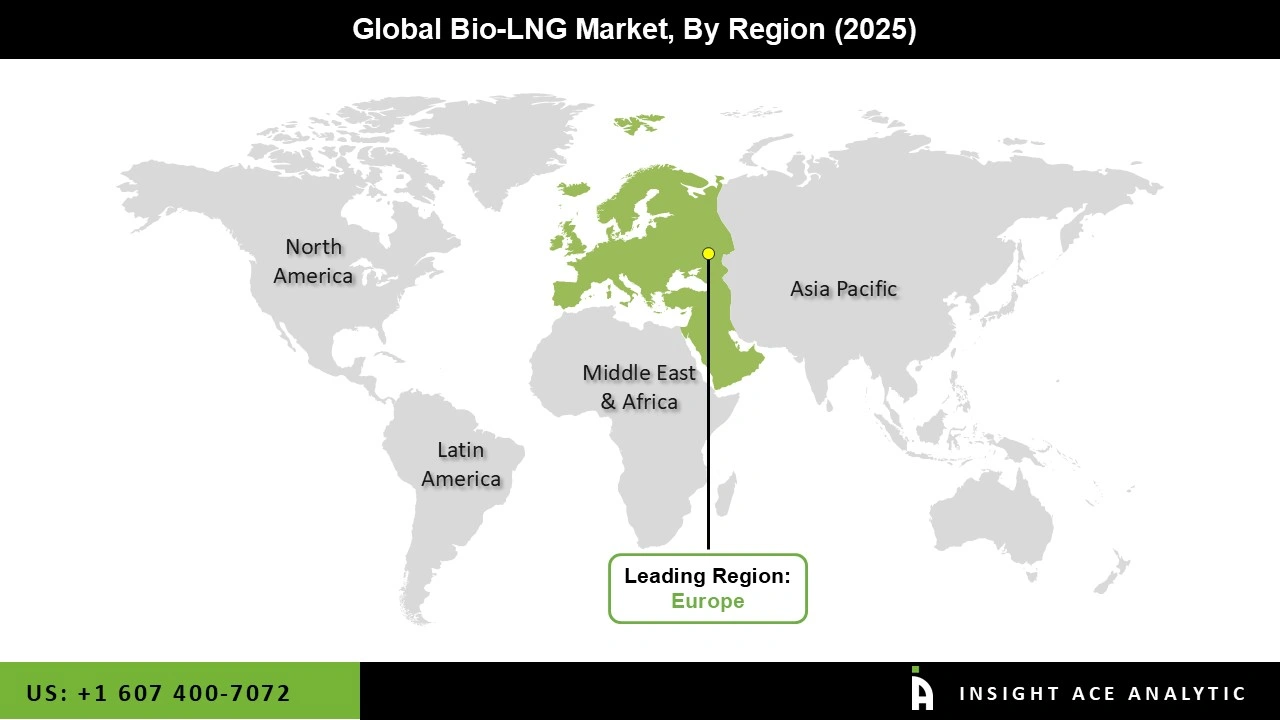

Europe's Bio-LNG market is expected to register the highest market share in terms of revenue in the near future. Countries such as Germany, the United Kingdom, Spain, and France are likely to have rapid expansion in the industry due to increased product demand from the transportation and power generation application sectors, supporting market growth throughout the forecast period. North America is predicted to grow rapidly, with the U.S. playing a prominent role in regional market growth.

The increased use of alternative fuels for energy generation in order to minimize greenhouse gas emissions is likely to drive the growth of the North American bio-LNG market in the coming years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 1.06 Billion |

| Revenue forecast in 2035 | USD 6.24 Billion |

| Growth rate CAGR | CAGR of 19.5% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, Volume (Kilo Tons) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Application And Source |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | TotalEnergies SE, Linde plc, MAKEEN Energy, Nordsol, BoxLNG Pvt. Ltd, Flogas Britain Limited, DBG Group B.V., Gasum Ltd, RUHE Biogas Service GmbH, LIQVIS GmbH, Andion Global Inc., Cycle0, Titan LNG, Alexela, EnviTec Biogas AG, Scandinavian Biogas Fuels International AB, Scale Gas Solutions, GREEN CREATE, Biomet SpA, Air Water Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.