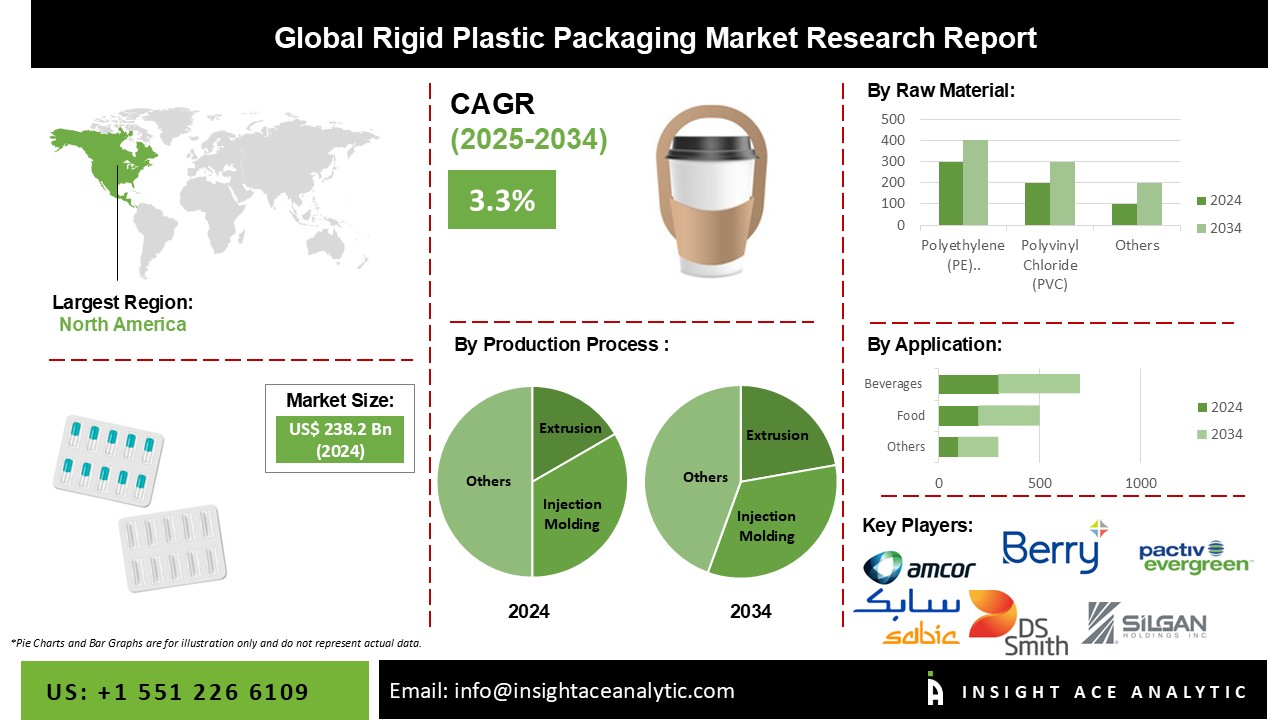

Rigid Plastic Packaging Market size is valued at USD 238.2 billion in 2024 and is predicted to reach USD 325.7 billion by the year 2034 at a 3.3% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the Report:

The elevated demand for sustainable and eco-friendly packaging options is the main factor driving the market for rigid plastic packaging, and it is creating potential growth chances for producers. Researchers and global market participants are collaborating to address issues facing the rigid plastic packaging business and satisfy demand from various end-use industries, such as food, home care, personal care, electronics, healthcare products, etc. Due to the increased need for plastic packaging systems, rigid plastic packaging solutions are utilized in various industry verticals, including agriculture, medicine, personal care, and pharmaceuticals.

However, it is projected that strict government rules regarding the use of plastic and fluctuations in the price of raw materials will impede the expansion of the world market for rigid plastic packaging. On the other hand, the increase in e-commerce sales would create profitable chances for the market's expansion.

The rigid plastic packaging market is segmented based on type, end-use industry, raw material and production process. The market is segmented based on type: bottles & jars, rigid bulk products, trays, tubs, cups, and pots. By end-use industry, the market is categorized into food, beverages, healthcare, cosmetics & toiletries. Based on raw material, the market is categorized into bioplastics, polyethylene (PE), polyethylene terephthalate (PET), polystyrene (PS), polypropylene (PP), polyvinyl chloride (PVC), expanded polystyrene (EPS), and others (PC, polyamide). Based on the production process, the market is further segmented into extrusion, injection molding, blow molding and thermoforming.

The rigid plastic packaging market's greatest share belonged to the polypropylene (PP) material category. Compared to other plastic materials like polyethylene, polyethylene terephthalate (PET), polystyrene (PS), and others, polypropylene offers good barrier qualities, improved surface polish, low cost, and high tensile strength. These features make polypropylene an ideal material for a range of packaging applications. Some expanding uses for polypropylene include medicine bottles, ketchup and syrup containers, bottle caps and closures. The market for rigid plastic packaging will increase over the projection period due to the rising demand for polypropylene (PP) material.

The rigid plastic packaging market's bottles and jars segment held the most significant market share. Juices, carbonated soft drinks, water, cosmetics, personal care items, pharmaceuticals, and food items are just a few products packaged in rigid plastic bottles and jars. Due to their durability and low weight, the demand for bottles and jars is increasing along with the rise of numerous end-use industries, including healthcare, cosmetics and personal care, and other industries.

The Asia Pacific rigid plastic packaging market is expected to witness the highest market share due to the increased demand for rigid plastic packaging in developing countries like Japan, China, India, and South Korea. China will dominate the rigid plastic packaging market throughout the forecast period. This is a result of the growing pharmaceutical, personal care and cosmetics, and food and beverage industries in the nation.

Additionally, it is projected that India and Indonesia's rigid plastic packaging markets will grow during the forecast period. Due to the expanding healthcare sector, the Asia Pacific region now monopolizes the rigid plastic packaging market. Additionally, Europe is expected to experience a slow growth rate throughout the projected period despite overtaking Asia Pacific as the second-largest regional market for plastic packaging. The region's market is expanding slowly, explained mainly by strict limits on the use of plastic packaging and high consumer awareness of sustainability.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 238.2 Bn |

| Revenue forecast in 2034 | USD 325.7 Bn |

| Growth rate CAGR | CAGR of 3.3% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, & Volume (Tons) and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, End-Use Industry, Raw Material And Production Process |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | Amcor Ltd. (Switzerland), Berry Global Group Inc. (US), Pactiv LLC (US), Holdings Inc. (US), Products Company (US), DS Smith Plc (UK), Alpla (Austria), Sabic (Saudi Arabia), AI Jabri Plastic Factory (UAE), Takeween Advanced Industries (Saudi Arabia) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Rigid Plastic Packaging Market By Type-

Rigid Plastic Packaging Market By End use industry-

Rigid Plastic Packaging Market By Raw material-

Rigid Plastic Packaging Market By Production process-

Rigid Plastic Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.