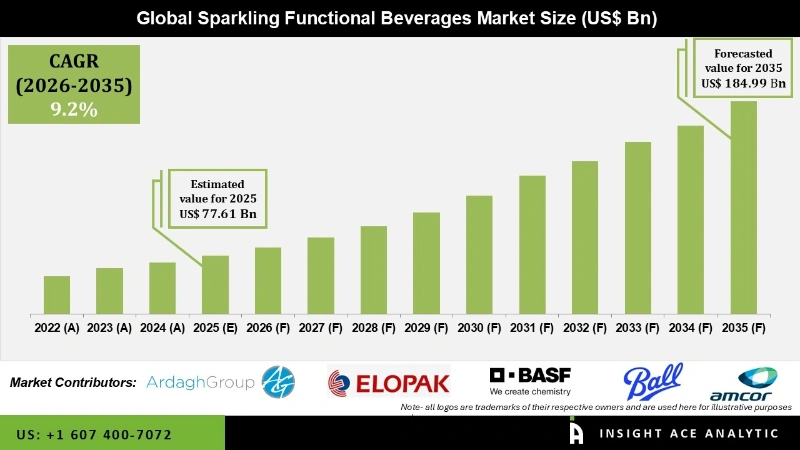

Global Sparkling Functional Beverages Market Size is valued at USD 77.61 Bn in 2025 and is predicted to reach USD 184.99 Bn by the year 2035 at a 9.2% CAGR during the forecast period for 2025-2035.

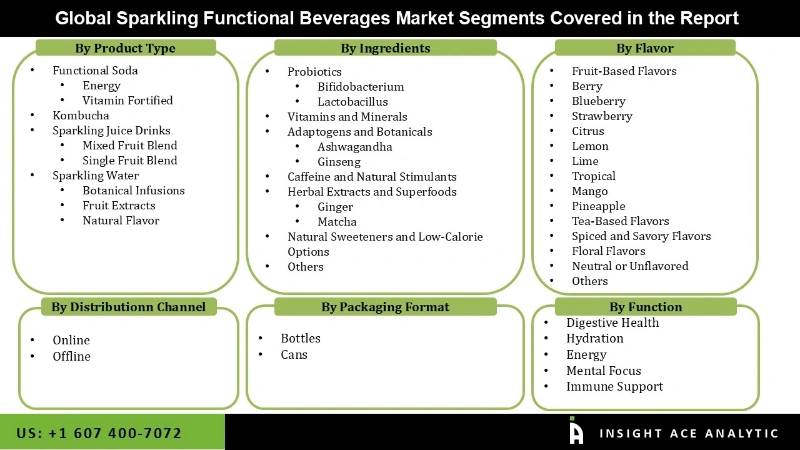

Sparkling Functional Beverages Market, Share & Trends Analysis Report, By Product Type ( Functional Soda, Kombucha, Sparkling Juice Drinks, Sparkling Water) By Ingredients( Probiotics, Bifidobacterium, Lactobacillus, Vitamins and Minerals, Adaptogens and Botanicals, Caffeine and Natural Stimulants, Herbal Extracts and Superfoods, Natural Sweeteners and Low-Calorie Options), By Function, By Distribution Channel, By Packaging Format, By Flavor, By Consumer Demographic By Region, and Segment Forecasts, 2026 to 2035.

Sparkling functional beverages are non-alcoholic, carbonated drinks infused with health-promoting ingredients that offer benefits beyond basic hydration. By combining the refreshing effervescence of sparkling water with functional components such as vitamins, minerals, probiotics, prebiotics, amino acids, adaptogens, and nootropics, these beverages are designed to support targeted health goals including enhanced energy, digestion, immune function, mental clarity, and stress relief.

Some formulations also include electrolytes, protein, or amino acids, making them ideal for post-workout recovery and appealing to athletes and fitness enthusiasts seeking to replenish nutrients and maintain hydration. The market is being driven by growing consumer demand for healthier, low-sugar alternatives to traditional soda, rising awareness around gut health, and a strong shift toward clean-label and plant-based ingredients.

Kombucha, a functional sparkling water, is naturally rich in probiotics and organic acids that support gut health and digestion, making it a popular choice among health-conscious consumers. It is typically made with organic tea, real fruit flavors, minimal sugar, and no preservatives, perfectly aligning with the growing demand for clean-label, vegan, and plant-based products. As a flavorful alternative to traditional sodas without artificial sweeteners, kombucha appeals to those seeking healthier beverage options. Its availability in ready-to-drink (RTD) bottled formats across mainstream retail stores, cafes, gyms, and wellness centers has enhanced its accessibility and convenience. The market growth is further fueled by a surge in interest in probiotic and gut-friendly drinks, as well as consumer preferences for functional, natural, and sustainable products.

Online platforms and direct-to-consumer (DTC) strategies have also played a significant role in expanding access to niche and premium kombucha brands, increasing brand visibility, and customer engagement. Millennials and Gen Z, in particular, are driving the rapid adoption of sparkling functional beverages like kombucha due to their preference for health-forward, and ethically sourced options that deliver both wellness benefits and clean ingredients.

Some of the Major Key Players in the Sparkling Functional Beverages Market are:

The sparkling functional beverages market is segmented based on product type, ingredients, function, distribution channel, packaging format, flavor, and consumer demographic. Based on product type, the market is segmented into functional soda, kombucha, sparkling juice drinks, and sparkling water. Based on the Ingredients, the market is divided into probiotics, bifidobacteria, lactobacilli, vitamins and minerals, adaptogens and botanicals, caffeine and natural stimulants, herbal extracts and superfoods, natural sweeteners and low-calorie options, and others. Based on the function, the market is divided into digestive health, hydration, energy, mental focus, and immune support. Based on the distribution channel, the market is divided into online, offline. Based on the packaging format, the market is divided into bottles, cans. Based on the flavor, the market is divided into fruit-based flavors, tea-based flavors, spiced and savory flavors, floral flavors, neutral or unflavored, and others. Based on the consumer demographic, the market is divided into adults, athletes, and millennials.

Based on technology, the market is segmented into therapeutic, machine learning, and natural language processing (NLP). Among these, the functional soda segment is expected to have the highest growth rate during the forecast period. The functional soda segment is experiencing rapid growth due to a combination of evolving consumer preferences, increasing health consciousness, and continuous market innovation. As traditional sugary sodas decline in popularity amid growing concerns over obesity, diabetes, and overall health, functional sodas have emerged as a healthier alternative. These beverages offer low-sugar or no-sugar options while delivering added health benefits, making them an attractive replacement for conventional soft drinks. Brands like Olipop and Poppi have gained popularity by infusing their sodas with prebiotics, fiber, and botanicals that support digestive health. With rising awareness of the gut-brain axis and the importance of the microbiome in overall wellness, functional sodas are perfectly positioned to meet the growing demand for daily digestive support.

Based on the Ingredients, the market is divided into probiotics, bifidobacteria, lactobacilli, vitamins and minerals, adaptogens and botanicals, caffeine and natural stimulants, herbal extracts and superfoods, natural sweeteners and low-calorie options, and others. Among these, the caffeine and natural stimulants segment dominates the market. The caffeine and natural stimulants segment dominate the sparkling functional beverages market due to its widespread appeal, energizing properties, and alignment with modern lifestyle demands. Consumers increasingly seek beverages that provide a clean energy boost without the crash associated with traditional energy drinks. This segment includes drinks infused with caffeine from natural sources like green tea extract, guarana, yerba mate, ginseng, and coffee fruit, as well as complementary compounds such as L-theanine, B-vitamins, and adaptogens that enhance alertness, focus, and endurance.

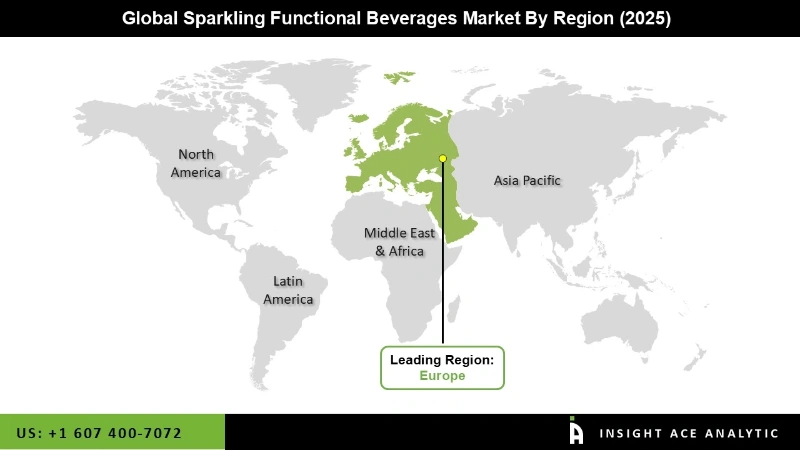

The Asia?Pacific (APAC) region currently holds the largest share of the market. Rapidly growing consumer awareness around healthy living, clean-label products, and plant-based wellness in countries like China, India, Japan, and South Korea is significantly boosting demand for sparkling functional beverages in the Asia-Pacific (APAC) region. Several APAC governments are actively supporting the health and functional food sector through favorable regulations and policies, further fostering industry growth. Additionally, the rapid expansion of digital retail and direct-to-consumer (DTC) models has enhanced brand visibility and product accessibility across urban and semi-urban areas. As disposable incomes continue to rise, consumers are increasingly shifting from traditional carbonated drinks to premium functional beverages that offer added health benefits, convenience, and alignment with modern wellness lifestyles.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 77.61 Bn |

| Revenue Forecast In 2035 | USD 184.99 Bn |

| Growth Rate CAGR | CAGR of 9.20% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, Ingredients, Function, Distribution Channel, Packaging Format, Flavor, Consumer Demographic |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Beyond Water, Big Watt Cold Beverage Co, Casamara Club, CENTR Brands Corp, Cold Spring Brewing Company, Danone S.A., Flying Embers, Fonterra Co, operative Group, Glanbia PLC, GLOW Beverages Inc, GT's Kombucha, Hain Celestial Group, Health-Ade LLC, Hint, Inc, Keurig Dr Pepper Inc., Kevita, Inc., KICR Innovation Ltd. Kombucha Wonder Drink, Makana Beverages Inc., Monster Beverage Corporation, National Beverage, Nestlé S.A., OCA, PepsiCo, Inc, Plants by People, REBBL, Red Bull GmBH, Reed’s Inc, Resync, LLC, Revive Kombucha, Rishi Tea & Botanicals, Spindrift Beverage Co., L.L.C., Talking Rain, The Coca-Cola Company, the Humm Kombucha LLC, Ultima Replenisher, Unique Beverage Company, LLC, WakeWater Beverage Co, Zevia PBC |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Sparkling Functional Beverages Market

Global Sparkling Functional Beverages Market - By Product Type

Global Sparkling Functional Beverages Market – By Ingredients

Global Sparkling Functional Beverages Market – By Function

Global Sparkling Functional Beverages Market – By Distribution Channel

Global Sparkling Functional Beverages Market – By Packaging Format

Global Sparkling Functional Beverages Market – By Flavor

Global Sparkling Functional Beverages Market – By Consumer Demographics

Global Sparkling Functional Beverages Market – By Region

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.