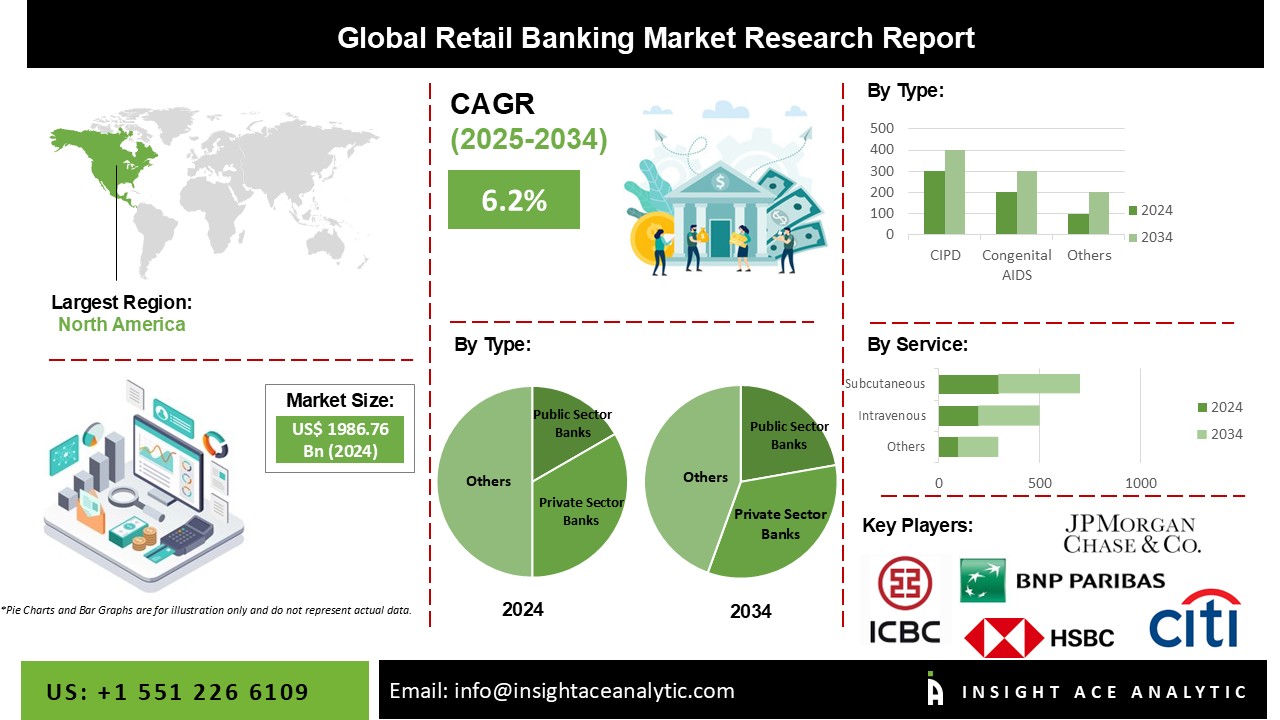

Retail Banking Market Size is valued at 1986.76 billion in 2024 and is predicted to reach 3591.16 billion by the year 2034 at a 6.2% CAGR during the forecast period for 2025-2034.

Rapid technological breakthroughs influencing the market's dynamics and growth potential are driving the growth. The development of digital technologies has changed how clients communicate with banks. Thanks to the growth of online mobile banking, customers now have easier access to banking services, including the ability to execute transactions, check balances, and access various services. Customer expectations are shifting, which is an important factor.

Customers today demand individualized and customized banking services. They demand flawless channel integration, encompassing online, mobile, and physical branches. Banks that can adapt to the competitive market and offer a superior client experience through individualized services, cutting-edge products, and effective procedures will likely succeed. Moreover, the retail banking market is being impacted by demographic changes. The expanding middle class in emerging economies gives banks additional chances to meet their customers' financial needs.

Additionally, the retail banking industry is experiencing increased rivalry. Traditional banks are battling against fintech startups and technology companies making inroads into the financial services industry. These new competitors offer innovative goods and services by utilizing technical advancements like deep learning and blockchain, which fuels the market growth.

The retail banking market is segmented based on type and service. The Retail Banking market is segmented based on types of public sector banks, private sector banks, foreign banks, community development banks and non-banking financial companies (NBFC). The market is segmented by service into savings & checking accounts, credit & debit cards, transactional accounts, personal loans, home loans and mortgages.

The public sector banks category is expected to hold a major share of the global Retail Banking market in 2022. Public sector banks, which governments of nations run, offer several advantages over other banks and have built up a solid market reputation. They offer a variety of government programs and subsidies, effectively manage risk and regulations, concentrate on new product creation, and charge minimal fees for banking services. These are the main drivers promoting the expansion of this market.

Rural and semi-urban areas benefit from the public sector banks' extensive network and presence in these areas. They can access a big customer base and reach underserved markets because of their wide branch network, which supports their expansion. Moreover, social and financial inclusion goals are frequently given top priority by public sector banks. They are dedicated to assisting the underserved and unbanked segments of society and supporting inclusive banking practices.

The debit & credit card segment is projected to grow at an increasing in the global retail banking market. The use of debit and credit cards allows for transactional convenience and flexibility. They make carrying cash unnecessarily, enabling customers to make purchases quickly and safely. The rapid use of debit and credit cards by retailers and contactless payment technologies have aided in this market's expansion. Additionally, debit and credit cards provide consumers various advantages and incentive schemes. Banks' incentives to promote card usage include cashback, rewards points, airline miles, and other benefits. The expansion of this market is fueled by the incentives provided by these rewards, which draw customers and encourage them to use cards as their preferred means of payment. Open banking is anticipated to develop as an industry-driven initiative in the United States.

The North American Retail Banking market is projected to register a tremendous market share in revenue soon. The area's population is sizable and expanding quickly, and it has a growing middle class and discretionary money. An increase in demand for banking services, such as savings accounts, loans, and investment goods, has been brought on by this demographic shift. Additionally, the area has undergone tremendous urbanization and economic growth, which has prompted corporate expansion and elevated financial activity. There is a larger need for financial services to serve both business and personal transactions.

In addition, Asia Pacific is projected to grow rapidly in the global Retail Banking market. The area has a sizable and quickly growing population, with a sizable proportion of young and tech-savvy people. These people seek convenient and accessible banking solutions to suit their financial demands, which creates a significant growth opportunity for retail banking. Additionally, the MEA area is focusing more on financial inclusion. Governments and regulatory bodies actively support programs to increase underserved groups' access to banking services, especially those in rural areas and low-income sectors. The emphasis on financial inclusion promotes retail banking usage and fuels the area's rapid expansion.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 1986.76 Bn |

| Revenue Forecast In 2034 | USD 3591.16 Bn |

| Growth Rate CAGR | CAGR of 6.2% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Chipset Type Analysis, Function Analysis, and Industry Analysis |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | BNP Paribas; Citigroup, Inc.; HSBC Group; ICBC; JP Morgan Chase & Co.; Bank of America Corporation; Barclays; China Construction Bank; Deutsche Bank AG, Mitsubishi UFJ Financial Group, Inc., Wells Fargo. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Retail Banking Market By Type

Retail Banking Market By Service

Retail Banking Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.