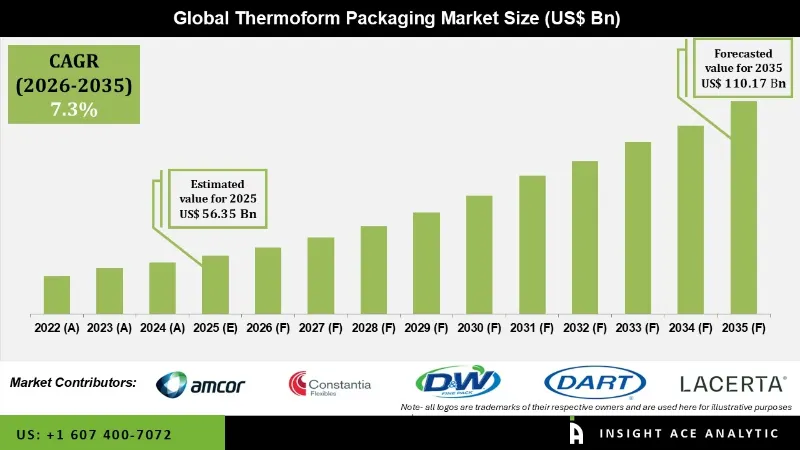

Thermoform Packaging Market Size is valued at USD 56.35 Billion in 2025 and is predicted to reach USD 110.17 Billion by the year 2035 at an 7.3% CAGR during the forecast period for 2026 to 2035.

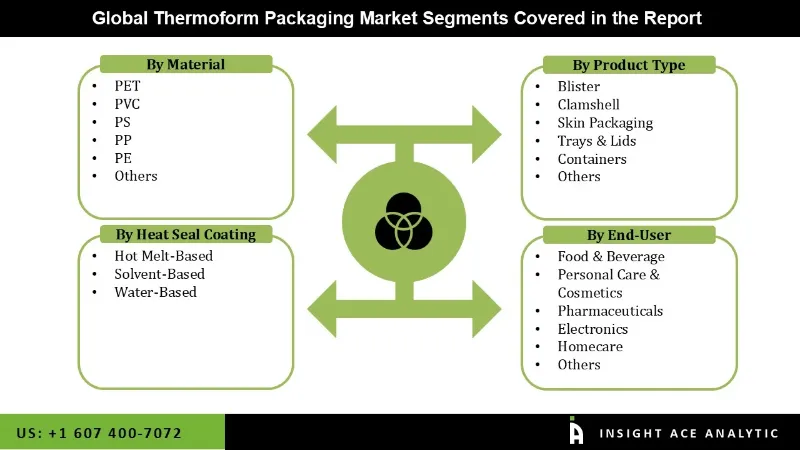

Thermoform Packaging Market Size, Share & Trends Analysis Report By Material (PET, PVC, PS, PP, PE), Product (Blister, Clamshell, Skin Packaging, Trays & Lids, And Containers), Heat Seal Coating (Solvent-Based, Hot Melt-Based, And Water-Based) And By End Users, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Thermoform packaging is biodegradable, largely constructed from different plastic packaging materials with synthetic bases. This packaging is well renowned for its simple shape, size, and design modification options, which have several shipping applications across sectors. Increasing environmental conservation awareness and the consumer trend toward sustainable products drive the worldwide thermoforming packaging market.

Furthermore, the thermoforming packaging market is anticipated to be driven by elements like the prohibition of single-use plastics and state officials' regulatory framework to stop plastic pollution. The sales of thermoforming packaging are projected to expand soon due to their important contribution to reducing plastic waste. Although flexible packaging uses fewer resources and is simpler to carry and handle, its popularity among end-use companies encourages them to do so. This aspect is expected to restrict market growth over the foreseeable timeframe.

Escalating ecological consequences, customer needs for sustainability, a strict regulatory environment, and advantageous governmental policies are driving the global different heat treatment packaging market. Due to environmental concerns, implementing thermoforming packaging is a crucial first step in reducing plastic usage. The market is projected to grow in the next years due to the benefits of different heat treatment packaging, such as its decreased carbon impact and simplicity in recycling.

The top competitors in the biodegradable water bottle market should concentrate on new developments and broaden their product offerings to gain a competitive advantage in the current market environment. They could also increase their R&D by concentrating on innovative and affordable products. Consumer awareness of environmental protection and custom packaging trends drive the global thermoforming market.

The thermoform packaging market is bifurcated based on material, product and heat seal coating and end users. Based on material, the market is segmented as PET, PVC, PS, PP, PE and others. Based on product, the market is segmented as blister, clamshell, skin packaging, trays & lids, and containers. Based on heat seal coating, the market is segmented as solvent-based, hot melt-based, and water-based. By End-user, the market is divided into food & beverage, pharmaceuticals, electronics, personal care & cosmetics, homecare, and others.

The blister category is expected to hold a major share of the global thermoform packaging market in 202 due to its extensive use in aesthetic and personal care, electronics, and industrial applications. Because blister thermoformed packaging is typically transparent and simple to print, customers can view the products inside and learn more about them. It is a practical packaging technique for showcasing goods, having several uses in technology and pharmaceutical products. Because blister packaging is lightweight and has great moisture and water resistance, it is ideal for various packing applications for food and beverage products. Blister packaging is frequently used in electronics to packaging products, including chargers, headsets, and accessories.

The food and beverages segment are projected to grow rapidly in the global thermoform packaging market. The importance of packaging to the food and beverage industry is enormous. The fundamental benefit of thermoform packaging is the ability to draw thin sheets in the precise size and shape needed to get the desired outcomes. Due to their flexibility, manufacturers of food and beverage products are becoming increasingly interested in thermoformed products. Blister packaging, canisters, trays, and bottles are examples of thermoformed packaging that have been utilized to adapt to shifting consumer tastes and eating patterns. The requirement for thermoplastic trays for food packaging is rising globally.

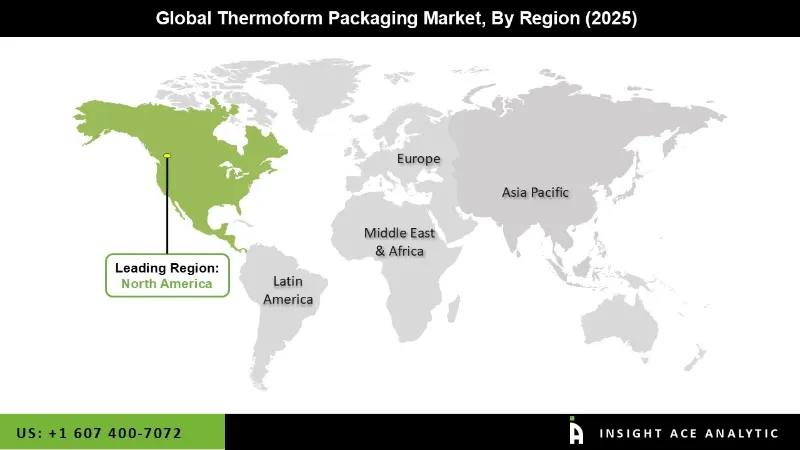

The North America thermoform packaging market is projected to register the highest market share. Due to the region's significant organized retail sector penetration and extensive presence of large-scale packaged food corporations. A further factor supporting the market expansion in the area is the presence of sizable thermoform packaging manufacturers committed to providing consumers with cutting-edge goods. The rising demand for products like packaged pastries and frozen meat, among other things, also aids the market expansion in North America. In addition, the Asia Pacific region is anticipated to grow rapidly in the global thermoform packaging market. The region's market is being pushed by two factors: expanding urbanization and rising product demand across various end-use sectors, including food & beverage, personal care, and cosmetics.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 56.35 Billion |

| Revenue forecast in 2035 | USD 110.17 Billion |

| Growth rate CAGR | CAGR of 7.3% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Material, Product And Heat Seal Coating And End Users |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Sonoco Products Company, Placon Corp., Display Pack, Inc., Pactiv LLC, Amcor, Mondi Group, Dart Container Corp., Constantia, Tray-Pak Corp., D&W Fine Pack and Lacerta Group, Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Thermoform Packaging Market By Material:

Thermoform Packaging Market By Product:

Thermoform Packaging Market By Heat Seal Coating:

Thermoform Packaging Market By End User:

Thermoform Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.