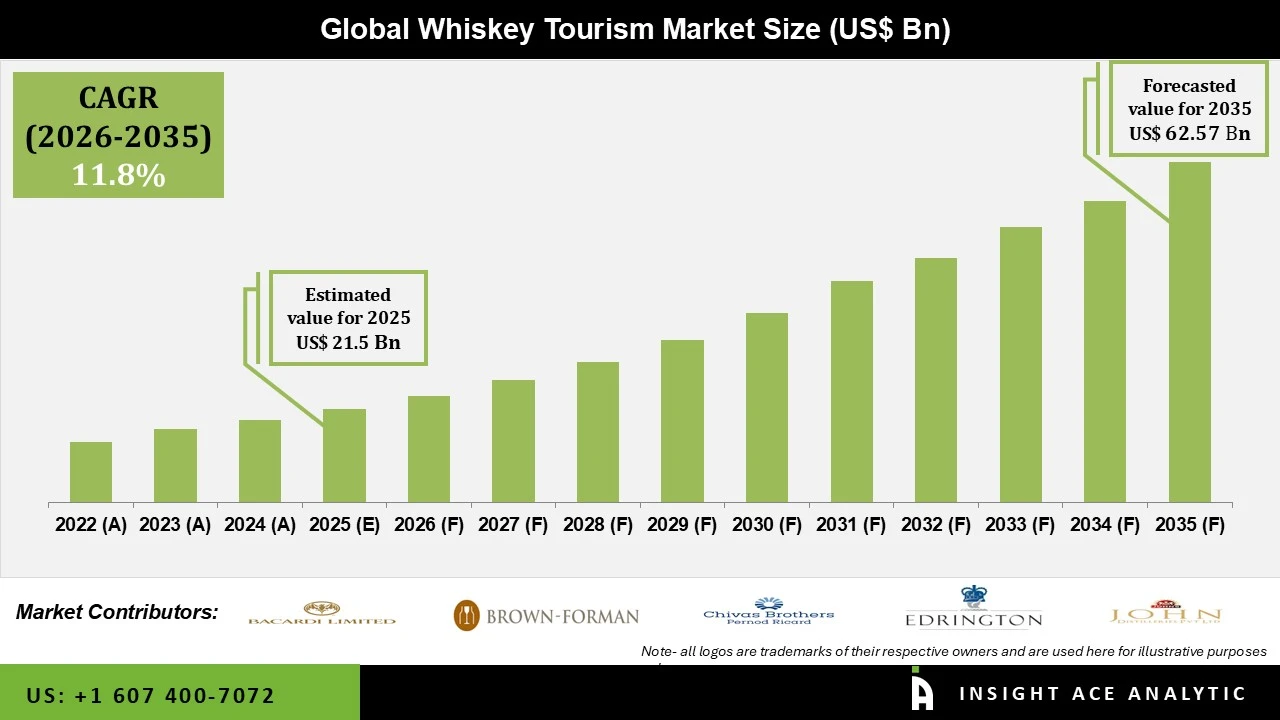

Whiskey Tourism Market Size is valued at USD 21.5 billion in 2025 and is predicted to reach USD 62.57 billion by the year 2035 at a 11.8% CAGR during the forecast period for 2026 to 2035.

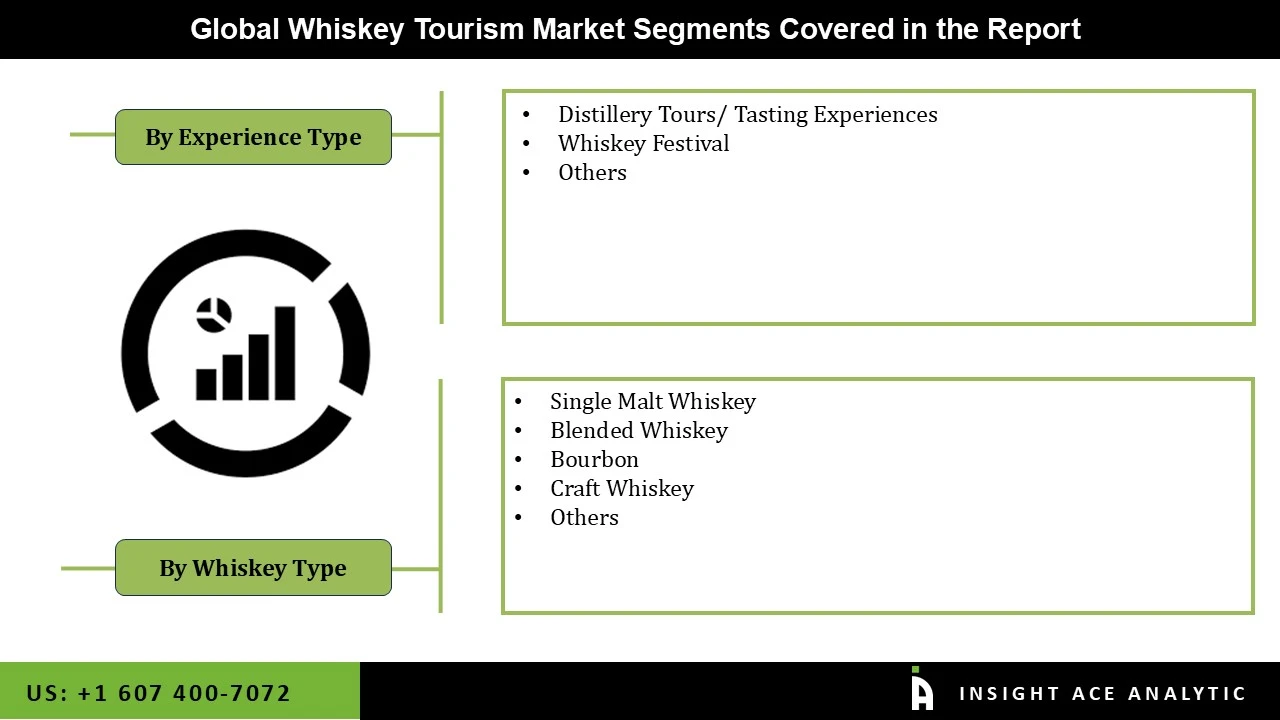

Whiskey Tourism Market Size, Share & Trends Analysis Report By Experience Type (Distillery Tours/ Tasting Experiences, Whiskey Festival, Others), By Whiskey Type (Single Malt Whiskey, Blended Whiskey, Bourbon, Craft Whiskey, Others), By Region, And By Segment Forecasts, 2026 to 2035

Whiskey tourism entails visiting whiskey-producing areas to tour distilleries, get knowledge about the production process, and partake in tastings. Notable destinations encompass Scotland, Ireland, the United States, and Japan, where travelers engage with whiskey trails and delve into local culture and history.

The rising number of consumers viewing whiskey as a measure of wealth and their preference for high-end liquor are the main factors driving the whiskey industry. Greater financial freedom due to industrialization and the development of the upper social class has led to greater expenditure on expensive beings, which in turn is driving up the need for whiskey. In addition, the whiskey sector is significantly influenced by the booming travel and tourism sector. Travellers and frequent travellers alike seek out genuine and high-quality ethnic drinks to imbibe, which boosts sales. Drinking events, occasions, and social gatherings piqued customer interest, which is fueling the market's expansion. Expenditures also aid the expansion of the whiskey market in distinctive containers and advertising strategies.

However, the biggest element limiting the whiskey industry's growth is the prolonged maturation process. Whiskey containers require lengthy storage and upkeep, which requires breweries to commit funds and resources with no guarantee of recovery. Alcohol distilleries may also find it difficult to precisely project market demands due to shifts in consumer choices and variations in supply. Alcohol distilleries manage the risk of either excessive or underproduction of old whiskey as a consequence, which could result in diminished profits or insufficient stock. Furthermore, external elements like temperature and moisture might have an impact on the standard of the end item during ageing.

The whiskey tourism market is segmented based on experience type and whiskey type. Based on experience type, the market is segmented into distillery tours/ tasting experiences, whiskey festivals, and others. By whiskey type, the market is segmented into single malt whiskey, blended whiskey, bourbon, craft whiskey, and others.

The whisky festivals' whiskey tourism market will hold a major global market share. Whisky festivals are becoming increasingly popular, progressing from small-scale communal events to significant global audiences. Whisky festivals are expected to develop further because they provide distinctive, deep experiences that reflect the extensive culture and tradition of the liquor. This rise is indicative of the sector's ability to engage with enthusiasts throughout nations.

The single malt whisky industry is the dominating category. A fully immersive event that showcases the tradition and creativity in single malt whisky manufacturing, the tour offers travellers the chance to discover Glenfiddich's historic storage facility, understand the history of barrel development, and taste the whisky's extraordinary level of sweetness.

The North American whiskey tourism market is expected to note the highest market share in revenue in the near future. This can be attributed to the area's food and beverage sector's sharply growing need for whiskey and the increasingly evolving living in this area. Furthermore, the distillery began producing whiskey because of a deadline for permission from government regulators. Big distilleries will thus become much more prevalent in the area. In addition, Europe is likely to grow rapidly in the global whiskey tourism industry because of the area's growing nightclub and eating establishment scene as well as the population's sharply expanding average disposable income. Furthermore, it is anticipated that the expanding impact of occidental societies on this region's youth will expand the global market.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 21.5 Bn |

| Revenue Forecast In 2035 | USD 62.57 Bn |

| Growth Rate CAGR | CAGR of 11.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Experience Type, Whiskey Type |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Diageo, Pernod Ricard, William Grant & Sons Ltd, Brown-Forman Corporation, Suntory Global Spirits, Inc, Bacardi Limited, Edrington Group, Heaven Hill Brands, Chivas Brothers Ltd, and LVMH. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Whiskey Tourism Market By Experience Type-

Whiskey Tourism Market By Whiskey Type-

Whiskey Tourism Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.