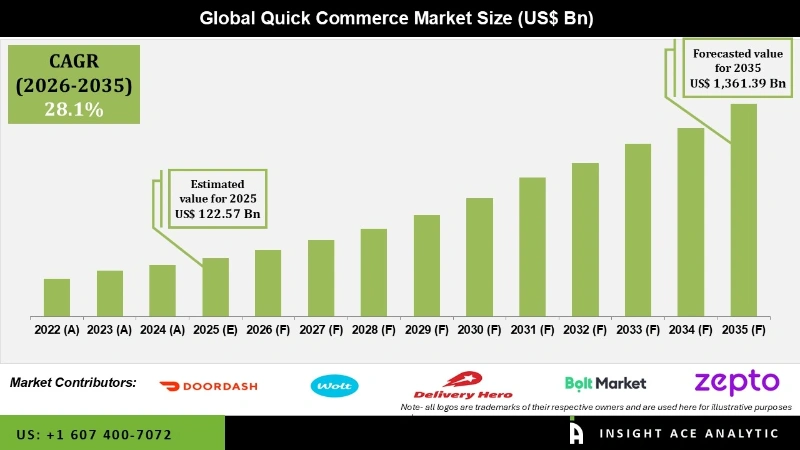

Global Quick Commerce Market Size is valued at USD 122.57 Billion in 2025 and is predicted to reach USD 1,361.39 Billion by the year 2035 at a 28.1% CAGR during the forecast period for 2026 to 2035.

Quick Commerce Market Size, Share & Trends Analysis Report By Category (Food Delivery, Grocery, Courier, Gifts & Flowers, Pharmacy, Others), By Delivery Timeframe (Instant Delivery, Same-day Delivery, Scheduled Delivery), By Filfilment Model, By Order Channel , By Region, And By Segment Forecasts, 2026 to 2035.

Q-commerce, short for Quick Commerce, denotes a swiftly expanding phenomenon in the e-commerce sector distinguished by the prompt and effective transportation of products to customers. Q-commerce is centred around delivering products with exceptional speed, typically within a few hours or even minutes of a customer's order placement. This concept is specifically engineered to cater to the growing need for immediate satisfaction and ease in online retail.

The expansion of the e-commerce sector and the widespread use of mobile applications and technology platforms are anticipated to propel the market. As e-commerce continues flourishing, many individuals are shifting to online shopping for various products, including groceries, daily essentials, electronic devices, and apparel. This surge in online shopping has generated a higher need for efficient and rapid delivery options. Furthermore, e-commerce platforms have instilled an expectation of convenience and swiftness in consumers' shopping experiences. Consequently, customers are increasingly seeking quicker delivery alternatives, prompting e-commerce companies to offer same-day or on-demand delivery services.

The increasing demand for same-day delivery services and technological advancements, such as mobile applications, GPS tracking, and route optimization, primarily drive the market's growth. In our fast-paced lives, consumers seek convenience in their shopping experiences. Moreover, same-day delivery services cater to this need, enabling customers to receive their essentials without physically visiting brick-and-mortar stores or planning their purchases well in advance. Furthermore, companies in the retail and logistics sectors offer same-day delivery as a competitive advantage.

· Gopuff

· DoorDash DashMart

· Delivery Hero (Dmart / quick commerce)

· Glovo (Delivery Hero group)

· Wolt Market

· Bolt Market

· Getir

· Flink

· Zapp (Quick Commerce Ltd / Zapp Commerce UK Ltd)

· JOKR

· Rappi Turbo

· Blinkit (Eternal / Zomato)

· Zepto

· Swiggy Instamart

· Flipkart Minutes

· BigBasket BB Now (Tata Group)

· Noon Minutes

· Talabat Mart

· GrabMart

· PandaMart

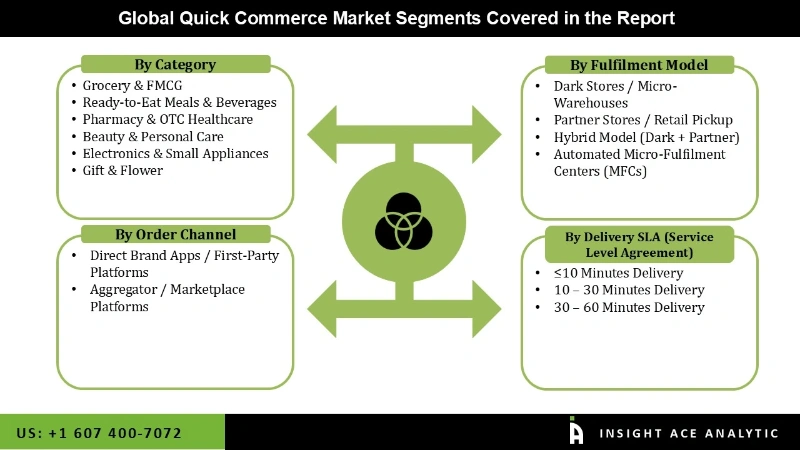

The quick commerce market is segmented on the basis of category and delivery time frame. Based on category, the quick commerce market is segmented as food delivery, grocery, courier, gifts & flowers, pharmacy, and others. By delivery time frame, the market is segmented into instant delivery, same-day delivery, and scheduled delivery.

The same-day delivery category is expected to hold a major share of the global quick commerce market in 2022. Customers are placing growing importance on rapid delivery, and same-day delivery effectively caters to their desire for convenience and swiftness. This inclination for instant satisfaction plays a pivotal role in propelling the expansion of the same-day delivery sector. Furthermore, in the age of smartphones and on-demand services, consumers have grown accustomed to their needs being addressed promptly. Same-day delivery aligns well with this culture of rapid gratification and is an appealing option for a wide range of products.

The grocery segment is projected to grow at a rapid rate in the global quick commerce market. Purchasing groceries online empowers customers to make convenient home-based purchases and receive swift deliveries, resulting in time savings and enhanced convenience. This aligns perfectly with the fundamental value proposition of quick commerce (q-commerce). Moreover, online grocery orders can encompass various products, including packaged foods, household essentials, and fresh produce. Thanks to the diverse array of items accessible, shoppers can source all their requirements from a single platform, thereby boosting order values and profitability for q-commerce enterprises.

The North American quick commerce market is expected to register a tremendous market share in terms of revenue in the near future. In North America, customers are experiencing greater ease in accessing Q-commerce platforms and making orders, thanks to the growing prevalence of smartphones and mobile applications. These user-friendly applications provide a smooth and convenient shopping experience. In addition, Asia Pacific is estimated to grow at a rapid rate in the global quick commerce market. In the Asia Pacific region, food delivery services have successfully attracted a substantial customer following. As these platforms extend their offerings beyond restaurant meals, they tap into a well-established user base already familiar with online ordering and swift deliveries. This broadens the potential customer base for Q-commerce services.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 122.57 Billion |

| Revenue Forecast In 2035 | USD 1,361.39 Billion |

| Growth Rate CAGR | CAGR of 28.1% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Category, Delivery Timeframe, By Fulfilment Model, By Delivery SLA , By Product Category, By Order Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Glovo, Getir, Rappi, Wolt, JOKR, Gopuff, Zomato, Swiggy, Rohlik, Gorillas, Ocado Zoom and others |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Quick Commerce Market By Category

· Grocery & FMCG

· Ready-to-Eat Meals & Beverages

· Pharmacy & OTC Healthcare

· Beauty & Personal Care

· Electronics & Small Appliances

· Gift & Flowers

By Fulfilment Model

· Dark Stores / Micro-Warehouses

· Partner Stores / Retail Pickup

· Hybrid Model (Dark + Partner)

· Automated Micro-Fulfilment Centers (MFCs)

By Order Channel

· Direct Brand Apps / First-Party Platforms

· Aggregator / Marketplace Platforms

By Delivery SLA (Service Level Agreement)

· ≤10 Minutes Delivery

· 10 – 30 Minutes Delivery

· 30 – 60 Minutes Delivery

Quick Commerce Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.