Mineral Salt Ingredients Market Size is valued at 11.99 billion in 2024 and is predicted to reach 23.80 billion by the year 2034 at 7.2% CAGR during the forecast period of 2025-2034.

Key Industry Insights & Findings from the report:

Ingredients such as minerals and salt are frequently employed in regular diets and typically exist in the form of minerals. Mineral salts can be found in seawater, mines, and brines, among other places. They can, however, also be taken out of dairy, meat, vegetables, fruits, flowers, and grains.

Some primary industries for minerals and salt ingredients are agriculture, food and beverage, and pharmaceuticals. Over the forecast period, it is also anticipated that rapid urbanization and consumer lifestyle changes that cause different chronic diseases, such as cancer, cardiovascular diseases, hypertension, and stroke, will accelerate the market expansion for mineral salt components. A significant trend in the market is anticipated to be the expanding use of mineral salt components in medicinal and cosmetic products. This pattern is anticipated to fuel market expansion.

Over the projection period, it is anticipated that rising dietary supplement use, expansion of the food sector, and rising consumer demand for healthy food will promote market growth for mineral salt components. However, the market encounters difficulties such as varying raw material prices, rivalry from other ingredient suppliers, and strict restrictions.

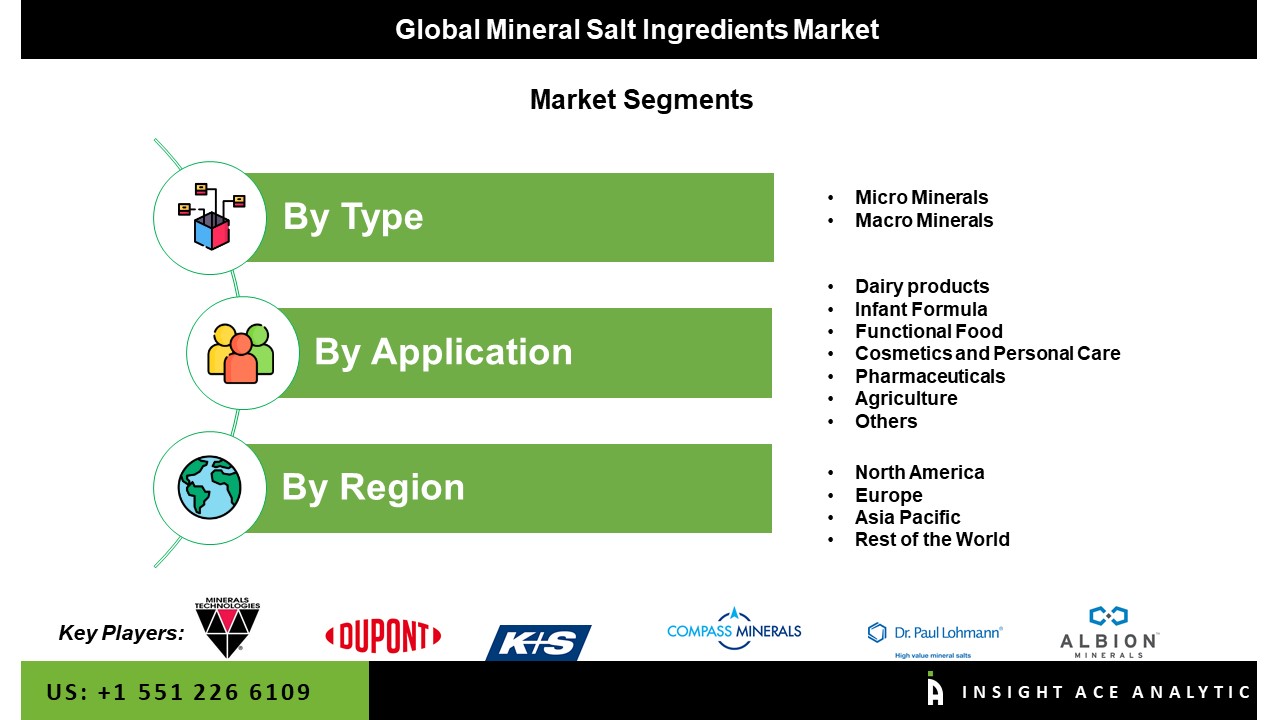

The mineral salt ingredients market is segmented based on type and application. Based on type, the market is segmented as micro mineral and macro mineral. By application, the market is segmented into dairy products, infant formula, functional food, cosmetics and personal care, pharmaceuticals, agriculture and others.

The macromineral salt element dominates the market. Several different mineral ions have seen strong demand in the market for mineral salt ingredients, including sodium, potassium, chloride, phosphorus, and magnesium. Two grams of sodium and five grams of magnesium salt per day provide a wealth of nutrients when consumed with food regularly. Sodium and magnesium are elements found in mineral salt. The daily recommended intake of these nutrients provides a summary of the mineral salt ingredient industry.

The functional food segment dominates the market for mineral salt ingredients. Functional food products are known to provide minerals for salt formation in humans and animals. Functional foods now contain more mineral ions due to the increased requirement for calcium in manufacturing. The consumer demand for food products that provide extra health advantages beyond basic nutrition is driving the rapid growth of the functional food sector. As a result, the need for mineral salt components in functional food products has surged. The functional food segment's market expansion is driven by the health benefits of mineral salts like potassium, magnesium, and calcium, which include maintaining strong bones, normal blood pressure, and cardiovascular health. The market expansion for mineral salt components in the functional food sector is also driven by the rising demand for fortified foods, which have added minerals and vitamins to improve their nutritional profile.

The Asia Pacific mineral salt ingredients market, is expected to register the highest market share in revenue shortly. This region has a larger consumer base in terms of the food business. Foods containing mineral salt have increased in the Asia Pacific region. People's knowledge of the importance of health is expanding quickly. The market for mineral salt ingredients has shown tremendous expansion due to the desire for wholesome cuisine. The countries with the biggest mineral salt ingredient product consumption are India and the Netherlands. This product also offers various flavors in the agriculture sector to draw customers.

An increase in the number of persons suffering from ailments related to a lack of minerals, such as goiter and anemia, leads to a rise in the demand for pharmaceutical products. Besides, the North American region is anticipated to expand throughout the projection period. It includes the largest market for the agriculture sector, which gives rise to goods with mineral salt as an ingredient. Sales of items containing mineral salt ingredients have increased due to the increasing demand for soil-enriching materials. The market is expanding due to the massive use of agricultural products such as plain salt blocks, stock salt, feed mix salt, etc.

In June 2022, Jungbunzlauer added two novel mineral salts: zinc gluconate and monomagnesium citrate. Zinc gluconate is obtained by combining gluconic acid with a highly pure zinc supply through a process called neutralization. Monomagnesium citrate is a magnesium salt of citric acid that has undergone partial neutralization. Both goods were included in our product group of specialized salts, which may be obtained through our sales offices and representatives.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 11.99 billion |

| Revenue forecast in 2034 | USD 23.80 billion |

| Growth rate CAGR | CAGR of 7.2% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Product Type, and Application |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Corbion, Minerals Technologies Inc., Compass Minerals International Inc., Albion Laboratories, Inc., Dr. Paul Lohmann GmbH KG, K+S AKTIENGESELLSCHAFT, Gadot Biochemical Industries Ltd., Arla Foods amba, DuPont, Jungbunzlauer Suisse AG, SEPPIC, and Koninklijke DSM N.V. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Mineral Salt Ingredients Market By Type-

Mineral Salt Ingredients Market By Application-

Mineral Salt Ingredients Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.