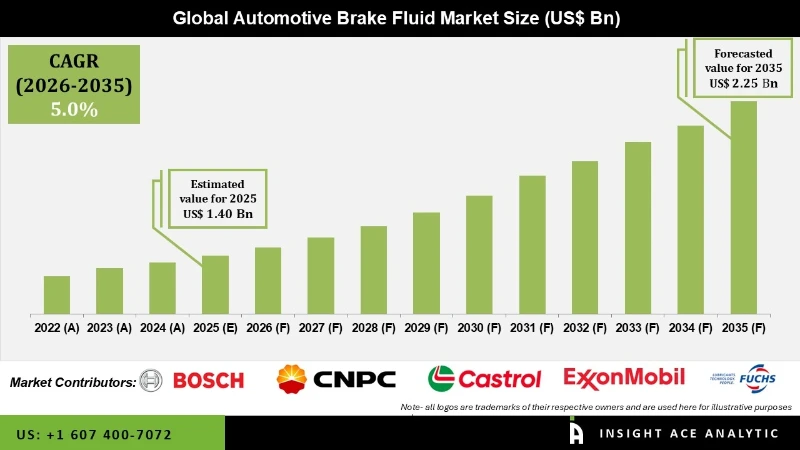

Automotive Brake Fluid Market Size is valued at USD 1.40 billion in 2025 and is predicted to reach USD 2.25 billion by the year 2035 at a 5.0% CAGR during the forecast period for 2026 to 2035.

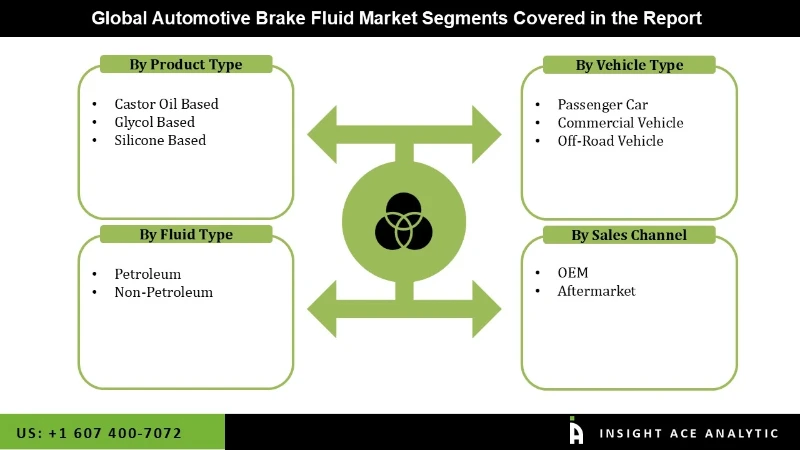

Automotive Brake Fluid Market Size, Share & Trends Analysis Report by Fluid Type (Petroleum and Non-Petroleum), By Product Type (Castor Oil Based, Glycol Based, and Silicone Based), By Vehicle Type (Passenger Car, Commercial Vehicle, and Off-Road Vehicle), By Sales Channel (OEM and Aftermarket), Region And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Automotive brake fluid is a specialized fluid that is used in hydraulic braking systems to transmit force from the brake pedal to the brake pads or shoes, hence providing the friction required to slow or stop a vehicle. It is an essential component of a vehicle's braking system, which is important in providing safe and dependable braking performance. Vehicle production and sales directly impact the demand for automotive brake fluid.

The need for brake fluid rises as the global automotive industry expands and more vehicles are created and sold. Economic factors, consumer preferences, and government rules governing vehicle production and sales can all have an impact on the overall demand for automotive braking fluid.However, the pandemic had an impact on the aftermarket, which includes brake fluid maintenance and replacement. People drove less because of lockdowns and restrictions, which reduced vehicle utilization and, as a result, demand for brake fluid replacement. Furthermore, financial restrictions faced by individuals during the epidemic may have resulted in maintenance chores being postponed or delayed.

The Automotive Brake Fluid Market is segmented on the basis of fluid type, product type, vehicle type, and sales channel. Based on fluid type, the market is segmented as Petroleum and Non-Petroleum. The product type segments include Castor Oil Based, Glycol Based, and Silicone Based. Vehicle type segment includes Passenger Cars, Commercial Vehicles, and Off-Road vehicles. The sales channel segment includes OEM and Aftermarket.

The OEM category is expected to hold a major share of the global Automotive Brake Fluid Market in 2022. Original Equipment Manufacturers (OEMs) play an important role in the automotive brake fluid business. OEMs are companies that produce and distribute brake fluid to vehicle manufacturers for use in their new automobiles. OEMs in the brake fluid industry create and distribute brake fluid to vehicle manufacturers as an essential component of the braking system. They collaborate closely with OEMs to meet their specific requirements and assure compatibility with the braking systems of the vehicles.

The passenger car segment is projected to expand at a rapid rate in the global Automotive Brake Fluid Market. Passenger automobiles account for a significant amount of the automotive brake fluid market. Passenger automobiles account for a sizable share of the overall automotive market. The increasing global population, urbanization, and increased disposable incomes have resulted in an increase in passenger car ownership. As a result, there is a high need for automotive brake fluid in the passenger car category.

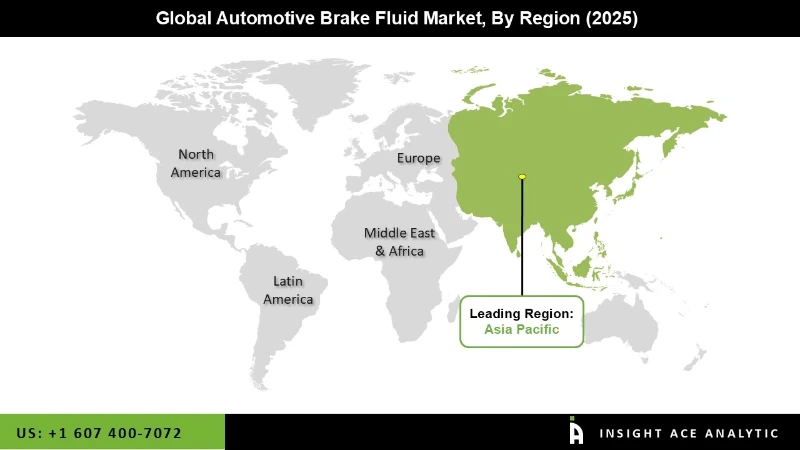

Asia Pacific Automotive Brake Fluid Market is expected to report the highest market share in terms of revenue in the near future. High demographic growth, infrastructure development, improved living standards, expansion of the industrial sector, and an increase in purchasing power among consumers are the major contributors to the rapid sales and production of vehicles, which fuels the growth of the automotive brake fluids market in this region.

Furthermore, the major firms are investing heavily to create and expand manufacturing units in rising markets like China and India. North America trails the Asia Pacific in terms of revenue share in the worldwide market, owing to rapid growth in the automotive industry and the adoption of technological advancements in automobiles.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.40 Bn |

| Revenue Forecast In 2035 | USD 2.25 Bn |

| Growth Rate CAGR | CAGR of 5.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Fluid Type, Vehicle Type, Product Type, Sales Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Robert Bosch GmbH, The China National Petroleum Corporation, Castrol, Exxon Mobil Corporation, Fuchs Petrolub SE, Royal Dutch Shell plc, China Petroleum & Chemical Corporation, Total S.A., Chevron Corporation, Qingdao Copton Technology Company Limited. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Automotive Brake Fluid Market By Fluid Type-

Automotive Brake Fluid Market By Product Type-

Automotive Brake Fluid Market By Vehicle Type-

Automotive Brake Fluid Market By Sales Channel-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.