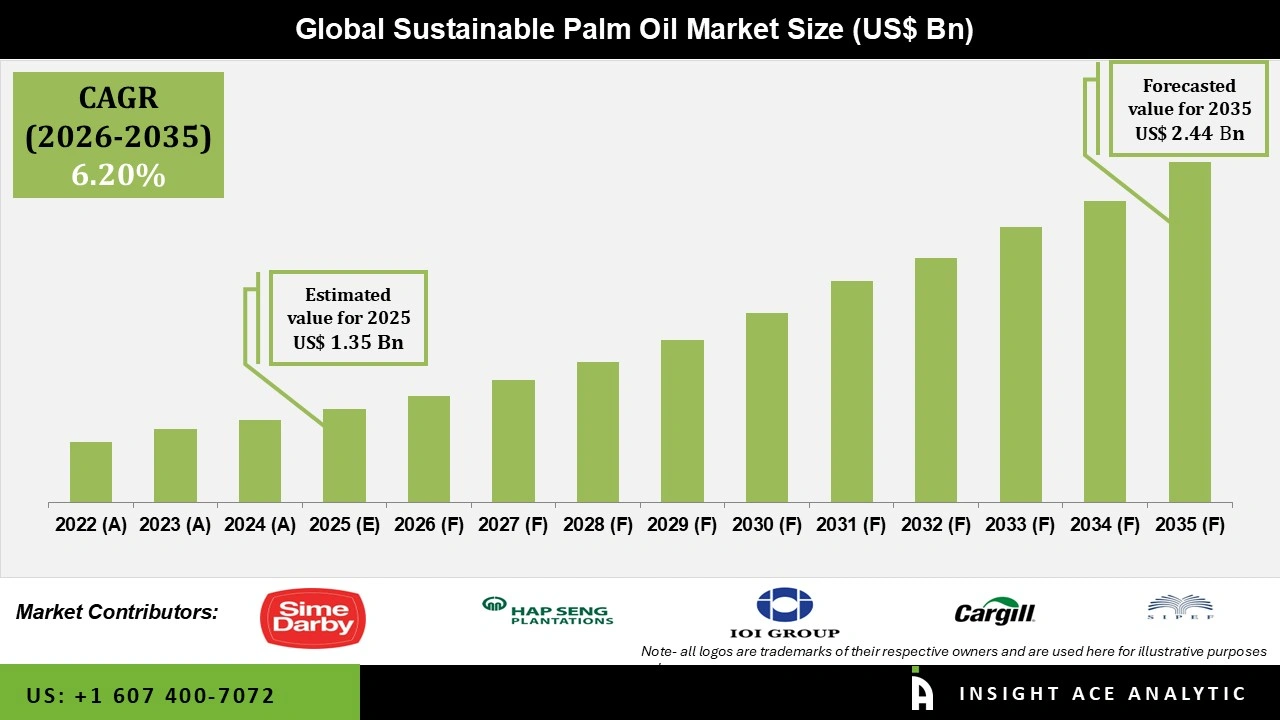

Global Sustainable Palm Oil Market Size is valued at USD 1.35 Billion in 2025 and is predicted to reach USD 2.44 Billion by the year 2035 at a 6.20% CAGR during the forecast period for 2026 to 2035.

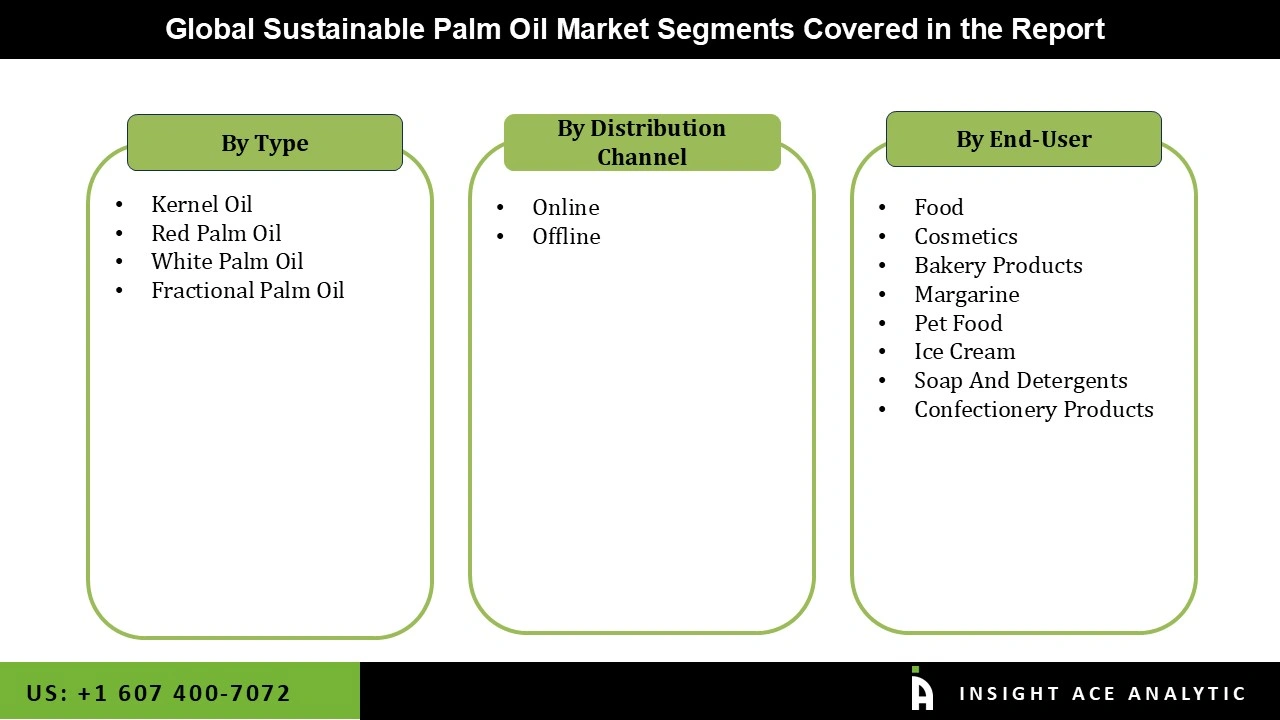

Sustainable Palm Oil Market Size, Share & Trends Analysis Report By Type (Kernel Oil, Red Palm Oil, White Palm Oil, Fractional Palm Oil), By Distribution Channel (Online, Offline), By End-User (Food, Cosmetics, Bakery Products, Margarine, Pet Food, Ice Cream, Soap And Detergents, Confectionery Products), By Region, And By Segment Forecasts, 2026 to 2035.

Sustainable palm oil is produced and utilized in a manner that adheres to ethical standards from economic, social, and environmental standpoints. Palm oil is a versatile and commonly used vegetable oil that is used in various everyday products such as food, cosmetics, and cleaning supplies. Nevertheless, the manufacturing of this product has been associated with other harmful environmental and social consequences, including habitat destruction, the release of greenhouse gases, the loss of forests, and breaches of human rights.

The deforestation and land-use changes that often occur during palm oil cultivation are some of the leading causes of climate change. Yet, the sector is increasingly vulnerable to its impacts. However, the production of palm oil is also very efficient: oil palms produce significantly more oil per ha of land than any other vegetable oil crop, with yields over ten times higher than soybean and sunflower. The sector also represents a source of livelihood for over 7 million smallholder farmers worldwide. Palm oil, therefore, plays an instrumental role in maintaining global food security and alleviating poverty.

However, COVID-19 impacted the sustainable palm oil market by disrupting supply chains and labour forces, causing delays in certification processes and audits. Economic uncertainties reduced investments in sustainability initiatives while shifting consumer priorities toward essential goods. However, the pandemic also heightened awareness of supply chain resilience and sustainability, prompting some companies to reinforce commitments to sustainable practices and diversify supply sources to mitigate future disruptions.

The sustainable palm oil market is segmented on the basis of by Type, distribution channel and by end-user. By Type, the global market is categorized into Kernel Oil, Red Palm Oil, White Palm Oil, and Fractional Palm Oil. According to the By Distribution Channel, the market is divided into Online and Offline channels. The End-User segment comprises Food, Cosmetics, Bakery Products, Margarine, Pet Food, Ice Cream, Soap And Detergents, and Confectionery Products.

Fractional palm oil is gaining traction due to its versatility. Unlike regular palm oil, it separates into liquid and solid fractions, each with specific functionalities. It allows for targeted applications, like high-heat frying with liquid oil or structure-providing stear in baked goods. Additionally, fractionation can create lower saturated fat options, appealing to health-conscious consumers. Efficiency, cost-effectiveness, and potential regulatory compliance with lower-fat content add to its appeal. However, sustainability concerns and the complexity of processing remain challenges. Overall, fractional palm oil's functional benefits, potential health advantages, and cost-effectiveness drive its growing demand. As a result, the product is readily available and has pricing that is within reach.

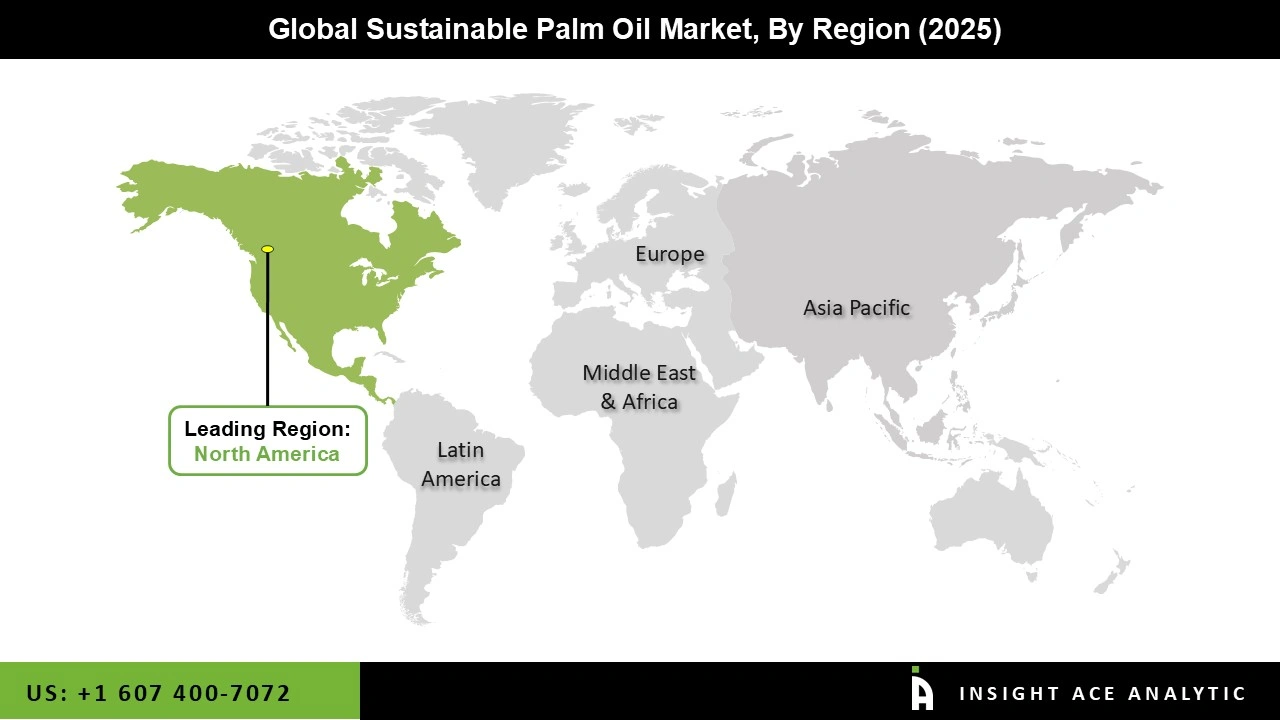

The North American sustainable palm oil market is projected to lead the overall market in terms of revenue in the coming years. This is because of the region's growing population as well as the increasing need from end-use industries such as food and beverage. The rise in consumption and population expansion are the main factors contributing to this trend.

The region's substantial palm oil consumption can be linked to the country's rapid population expansion, shifting demographic trends, and various food consumption habits. The Asia Pacific region is expected to experience significant growth in the worldwide sustainable palm oil market. This growth can be attributed to increased environmental concerns, fast industrialization, government initiatives, and rising investments in various industries.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.35 Billion |

| Revenue Forecast In 2035 | USD 2.44 Billion |

| Growth Rate CAGR | CAGR of 6.20% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 to 2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Distribution Channel And End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; Southeast Asia; South Korea |

| Competitive Landscape | Sime Darby Berhad, Hap Seng Plantation Holdings Berhad, Kuala Lumpur Kepong Berhad, IOI Corporation Berhad, Wilmar International Ltd, Cargill, Incorporated., SIPEF NV. Kulim Berhad, New Britain Palm Oil Ltd, Golden Agri-Resources Ltd. And others. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.