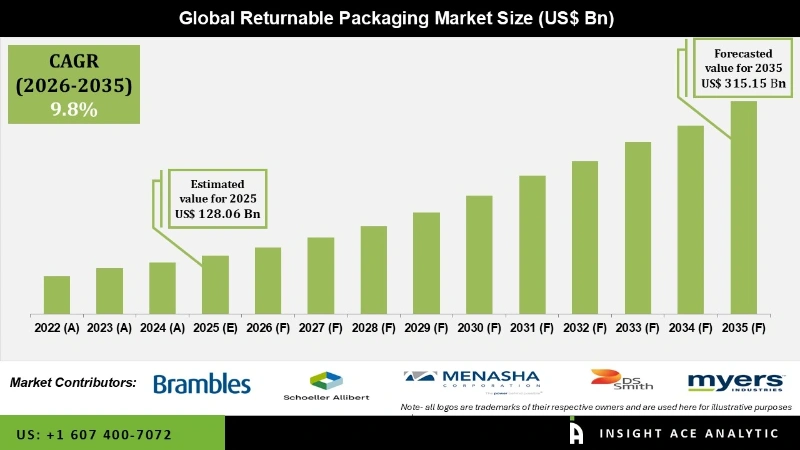

Returnable Packaging Market Size is valued at USD 128.06 billion in 2025 and is predicted to reach USD 315.35 billion by the year 2035 at a 9.8% CAGR during the forecast period for 2026 to 2035.

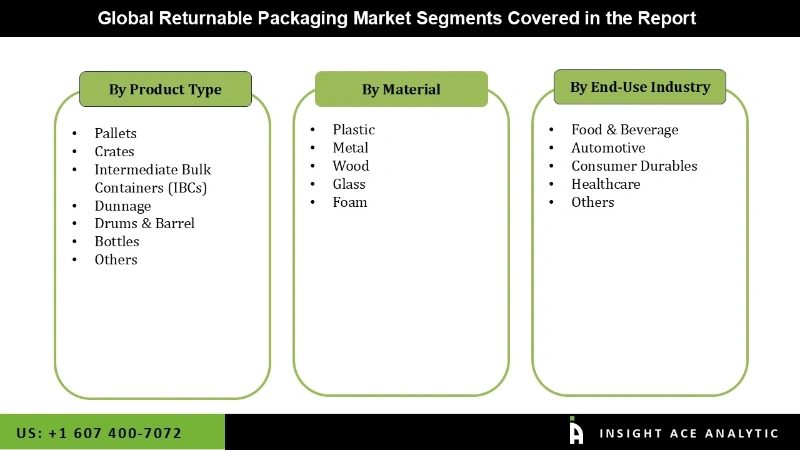

Returnable Packaging Market Size, Share & Trends Analysis Report By Product Type (Pallets, Crates, Intermediate Bulk Containers (Ibcs), Dunnage, Other), Material, And End-Use Industry, By Region, And Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Returnable packaging, which includes portable solid and bulk containers, pallets, dunnage, shipping racks, and other similar things intended to be reused again, is also known as reusable packaging or returnable transport packing. These containers are manufactured from durable materials like plastic, wood, metal, glass, and paperboard and are intended for multiple uses to promote use, durability, cleaning, and repair.

The demand for sustainable and long-lasting packaging from various end-use industries is driving demand for returnable packaging. The many advantages of returnable packaging are also having a significant impact on its expansion. Because of the factors above, the market is expected to proliferate throughout the forecast period. Rising urbanization, rising disposable income, and high pack size optimization are also likely to contribute to this growth.

Additionally, the rising product demand for items with standard dimensional sizes, like sleeves and boxes, and the simple accessibility of other returnable packaging containers based on customer demand are anticipated to drive the development of the returnable packaging market during the forecast above period.

However, small manufacturers are concerned about the cost-to-benefit ratio, which will restrain the expansion of the returnable packaging market during the projection year.

The key players in the returnable packaging market are:

The returnable packaging market is segmented on the product type, material, and end-use industry. On the basis of product type, the market is segmented into pallets, crates, intermediate bulk containers (IBCs), dunnage, drums & barrel, bottles, and others. Based on material, the returnable packaging market is cateinto plastic, metal, wood, glass, and foam. Based on the end-use industry, the returnable packaging market is segmented into food & beverage, automotive, consumer durables, healthcare, and others.

The pallets category grabbed the highest revenue share. It is anticipated that they will continue to hold that position during the anticipated time due to the widespread usage of pallets across various end-use sectors, from food and beverage to oil and lubricants. Due to the former's durability and financial viability, reusable pallets are increasingly preferred to throwaway pallets, which is predicted to boost segment expansion. A new 40 by 48-inch Odyssey Pallet was added to Orbis Corporation's collection of rackable plastic pallets in September 2020. The new pallet is an addition to its line of plastic pallet products intended for use in heavy-duty racking applications. With its distinctive design features, such as moulded-in frictional elements and optional steel reinforcements, the pallet has a long-lasting solution that aids in heavy loads and provides stability.

The plastic category is anticipated to grow significantly over the forecast period. Due to their strength, low weight, good corrosion resistance, and solvent resistance, high-density polyethylene (HDPE) and polypropylene (PP) polymers are frequently used in manufacturing products, including pallets, crates, IBCs, and drums.

Plastic RTP goods often sustain low to no damage when handled roughly by forklifts and other material handling equipment due to their exceptional impact resistance. In addition, the high chemical and weather resistance of RTP plastic products makes them ideal for usage in the food and pharmaceutical sectors.

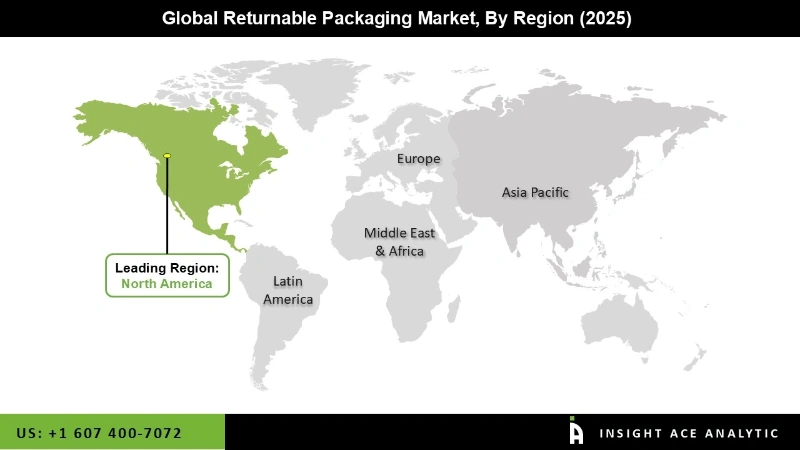

The Asia Pacific returnable packaging market is expected to register the highest market share in revenue in the near future. The presence of various manufacturing companies in countries like China, India, Indonesia, and Vietnam is the primary driver of the regional market. Additionally, the rapid industrialization of the Asia Pacific region is predicted to help the market expansion due to the area's low production costs. In addition, North America is projected to overgrow in the global returnable packaging market.Favorable trade agreements, such as the USMCA between the United States, Canada, and Mexico, are expected to stimulate manufacturing in the region, hence boosting the North American market for returnable packaging.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 128.06 billion |

| Revenue forecast in 2035 | USD 315.35 billion |

| Growth rate CAGR | CAGR of 9.8% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Million, Volume in Units and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product Type, Material, End-use Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia |

| Competitive Landscape | Brambles, Schoeller Allibert, Menasha Corporation, DS SMITH, Myers Industries, Nefab Groups, IPL Plastics, Vetropack Holding, Schutz Gmbh & Co. KGAA, Rehrig Pacific Company, Amatech Inc, Reusable Transport Packaging, Monoflo International, Mjsolpac LTD, UFP Technologies, Plasmix Private Limited, Ckdpack Packaging LTD., Multipac Systems, TRI-Wall Limited, GWP Groups, Weigand-Glas Gmbh, Mpact Limited, Toyo Glass Co.Ltd and RPP Containers |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Global Returnable Packaging Market By Product Type

Global Returnable Packaging Market By Material

Global Returnable Packaging Market By End-Use Industry

Global Returnable Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.