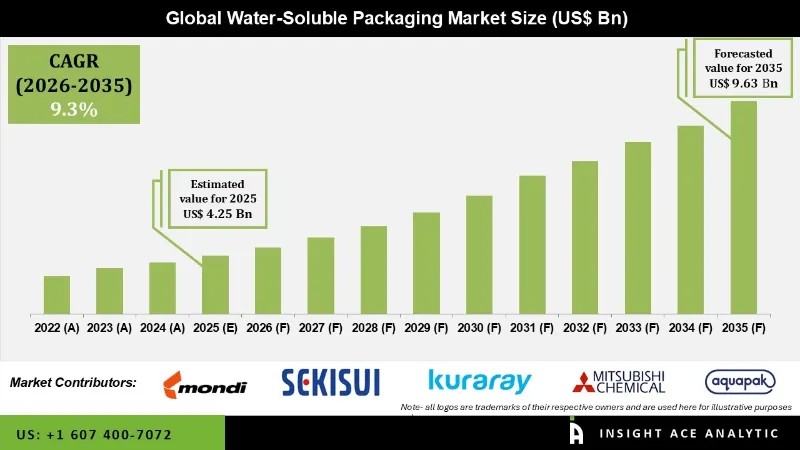

Water Soluble Packaging Market Size is valued at 4.25 billion in 2025 and is predicted to reach 9.63 billion by the year 2035 at an 9.0% CAGR during the forecast period for 2026 to 2035.

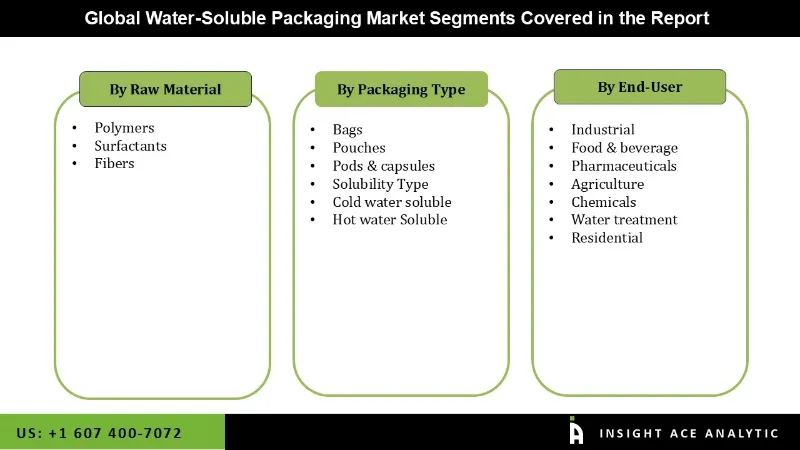

Water-soluble Packaging Market Size, Share & Trends Analysis Report By Raw Materials (Polymers, Surfactants And Fiber), End Users (Industrial, Food & Beverage, Pharmaceuticals, Agriculture, Chemicals, Water Treatment And Residential) And Packaging Type (Bags, Pouches, Pods & Capsules, Cold Water Soluble And Hot Water Soluble), By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

The biological components that create the water-soluble packaging dissolve in water to produce a safe, non-toxic aqueous solution. They are a popular material commonly in various sectors due to their better solubility in water with less residue and strong impact resistance. Due to escalating environmental concerns, green packaging has become more popular in most nations.

The market is gaining popularity as a result of rising transport and energy expenses. Government pressure to switch to eco-friendly materials and wrong customer impressions of conventional packaging have fueled industry expansion. Recently, several companies have adopted water-soluble treatments to lessen their carbon footprint. The global market for water-soluble packaging will also continue to expand due to rising government measures to reduce plastics and the growing focus on single-use plastics.

Water-soluble packaging revenue will rise during the forecast period due to increasing customer demands for natural and organic goods and changes in purchasing habits brought on by growing disposable income. The global market for water-soluble packaging will continue to expand due to rising government measures to reduce plastics, raising single-use plastic awareness, and other factors. During the projection period, there will be an increase in demand for items with organic and natural ingredients and changes in consumption habits brought on by consumers' rising disposable income.

The water-soluble packaging market is segmented based on raw materials, end users and packaging type. Based on raw materials, the market is segmented into polymers, surfactants and fiber. By end users, the market is segmented into industrial, food & beverage, pharmaceuticals, agriculture, chemicals, water treatment and residential. Based on packaging type, the market is segmented as bags, pouches, pods & capsules, cold water soluble and hot water soluble.

The category for industrial is predicted to experience faster CAGR growth in the forecast period. Most companies are reducing their use of plastic because it takes up more space and produces a lot of waste, which will help chemical industries dominate the global water-soluble packaging market in the future. The need for water-soluble packaging in industrial applications is expected to increase because of the wide range of uses for this type of packaging in many industries, including casual dining, petrochemical, home healthcare and products, and medications. The packaging of instant coffee has increasingly used water-soluble materials in recent years. The safety of employees in agricultural fields is also guaranteed by fertilizer packets made of PVA film.

The pouches segment is projected to proliferate in the global water-soluble packaging market. This kind of packaging is meant to provide a which was before the product and offer benefits for environmental safety. A container dissolves quickly at any water temperature and incorporates a heat seal coating. Additionally, heat seal treatment is utilized in packing water-soluble pouches since it enables the substance to be transformed into a pouch. Due to the increased use of water-soluble packaging in numerous chemical industries, pouch compounds are expanding in the global market for water-soluble packaging.

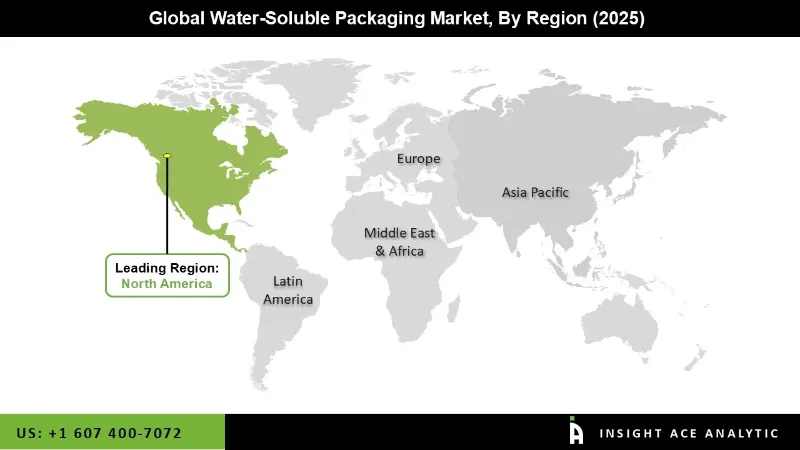

The North American water-soluble packaging market is expected to register the highest market share in revenue shortly. The fastest growth in the medicines, food & refreshment, chemicals, and healthcare industries in the US and Canada is primarily to blame for this region's most significant market share. The primary driver of North America's water-soluble packaging market is the growing demand for environmentally friendly packaging choices, accompanied by strict government regulations regarding the usage of single-use plastic. In addition, the Asia Pacific region is anticipated to increase in the global water-soluble packaging market. Governments are also making efforts to encourage the adoption of environmentally friendly packaging in this region.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 4.25 billion |

| Revenue forecast in 2035 | USD 9.63 billion |

| Growth rate CAGR | CAGR of 9.0% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Raw Materials, End Users And Packaging Type |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Lithey Inc. (India), Mondi Group (Ausria), Sekisui Chemicals (Japan), Kuraray Co.Ltd (Japan), Mitsubishi Chemicals Holdings (Japan), Aquapak Poluymer Ltd (UK), Lactips (France, Cortec Corporation (US), Acedag Ltd. (UK, MSD Corportation (China, Prodotti Solutions (US, JRF Technology LLC (US, Amtopak Inc. (US) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Water-soluble packaging Market By Raw Material

Water-soluble packaging Market By End Use

Water-soluble packaging Market By Packaging Type

Water-soluble packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.