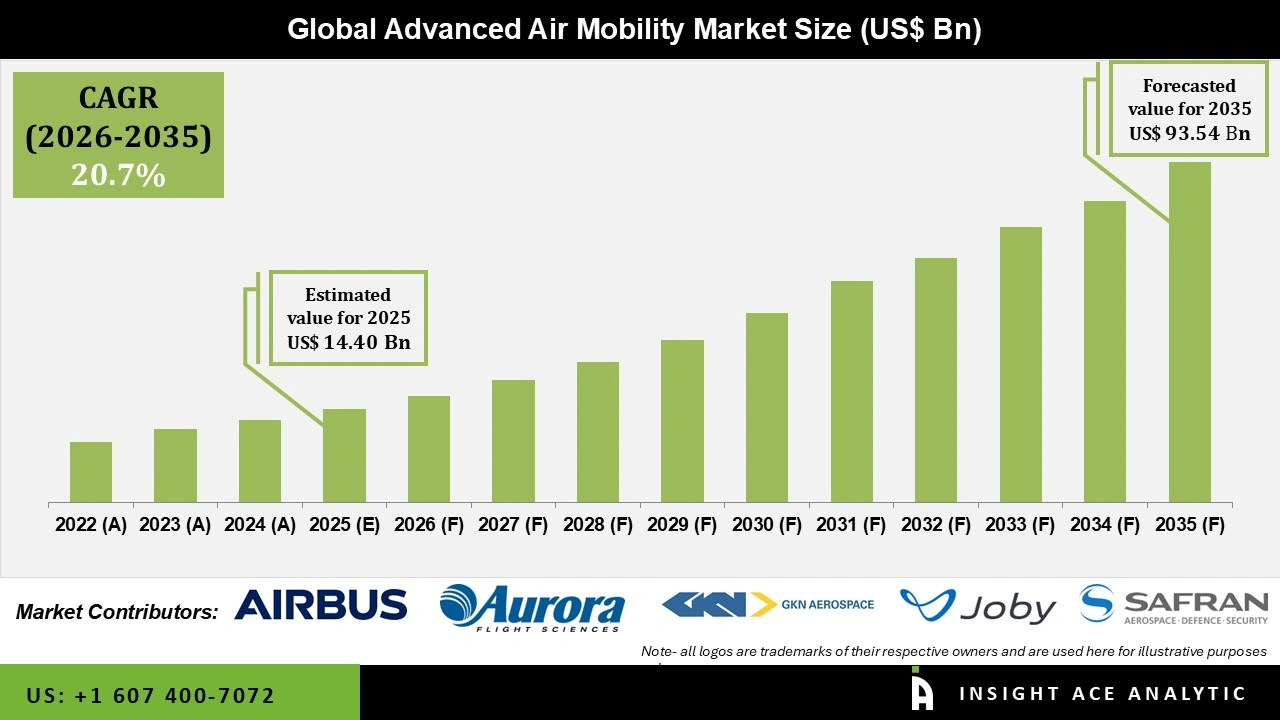

Global Advanced Air Mobility Market Size is valued at US$ 14.40 Bn in 2025 and is predicted to reach US$ 93.54 Bn by the year 2035 at an 20.7% CAGR during the forecast period for 2026 to 2035.

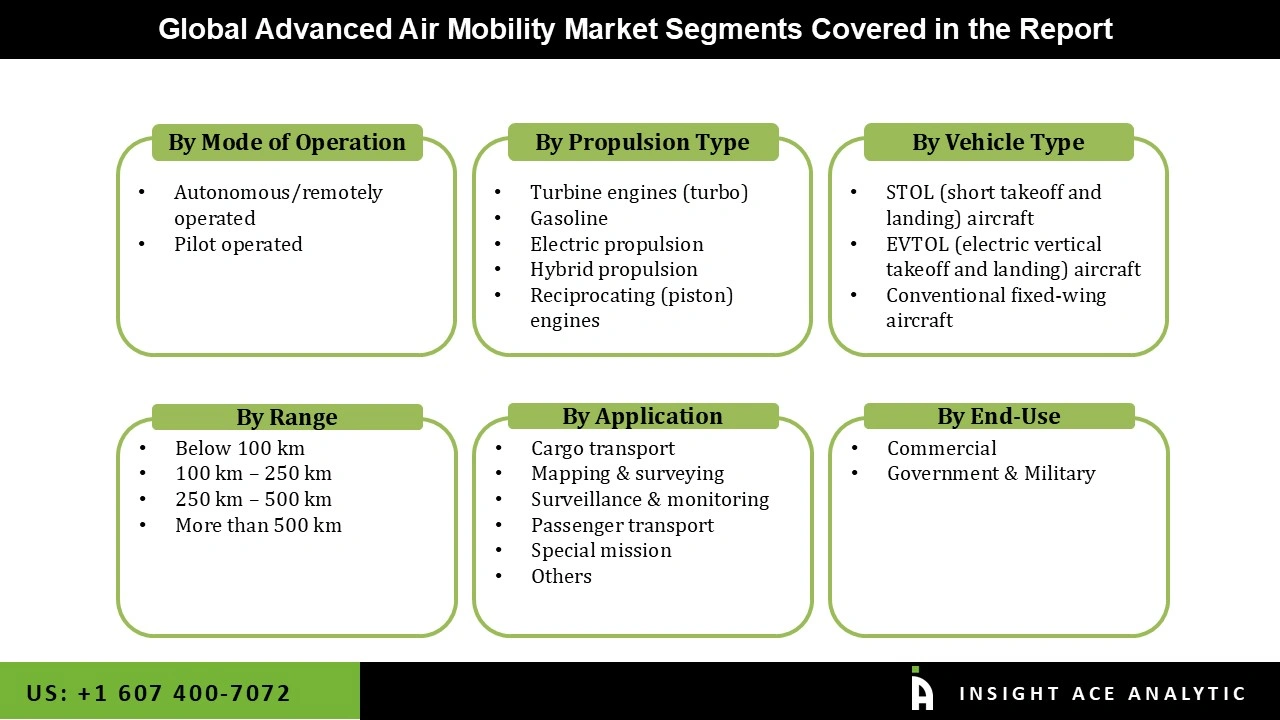

Advanced Air Mobility Market Size, Share & Trends Analysis Distribution by Mode of Operation (Autonomous/Remotely Operated and Pilot Operated), Propulsion Type (Turbine Engines (Turbo), Gasoline, Electric Propulsion, Hybrid Propulsion, and Reciprocating (Piston) Engines), Vehicle Type (STOL (Short Takeoff and Landing) Aircraft, EVTOL (Electric Vertical Takeoff and Landing) Aircraft, and Conventional Fixed-wing Aircraft), Application (Cargo Transport, Mapping & Surveying, Surveillance & Monitoring, Passenger Transport, Special Mission), By Range, By End-use, By Region and Segment Forecasts, 2026 to 2035

The integration of autonomous and electric aircraft for urban transportation is the focus of the developing field of advanced air mobility. Moreover, urban air mobility infrastructure, autonomous flight systems, and electric vertical takeoff and landing aircraft are essential components of advanced air transportation. It provides numerous advantages, including quick travel times, less traffic, ease of use, and less environmental impact. The growing number of companies providing cutting-edge air mobility solutions has been identified as one of the main causes of the expansion. As more businesses expand their operations into new areas, clients will have more options for cutting-edge air mobility solutions.

The demand for advanced air mobility is expected to rise further due to the growing demand for commercial air mobility and the growing traffic congestion that results in longer travel times both within and between cities. The services are now also essential for transporting other vital services like disaster relief and air ambulance. Additionally, several new laws and regulations have been implemented to support the growth of air mobility services.

The Advanced Air Mobility market is segmented by Mode of Operation, Propulsion Type, Vehicle Type, Application, Range, and End-use. By Mode of Operation, the market is segmented into Autonomous/Remotely Operated and Pilot Operated. By Propulsion Type, the market is segmented into Turbine Engines (Turbo), Gasoline, Electric Propulsion, Hybrid Propulsion, and Reciprocating (Piston) Engines. By Vehicle Type, the market is segmented into STOL (Short Takeoff and Landing) Aircraft, EVTOL (Electric Vertical Takeoff and Landing) Aircraft, and Conventional Fixed-wing Aircraft. By Application, the market is segmented into Cargo Transport, Mapping & Surveying, Surveillance & Monitoring, Passenger Transport, Special Mission, and Others. By Range, the market is segmented into Below 100 km, 100 km – 250 km, 250 km – 500 km, and More than 500 km. By End-use, the market is segmented into Commercial and Government & Military.

In 2024, the demand for controlled and flexible flight operations caused the autonomous/remotely piloted sector to hold the biggest market share. The airplanes in the remotely piloted portion are piloted by humans from a distance. When human judgment is needed, such as in complex missions, emergency response, and locations with difficult environmental circumstances, this style of operation is especially useful. The versatility and quick deployment of remotely piloted aircraft make them appropriate for a variety of uses, such as cargo transportation, infrastructure inspection, and surveillance.

The advanced air mobility market is dominated by cargo transport applications because of the growing need for quick, easy, and affordable logistics solutions. Today's innovations mostly focus on the employment of drones and autonomous aircraft in many sectors of the supply chain, particularly in last-mile deliveries, medical supplies, and other commodities that require quick turnaround times. Businesses are using self-piloted freight transportation systems, AI-powered route planning, and modern monitoring to enhance the flow of goods.

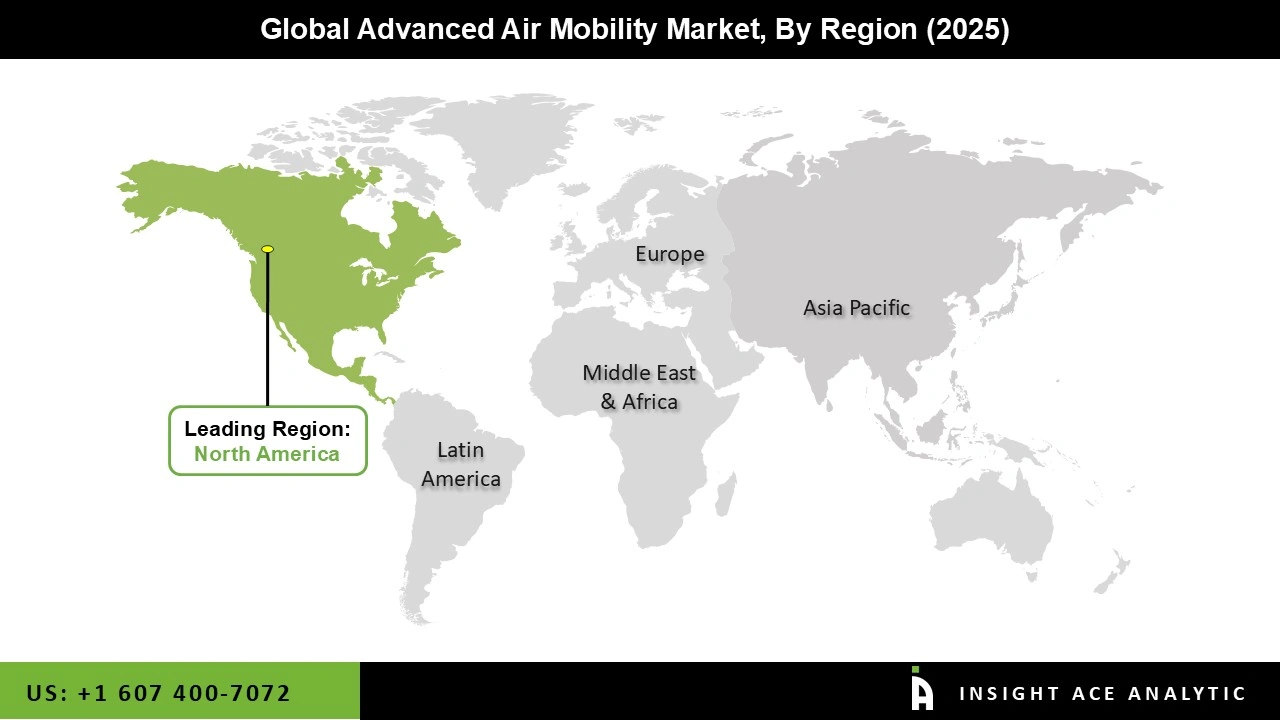

North America dominates the Market for Advanced Air Mobility because of strong government backing, including programs like the FAA's Urban Air Mobility (UAM) roadmap that encourage investment for research and regulatory frameworks. Significant private sector investments are also driving the market, allowing for the quick development and implementation of AAM infrastructure. Moreover, with intentions for commercial operations in the upcoming years, major aerospace companies such as Joby Aviation, Lilium, and Urban Aeronautics are pushing the development of eVTOLs in this region. Additionally, venture finance and private investment are speeding up the adoption of autonomous flight technology, putting the United States in a leadership position for AAM in the years to come.

However, with a strong focus on sustainability and technical innovation, Europe is the second-largest region in the market for advanced air mobility. While nations like the UK and Germany invest in infrastructure like vertiports, the European Aviation Safety Agency (EASA) has played a significant role in creating regulatory frameworks. Integrating eVTOL aircraft into urban transportation networks requires public-private sector partnerships, as demonstrated by initiatives like the UK's vertiport testbed by E-Skyports Infrastructure.

| Report Attribute | Specifications |

| Market Size Value In 2025 | US$ 14.40 Bn |

| Revenue Forecast In 2035 | USD 77.5 Bn |

| Growth Rate CAGR | CAGR of 20.7% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Mode of Operation, By Propulsion Type, By Vehicle Type, By Application, By Range, By End-use, and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; Germany; The UK; France; Italy; Spain; Rest of Europe; China; Japan; India; South Korea; Southeast Asia; Rest of Asia Pacific; Brazil; Argentina; Mexico; Rest of Latin America; GCC Countries; South Africa; Rest of the Middle East and Africa |

| Competitive Landscape | Bell Textron Inc., Airbus, Aurora Flight Sciences, The Boeing Company, and Guangzhou EHang Intelligent Technology Co. Ltd. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.