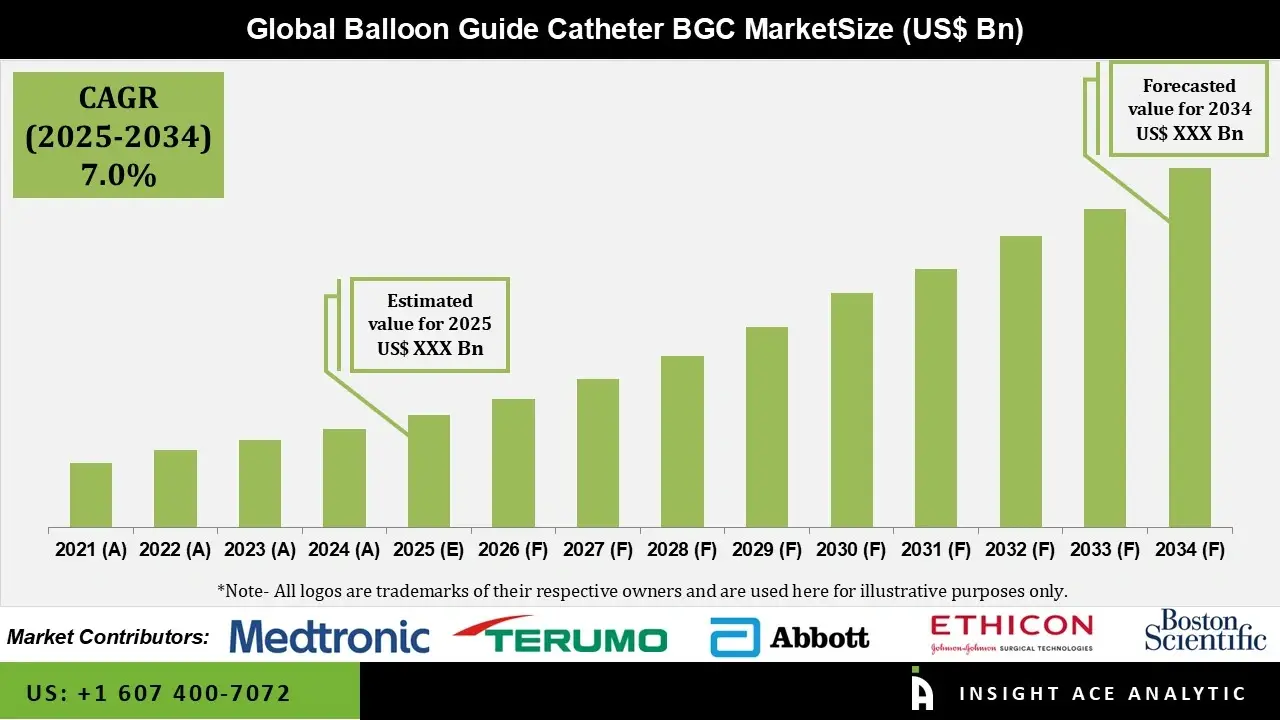

Balloon Guide Catheter Market Size is predicted to grow at a 7.0% CAGR during the forecast period for 2025-2034.

A balloon guide catheter (BGC) is a specialized medical device primarily used in endovascular and neurointerventional treatments to treat conditions such as aneurysms, acute ischemic stroke, and other vascular disorders. During a procedure, the doctor can temporarily stop blood flow in a specific artery using a flexible catheter with an inflatable balloon at its tip.

By doing this, the BGC improves blood flow control, helps prevent clot fragments from moving downstream, and increases the efficacy of clot retrieval tools such as aspiration catheters and stent retrievers. The balloon guide catheter market's most significant growth driver is the increasing adoption of less-invasive surgical methods. These operations are becoming increasingly popular among patients and healthcare professionals due to their quick recovery times, low risk of complications, and shorter hospital stays.

The increasing incidence of cardiovascular diseases (CVDs), such as peripheral artery disease (PAD) and coronary artery disease (CAD), is driving up demand for balloon guide catheters, especially in angioplasty treatments. The prevalence of these diseases is predicted to rise as populations age and life expectancy increases, increasing the demand for efficient treatment strategies.

Moreover, the market is growing as a result of ongoing advancements in catheter design and materials, such as increased maneuverability and flexibility, which are increasing the use of BGCs. However, the market faces obstacles, including strict regulations and the high cost of sophisticated catheter technology, which could make them inaccessible in developing nations.

In the upcoming years, the balloon guide catheter market is expected to gain from a number of attractive opportunities. The continuous growth of minimally invasive procedures, driven by patients' desire for less traumatic interventions and quicker recovery times, is one of the most promising paths. The need for technology that improves procedural safety and efficacy, such as balloon guide catheters, is expected to grow as healthcare systems worldwide continue to emphasize value-based care.

Additionally, knowledge transfer and market access can be facilitated by strategic partnerships between international market leaders and regional healthcare providers, enabling businesses to capture a larger share of the growing global market. The balloon guide catheter market's long-term growth prospects are further supported by the likelihood that ongoing research and development investments will yield innovative solutions to address unmet clinical needs.

• Abbott Laboratories

• Asahi Intecc Co., Ltd.

• Medtronic

• Boston Scientific Corporation

• Johnson & Johnson (Ethicon)

• Cook Medical

• Terumo Corporation

• Cardinal Health

• Merit Medical Systems

The rising prevalence of vascular problems worldwide is one of the most important key factors driving the balloon guide catheter market. Balloon guide catheters are essential in minimally invasive interventions, which have become more common due to the rising incidence of diseases such as peripheral arterial disease, coronary artery disease, and ischemic stroke. By enabling safer and more efficient navigation across intricate arterial systems, these devices lower procedural complications and enhance patient outcomes.

The need for these specialized catheters is further increased by the global aging population, which is increasingly prone to vascular disorders. Furthermore, the growing awareness of and adoption of advanced interventional techniques in emerging nations is another important factor driving the market for balloon guide catheters. In areas like the Asia Pacific and Latin America, governments and healthcare organizations are making significant investments to enhance healthcare infrastructure and increase access to cutting-edge medical technologies. Balloon guide catheter demand has increased as a result of the increased procedure volumes.

The strict regulatory framework governing medical equipment is one of the main obstacles. Regulations can cause major delays in product approvals, which affects market availability even if they are essential for guaranteeing product safety. Manufacturers may have to deal with protracted testing and validation schedules, which impede the quick release of novel products. Additionally, market access is hampered by the high cost of sophisticated catheter technologies, especially in developing nations. Due to financial limitations and the emphasis on fundamental healthcare requirements, many healthcare providers in these areas may find it difficult to implement the newest BGC advancements. This cost issue may seriously impede accessibility and penetration, thus restricting the market's potential for growth in some regions.

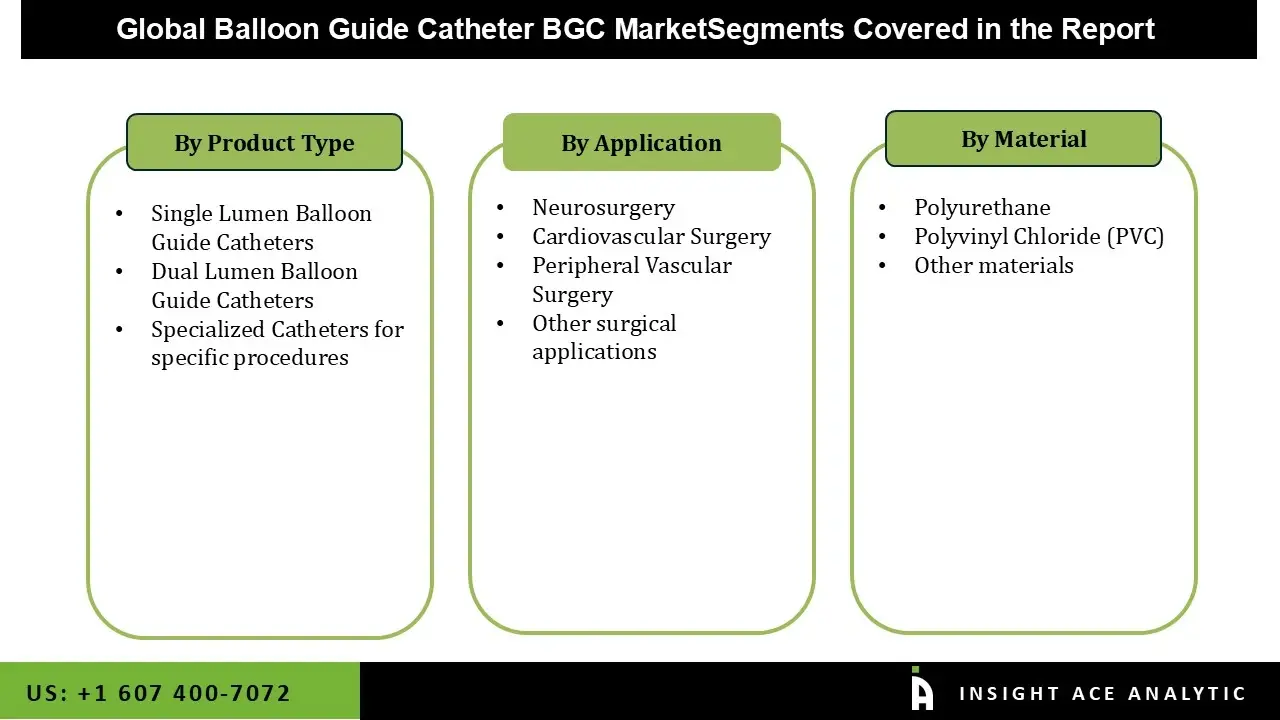

Balloon guide catheter market is segmented based on type, material and end-user. Type segment includes single lumen balloon guide catheters, dual lumen balloon guide catheters, and specialized catheters for specific procedures. material segment includes polyvinyl chloride (PVC), polyurethane, and others. End-user segment includes cardiovascular surgery, neurosurgery, peripheral vascular surgery, and others.

The single lumen balloon guide catheters category held the largest share in the Balloon Guide Catheter market in 2024 because they are frequently used in routine vascular procedures and provide dependable performance and user-friendliness for a range of clinical applications. These catheters are preferred because of their simple construction, which enables effective balloon inflation and deflation, enabling quick vascular occlusion or support during procedures. They are in constant demand in hospitals and specialist clinics all over the world because of their compatibility with a variety of guidewires and interventional devices, which further increases their usefulness in routine treatments.

In 2024, the neurosurgery category dominated the Balloon Guide Catheter market, driven by the growing prevalence of cerebrovascular conditions, including ischemic stroke. In neurointerventional treatments like mechanical thrombectomy, balloon guide catheters are crucial because they reduce the chance of distant embolization and enable efficient clot recovery. Strong demand for balloon guide catheters in this market is anticipated to be sustained by the growing use of minimally invasive neurovascular procedures, which are backed by advantageous clinical guidelines and technological developments.

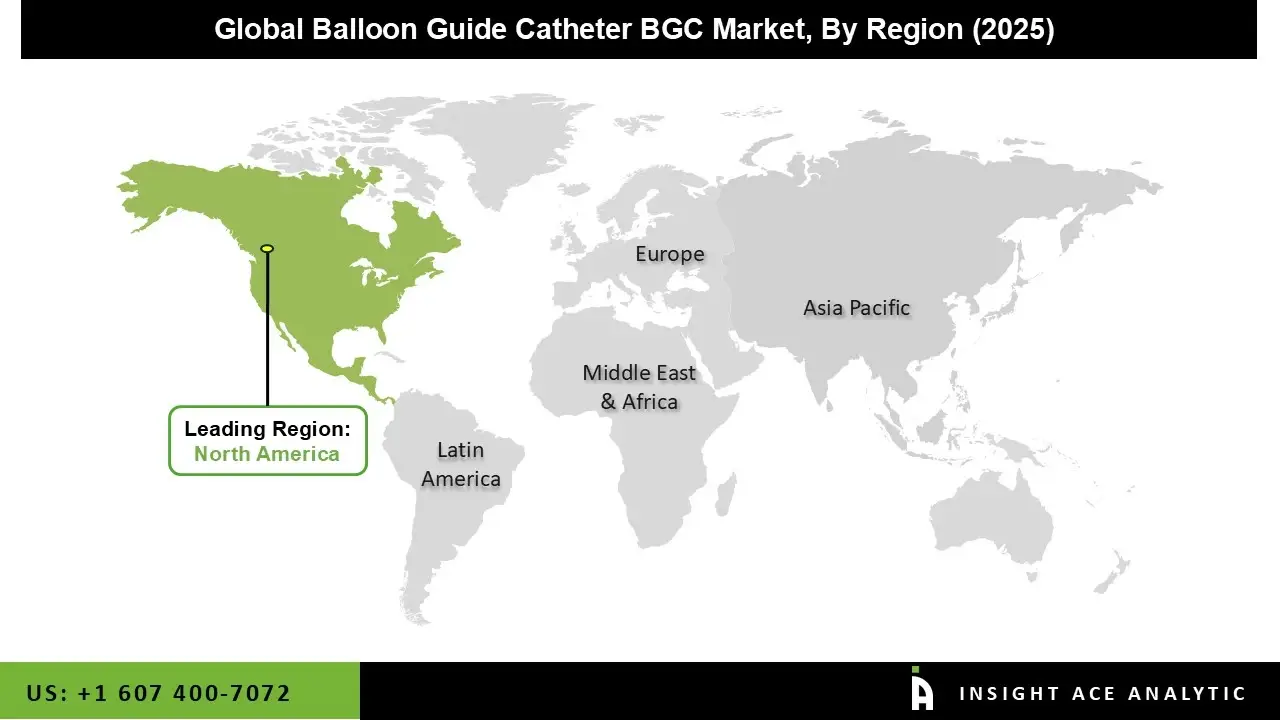

The Balloon Guide Catheter market was dominated by the North America region in 2024 because of early adoption of cutting-edge interventional technology, high procedural volumes, and sophisticated hospital infrastructure.

Additionally, the region's supremacy is reinforced by the existence of significant market players, established clinical guidelines, and advantageous reimbursement regulations. With rising healthcare spending and a growing emphasis on minimally invasive procedures, Canada also makes a substantial contribution. Driven by continuous innovation and a strong pipeline of new product launches, the region is anticipated to sustain its leadership position during the projected period.

• December 2023: Poiesis Medical LLC and HR Pharmaceuticals, Inc. (HRP) have struck an Exclusive Commercial Agreement that gives HRP the right to market Poiesis's Dual Balloon Catheter (DuetteTM) in North America. It is anticipated that the dual balloon catheter technology would outperform traditional Foley catheters. The company hopes to enhance patient outcomes with this latest addition to its urology line.

• September 2023: To improve its Balloon Guide Catheter technology through practical data insights, Johnson & Johnson established a strategic alliance with a top data analytics firm. The goal of this partnership is to use data to enhance clinical outcomes and product efficacy in cardiovascular therapy. This collaboration is strategically significant because it has the potential to advance cutting-edge R&D methods and improve patient outcomes through data-driven choices.

• June 2023: A modest technological company that specializes in cutting-edge balloon catheter systems has been acquired by Boston Scientific Corporation. Boston Scientific can now incorporate cutting-edge technologies into its product line, strengthening its competitive advantage, thanks to this strategic merger. In markets that are becoming more competitive and where technical innovation is essential for distinction, the integration is especially important. As businesses look to strengthen their portfolios through mergers, this calculated action also suggests a tendency toward industry consolidation in the BGC sector.

| Report Attribute | Specifications | |

| Growth Rate CAGR | CAGR of 7.0% from 2025 to 2034 | |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2024 to 2034 | |

| Historic Year | 2021 to 2023 | |

| Forecast Year | 2024-2034 | |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends | |

| Segments Covered | Type, Material, End-user, and By Region | |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa | |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia | |

| Competitive Landscape | Abbott Laboratories, Asahi Intecc Co., Ltd., Medtronic, Boston Scientific Corporation, Johnson & Johnson (Ethicon), Cook Medical, Terumo Corporation, Cardinal Health, and Merit Medical Systems | |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. | |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Balloon Guide Catheter Market by Type-

• Single Lumen Balloon Guide Catheters

• Dual Lumen Balloon Guide Catheters

• Specialized Catheters for specific procedures

Balloon Guide Catheter Market by Material-

• Polyvinyl Chloride (PVC)

• Polyurethane

• Others

Balloon Guide Catheter Market by End-user-

• Cardiovascular Surgery

• Neurosurgery

• Peripheral Vascular Surgery

• Others

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.