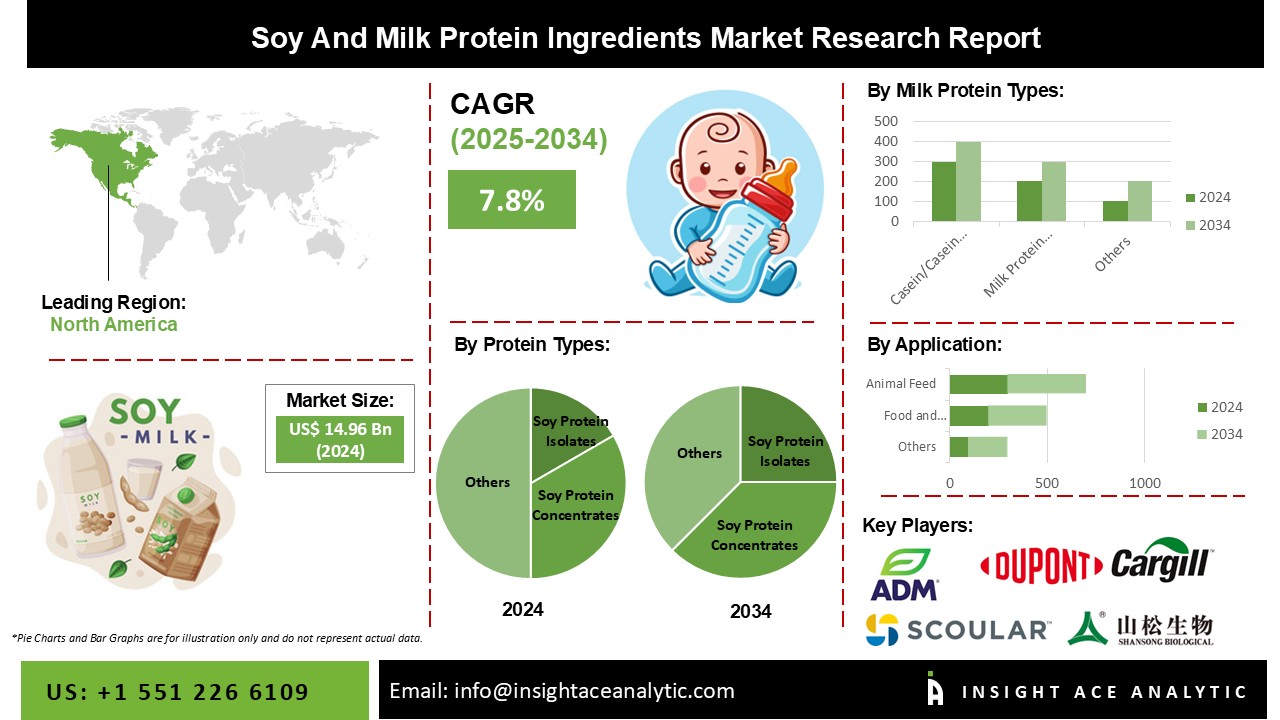

Soy And Milk Protein Ingredients Market Size is valued at 14.96 billion in 2024 and is predicted to reach 31.25 billion by the year 2034 at a 7.8% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

The soy and milk protein ingredients market is growing, driven by increasing consumer demand for plant-based and dairy-based protein sources. Soy protein is a widespread alternative to animal-based proteins and is used in various food and beverage applications, including meat alternatives, dairy alternatives, and sports nutrition products. On the other hand, milk protein is a high-quality protein source widely used in sports nutrition and functional food products. Both soy and milk protein ingredients have been shown to positively impact human health and wellness, contributing to their growing popularity.

However, rising prices and the possibility of replacements are anticipated to impact both developed and emerging nations' overall market growth. Additionally, it is anticipated that investments in R&D activities will provide prospects for growth to produce soy protein ingredients that are low-cost and high in nutrition.

The soy and milk protein ingredients market is segmented by protein type, milk protein types and application. Based on the protein type, the market is segmented into soy protein isolates, soy protein concentrates, soy protein hydrolysates and others. The market is segmented on milk protein types such as casein/caseinates, whey protein concentrates, whey protein isolates, and whey protein hydrolysates. The application segment includes food and beverages, infant formulations, personal care and cosmetics, and animal feed.

The food and beverage industry is the greatest soy and milk protein market. In various food applications, such as bakery & confectionery, dairy & frozen desserts, prepared foods, and others, these proteins are replaced as a replacement to animal-based proteins. During the projection period, the growing market for plant-based meat substitutes is anticipated to propel the expansion of this market segment. Due to the rising customer demand for protein-rich foods, the food and beverage sector is increasing, including soy and milk protein components in its products.

Over the forecast period, the market is expected to benefit from the rising demand for functional foods in developed countries. The food and beverage industry is increasingly incorporating soy and milk protein ingredients due to the growing consumer demand for protein-rich food products. Soy and milk protein ingredients are considered a healthy food alternative, as they are rich in essential nutrients such as protein, amino acids, and vitamins, driving the market growth in the food and beverage industry.

Due to the product's shown advantages in improving digestive and cardiovascular health while controlling cholesterol levels, the soy isolate product sector retained the biggest share. Antioxidants, vitamins, and minerals included in soy protein isolates, including zinc, iron, and isoflavones, can help prevent bone loss brought on by menopause or some malignancies. Given its low-fat content and bland flavour, soy protein isolate is also widely used in dairy products, infant formulas, and functional foods. Meeting the younger generation's demand for protein-rich foods has a positive impact on the market outlook.

The North American soy and milk protein ingredients market is expected to report the most increased market share in revenue shortly. Major manufacturers' presence in the area, growing knowledge of these proteins' health advantages, and expanding demand from the food and beverage industries are all credited with this growth. The demand for soy protein as a meat alternative is on the rise, and soy protein's organic health benefits in the Asia-Pacific area are contributing causes to this expansion. The growth of the Soy & Dairy Protein Ingredients Market in the Asia-Pacific region is further fueled by the expanding demand for dairy proteins like whey protein concentrates due to their excellent affordability.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 14.96 Bn |

| Revenue forecast in 2034 | USD 31.25 Bn |

| Growth rate CAGR | CAGR of 7.8% from 2024 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, Volume (KT) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Protein Type, Milk Protein Types and Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Archer Daniels Midland Company (ADM), Scoular Company, Cargill Inc., Dupont-Solae, Linyi Shansong Biologicals Products Cp. Ltd., and Solbar Ltd. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Soy And Milk Protein Ingredients Market By Protein Type-

Soy And Milk Protein Ingredients Market By Milk Protein Types-

Soy And Milk Protein Ingredients Market By Application-

Soy And Milk Protein Ingredients Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.