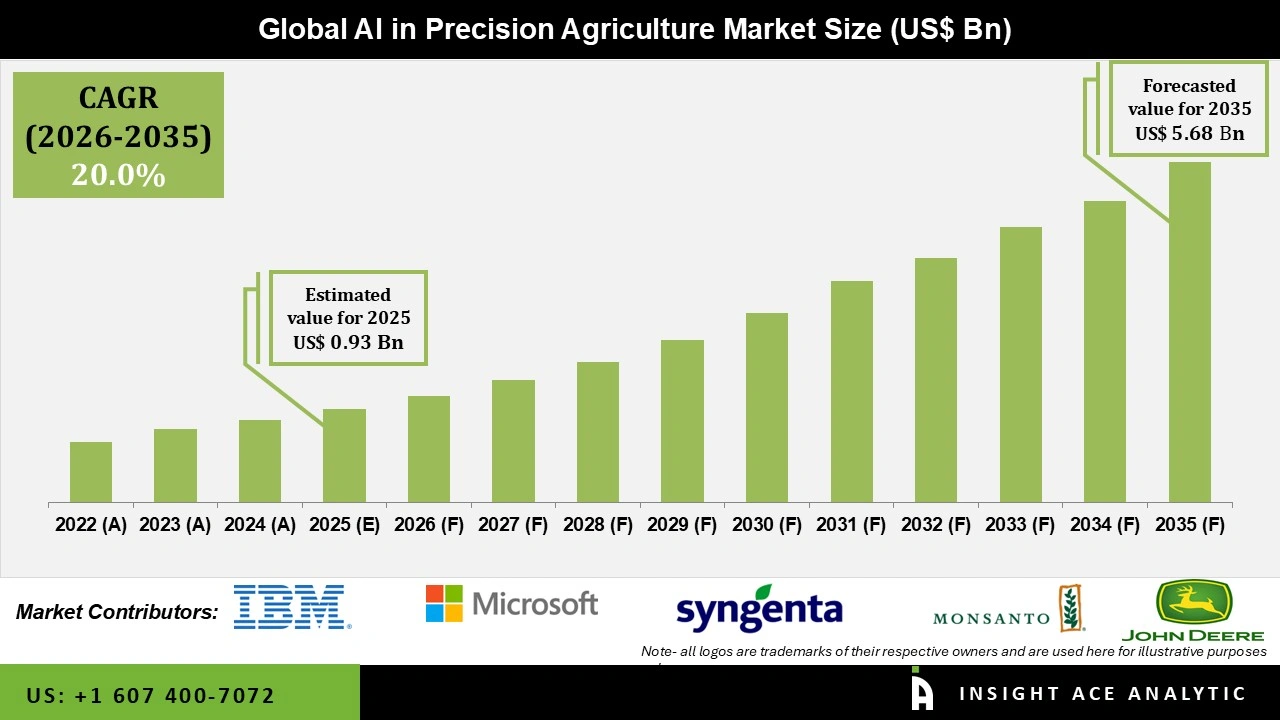

Global AI in Precision Agriculture Market Size was valued at USD 0.93 Bn 2025 and is predicted to reach USD 5.68 Bn by 2035 at a 20.0% CAGR during the forecast period for 2026 to 2035.

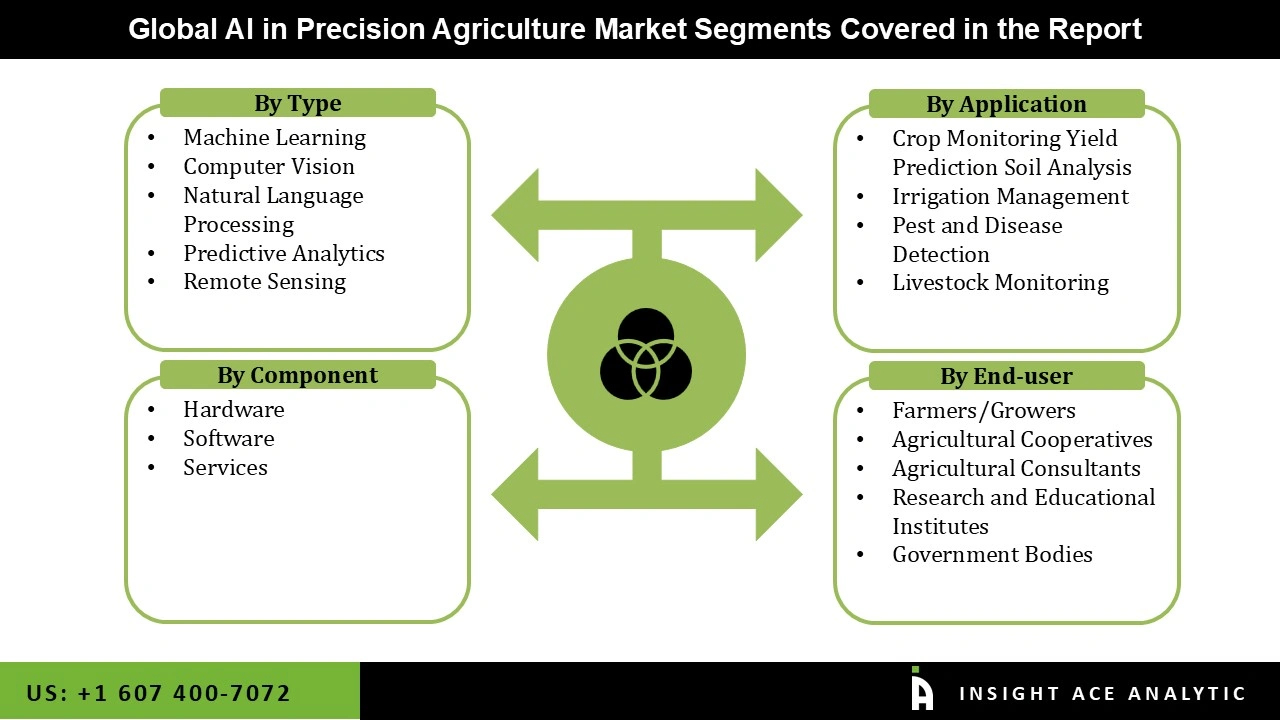

AI in Precision Agriculture Market Size, Share & Trends Analysis Report, By Type (Machine Learning, Computer Vision, Natural Language Processing, Predictive Analytics, Remote Sensing) By Application (Crop Monitoring, Yield Prediction, Soil Analysis, Irrigation Management, Pest and Disease Detection, Livestock Monitoring) By Component; By End-user, By Region, Forecasts, 2026 to 2035.

AI in Precision Agriculture has emerged as a revolutionary approach to modernizing traditional agricultural practices. By leveraging cutting-edge technologies like Artificial Intelligence (AI), the industry has experienced tremendous growth and is continually evolving. One of the key drivers of Al adoption in precision agriculture is its ability to enhance crop yield and quality. By harnessing Al-powered analytics, farmers can gain deeper insights into soil health, weather patterns, and plant growth conditions.

This information empowers them to apply targeted treatments, allocate resources more efficiently, and adopt sustainable farming practices. As a result, crop yields are significantly increased while minimizing resource wastage, contributing to a more environmentally friendly approach. Another critical aspect of Al in precision agriculture is its role in automation and robotics. Al-driven robotic systems enable performing tasks like planting, harvesting, and weeding with high precision and consistency.

However, Al-driven robotic systems enable the performance of tasks like planting, harvesting, and weeding with high precision and consistency. It reduces the labor burden on farmers and ensures that agricultural operations are executed accurately and at optimal times, further improving overall crop productivity. One of the most promising segments of Al in precision agriculture is the development of smart sensors and loT devices. These devices collect data on soil moisture, temperature, humidity, and nutrient levels, among other variables.

The AI in the precision agriculture market is segmented by type, application, component, and end user. The market is segmented based on type into machine learning, computer vision, natural language processing, predictive analytics, and remote sensing. The market is segmented by application into crop monitoring, yield prediction, soil analysis, irrigation management, pest and disease detection, and livestock monitoring. The market is segmented into hardware, software, and services based on components. Based on the end-user, the market is segmented into farmers/growers, agricultural cooperatives, agricultural consultants, research and educational institutes, and government bodies.

The machine learning segment is expected to hold a major share in the global AI in precision agriculture market in 2023. Machine learning algorithms are pivotal for analyzing vast amounts of agricultural data, enabling precise predictions and decisions. This technology enhances crop monitoring, soil management, and yield forecasting by learning from historical data and identifying patterns that optimize farming practices. The ability of Machine Learning to continuously improve its models and adapt to new data makes it a significant contributor to the market. Its applications in predictive analytics, pest detection, and resource management drive efficiency and productivity in agriculture, positioning it as a key factor in the growth and advancement of AI-driven precision farming solutions.

The crop monitoring segment is projected to grow at a rapid rate in the global AI in precision agriculture market owing to using advanced technologies like drones, satellite imaging, and sensors to collect real-time data on crop health, soil conditions, and growth patterns. This data is analyzed to optimize irrigation, detect pests and diseases early, and enhance overall crop yield. The integration of AI helps in predictive analysis, enabling farmers to make informed decisions and implement targeted interventions. This segment is growing rapidly due to its ability to improve agricultural productivity and sustainability, which is driven by increasing demand for efficient farming practices and technological advancements in AI and data analytics.

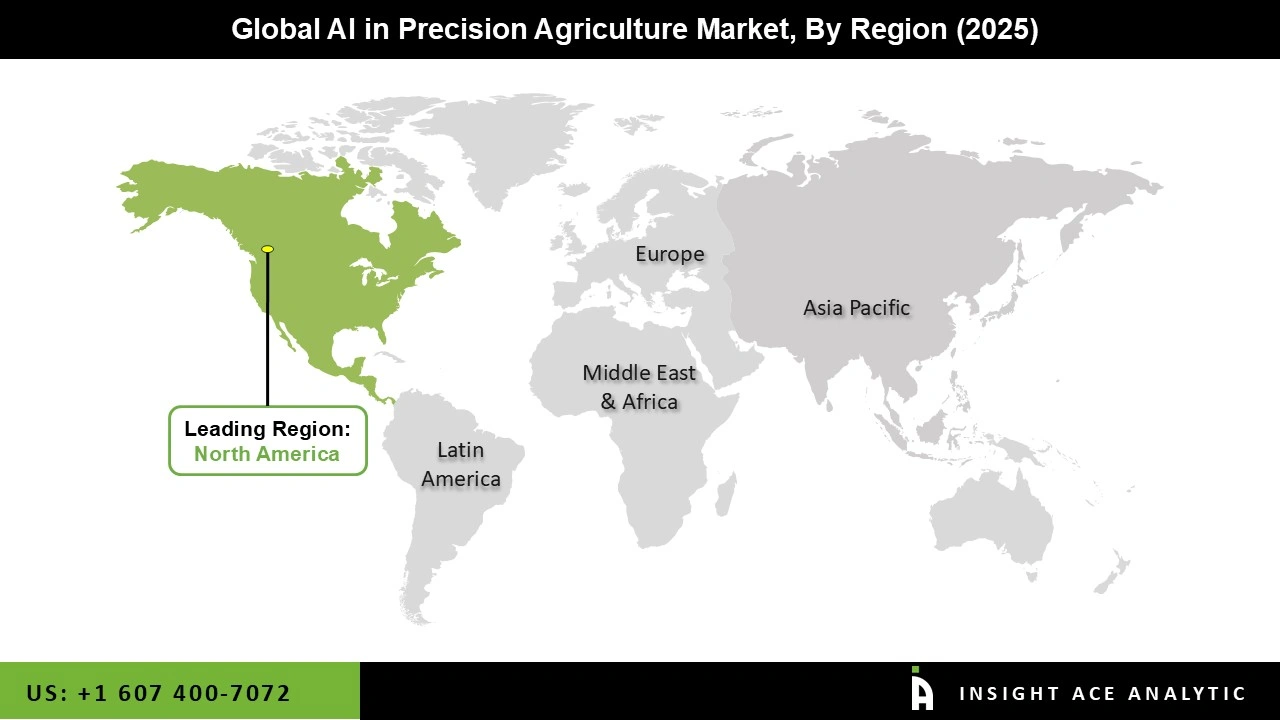

The North American AI in the precision agriculture market is expected to register the highest market share in terms of revenue in the near future. It can be attributed to the region's advanced technological infrastructure and substantial investment in agricultural innovation. The integration of AI technologies in precision agriculture is supported by the growing adoption of smart farming practices and the increasing demand for high-efficiency farming solutions.

North America's dominance is further bolstered by the presence of major technology providers and research institutions that drive advancements in AI applications for crop monitoring, soil analysis, and predictive analytics. The region's robust agricultural sector, combined with a favorable regulatory environment and funding for research and development, enhances its leading position in the global market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 0.93 Bn |

| Revenue Forecast In 2035 | USD 5.68 Bn |

| Growth Rate CAGR | CAGR of 20.0% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, By Application, By Component, By End User and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | IBM Corporation, Microsoft Corporation, John Deere, Monsanto Company, Syngenta AG, Trimble Inc., Deere & Company, AGCO Corporation, Climate Corporation, Descartes Labs, Granular Inc., Prospera Technologies Ltd., Taranis, Blue River Technology, PrecisionHawk, Farmwise, Gamaya, The Climate Corporation, Ceres Imaging, Awhere Inc., Tule Technologies, AgEagle Aerial Systems Inc., Harvest Croo Robotics, CNH Industrial N.V., and Others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.