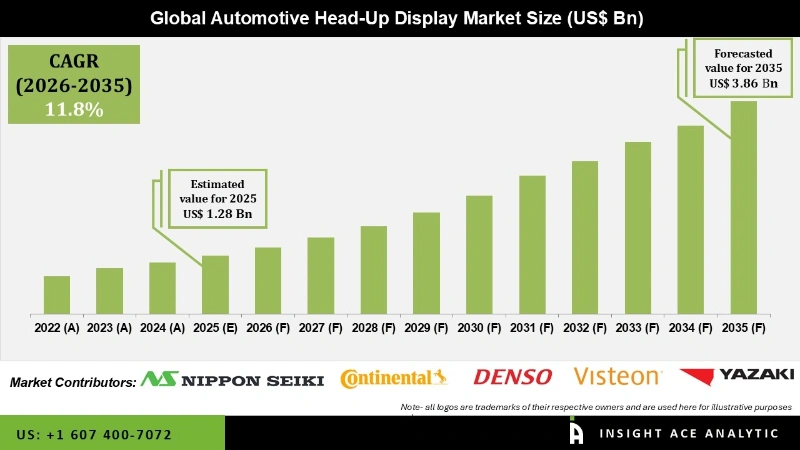

Automotive Head-Up Display Market Size is valued at USD 1.28 Bn in 2025 and is predicted to reach USD 3.86 Bn by the year 2035 at a 11.8% CAGR during the forecast period for 2026 to 2035.

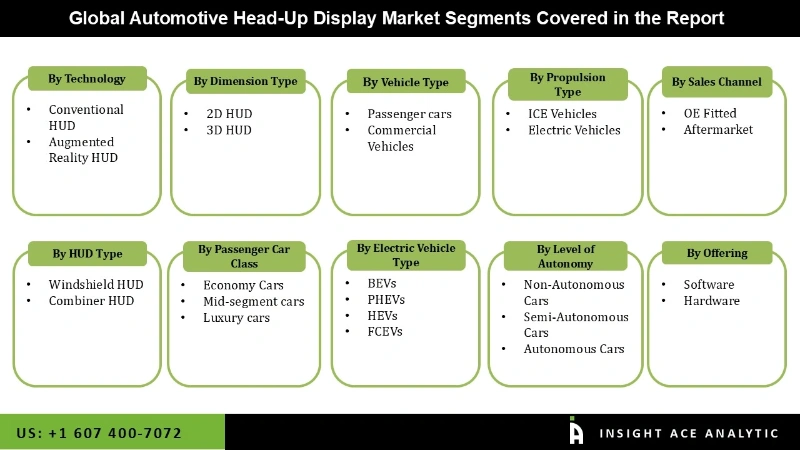

Automotive Head-Up Display Market Size, Share & Trends Analysis Report By Technology (Conventional HUD, Augmented Reality HUD), By HUD Type, By Dimension Type, Level of Autonomy, Offering, Vehicle Type, Propulsion Type, Electric Vehicle Type, Passenger Car Class, By Region, And By Segment Forecasts, 2026 to 2035.

The automotive head-up display (HUD) is a small projector that shows crucial smartphone functions on the innermost portion of the helmet's visor, such as phone calls and Google Maps. It won't block the view and will continue to be transparent. Connectivity with other riders and a robust audio experience are guaranteed by a directional microphone and a 55mm, 99-decibel flat speaker. To navigate without a smartphone and to be aware of blind areas while driving, consumers can utilize automotive head-up display (HUD) helmets, which reduces the likelihood of accidents. Additionally, the market for automotive head-up displays (HUD) helmets is expected to develop due to the increasing use of artificial intelligence in vehicles.

Another new technology that is having a similar effect on the size and functionality of HUD applications is holographic film. Thanks to recent developments in polymer films and novel printing methods, holographic films now have more options. Furthermore, automobile OEMs have limited profit margins and continuously seek ways to cut expenses. HUD adoption was formerly restricted to premium and luxury vehicles because of their high cost but is currently only permitted in mid-size vehicles.

The automotive head-up display market is divided based on technology type, HUD type, dimension type, passenger class, vehicle class, level of autonomy and sales channel. As per the technology, the market is bifurcated as conventional HUD and combiner HUD. According to HUD type, the market is segmented into windshield and combiner. The market is segmented as 2-D HUD and 3-D HUD based on dimension type. As per the passenger class, the market is segmented into the economy, mid-segment, and luxury cars. Based on vehicle type, the automotive head-up display market includes passenger, light, and heavy commercial cars. Based on the level of autonomy, the automotive head-up display market is segmented as non-autonomous, semi-autonomous and autonomous. Based on sales channels, the market is segmented as OEM and aftermarket.

The windshields category will hold a major share of the global automotive head-up display market 2022. To ensure good projected picture quality, the windshield has laminated safety glass with optical qualities like the nominal surface of CAD and low surface tolerance. It is a standard feature in some premium car types and an optional feature in some luxury and mid-range automotive variations.

Companies are focusing on lowering the cost of windshield head-up displays to make the product installable in a greater variety of mid-range automobile variations. Additionally, the evolution of display technology is helping automotive vehicle makers produce head-up displays at a reduced cost thanks to the integration of technologies, including LEDs and LCDs, which give bright and transparent projections and data on the windshield display.

The AR HUD segment is projected to grow rapidly in the global automotive head-up display market. In contrast to a traditional dashboard, AR HUD enables the vehicle to interact with a significant amount of information. The system is useful for demonstrating how well the car understands the environment in which it lives, identifies hazards, plans routes, establishes interactions with additional features, and starts an advanced driver-aid system. Advanced AR HUD can present complex images related to actual things.

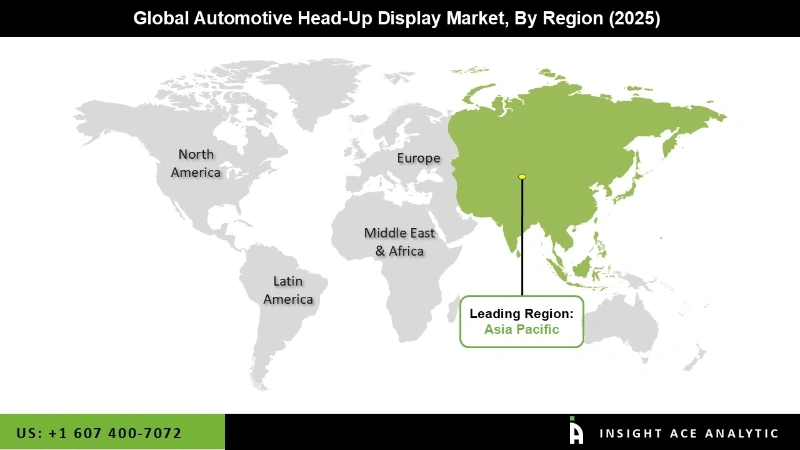

The Asia Pacific Automotive Head-Up Display market is expected to record the maximum market share in revenue shortly. With an emphasis on safety and security, Asia Pacific is working hard to develop its auto sector.

On the other hand, several Asian automakers are incorporating safety measures into upcoming vehicles by utilizing recent advancements in heads-up display technology. In addition, Europe is estimated to grow rapidly in the global automotive head-up display market. Additionally, the demand for automotive head-up display (HUD) helmets is expected to expand due to sophisticated technology, such as light-emitting diodes and liquid crystal displays, which provide transparent and vivid images on the windshield. Vehicle buyers' top priority has evolved to include passenger and vehicle safety. Regulatory bodies around the world are concentrating on enhancing vehicle safety.

The market for automotive head-up displays (HUDs) is expected to develop significantly as more artificial intelligence is adopted by automobiles. Developed nations like the U.S. and Japan are more concerned with deploying head-up display helmets.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.28 Bn |

| Revenue Forecast In 2035 | USD 3.86 Bn |

| Growth Rate CAGR | CAGR of 11.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | HUD Type, Technology, Dimension Type, Sales Channel, Level of Autonomy, Offering, Vehicle Type, Propulsion Type, Electric Vehicle Type, Passenger Car Class |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Nippon Seiki Co., Ltd., Continental Ag, Panasonic Holdings Corporation, Denso Corporation, Foryou Corporation, Yazaki Corporation, Visteon Corporation, Huawei Technologies Co.,Ltd., Valeo, Jiangsu Zejing Automotive Electronics Co., Ltd., Hyundai Mobis, LG Electronics, Harman International, Wayray Ag, Futurus Technology Co., Ltd., Hudway, Llc, Hudly, Cy Vision, Envisics, Zhejiang Crystal-Optech Co., Ltd., E-Lead Electronic Co., Ltd., Maxell |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automotive Head-Up Display Market By Technology-

Automotive Head-Up Display Market By HUD Type-

Automotive Head-Up Display Market By Dimension Type

Automotive Head-Up Display Market By Passenger Car Class

Automotive Head-Up Display Market By Vehicle Type

Automotive Head-Up Display Market By Electric Vehicle Type

Automotive Head-Up Display Market By Propulsion Type

Automotive Head-Up Display Market By Level of Autonomy

Automotive Head-Up Display Market By Sales Channel-

Automotive Head-Up Display Market By Offering

Automotive Head-Up Display Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.