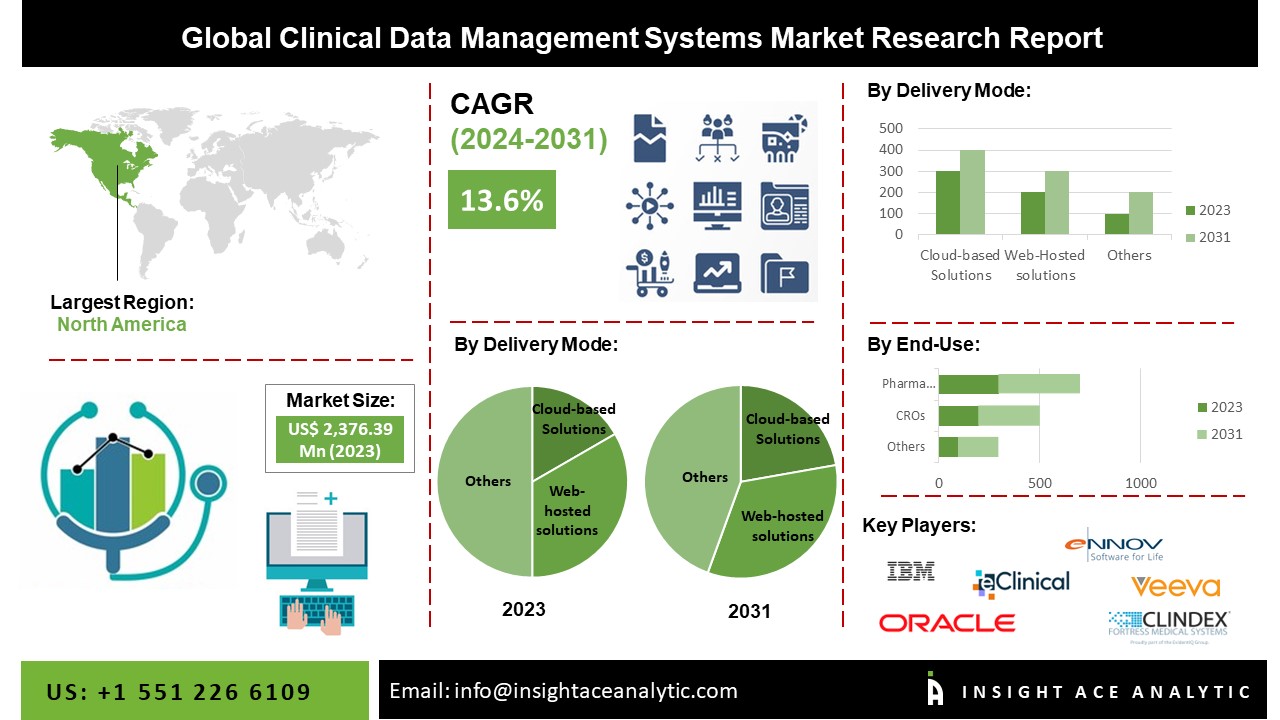

The Clinical Data Management Systems Market Size is valued at USD 2,376.39 Million in 2023 and is predicted to reach USD 6,399.82 Million by the year 2031 at a 13.6 % CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Clinical research employs the technique of clinical data management to provide reliable, fruitful, and high-quality data from clinical trials. Clinical data management ensures reliable information is gathered, integrated, and available at a fair price. It is also advantageous to conduct clinical research and manage the data analysis and management. Its main goal is to make sure that the study's findings are supported by data that has been collected and stored. The rising number of clinical trials worldwide is anticipated to drive steady growth in the clinical data management systems (CDMS) market by 2030.

Additionally, throughout the course of the projected period, market growth is likely to be boosted by the expanding healthcare sector and the rapid advancements in the pharmaceutical industry. Product adoption has been driven by the increasing use of clinical data management systems by CROs and medical device manufacturers to maintain track of clinical data. Large-scale manufacture of pharmaceutical products needs effective data management for stringent process assurance, which helped the clinical data management systems market grow favourably in recent years. Key industry players have been making tactical growth choices to increase their market share in the clinical data management systems (CDMS) market, including partnerships, collaborations, and product development.

The clinical data management system industry must address three key problems: data cleaning, time-consuming clinical data reconciliation, and high software prices. Data collection raises patient privacy concerns, especially in the electronic data capture business, which might limit the market growth.

The Clinical Data Management Systems Market is segmented on the basis of Delivery Mode and End-use. Based on Delivery Mode, the market is segmented as Licensed Enterprise Solutions, Cloud-based Solutions, and Web-hosted Solutions. Based on End-use, the market is segmented into Contract Research Organizations, Medical Device Companies, and Pharma/Biotech Companies.

Over the course of the forecast, the cloud segment's market share will rise. The cloud deployment technique provides better data management, a lower chance of data loss, and less concern for regulatory compliance. More businesses are using cloud-based security and safety solutions as a result of these advantages. In response to customer demands and business objectives, organizations are progressively implementing cloud-based solutions. The cloud deployment technique has advantages, including higher speed, scalability, 24/7 support, and improved IT security. The increasing need for efficient cloud storage, access, and administration of the massive volumes of data produced by these organizations has been a crucial growth facilitator.

During the projection period, the contract research organization (CRO) segment is anticipated to increase at a faster rate. Globally expanding contract research organizations (CROs) are expected to boost market revenue. The market demand is also anticipated to be further fuelled by a growing trend of outsourcing clinical trials to CROs, which lowers the overall cost of drug development. In addition, a number of CROs have chosen to use the clinical data management system (CDMS) and electronic data capture (EDC) as two of the most popular digital solutions to handle the growing volume of data. Therefore, it is projected that the use of CDMS in various clinical research initiatives will positively impact market growth in the upcoming years.

North America dominated the clinical data management systems market due to the increased demand for data standardization and rising investments in pharmaceutical firms. The growth of the E medical answer software market was also fuelled by the presence of multiple pharmaceutical organizations in North America, primarily focused on improving new drugs. The expansion of the clinical data management market is attributed to the outsourcing of medical trials and the accessibility of a variety of patients in the area. Additionally, the region's population base made it possible for contract research organizations to conduct studies there, which resulted in the widespread use of such software in the region.

· Oracle Corporation

· eClinical Solutions LLC

· IBM Corporation

· CIMS Global (CIMS)

· Axiom Real-Time Metrics

· Medidata Solutions (Dassault Systèmes)

· Fortress Medical

· Veeva Systems

· OpenClinica LLC

· IQVIA Holdings, Inc.

· Syneos Health

· Veranex

· Premier Research

· ICON plc

· Signant Health

· Pharmaron

· Quanticate

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 2,376.39 Million |

| Revenue Forecast In 2031 | USD 6399.82 Million |

| Growth Rate CAGR | CAGR of 13.6 % from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, By Delivery Mode, By End User, By Phase of Clinical Trial, By Functionality, By Therapeutic Area |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Oracle Corporation, eClinical Solution LLC, IBM Corporation, CIMS, Axiom Real-Time Metrics, Medidata Solution (Dassault Systemes)., Fortress Medical, Veeva Systems, OpenClinica LLC, and Ennov. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Delivery Mode

By Component

By End-use

· Pharmaceutical & Biotechnology Companies

· Contract Research Organizations (CROs)

· Medical Device Manufacturers

· Academic & Research Institutions

By Phase of Clinical Trial

· Phase I

· Phase II

· Phase III

· Phase IV (Post-Marketing / Observational)

By Functionality

· Data Capture & Entry

· Data Validation & Cleaning

· Database Design & Build

· Data Integration & Interoperability

· Reporting & Visualization

By Therapeutic Area

· Oncology

· Cardiovascular Diseases

· Central Nervous System (CNS)

· Infectious Diseases / Vaccines

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Rest of Middle East and Africa

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.