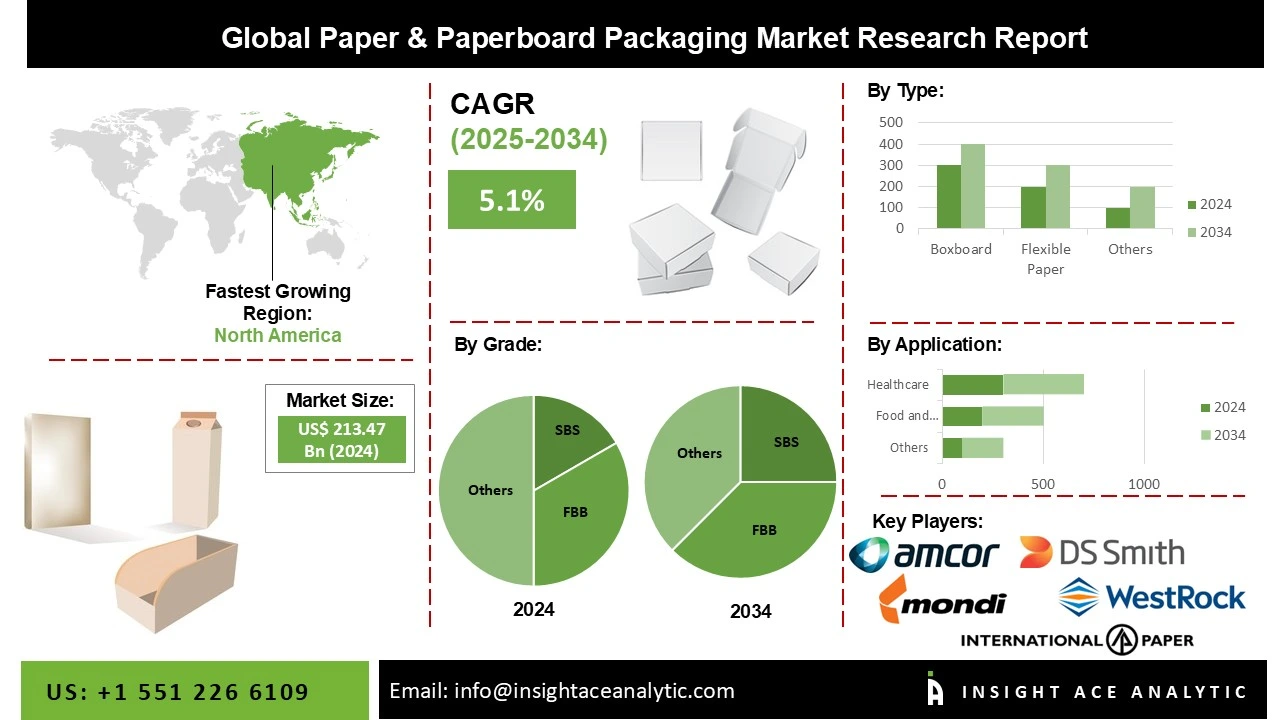

The Global Paper and Paperboard Packaging Market Size is valued at 213.47 billion in 2024 and is predicted to reach 347.35 billion by the year 2034 at a 5.1% CAGR during the forecast period for 2025-2034.

Paper and paperboard packing materials are made of pulp generated from wood and non-wood sources such as straw and bamboo. Wood pulp is commercially available and is increasingly produced through paper recycling. Paper and paperboard packaging are ideal for end-use industries due to their sustainable nature and the low cost of wood pulp.

The rise of the e-commerce industry has also aided in expanding the paper & paperboard packaging market. E-commerce enterprises commonly use corrugated packaging for secondary and tertiary packing due to its lightweight and inexpensive cost.

Furthermore, rising plastic material sustainability difficulties are prompting e-commerce enterprises to replace flexible plastic packaging with paper packaging, which is likely to boost growth in the paper & paperboard packaging market.

However, the environmental benefits of paper and paperboard packaging are opening up new prospects for industry expansion. Government regulations governing the use of packaging materials are the primary limitation on the paper and paperboard packaging market. Maintaining the quality of paper-based packaging products is posing a significant impediment to the market's growth.

The paper and paperboard packaging market is segmented on the basis of grade, type and application. Based on grade, the market is segmented as solid breached sulfate, coated unbleached kraft paperboard, folding boxboard, white lined chipboard, glassine & greaseproof paper, label paper, and others. By type, the market is segmented into corrugated boxes, box boards, and flexible paper. The application segment includes food, beverage, healthcare, personal & healthcare, and others.

The food category is expected to hold a major share of the global paper and paperboard packaging market in 2024. Paper and paperboard packaging goods are widely used for packaging food and beverages due to their low cost, lightweight, outstanding printability, sustainability, and non-reactive qualities. The worldwide packaged food sector has grown significantly in recent years due to increased disposable income and retail network expansion. As a result, the rising packaged food industry is predicted to favorably impact the demand for paper & paperboard packaging over the forecast period.

The flexible paper segment is projected to grow rapidly in the global paper and paperboard packaging market. Flexible paper bags are increasingly being used to replace single-use plastic bags. Furthermore, low cost and high printability contribute to the segment's largest share. Growing customer desire for such products due to a more hectic lifestyle is likely to boost the expansion of the flexible paper packaging market during the forecast period.

Asia Pacific's paper and paperboard packaging market is expected to register the highest market share in revenue in the near future. Factors like population expansion, rising middle-class populations, and increased retail network penetration all contribute to the steady growth of various end-use sectors, boosting market for paper and paperboard packaging in the region. Europe is likewise expected to grow at a rapid pace in the future years, and the European Union intends to phase out single-use plastic by 2023. Furthermore, when compared to other nations, European consumers have a far higher level of sustainability awareness. These reasons are mostly boosting market expansion in Europe.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 213.47 Bn |

| Revenue forecast in 2034 | USD 347.35 Bn |

| Growth rate CAGR | CAGR of 5.1% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, Volume (Ton), and CAGR from 2024 to 2031 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Grade, Type And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; Japan; India; South Korea; Southeast Asia |

| Competitive Landscape | Amcor Plc, DS Smith, International Paper, Mondi Group, Westrock Company, Cascades Inc., Clearwater Paper Corporation, ITC Limited, Metsa Group, and Packaging Corporation of America. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Paper and Paperboard Packaging Market By Grade-

Paper and Paperboard Packaging Market By Type-

Paper and Paperboard Packaging Market By Application-

Paper & Paperboard Packaging Market By Printing Technology

Paper and Paperboard Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.