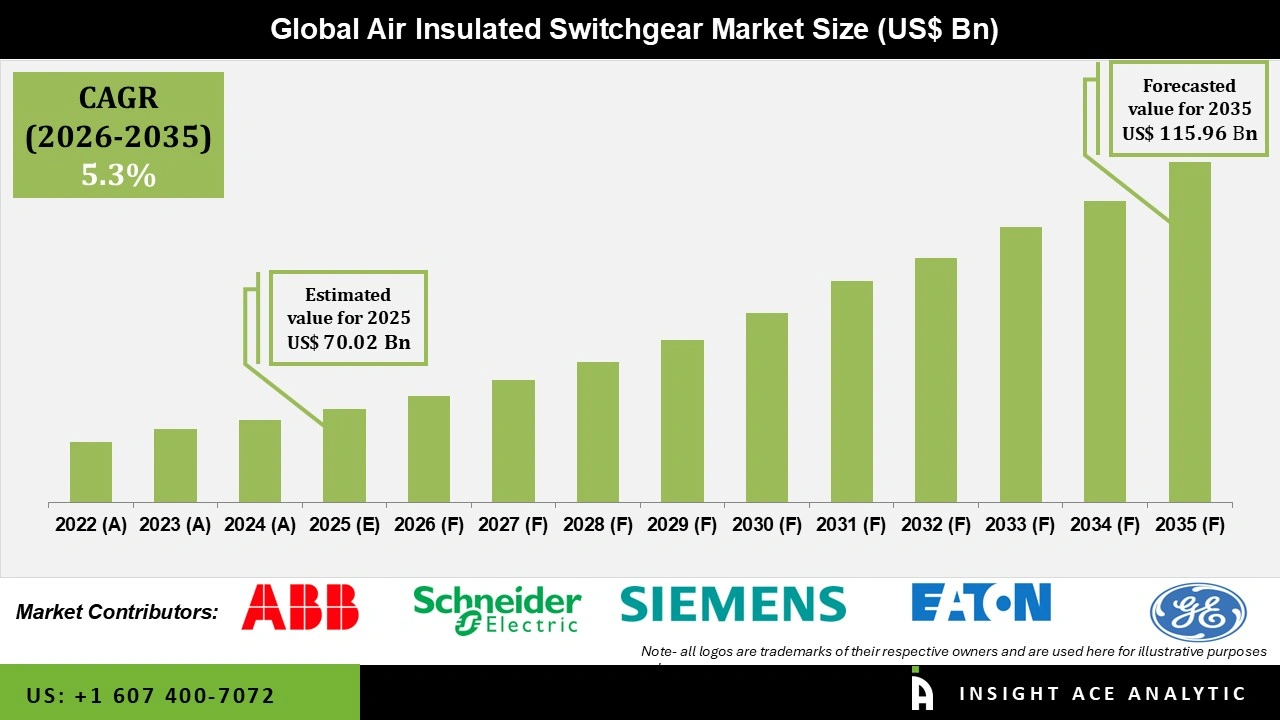

Global Air-Insulated Switchgear Market Size is valued at USD 70.02 Bn in 2025 and is predicted to reach USD 115.96 Bn by the year 2035 at a 5.3% CAGR during the forecast period for 2026 to 2035.

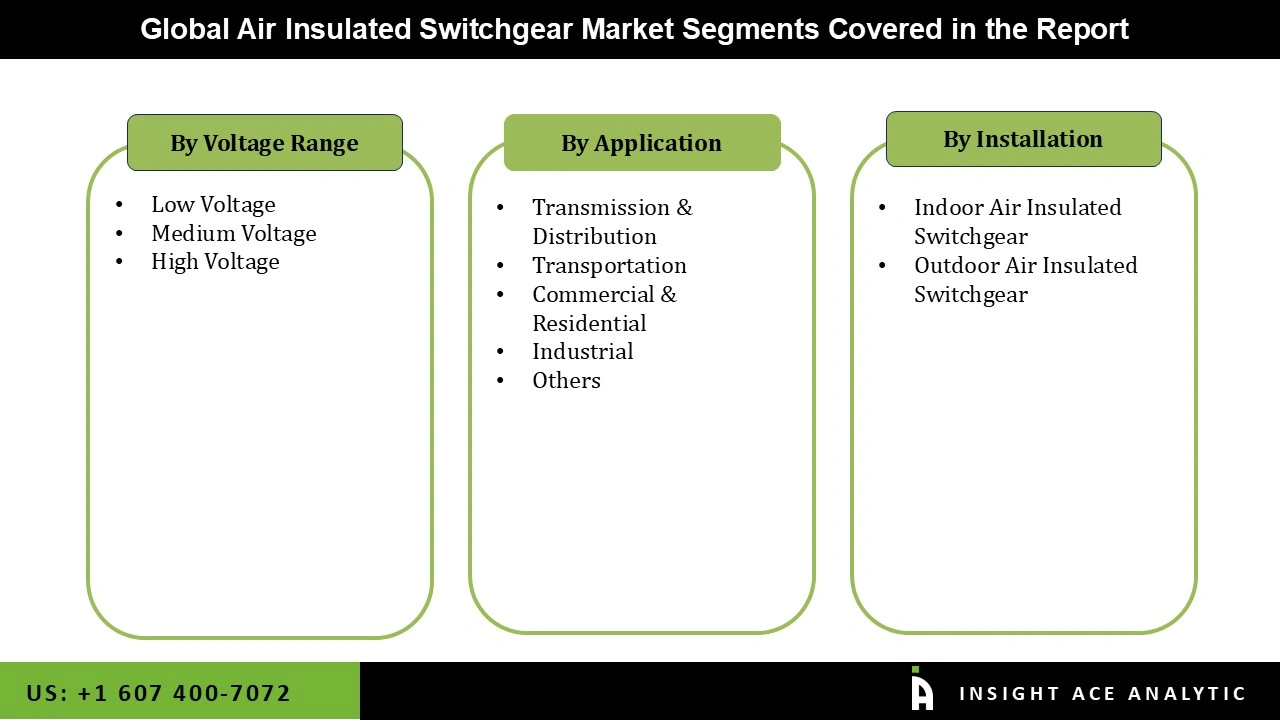

Air Insulated Switchgear Market Size, Share & Trends Analysis Report By Voltage (Low Voltage, Medium Voltage, High Voltage), By Installation (Indoor, Outdoor), By Application (Transmission & Distribution, Industrial, Commercial & Residential, Transportation, Others), By Region, And Segment Forecasts, 2026 to 2035

Air Insulated Switchgear Market Key Takeaways:

|

Key Industry Insights & Findings from the Report:

Air-insulated switchgear (AIS) is a form of electrical switchgear that insulates the elements that transport current with air. This form of switchgear, which can be enclosed or open, is utilized in high-voltage applications. When air is used as an insulating medium, larger voltages and currents can be handled without the risk of electrical arcing. In response to environmental concerns, many countries around the world have enacted laws and regulations to minimize the use of hydrocarbons in electricity generation, which is projected to expand the growth of the global air-insulated switchgear market.

Significant investment by developing countries in electrifying rural areas, as well as increasing network development, have fueled the growth of the worldwide air-insulated switchgear market. Furthermore, the growing demand for resilient and highly reliable electric networks across various business verticals has fueled market expansion.

However, The COVID-19 pandemic reduced worldwide economic growth, which slowed industrial and commercial activity, and hindered the air-insulated switchgear market development.

Furthermore, the use of gas-insulated switchgear (GIS) as an alternative to air-insulated switchgear is anticipated to hinder market growth during the projection period, as air-insulated switchgear substations require high maintenance, resulting in increased operational expenses.

The air-insulated switchgear market is segmented on the basis of voltage range, installation, and application. Based on voltage, the market is segmented as Low, medium, high. The installation segment includes indoor and outdoor. By application, the market is segmented into transmission & distribution, industrial, commercial & residential, transportation, and other applications.

The medium voltage category is expected to hold a major share in the global air-insulated switchgear market in 2024. It is intended to protect electrical equipment against excessive quantities of energy present in an electric field. This sort of switchgear, also known as an EMI filter, can help limit the amount of interference that electronic equipment experiences.

The transmission & distribution segment is projected to grow rapidly in the global air-insulated switchgear market due to the presence of a robust electrical grid network throughout major economies such as North America and Europe. This issue has resulted in increased demand for air-insulated switchgear from countries such as the United States, Canada, Mexico, China, Japan, and others, who have spent heavily in developing their power grid networks in recent years.

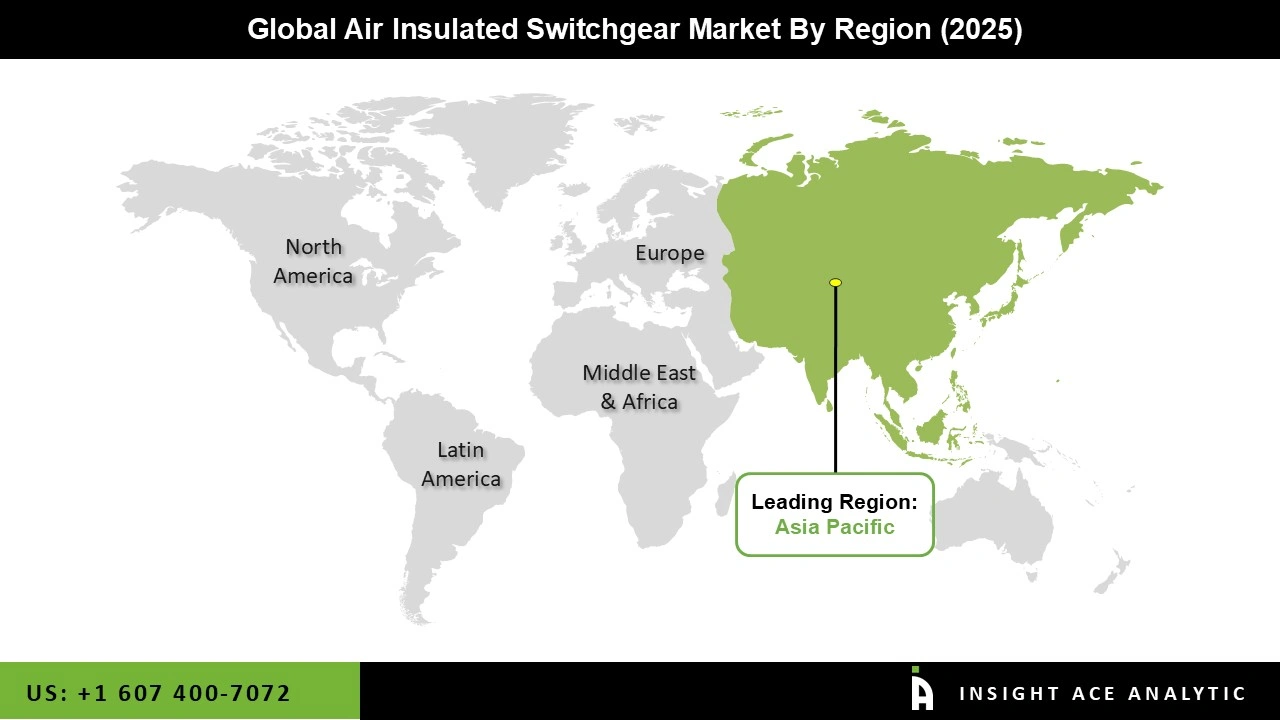

The Asia Pacific air-insulated switchgear market is expected to record an augmented market share in revenue shortly, owing to the rising demand for higher-voltage power distribution systems in growing markets such as China, India, Indonesia, Malaysia, and Thailand. Furthermore, rising investments in new power generation facilities and increased demand from end-use sectors are expected to boost growth in this region throughout the projection period.

Increasing investments in the renewable energy industry in North America and aging power infrastructure will likely provide market participants with significant business prospects in the next years.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 70.02 Bn |

| Revenue forecast in 2035 | USD 115.96 Bn |

| Growth rate CAGR | CAGR of 5.3% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Voltage Range, Installation, And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | ABB, ltd., Schneider Electric, Siemens AG, General Electric Company, Eaton Corporation, PLC, Larsen & Toubro Limited, Toshiba Corporation, Crompton Greaves, Ltd., Elatec Power Distribution GmbH, Epe Power Switchgear Sdn. BHD, Efacec Power Solutions, Alfanar Group, Ormazabal, Zpeu, PLC., Tavrida Electric AG, C&S Electric Limited, Lucy Electric, Tepco Group, Arteche, Nissin Electric Co. Ltd., Kohl S.A R.L, Medelec, Matelec Group, Pars Tableuau, and Wenzhou Rockwell Transformer Co. Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.