The Global Organic Soya Protein Market Size is valued at 632.30 million in 2023 and is predicted to reach 1603.67 million by the year 2031 at an 12.37% CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

One of the finest alternatives to animal and meat proteins is soy protein. A vital component in boosting food's nutritional content and performance is protein. Increased doctor prescriptions fuel the demand for organic soy proteins for clean food and customer knowledge of the negative impacts of ingesting unhealthy foods. This market will expand during the term as customers switch more and more from meat to soy products. Customers who are low in carbohydrates and unable to eat milk and milk products also drive-up demand for these products.

Furthermore, the primary driver of the expansion of the organic soy protein industry is substituting traditional dairy and meat products with soy products. Another factor influencing the demand for organic soy protein is health-conscious consumers' growing acceptance of organic food.

In addition to witnessing unheard-of market expansion, organic soy protein competes with non-organic soya foods and other organic soybean goods like flax and sesame. Additionally, some people have allergies to soy or a lot of protein. These two criteria constrain the market for organic soy protein.

Demand for utilization in food and beverage, nutrition, and functional food applications has surged, driving the market. Due to its functional qualities, soy protein is employed more frequently as a powerful dietary ingredient in formulated foods. However, the advent of non-organic soy protein, which is even less expensive, poses a challenge to the market. This will limit the market's expansion. People are choosing prevention over treatment as they become more aware of the unfavorable effects of modern living.

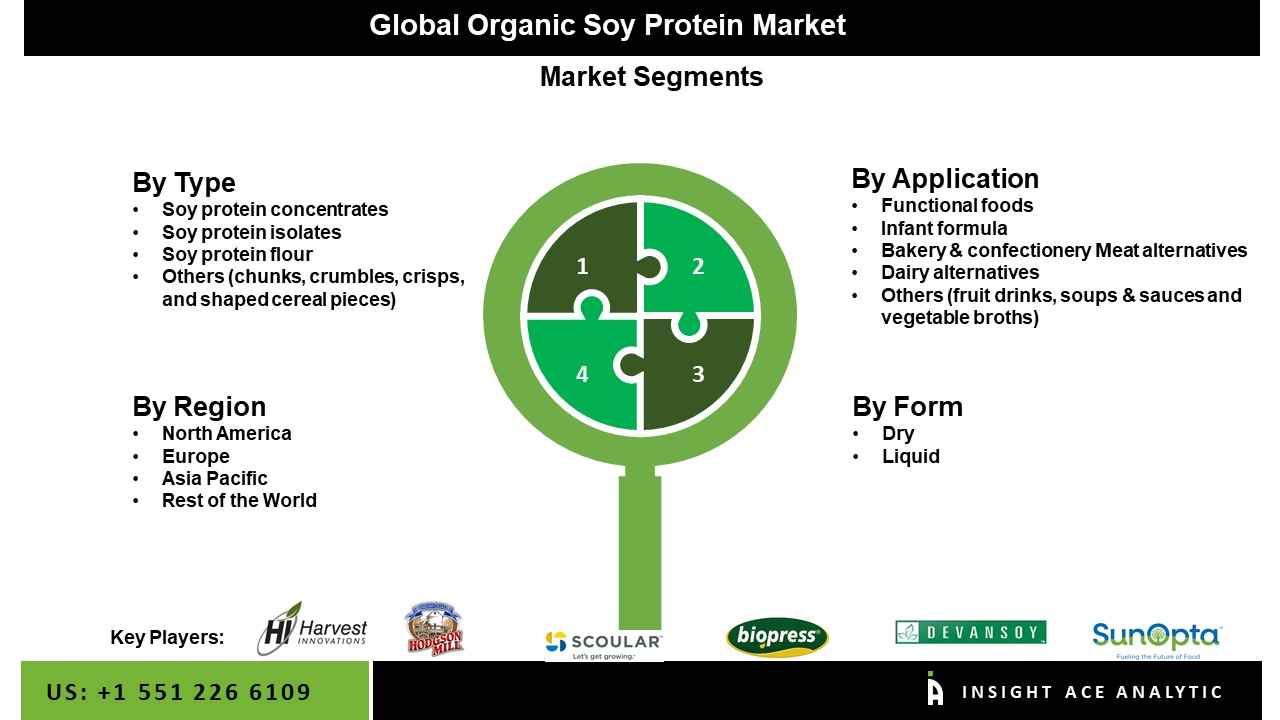

The organic soya protein market is segmented based on type, application and form. Based on type, the market is segmented as soy protein concentrates, soy protein flour, soy protein isolates and others. By application, the market is segmented into functional foods, infant formula, bakery & confectionery, meat alternatives, dairy alternatives and others (fruit drinks, soups & sauces and vegetable broths. By form, the market is segmented into dry form and liquid form.

The meat alternatives category is expected to hold a major share of the global organic soya protein market in 2024. Due to the heavy utilization of non-renewable resources like water and land during animal protein production, the meat industry has a substantial adverse effect on the environment. Animal protein's carbon footprints significantly contribute to greenhouse gas emissions and global warming. Animal welfare advocacy groups are taking steps to raise awareness about the treatment of animals used in the manufacture of items derived from them. Due to the lack of cruelty in these goods, customer attitudes have evolved in favor of plant-based proteins like soy.

The soya protein concentrates segment is projected to proliferate in the global organic soya protein market. This segment holds a sizable market share because of various factors, including its low cost compared to other proteins, potential health benefits, expanding demand from the livestock industry, more significant usage of soy protein concentrate in food applications, and growth in product releases. Additionally, it is anticipated that the expanding demand for soy protein concentrates from the meat and animal feed industries will fuel the expansion of this market.

The North American organic soya protein market is expected to register the highest market share in revenue soon. The vast number of vegetarians, the rising knowledge of the value of eating diets high in protein, technical developments in the food and beverage sector, and the accessibility of raw materials are all factors that have been cited as contributing to this expansion. In addition, Asia Pacific is projected to proliferate in the global organic soya protein market. The population of India and China is quickly urbanizing, which has made people more health concerned and inclined toward wholesome eating habits. The quickest market for organic soy protein is Asia Pacific (excluding Japan), thanks to this inclination in these and the neighbouring nations. Organic soy protein is consistently in demand across the Middle East and Africa.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 632.30 million |

| Revenue forecast in 2031 | USD 1603.67 million |

| Growth rate CAGR | CAGR of 12.37% from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Type, Application and Form |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; South East Asia |

| Competitive Landscape | Harvest Innovations (U.S.), World Food Processing (U.S.), Devansoy Inc. (U.S.) The Scoular Company (U.S.), and SunOpta Inc. (Canada) FRANK Food Products (Netherlands), Hodgson Mill (U.S.), Agrwal Oil & Biocheam (India), Biopress S.A.S. (France) and Natural Products, Inc. (U.S.) |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Type

By Application

By Form

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.