Global Pro-diet Bar Market Size is valued at USD 7.3 Bn in 2024 and is predicted to reach USD 18.0 Bn by 2034 at 9.6% CAGR during the forecast period for 2025-2034.

Key Industry Insights & Findings from the report:

Protein bars with a high protein content are known as pro-diet bars. Due to consumers' growing awareness of the importance of health and wellness, these bars are in high demand in the health and wellness sector.

Various nutrition bars are offered to meet the growing customer demands, with pro-diet bars being one of the most popular options. Pro-diet bars have gained popularity among customers thanks to their nutritional benefits. It offers fewer carbohydrates, vitamins, and minerals but a higher protein concentration, making it ideal for customers on a protein diet and athletes and gym goers.

The market for pro-diet bars primarily caters to people looking for ready-to-eat protein sources. Additionally, the leading competitors in the pro-diet bar market have a tremendous market opportunity due to the rising popularity of convenience foods.

However, the high sugar content in protein bars raises the risk of diabetes, heart disease, and obesity. Protein bars' sugar alcohols have been linked to bloating, diarrhoea, and gas, and these health concerns impede commercial expansion.

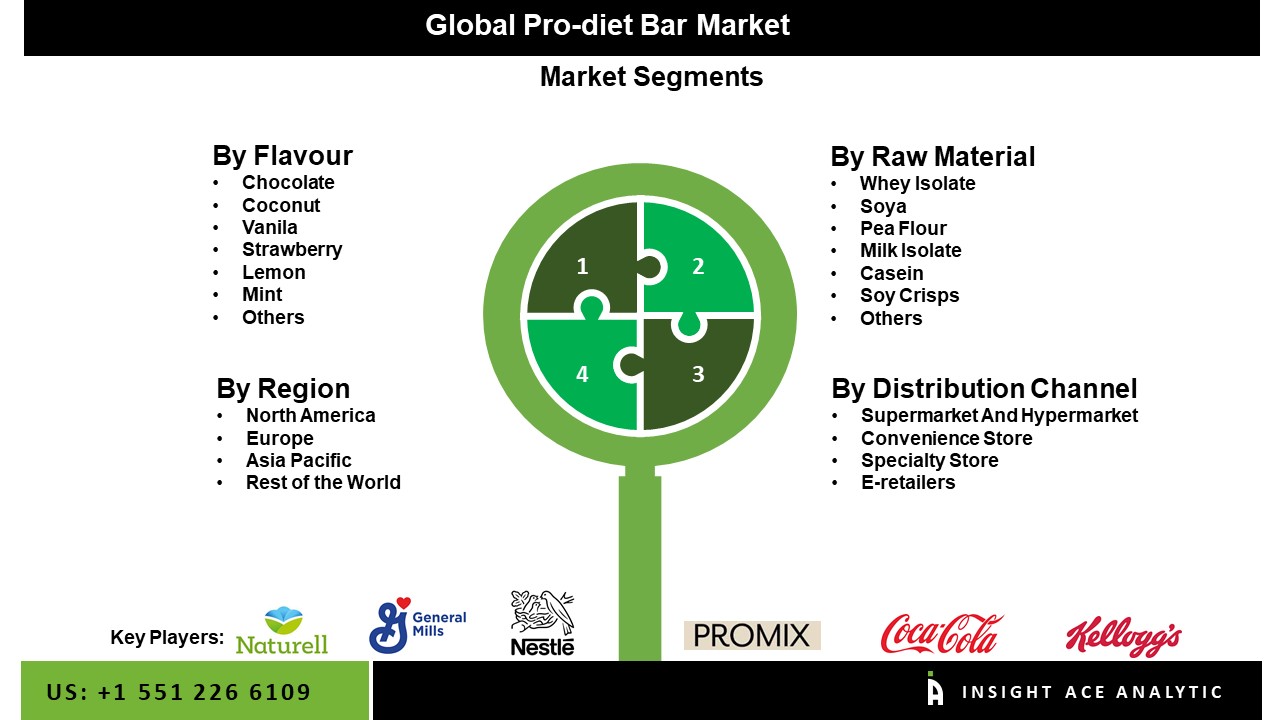

The pro-diet bar market is segmented based on flavor, raw material, and distribution channel. Based on flavor, the market is segmented into chocolate, coconut, vanilla, strawberry, lemon, mint, and others. The market is segmented by raw materials: whey isolate, soya, pea flour, milk isolate, casein, soy crisps, and others. Based on distribution channels, the market is further divided into supermarkets and hypermarkets, convenience stores, speciality stores, and e-retailers.

The milk isolate is anticipated to dominate the market during the forecast period. It can be used in various goods, including yoghurt, cheese, ice cream, and others, and has a high nutritional value. Since milk isolate is now a necessary component in creating pro-diet bars, the market for it is expanding quickly. Milk isolate is anticipated to increase rapidly during the projected period because of its high nutritional value and several health advantages, including muscle growth and weight loss. Health-conscious consumers seeking low-calorie or low-fat foods with significant dietary content are increasingly fond of these bars. They are also promoted as a nutritious snack for those looking to lose or maintain their weight.

The retail segment is expected to dominate the market during the forecast period. Pro-Diet Bars are utilized in retail establishments to give customers essential nutrition. Customers' health is maintained, and weight loss is aided by the bars. All types of clients' needs are met by the bars, which come in various tastes. They don't have any artificial components and are very healthy. They are, therefore, a better option for clients. Customers may purchase the bars because they are also reasonably priced.

Additionally, they are widely accessible throughout the world, and they are a popular option because of this. The market for Pro-Diet Bars in retail outlets is expanding due to all these factors.

North America is projected to dominate the market during the forecast period. This is due to increased awareness of health and nutritional supplements, including protein bars, pre-diet bars, and others. This can be due to consumers' growing health concerns and growing knowledge of dietary items, which has increased pro-diet bar demand throughout this region. Additionally, during the forecast period, it is projected that sporting events' popularity and fitness facilities' growth will drive up product sales. Besides, Asia Pacific is predicted to have the fastest-expanding market for pro-diet bars due to the rising number of fitness lovers and health enthusiasts in emerging countries.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 7.3 Bn |

| Revenue forecast in 2034 | USD 18.0 Bn |

| Growth rate CAGR | CAGR of 9.6% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Bn , and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By flavor, raw material, and distribution channel |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Naturell, Xterra Nutrition, Nestle (Powerbar), Coca-Cola (Odwalla), General Mills, Kelloggs, Promax Nutrition, Nutrisystem, Mars, Incorporated, Atkins Nutritionals, Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Flavor-

By Raw material-

By Distribution channel-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.