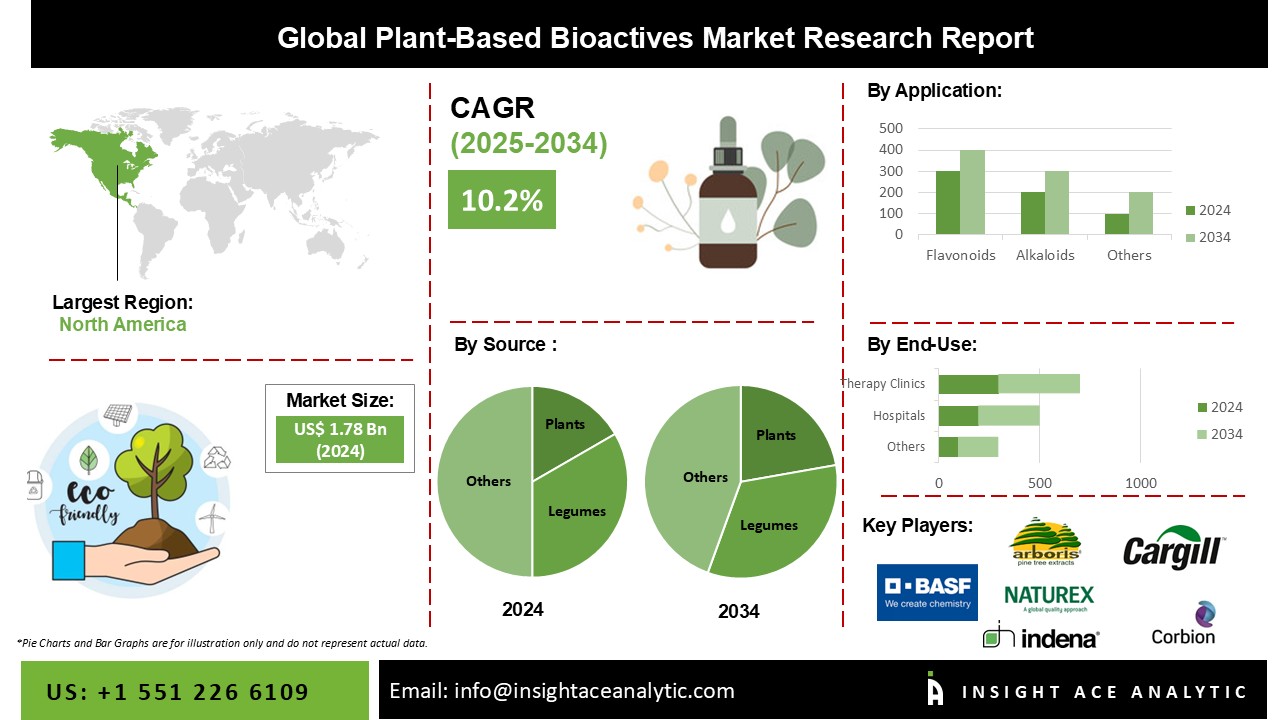

Plant-Based Bioactives Market Size is valued at 1.78 Billion in 2024 and is predicted to reach 4.65 Billion by the year 2031 at a 10.2% CAGR during the forecast period for 2025-2034.

Bioactive ingredients are substances that affect living creatures biologically. Plants, food, animals, the sea, and microorganisms are among the sources of the components. Customers' physical and physiologic health is improved by adding bioactive chemicals to food and feed products. Plant-based Bioactive are vegan extracts with a wide range of applications, including food and beverage, nutritional supplements, animal nutrition, and personal care products. Rising natural-sourced product trends and a preference for plant-based derivatives over animal-sourced derivatives would favourably influence the market expansion.

Animals were traditionally used to extract bioactive chemicals. In the upcoming years, market growth will be stimulated by rising consumer awareness combined with a demand for a healthy lifestyle that includes eating a balanced diet. Changes in consumer purchasing patterns have encouraged industry suppliers to develop more environmentally friendly products for broader customer appeal. Consumers' increased use of health supplements is being driven by significant influencing factors such as the ageing population and the rise in chronic illness rates, which will cause the expansion of the plant-based bioactive market. The availability of shakes and smoothies fortified with antioxidants and vitamins has also increased the demand for bio-based functional foods and dietary supplements.

However, high investment costs in licensing and regulatory processes hinder the market growth, resulting in an overall rise in the manufacturer's operational costs. A lack of awareness about the harmful health effects of food containing chemical substances: health implications include gastrointestinal problems, renal damage, liver illness, and nervous system impairment. This is a substantial barrier to market growth.

The Plant-Based Bioactive market is segmented on the basis of source, application and end-use. Based on the source, the market is categorized as Fruits & vegetables, Plants, Legumes and Others. Based on application, the market is segmented into Flavonoids, Phenolic Acids, Alkaloids, Saponins, Polysaccharides and Others. Based on the end-user, the market is segmented into Functional Foods & beverages, Dietary Supplements, Animal Nutrition, Personal Care and Others.

The industry for plant-based bioactive has found many important sources, including fruits & vegetables, plants, legumes and others. The use of Plant-Based Bioactive in the functional food and personal care business has been driven by the rising demand for vegan goods, whether for consumption or non-consumption purposes. However, due to their remarkable effectiveness and availability, fruits and vegetables and legumes make up the majority of the industry's contributing sources. These sources are packed with antioxidant qualities that, when consumed, have a favorable impact on the body. One of the most enriched legumes is soy, which is frequently employed as a component in functional foods.

Major industry contributors include the functional food and beverage, dietary supplement, animal nutrition, personal care industries and others. Due to its broad range of applications and the increasing demand for vegan functional food, food and drinks made up the greatest portion of the sector. The penetration in this market has increased as a result of important influencing factors like the rising trend for healthy eating habits and consumers' preference for vegan products over those made with animal ingredients. The most growth is anticipated in the market for dietary supplements in the upcoming year. The growth of the nutraceutical business and the rising need for immunity boosters have driven up demand for dietary supplements.

The North America Plant-Based Bioactive market is likely to dominate the market growth over the forecast period. The existence of many producers and benevolent government policies will fuel regional industrial expansion. Another essential aspect driving product adoption is consumers' high levels of acceptability and financial capacity to do so. The rising need to increase immunity among young and elderly populations strongly influences the market. Diabetes, Alzheimer's disease, and heart disease are common illnesses in the area. The growth of the personal care sector and rising investments in technologically advanced products are the main factors driving regional demand. Due to increasing consumer expenditure on vegan cosmetics and other personal care items like creams, lotions, and shampoos, the area also has a significant penetration scope in the individual care applications market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 1.78 Billion |

| Revenue forecast in 2034 | USD 4.65 Billion |

| Growth rate CAGR | CAGR of 10.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | By Source, By Application, By End-Use |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Naturex SA, IndenaSpA, Linnea SA, BASF SE, Arboris LLC, Cargill Inc., Dupont De Nemours & Co ltd, Martin Bauer GmbH &Co. KG, Hansen A/S, LIPO Foods, Roquette, Arla Foods, Doehler Group, Archer Daniels Midland Co. (ADM), DSM, Ajinomoto Co. Inc., Ingredion Inc., Kerry Group, Corbion, and Changsha Organic Herb Inc. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Source

By Application

By End-Use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.