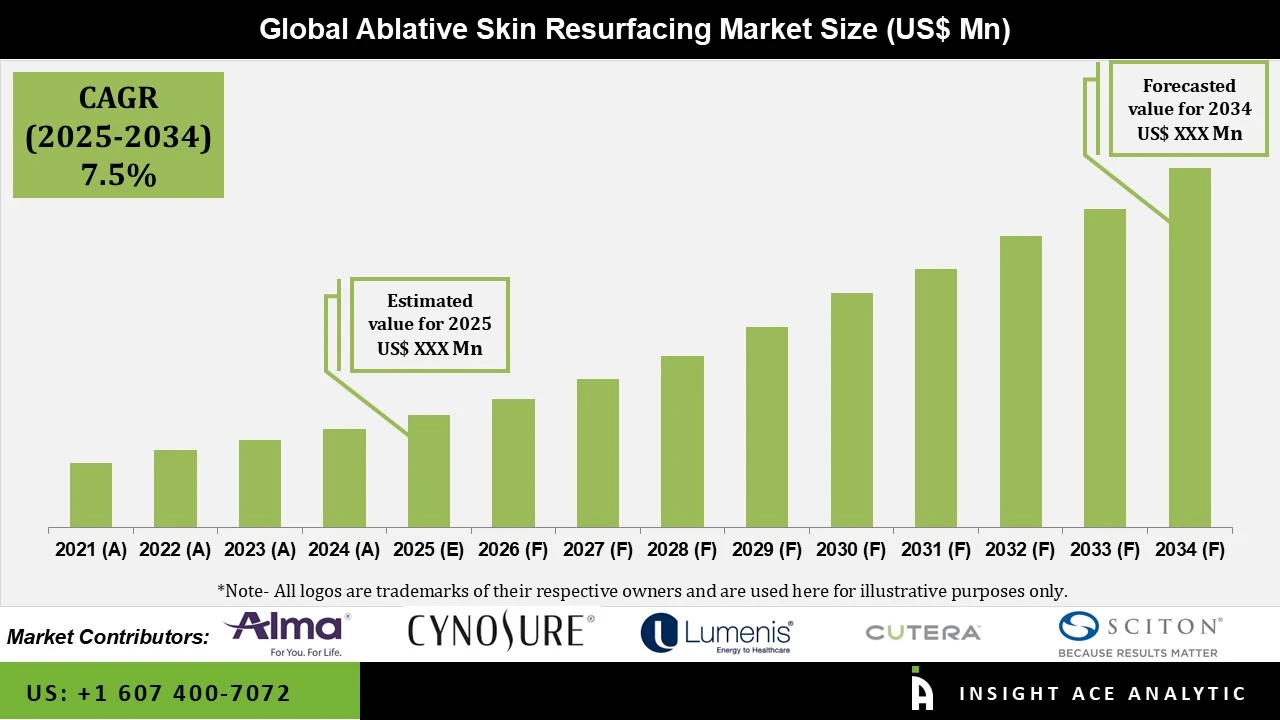

Global Ablative Skin Resurfacing Market Size is predicted to grow at a 7.5% CAGR during the forecast period for 2025-2034.

In order to encourage the body's natural healing process and foster the development of new, smoother skin, ablative skin resurfacing is a cosmetic dermatological technique that removes the outer layers of damaged skin. Laser technologies like CO₂ (carbon dioxide) or Er:YAG (erbium) lasers, which accurately vaporize the skin's outer layers while simultaneously tightening the underlying tissue, are frequently used for this procedure. Deep wrinkles, scars (including acne scars), UV damage, uneven skin tone, and other cosmetic flaws can all be lessened with this treatment.

Ablative resurfacing produces more striking effects than non-ablative techniques because it targets deeper skin layers. The growing incidence of skin aging and dermatological problems that require efficient treatment choices is the main factor driving the growth dynamics of the ablative skin resurfacing market.

In addition, the ablative skin resurfacing market expansion is further supported by customers' increased aesthetic sensibility and rising disposable incomes. The growing demand for cutting-edge dermatological procedures targeted at wrinkle reduction, scar removal, and skin rejuvenation is propelling the global market for ablative skin resurfacing. Further driving market expansion are technical developments and growing public awareness of minimally invasive cosmetic procedures. The ablative skin resurfacing market's strong trajectory is supported by the convergence of cutting-edge laser technology and rising aesthetic sensitivity among consumers globally. Moreover, innovative product introductions that support the ablative skin resurfacing market's growth potential are also being fostered by strategic expenditures in research and development.

However, the high cost of the operations, dangers and side effects, limited reimbursement coverage for the procedures, and lack of knowledge about skin resurfacing are some of the primary challenges holding back the ablative skin resurfacing market. Additionally, since strict safety and efficacy requirements must be fulfilled, regulatory obstacles may affect the adoption of innovative technology and practices. For startups and small firms looking to innovate in this field, navigating the regulatory framework can be especially difficult. On the other hand, during the course of the projection period, the ablative skin resurfacing market is expected to develop due to the widespread availability of accurate, energy-efficient ablative laser systems, which will offer safer and quicker recovery choices.

Which are the Leading Players in Ablative Skin Resurfacing Market?

Driver

Growing Awareness for Skin Care

There has been a noticeable movement toward proactive skincare and cosmetic treatments as people become more aware of the significance of maintaining good skin. Increased awareness of skin protection and rejuvenation has resulted from awareness campaigns, social media influence, and instructional content about the detrimental effects of environmental variables like UV radiation, pollution, and lifestyle choices. As more people become aware of the long-term consequences of ignoring skin health, more people are looking for ways to prevent skin damage and deal with pre-existing issues like wrinkles, pigmentation, and acne scars. Additionally, people are more likely to spend money on professional skin treatments, such as resurfacing procedures, to enhance the health and appearance of their skin due to the increased emphasis on self-care. As a result, there is a greater need for ablative skin resurfacing procedures, especially among those who are increasingly aware of the dangers of neglecting their skin's demands and are searching for practical solutions.

Restrain/Challenge

High Cost Associated with the Treatment

A major obstacle for both patients and clinicians is the high initial cost of sophisticated ablative skin resurfacing tools and techniques. Modern laser systems and energy-based equipment can be difficult for smaller clinics and practitioners to get because of their high capital costs. The operational costs are further raised by the cost of maintenance, consumables, and operator training. Many patients consider ablative skin resurfacing to be a cosmetic or elective procedure, which results in restricted insurance coverage and the need for out-of-pocket expenses. In price-conscious markets, this cost sensitivity limits procedure volumes. For the ablative skin resurfacing market to continue expanding widely, affordability issues must be resolved.

The CO₂ laser segment held the largest share in the ablative skin resurfacing market in 2024 because of its significant clinical efficacy in treating photoaging, wrinkles, acne scars, and dyschromia, which is why dermatologists and patients are in high demand. While maintaining the superior collagen-remodeling benefits of classic ablative systems, innovations like fractional CO₂ technologies have drastically decreased downtime and side effects, increasing therapy acceptability for a larger patient group. Additionally, the dermatology clinics and medical spas are seeing an increase in procedure volumes due to rising aesthetic consciousness, rising disposable incomes, and the popularity of less invasive cosmetic operations.

In 2024, the wrinkle removal segment dominated the ablative skin resurfacing market, since wrinkles are among the most prevalent and obvious indications of aging and are a major concern for many patients seeking ablative skin resurfacing treatments. The normal aging process, which involves a decrease in the production of collagen and elastin, is usually the cause of these skin flaws. While elastin enables the skin to regain its previous shape after stretching, collagen gives the skin strength and structure. Over time, the breakdown of these proteins causes the skin to become less firm and more prone to wrinkles and sagging. Due to the large number of people looking for remedies for these obvious indications of aging, the demand for ablative skin resurfacing procedures that target wrinkles and fine lines has increased dramatically.

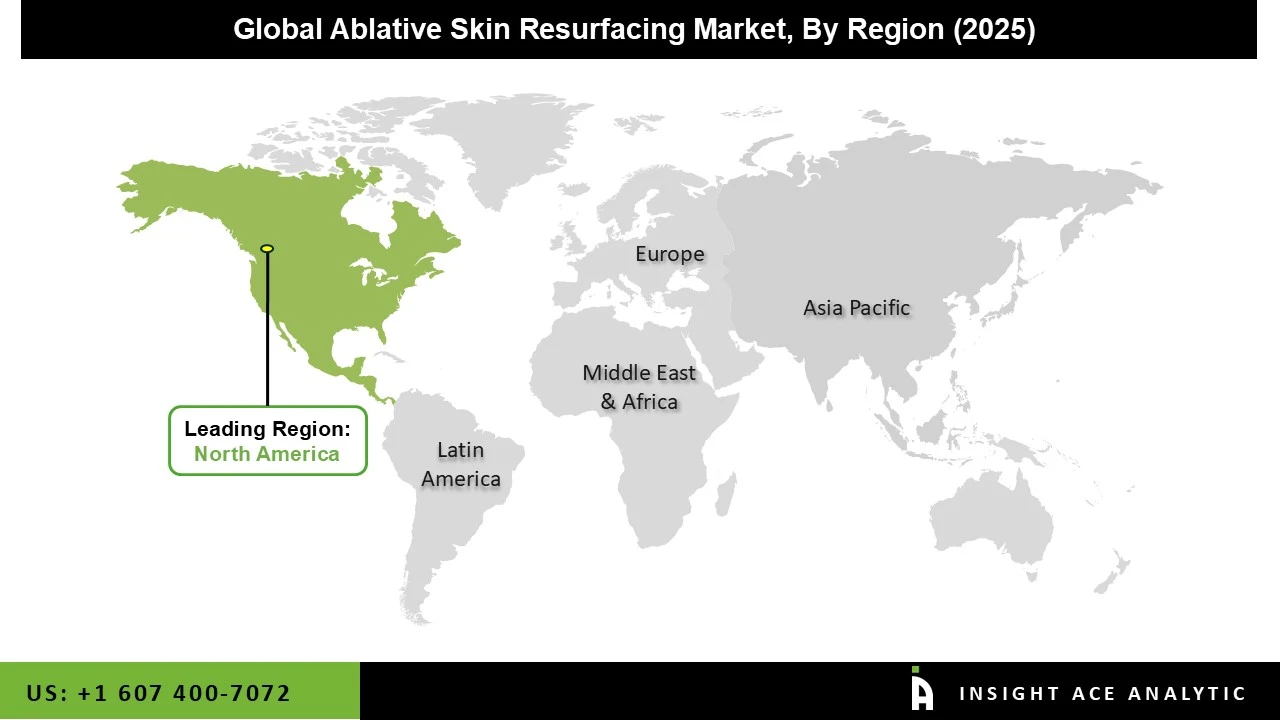

The ablative skin resurfacing market was dominated by the North America region in 2024, driven by an aging population looking for efficient anti-aging therapies, greater awareness of cosmetic dermatology, and an increasing demand for sophisticated aesthetic procedures. Strong adoption of laser-based technology, high disposable income, and the existence of reputable dermatology clinics and medical spas all contribute to market growth.

Furthermore, ongoing technological developments in CO2 and Er:YAG laser systems, which provide enhanced safety, accuracy, and quicker recovery periods, are increasing procedural volumes in the United States and Canada. The sustained market growth is also greatly aided by the impact of social media, local medical tourism, and growing indications for pigmentation treatment and scar revision.

November 2023: Venus Versa Pro was introduced in the United States by Venus Concept Inc., a leader in medical aesthetic technology worldwide. Ten applicators can be used with this unique multi-application platform to address wrinkles, pigmentation, acne, and skin texture. It improves coagulation and ablation for better skin resurfacing, building on the Venus VivaMD system. Additionally, the gadget offers the renowned TriBella therapy, which combines NanoFractional RF and (MP)² IPL technologies for complete skin rejuvenation.

February 2023: In the United States, Biolase Inc. launched the Waterlase Fractional Handpiece. Physicians can modify penetration depth using various settings and approaches using this device, which offers both ablative and non-ablative fractional therapies. It increases the effectiveness of treatment by creating a uniform, one-dimensional micro-perforation pattern on tissue surfaces.

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.