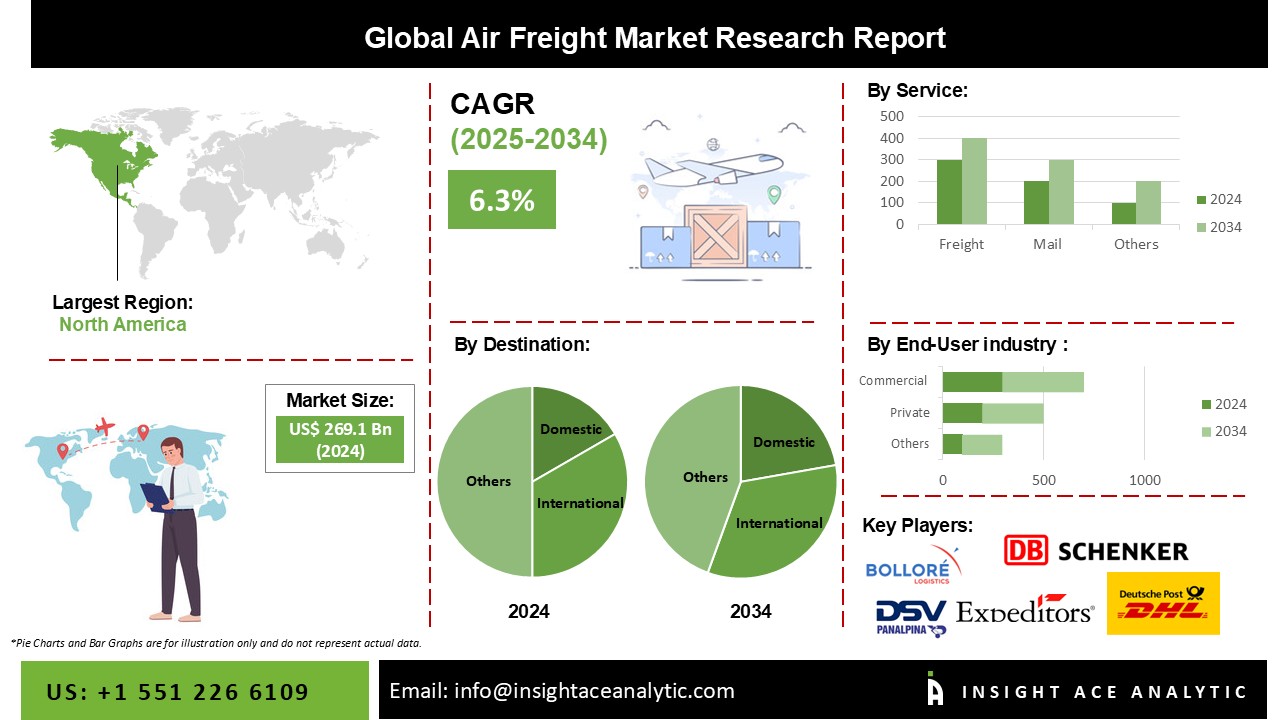

Air Freight Market Size is valued at 269.1 billion in 2024 and is predicted to reach 487.6 billion by the year 2034 at a 6.3% CAGR during the forecast period for 2025-2034

Air Freight solutions are designed to meet the demands of businesses that engage in air and ground transportation. Industrial and passenger cargo can be transported securely and safely from one point to another using these technologies. Air Freight technologies, which provide more affordable and practical options for speedier and easier transportation, are used to trace the item.

The demand for enhanced Air Freight systems is rising as a result of population increase and the outsourcing of manufacturing operations. One of the main elements promoting the development of Air Freight solutions is the demand for the safety and security of shipments. For normal trading and shipping firms, on-time delivery and cost-effectiveness are top priorities. Tools are available through Air Freight solutions to meet and address these issues. This has further improved the market for freight management systems growth prospects.

Additionally, faster and better transportation and growth in air cargo volume has led to a greater need for Air Freight solutions.

Furthermore, technological developments are influencing advancements in the market for Air Freight, including the integration of software for finance, personnel management, and customer relationship management to support the organization's end-to-end operation. Strong infrastructure, rising maintenance costs, and hefty setup prices are some of the sector's biggest obstacles.

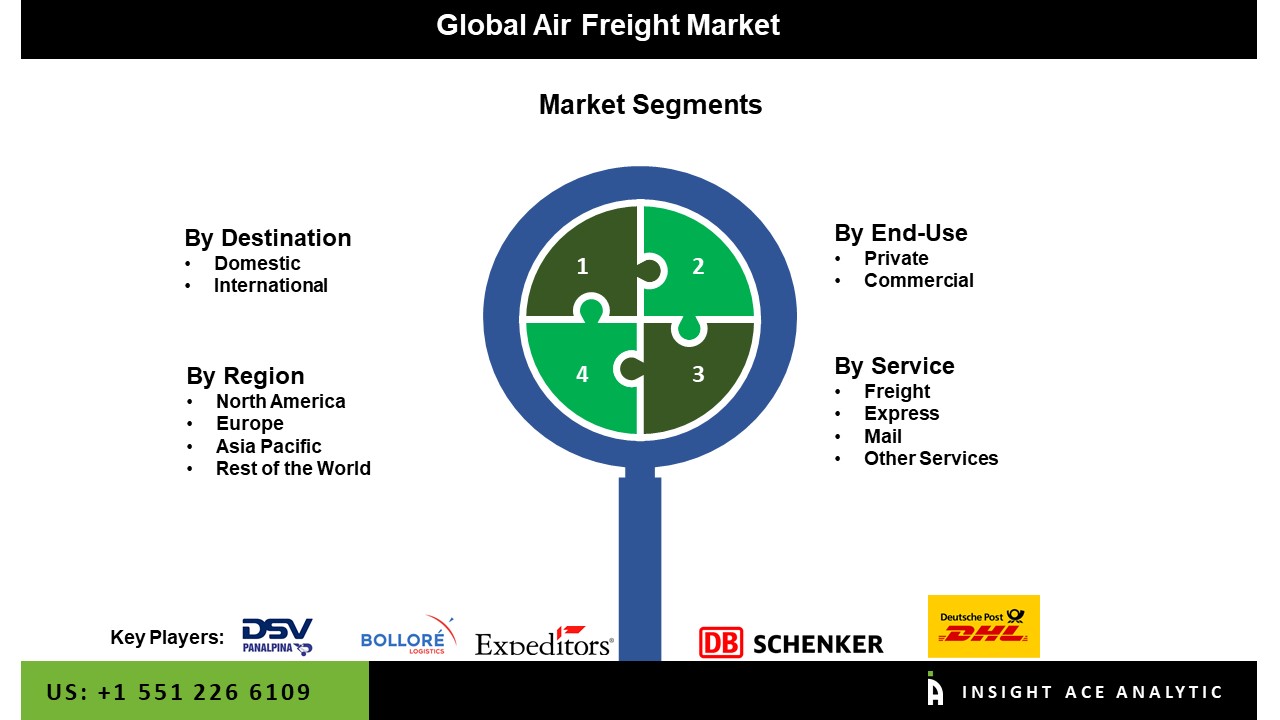

The Air Freight market is segmented on service, destination and end-use. Based on service, the market is categorized into freight, express, mail and other services. Based on the destination, the market is segmented into domestic and international. Based on end-use, the Air Freight market is segmented into private and commercial.

The freight category grabbed the highest revenue share, and it is projected that it will continue to maintain that position during the anticipated time. The expansion of air freight fleets across various locations is one of the factors propelling the growth of the regular services segment. The majority of operators of cargo aircraft have been pressing for expenditures to expand their own fleets of air cargo aircraft. To do this, the operators are concentrating on developing teamwork and aircraft leasing techniques, in which the businesses rent out cargo aircraft models to various customers, allowing them to expand into new areas.

The construction & infrastructure category is anticipated to grow significantly over the forecast period. The quickest delivery method for goods across international borders is via cargo jets. Additionally, air cargo is the safest way of shipping orders internationally because it requires the least handling and airport safety measures are closely enforced. This reduces the possibility of theft and shipment damage. Additionally, because air cargo shipments are typically short, insurance costs are frequently modest. These elements make Air Freight systems superior and necessary for moving products. Importing high-value commodities like electronics, jewelry, medications, perishables, and other items through air cargo is advantageous.

North America Air Freight market is expected to record the highest market share in revenue shortly. This is made feasible by regional users' widespread adoption of Air Freight products and services. High levels of technological adoption and the presence of important solution providers will affect how quickly the North American Air Freight system market will expand. Air Freight software is widely used in the US and Canada, two nations in North America. In addition, the European is projected to grow at a rapid rate in the global Air Freight market. This can be attributed to the increasing cargo freight handled by the area's logistics sector. Additionally, it is anticipated that the industry in the area will grow due to the major market players' rising investments in developing improved Air Freight software. The expansion is also credited to the presence of numerous important players in this area.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 269.1 Bn |

| Revenue forecast in 2034 | USD 487.6 Bn |

| Growth rate CAGR | CAGR of 6.3% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Service, Destination And End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Bolloré Logistics, DB SCHENKER (Deutsche Bahn Group (DB GROUP)), Deutsche Post AG (DHL GROUP), DSV Panalpina , Expeditors International of Washington, Inc., FedEx, Hellmann Worldwide Logistics, Kuehne+Nagel International AG, Nippon Express and United Parcel Service, Inc. (UPS). |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Air Freight Market By Service

Air Freight Market By Destination

Air Freight Market By End-Use

Air Freight Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Air Freight Market Snapshot

Chapter 4. Global Air Freight Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Service Estimates & Trend Analysis

5.1. by Service & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Service:

5.2.1. Freight

5.2.2. Express

5.2.3. Mail

5.2.4. Other Services

Chapter 6. Market Segmentation 2: by Destination Estimates & Trend Analysis

6.1. by Destination & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Destination:

6.2.1. Domestic

6.2.2. International

Chapter 7. Market Segmentation 3: by End-Use Estimates & Trend Analysis

7.1. by End-Use & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-Use:

7.2.1. Private

7.2.2. Commercial

Chapter 8. Air Freight Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Service, 2021-2034

8.1.2. North America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Destination, 2021-2034

8.1.3. North America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

8.1.4. North America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Service, 2021-2034

8.2.2. Europe Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Destination, 2021-2034

8.2.3. Europe Air Freight Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

8.2.4. Europe Air Freight Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Service, 2021-2034

8.3.2. Asia Pacific Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Destination, 2021-2034

8.3.3. Asia-Pacific Air Freight Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

8.3.4. Asia Pacific Air Freight Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Service, 2021-2034

8.4.2. Latin America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Destination, 2021-2034

8.4.3. Latin America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

8.4.4. Latin America Air Freight Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Service, 2021-2034

8.5.2. Middle East & Africa Air Freight Market Revenue (US$ Million) Estimates and Forecasts by Destination, 2021-2034

8.5.3. Middle East & Africa Air Freight Market Revenue (US$ Million) Estimates and Forecasts by End-Use, 2021-2034

8.5.4. Middle East & Africa Air Freight Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. Bolloré Logistics

9.2.2. DB SCHENKER (Deutsche Bahn Group (DB GROUP))

9.2.3. Deutsche Post AG (DHL GROUP)

9.2.4. DSV Panalpina

9.2.5. Expeditors International of Washington, Inc.

9.2.6. FedEx

9.2.7. Hellmann Worldwide Logistics

9.2.8. Kuehne+Nagel International AG

9.2.9. Nippon Express

9.2.10. United Parcel Service, Inc. (UPS)

9.2.11. Other Prominent Players