Respiratory Disease Genetic Testing Market Size is predicted to witness a 5.34% CAGR during the forecast period for 2023-2031.

Respiratory disease is a pathological condition that affects the respiratory system, primarily the lungs. Respiratory ailments encompass asthma, chronic obstructive pulmonary disease (COPD), pulmonary fibrosis, pneumonia, and lung cancer. Testing for respiratory diseases is the most basic and widely performed examination of the lungs. Pollution, smoking, and an ageing population are all contributing to a rise in the prevalence of these diseases. Genetic testing greatly affects respiratory disease diagnosis and treatment. By identifying at-risk patients early, genetic testing allows for timely intervention and individualized treatment. Genetic profiles assist clinicians identify the best medicines, reducing trial-and-error and improving patient outcomes. Genetic testing helps families screen for respiratory illness predispositions, enabling prevention.

Furthermore, the COVID-19 pandemic has had a major impact on the expansion of the market for testing for respiratory diseases. Improvements in patient outcomes have resulted from these innovations' facilitation of early diagnosis and individualized treatment. Rapid technological change has resulted in a shortage of appropriately trained professionals. Due largely to a shortage of qualified specialists, instrumentation and procedure execution have suffered. Investing in equipment and chemicals and ensuring quality control for a state-of-the-art laboratory for testing for respiratory diseases can add up quickly.

In addition, Demand for COVID-19 testing has increased because of the pandemic. However, this has come at the expense of focusing on other respiratory disorders. The total number of tests performed and the resources available for testing respiratory diseases other than COVID-19 may have been temporarily reduced due to this diversion.

The respiratory disease genetic testing market is segmented based on offerings, disease type, technology, trait type, age group and end-user. By Offerings, market is divided into Products (Kits and Consumables), Services, and Others. By Disease Type segment, the market is segmented into COPD (Alpha-1-antitrypsin (AAT), Cystic Fibrosis (CF), Diffuse Lung Disease/Surfactant Dysfunction (RHD (Respiratory Distress Syndrome), PPHN (Persistent Pulmonary Hypertension of the Newborn)), Interstitial lung disease, Pulmonary Arterial Hypertension, Pulmonary Hypoplasia, Primary Ciliary Dyskinesia, Other Diseases (BPD)).

Whereas, By Technology, the market is divided into PCR, NGS (Whole Genome Sequencing, Whole Exome Sequencing), and Others (Targeted Sequencing, Karyotyping, and FISH)). As per the Trait Type, the market is categorized into Inherited Trait, and Acquired Trait. The Age Group segment includes Children, and Adult. At last, the End-User comprises Hospital Laboratories, Diagnostics Laboratories, Genetic Testing Laboratories, Research Laboratories, and Other End User

The products category is expected to hold a major global market share. Kits and consumables are most significant factors for market growth. The availability and advancements of products in the applications are responsible to boost the Respiratory Disease Genetic Testing Market.

The disease type segment comprises COPD and cystic Frosis which will drive the segment due to increasing prevelence. Also, rise in rapid diagnositcs services are responsible for the segment development.

The North American respiratory disease genetic testing market is expected to record the maximum market share in revenue in the near future. It can be attributed to the high healthcare expenditure and a developed infrastructure. Additionally, the high prevalence of respiratory disorders, such as asthma, COPD, and lung cancer, contributes to the demand for respiratory disease testing in North America. In addition, Asia Pacific is estimated to grow rapidly in the global respiratory disease genetic testing market because large populations, growing urbanization, higher levels of education and awareness of respiratory disorders, and better healthcare infrastructure are all driving forces behind this expansion. Air pollution, tobacco use, and altered diets have all contributed to an increase in respiratory illnesses in the area.

|

Report Attribute |

Specifications |

|

Growth Rate CAGR |

CAGR of 5.34% from 2023 to 2031 |

|

Quantitative Units |

Representation of revenue in US$ Bn and CAGR from 2023 to 2031 |

|

Historic Year |

2019 to 2022 |

|

Forecast Year |

2023-2031 |

|

Report Coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments Covered |

By Offerings, By Disease Type, By Offerings, By Trait Type, By Age Group, By End-User |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

|

Competitive Landscape |

23andMe, Inc., Centogene A.G., GeneDx, Inc.(Sema4), Invitae Corporation, Color Genomics, Myriad Genetics, Medicover Genetics, Blueprint Genetics, Prevention Genetics, Quest Diagnostics, Genesis Genetics, ARUP Laboratories, EGL Genetic Diagnostics, Laboratory Corporation of America Holdings (LabCorp), and Others |

|

Customization Scope |

Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

|

Pricing And Available Payment Methods |

Explore pricing alternatives that are customized to your particular study requirements. |

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Respiratory Disease Genetic Testing Market Snapshot

Chapter 4. Global Respiratory Disease Genetic Testing Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Trait Type Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: By Offering Estimates & Trend Analysis

5.1. By Offering, & Market Share, 2020 & 2031

5.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Offering:

5.2.1. Products

5.2.1.1. Kits and Consumables

5.2.2. Services

5.2.3. Others

Chapter 6. Market Segmentation 2: By Specialty Type Estimates & Trend Analysis

6.1. By Specialty Type & Market Share, 2020 & 2031

6.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Specialty Type:

6.2.1. COPD (Alpha-1-antitrypsin (AAT)

6.2.2. Cystic Fibrosis (CF)

6.2.3. Diffuse Lung Disease/Surfactant Dysfunction

6.2.3.1. RHD (Respiratory Distress Syndrome)

6.2.3.2. PPHN (Persistent Pulmonary Hypertension of the Newborn)

6.2.4. Interstitial lung disease

6.2.5. Pulmonary Arterial Hypertension

6.2.6. Pulmonary Hypoplasia

6.2.7. Primary Ciliary Dyskinesia

6.2.8. Other Diseases (BPD)

Chapter 7. Market Segmentation 3: By Trait Type Estimates & Trend Analysis

7.1. By Trait Type & Market Share, 2020 & 2031

7.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Trait Type:

7.2.1. Inherited Trait

7.2.2. Acquired Trait

Chapter 8. Market Segmentation 4: By Test Type Technology Estimates & Trend Analysis

8.1. By Test Type Technology & Market Share, 2020 & 2031

8.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Test Type Technology:

8.2.1. PCR

8.2.2. NGS

8.2.2.1. Whole Genome Sequencing

8.2.2.2. Whole Exome Sequencing

8.2.3. Others (Targeted Sequencing, Karyotyping, and FISH)

Chapter 9. Market Segmentation 5: By Age Group Estimates & Trend Analysis

9.1. By Age Group & Market Share, 2020 & 2031

9.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By Age Group:

9.2.1. Children Age Group

9.2.2. Adult Age Group

Chapter 10. Market Segmentation 6: By End User Estimates & Trend Analysis

10.1. By End User & Market Share, 2020 & 2031

10.2. Market Size (Value US$ Mn) & Forecasts and Trend Analyses, 2020 to 2031 for the following By End User:

10.2.1. Hospital Laboratories

10.2.2. Diagnostics Laboratories

10.2.3. Genetic Testing Laboratories

10.2.4. Research Laboratories

10.2.5. Other End User

Chapter 11. Respiratory Disease Genetic Testing Market Segmentation 7: Regional Estimates & Trend Analysis

11.1. North America

11.1.1. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts By Offering, 2019-2031

11.1.2. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts By Specialty Type, 2019-2031

11.1.3. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts By Trait Type, 2019-2031

11.1.4. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts By Test Type Technology, 2019-2031

11.1.5. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts By Age Group, 2019-2031

11.1.6. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts By End User, 2019-2031

11.1.7. North America Respiratory Disease Genetic Testing Market revenue (US$ Million) estimates and forecasts by country, 2019-2031

11.2. Europe

11.2.1. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) By Offering, 2019-2031

11.2.2. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) By Specialty Type, 2019-2031

11.2.3. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) By Trait Type, 2019-2031

11.2.4. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) By Test Type Technology, 2019-2031

11.2.5. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) By Age Group, 2019-2031

11.2.6. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) By End User, 2019-2031

11.2.7. Europe Respiratory Disease Genetic Testing Market revenue (US$ Million) by country, 2019-2031

11.3. Asia Pacific

11.3.1. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) By Offering, 2019-2031

11.3.2. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) By Specialty Type, 2019-2031

11.3.3. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) By Trait Type, 2019-2031

11.3.4. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) By Test Type Technology, 2019-2031

11.3.5. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) By Age Group, 2019-2031

11.3.6. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) By End User, 2019-2031

11.3.7. Asia Pacific Respiratory Disease Genetic Testing Market revenue (US$ Million) by country, 2019-2031

11.4. Latin America

11.4.1. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) By Offering, (US$ Million) 2019-2031

11.4.2. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) By Specialty Type, (US$ Million) 2019-2031

11.4.3. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) By Trait Type, (US$ Million) 2019-2031

11.4.4. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) By Test Type Technology, (US$ Million) 2019-2031

11.4.5. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) By Age Group, (US$ Million) 2019-2031

11.4.6. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) By End User (US$ Million) 2019-2031

11.4.7. Latin America Respiratory Disease Genetic Testing Market revenue (US$ Million) by country, 2019-2031

11.5. Middle East & Africa

11.5.1. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) By Offering, (US$ Million) 2019-2031

11.5.2. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) By Specialty Type, (US$ Million) 2019-2031

11.5.3. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) By Trait Type, (US$ Million) 2019-2031

11.5.4. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) By Test Type Technology, (US$ Million) 2019-2031

11.5.5. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) By Age Group, (US$ Million) 2019-2031

11.5.6. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) By End User, (US$ Million) 2019-2031

11.5.7. Middle East & Africa Respiratory Disease Genetic Testing Market revenue (US$ Million) by country, 2019-2031

Chapter 12. Competitive Landscape

12.1. Major Mergers and Acquisitions/Strategic Alliances

12.2. Company Profiles

12.2.1. 23andMe, Inc.

12.2.2. Centogene A.G.

12.2.3. GeneDx, Inc.

12.2.4. Invitae Corporation

12.2.5. Color Genomics

12.2.6. Myriad Genetics

12.2.7. Medicover Genetics

12.2.8. Blueprint Genetics

12.2.9. Prevention Genetics

12.2.10. Quest Diagnostics

12.2.11. Genesis Genetics

12.2.12. ARUP Laboratories

12.2.13. EGL Genetic Diagnostics

12.2.14. Laboratory Corporation of America Holdings (LabCorp)

By Offerings

By Disease Type

By Technology

By Trait Type

By Age Group

By End-User

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

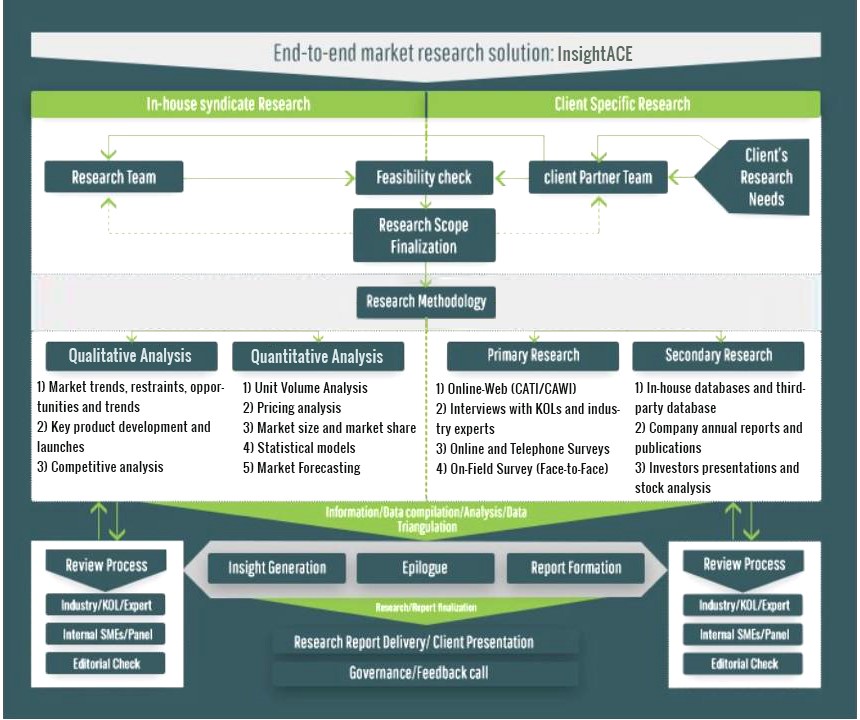

InsightAce Analytic follows a standard and comprehensive market research methodology focused on offering the most accurate and precise market insights. The methods followed for all our market research studies include three significant steps – primary research, secondary research, and data modeling and analysis - to derive the current market size and forecast it over the forecast period. In this study, these three steps were used iteratively to generate valid data points (minimum deviation), which were cross-validated through multiple approaches mentioned below in the data modeling section.

Through secondary research methods, information on the market under study, its peer, and the parent market was collected. This information was then entered into data models. The resulted data points and insights were then validated by primary participants.

Based on additional insights from these primary participants, more directional efforts were put into doing secondary research and optimize data models. This process was repeated till all data models used in the study produced similar results (with minimum deviation). This way, this iterative process was able to generate the most accurate market numbers and qualitative insights.

Secondary research

The secondary research sources that are typically mentioned to include, but are not limited to:

The paid sources for secondary research like Factiva, OneSource, Hoovers, and Statista

Primary Research:

Primary research involves telephonic interviews, e-mail interactions, as well as face-to-face interviews for each market, category, segment, and subsegment across geographies

The contributors who typically take part in such a course include, but are not limited to:

Data Modeling and Analysis:

In the iterative process (mentioned above), data models received inputs from primary as well as secondary sources. But analysts working on these models were the key. They used their extensive knowledge and experience about industry and topic to make changes and fine-tuning these models as per the product/service under study.

The standard data models used while studying this market were the top-down and bottom-up approaches and the company shares analysis model. However, other methods were also used along with these – which were specific to the industry and product/service under study.

To know more about the research methodology used for this study, kindly contact us/click here.