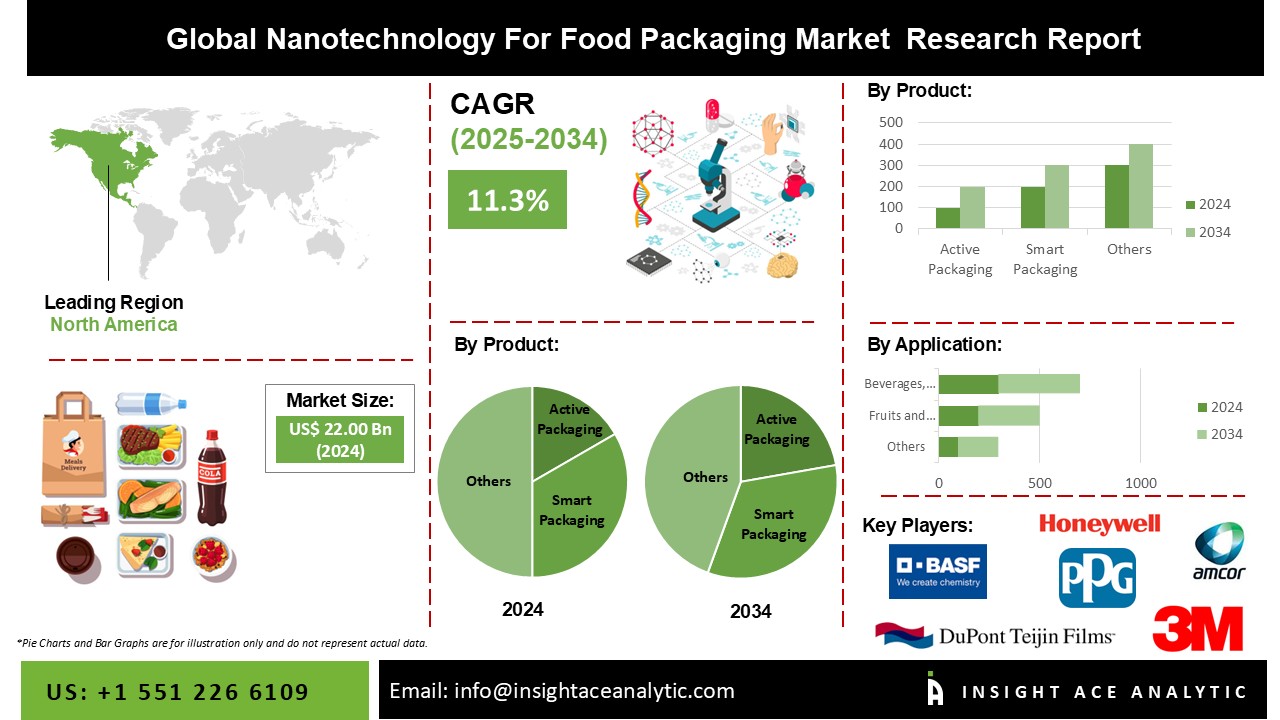

Nanotechnology For Food Packaging Market Size is valued at 22.0 billion in 2024 and is predicted to reach 63.4 billion by the year 2034 at an 11.3% CAGR during the forecast period for 2025-2034.

The packaging supply chain has already seen the commercialization of nanomaterials at several points, from food storage to traceability and tracking. Packaging materials are greatly improved by their qualities, such as UV protection, moisture, gas, volatile component barriers, mechanical strength, and sturdiness.

Key Industry Insights & Findings from the Report:

A natural progression is the incorporation of nanotechnology in food packagings, such as enhanced packaging, active packaging, and an upcoming category of smart/intelligent packaging that has sensors embedded in the packaging itself and provides suppliers with a wealth of data that is more comprehensive than what can be provided by current packaging. In the next ten years, it's anticipated that opportunities and trends in nanotechnology-based food packaging will be at the forefront, with blockchain-based food packaging projected to become the most well-known.

The packaging industry is always evolving due to new technological advancements in the sector, which have improved characteristics in packaging materials to improve the food consumption experience. The complexity of safer and more secure packaging of goods is caused by the rising demand for exotic food types and variants, which promotes the idea of food packaging in the sector.

Additionally, the introduction of nanotechnology hastened the development of packaging in the food sector. As food manufacturers try to keep up with the new packaging materials that serve as a part of the branding and certify food safety, packaging has become their most recent area of concentration.

The nanotechnology for the food packaging market is segmented on the product and application. Based on product, the market is segmented into active packaging, improved packaging and smart packaging. Based on application, the nanotechnology for food packaging market is segmented into fruits and vegetables, beverages, prepared foods, meat products, bakery and others.

The active packaging category grabbed the highest revenue share, and it is anticipated that it will continue to hold that position during the anticipated time. Utilizing nanotechnology, active packaging introduces the active component into a food package material, extending shelf life and enhancing food quality and safety. Some technologies employed in nanotechnology packaging include oxygen scavengers, water vapor removers, carbon dioxide producers, ethylene removers, and ethanol releasers. The growing demand for this technology in the food and pharmaceutical sectors is a major reason fueling the expansion of this market.

The beverages category is anticipated to grow significantly over the forecast period. Nanotechnologies are typically considered advantageous in beverage packaging for extending product shelf life, identifying rotten ingredients, and enhancing product quality. The expansion of this market segment is being driven by the beverage sector, one of the areas where nanotechnology is anticipated to have a big impact in the future.

The Asia Pacific nanotechnology for food packaging market is expected to register the highest market share in revenue in the near future. A rising supply of raw materials and the expansion of sectors, including food processing, pharmaceuticals, and human resources, are driving growth in this region. China, Japan, and India won't be the only Asian nations to experience rapid growth. In addition, North America is projected to grow rapidly in the global nanotechnology for the food packaging market. In sectors with supportive rules and regulations, such as the food, pharmaceutical, and export industries, the usage of nanotechnology is anticipated to increase. As a result, it is projected that the market for nanotechnology in food packaging will expand more successfully in the future.

| Report Attribute | Specifications |

| Market size value in 2023 | USD 20.00 Bn |

| Revenue forecast in 2031 | USD 46.50 Bn |

| Growth rate CAGR | CAGR of 11.32% from 2024 to 2031 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product And Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; China; Japan; India; South Korea; Southeast Asia; South Korea; Southeast Asia |

| Competitive Landscape | Amcor Ltd., Sonoco Products Company, BASF SE, Tetra Laval International S.A., Honeywell International Inc., 3M and Chevron Phillips Chemical Company, LLC, among others |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Nanotechnology for Food Packaging Market By Product

Nanotechnology for Food Packaging Market By Application

Nanotechnology for Food Packaging Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Nanotechnology for Food Packaging Market Snapshot

Chapter 4. Global Nanotechnology for Food Packaging Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Product Type Estimates & Trend Analysis

5.1. by Product Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Product Type:

5.2.1. Active Packaging

5.2.2. Improved Packaging

5.2.3. Smart Packaging

Chapter 6. Market Segmentation 2: by End-users Estimates & Trend Analysis

6.1. by End-users & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn) & Forecasts and Trend Analyses, 2021 to 2034 for the following by End-users:

6.2.1. Fruits and Vegetables

6.2.2. Beverages

6.2.3. Prepared Foods

6.2.4. Meat Products

6.2.5. Bakery

6.2.6. Others

Chapter 7. Nanotechnology for Food Packaging Market Segmentation 3: Regional Estimates & Trend Analysis

7.1. North America

7.1.1. North America Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.1.2. North America Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2021-2034

7.1.3. North America Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.2. Europe

7.2.1. Europe Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.2.2. Europe Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2021-2034

7.2.3. Europe Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.3. Asia Pacific

7.3.1. Asia Pacific Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.3.2. Asia Pacific Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2021-2034

7.3.3. Asia Pacific Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.4. Latin America

7.4.1. Latin America Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.4.2. Latin America Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2021-2034

7.4.3. Latin America Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

7.5. Middle East & Africa

7.5.1. Middle East & Africa Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by Product Type, 2021-2034

7.5.2. Middle East & Africa Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by End-users, 2021-2034

7.5.3. Middle East & Africa Nanotechnology for Food Packaging Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 8. Competitive Landscape

8.1. Major Mergers and Acquisitions/Strategic Alliances

8.2. Company Profiles

8.2.1. Amcor Limited

8.2.2. Avery Dennison

8.2.3. BASF SE

8.2.4. Bemis Company Inc.

8.2.5. Chevron Phillips Chemical Company, L.L.C.

8.2.6. Danaflex Nano LLC

8.2.7. DuPont Teijin Films

8.2.8. Honeywell International Inc.

8.2.9. Klöckner Pentaplast

8.2.10. Mitsubishi Gas Chemical Company

8.2.11. Nanocor

8.2.12. PPG Industries, Inc.

8.2.13. Sealed Air

8.2.14. Sidel

8.2.15. Sonoco Products Co.

8.2.16. Tetra Laval International S.A.

8.2.17. Other Prominent Players