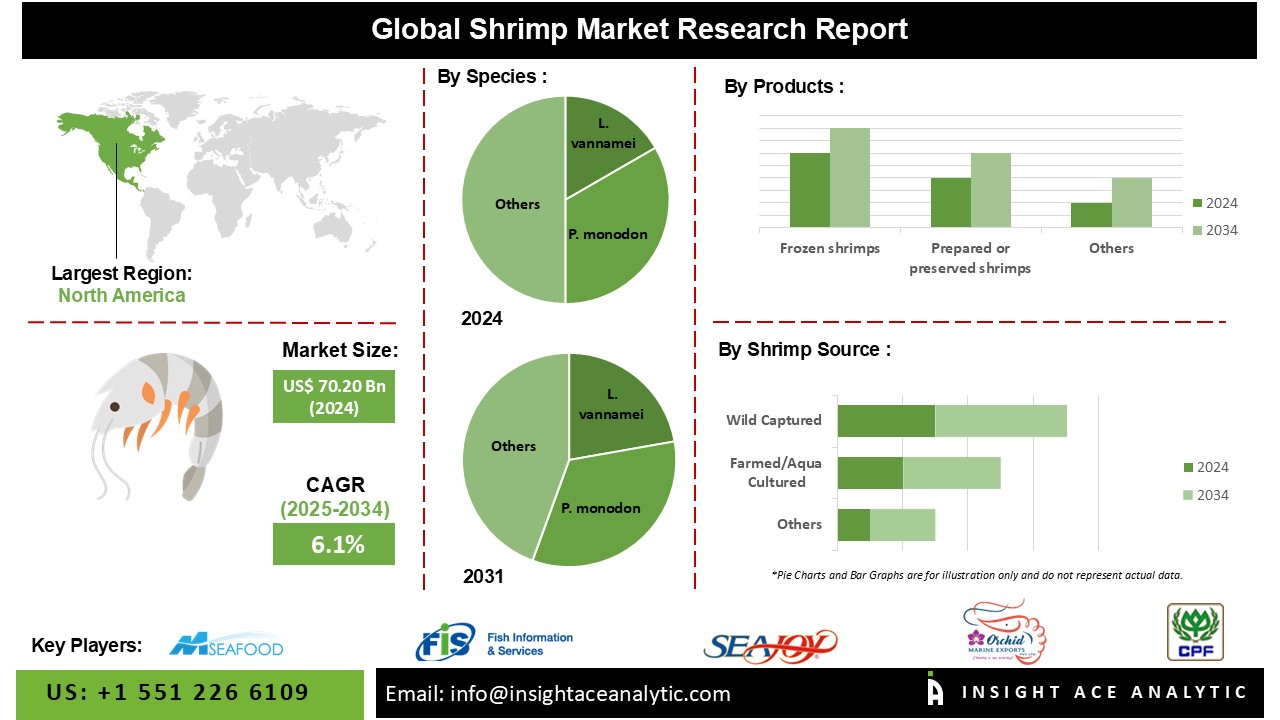

The Shrimp Market Size is valued at USD 70.20 Bn in 2024 and is predicted to reach USD 124.77 Bn by the year 2034 at an 6.1% CAGR during the forecast period for 2025-2034.

The new and exciting source for low-fat, high-protein alternatives to traditionally consumed meats is emerging in the shrimp market, attracting health-conscious consumers seeking dietary options that are nutrient-rich. Shrimp, being a crustacean, contains an impressive amount of protein, about 20 grams per 3-ounce serving and only minimal calories and virtually no saturated fats. This nutritional profile makes shrimp a perfect option for those who wish to keep their diet in order without giving up on taste. In addition, it contains other essential nutrients like omega-3 fatty acids and vitamin B12 that also make it an excellent source of protein as more health-conscious consumers are becoming increasingly aware of these benefits. After all, demand for shrimp is on the increase while more and more become aware of these benefits.

Shrimps not only have health benefits but also other culinary applications which make them very versatile. They could be grilled, boiled, sautéed, or even incorporated into a wide range of dishes from salads to soups. It comes out as how great a part shrimps play in cuisines across the entire world. There have been rising incomes, increasing eating out, and demand for seafood over red meat on rise. Advancements in aquaculture practices have made shrimp farming much more sustainable and efficient, thereby opening up the possibility of greater production to meet global demand. Hence, the shrimp market will continue growing in the following years with healthy eating and sustainable sourcing gradually becoming a priority for consumers.

The Global Shrimp Aquaculture Production Survey results demonstrate that the global production of farmed shrimp in 2023 will likely be slightly lower than in 2022, at approximately 5.6 million metric tons (MMT). However, it is anticipated to increase by approximately 4.8 percent in 2024, reaching nearly 5.88 MMT. Despite the consistently increasing worldwide demand, both wild and farmed shrimp production face significant, well-documented challenges that hinder sustainability. numerous viral, bacterial, and fungal illnesses, together with the availability of sufficient aquafeed components, provide significant challenges to business expansion. The introduction of infections can result in significant disease epidemics in shrimp, with catastrophic effects. However, the shrimp industry is poised for substantial advancement in the forthcoming years provided it can assimilate existing expertise into the industrial innovation process.

The shrimp market is segmented by products, species, shrimp and source. By products the market is segmented into frozen shrimps, live/fresh/chilled/cooked/smoked shrimps, prepared or preserved shrimps. By Species market is categorized into L. vannamei, P. monodon, M. rosenbergii, other. By shrimp source the market is categorized into farmed/aqua cultured, and wild captured.

The major driver for the frozen shrimp market segment has been the increasing demand for this product with convenience foods, particularly among the working population and health-conscious consumers. Frozen shrimp are in line with ready-to-eat meals and high-protein diets due to the extended shelf life and easy preparation. It is favored for its steady supply throughout the year, and there is also greater versatility in how it is prepared for both household and food service operations. Although live, fresh, and processed shrimp do meet niche markets like the gourmet trade, their volumes and growth rates are lower. Prepared or preserved shrimp, comprising ready-to-cook value-added products, including breaded and marinated products, are gaining popularity due to convenience and sustainability trends, but still account for a smaller share of the market than frozen shrimp.

L. vannamei shrimp had a great growth experience in the shrimp market due to a few primary factors. Its increased consumption in Asian cuisines has stimulated market demand. L. vannamei adapts well to the variances in the aquatic farming environment and thrives, regardless of changes in salinity or temperatures, which permits the application of both extensive and intensive farming practices and makes it easier to culture. The L. vannamei production sector meets the dietary and flavor requirements of consumers by capitalizing on its reputation as a premium source of ocean protein. Asia-Pacific holds the leading position in the global regional distribution of L. vannamei culture. According to FAO data from 2022, L. vannamei is cultivated in 47 countries, with a total yield of 6.82 million tonnes. Unexpectedly, the production of more than 100,000 tons is found in eight countries: China, India, Ecuador, Indonesia, Vietnam, Thailand, Mexico, and Brazil. China leads the world in production with 2.09 million tonnes.

As the industry grows, domestic research institutes and companies are concentrating on deep processing and full use of L. vannamei, establishing industry norms, and developing high-value products to increase economic returns and product value, thus enhancing and expanding the industrial chain.

Asia dominates the market for shrimp due to a strong dominant capacity for production, the support of the government, and other economic factors. In fact, according to a market research company, Asia only takes up two-thirds of global shrimp production, with countries such as China, India, Vietnam, and Indonesia, amongst many other key players, benefiting from well-established infrastructure for farming, processing, and export. The low labor and production costs give this region a competitive advantage that allows for large production at profitable margins. As increased incomes across Asia raise local demand for shrimp, the market is further strengthened.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 70.20 Bn |

| Revenue Forecast In 2034 | USD 124.77 Bn |

| Growth Rate CAGR | CAGR of 6.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn, Volume (MT) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Products, Species, Shrimp Source |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Mseafood Corp., Ristic AG, Seajoy Seafood Corporation, ArtisanFish LLC, Orchid Marine, Ananda Group, Charoen Pokphand Food PCL, The Clover Leaf Seafoods Family, Nippon Suisan Kaisha, Ltd., Marine Harvest ASA, Gulf Shrimp Company, Thai Union Frozen Products PLC, Baton Rouge Shrimp Company, Inc., Pescanova S.A, Galveston Shrimp Company, Labrador Fishermen's Union Shrimp Company Ltd., Ristic GmbH, Vinnbio India Pvt. Ltd, Dom International Limited, Carribbean Shrimp Company Limited, Artisanfish LLC |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Shrimp Market by Products-

Shrimp Market by Species -

Shrimp Market by Shrimp Source-

Shrimp Market by Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.