Global Automotive Lead Acid Battery Market Size is valued at USD 25.0 Bn in 2024 and is predicted to reach USD 33.2 Bn by the year 2034 at a 3.0% CAGR during the forecast period for 2025-2034.

The automotive lead-acid battery market is a mature market that has existed for many decades. Lead-acid batteries have been widely used as a power source in vehicles due to their low-cost, high-energy density, and reliable performance. The market has been growing in recent years due to the elevated demand for electric vehicles and the requirement for backup power supplies in vehicles. Factors driving growth in the market include increasing production and sales of vehicles, growing demand for electric vehicles, and increasing use of lead-acid batteries as backup power sources.

The increasing popularity of electric vehicles is a major driver of growth, as these vehicles require large, high-capacity batteries to store energy. The automotive lead-acid battery market growth is also expected to be pushed by the increasing demand for backup power supplies in vehicles, which provide an emergency power source in case of a dead battery or another power failure.

However, the market is facing certain challenges, such as the competition from alternative battery technologies, such as lithium-ion batteries, which offer higher energy density and longer lifespan compared to lead-acid batteries. Additionally, the toxic nature of lead and sulfuric acid used in the manufacturing process of lead-acid batteries is also a challenge for the market.

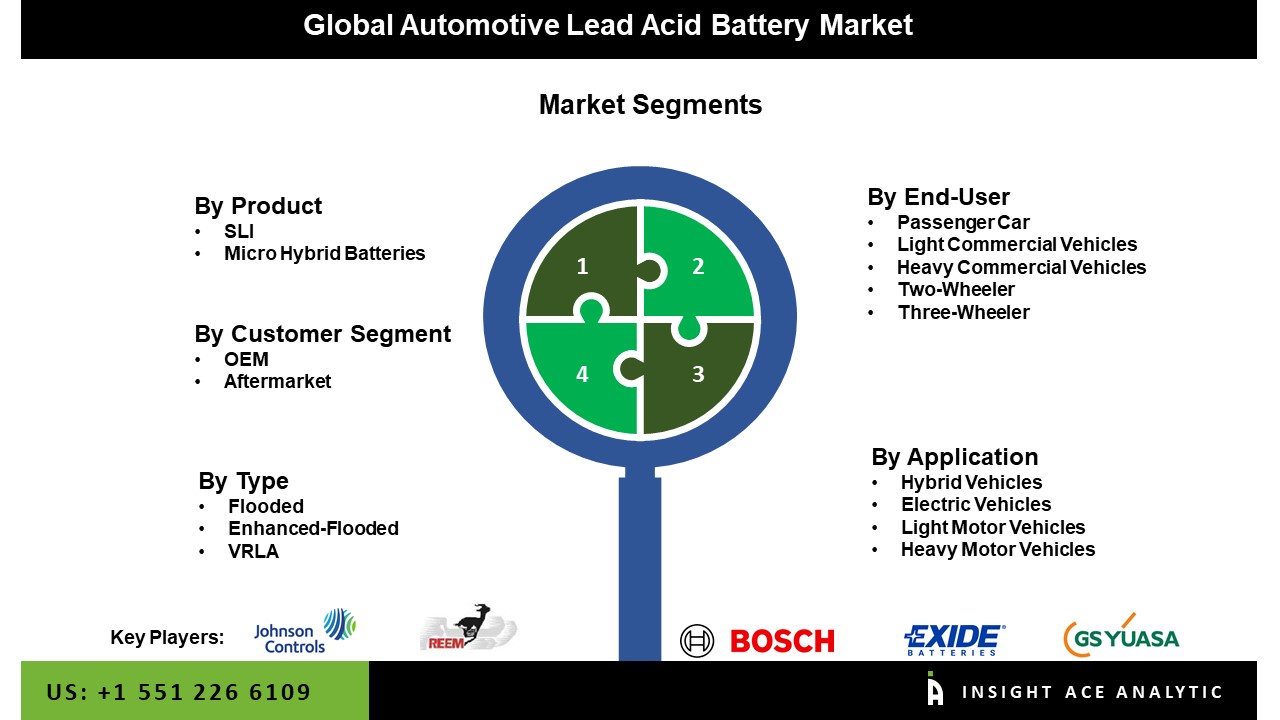

The automotive lead acid battery market is segmented on type, product, customer segment, end user and application. Based on the product, the market is categorized into SLI and micro-hybrid batteries. Based on type, the market is categorized into Flooded, enhanced flooded and VRLA. Based on customer segment, the market is segmented into OEM and aftermarket. Based on end-user, the market is categorized into passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheeler, and three-wheeler. Based on application, the market is further categorized into hybrid vehicles, electric vehicles, light motor vehicles and heavy motor vehicles.

The flooded lead-acid battery is expected to dominate the automotive lead-acid battery market in the coming years. This type of battery is widely used in vehicles due to its low cost, high energy density, and reliable performance. Additionally, flooded lead-acid batteries are readily available and easily replaced, making them a popular choice for many vehicle owners. Flooded lead-acid batteries use a combination of lead plates and a sulfuric acid electrolyte to produce electrical energy. They are known for their robustness, high discharge rate, and ability to deliver high power quickly, making them well-suited for vehicle use. Although flooded lead-acid batteries face competition from alternative battery technologies, such as lithium-ion batteries, they are still widely used due to their low cost and reliability. The flooded lead-acid battery market is expected to continue to grow, driven by the increasing demand for vehicles and the need for backup power supplies in vehicles.

The passenger car segment is projected to lead the automotive lead-acid battery market in the coming years. Passenger cars are the largest market for lead-acid batteries due to their high demand, the increased number of vehicles on the road, and the need for reliable power sources in vehicles. Driven by the increased demand for vehicles and the need for reliable power sources in vehicles. Also, the market is expected to continue to grow, driven by the increasing popularity of electric vehicles and the need for backup power supplies in vehicles.

One of the biggest markets for automotive lead-acid batteries in North America. There is a thriving automotive industry in the area, and many cars and significant demand for vehicles are on the road. The market in North America has expanded as a result of this demand, a robust automotive aftermarket, and the existence of significant battery producers. Due to factors including the high number of vehicles on the road, the sizeable automotive aftermarket, and the presence of major battery manufacturers, the United States is the largest market in North America for automotive lead-acid batteries.

The region's rising demand for electric vehicles is also a major factor in expanding the automotive lead-acid battery market. In addition, the Asia Pacific region is one of the largest markets for automotive lead-acid batteries and is expected to grow in the forthcoming years. The region is characterized by a large and rapidly growing automotive industry, driven by increasing production and sales of vehicles, growing demand for electric vehicles, and the increasing number of vehicles on the road. In the Asia Pacific region, nations such as Japan, China, and India are the most numerous markets for automotive lead-acid batteries due to factors such as the large and rapidly growing automotive industries in these countries and the presence of major battery manufacturers. Additionally, the increasing demand for electric vehicles in the region is also driving the automotive lead-acid batteries market growth.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 25.0 Billion |

| Revenue forecast in 2034 | USD 33.2 Billion |

| Growth rate CAGR | CAGR of 3.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Bn, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Product, Customer Segment, End User And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Johnson Controls, Exide Technologies, GS Yuasa International Ltd, Reem Batteries & Power Appliances Co. SAOC, C&D TECHNOLOGIES, Robert Bosch GmbH, EnerSys Inc, Samsung SDI Company Limited, Trojan Battery Company, NorthStar Battery Company LLC. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automotive Lead Acid Battery Market By Product-

Automotive Lead Acid Battery Market By Type-

Automotive Lead Acid Battery Market By Customer Segment

Automotive Lead Acid Battery Market By End-user

Automotive Lead Acid Battery Market By Application

Automotive Lead Acid Battery Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.