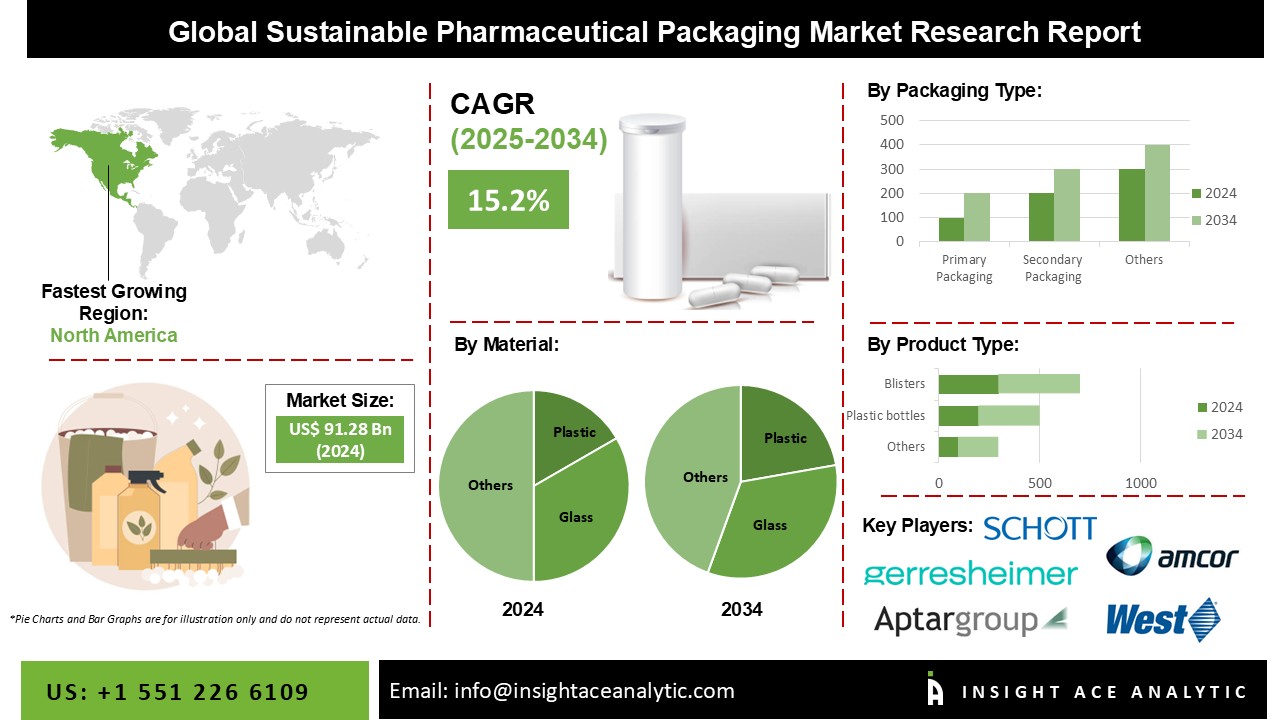

Sustainable Pharmaceutical Packaging Market Size is valued at USD 91.28 billion in 2024 and is predicted to reach USD 372.46 billion by the year 2034 at a 15.2% CAGR during the forecast period for 2025-2034.

Sustainable Pharmaceutical packing (also known as medication packing) refers to the containers and techniques used in packaging pharmaceutical preparations. Medication distribution networks encompass all operations, from medication production to the final user. The worldwide Sustainable Pharmaceutical Packaging market is expected to expand substantially during the projected period. The pharmaceutical industry's huge growth is one of the primary drivers of growth for the Sustainable Pharmaceutical Packaging market. Scientific and technological advances have resulted in tremendous growth in the pharmaceutical business in recent years.

However, the Covid-19 pandemic benefited the industry. Investments in medication development, as well as increased pharmaceutical production and consumption, resulted in an increase in demand for packaging. Another issue brought on by the disease outbreak was concern over the virus's ability to thrive on packing surfaces, which boosted the creation of high-performance and ecologically friendly packaging.

The sustainable pharmaceutical packaging market is segmented on the basis of material, packaging type, product type, and process. Material segment includes paper & amp; paperboard, glass, metal, and others. The packaging type segment includes primary packaging and secondary packaging. The product type segment includes plastic bottles, blister, labels & accessories, caps & closures, pre-filled syringes, medical specialty bags, temp-controlled packaging, pouches & strip packs, pre-filled inhalers, vials, ampoules, medication tubes, jars & canisters, cartridges, and others. The process segment includes recyclable, reusable, and biodegradable.

The primary packaging category is expected to hold a major share of the global sustainable pharmaceutical packaging market in 2022. Primary packaging, such as bottles, tubes, or blister packs, has direct contact with the drug and encloses it to keep it safe from contamination. Furthermore, it is typically responsible for dosing and distributing prescription ingredients. Packaging manufacturers are emphasizing the inclusion of dispensing systems that provide the correct amount at the right time and easy-to-open closures that can assist the senior population with medicine administration.

The glass segment is projected to grow at a rapid rate in the global Sustainable Pharmaceutical Packaging Market. Due to it being impervious to gases, moisture, odors, and germs, glass is commonly employed in the packaging of liquid and semisolid pharmaceutical compositions. Glass is used to make syringes, syrup jars, cartridges, injection vials, and other products. Amber-colored. Glass is commonly used for pharmaceutical packaging because it absorbs harmful UV rays and prevents pharmaceuticals from becoming contaminated.

The North America Sustainable Pharmaceutical Packaging Market is expected to register the highest market share in terms of revenue in the near future. The presence of a considerable number of pharmaceutical plastic bottle manufacturers in the country, such as AptarGroup Inc., Gerresheimer AG, Amcor Ltd., and Berry Plastics Group, Inc., is expected to boost demand for pharmaceutical plastic bottles over the projection period. The rise in health awareness among consumers in the Asia Pacific, particularly in developing nations such as China and India, along with rising disposable income levels, is expected to promote pharmaceutical sector growth throughout the forecast period, enhancing demand for its packaging.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 91.28 Bn |

| Revenue Forecast in 2034 | USD 372.46 Bn |

| Growth rate CAGR | CAGR of 15.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (KT) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments Covered | Material, Packaging Type, Product Type, And Process |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Berry Global Inc., Gerresheimer AG, Amcor Plc., Schott AG, Aptargroup, Inc., Becton, Dickinson and Company, Westrock Company, Nipro Corporation, Catalent, Inc., Sealed Air Corporation, West Pharmaceutical Services, Inc and Other Market Players |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Sustainable Pharmaceutical Packaging Market By Material-

Sustainable Pharmaceutical Packaging Market By Packaging Type-

Sustainable Pharmaceutical Packaging Market By Product Type-

Sustainable Pharmaceutical Packaging Market By Process-

Sustainable Pharmaceutical Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.