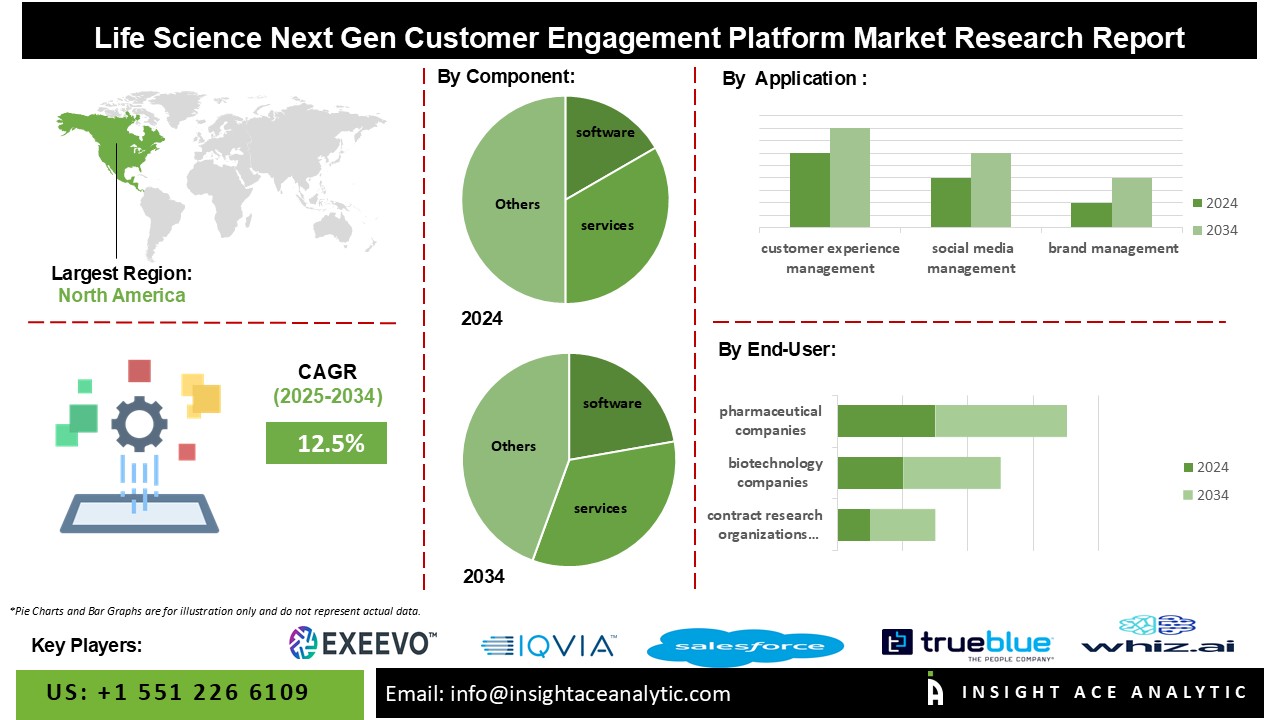

Life Sciences Next Gen Customer Engagement Platform Market Size is predicted to witness a 12.5% CAGR during the forecast period for 2025-2034.

Next-generation customer engagement platforms in the life sciences sector embody the cutting-edge fusion of technology and customer relationship management. By harnessing the power of digital innovation, these platforms redefine how life sciences companies—ranging from pharmaceutical firms to biotechnology entities—interact with a diverse array of stakeholders, including healthcare professionals, patients, and researchers.

The core objective is to foster deeper, more meaningful connections that are tailored to individual needs and preferences, thereby elevating the overall engagement experience. Primary drivers of the life sciences next-gen customer engagement platform market are the shift toward patient-centred care and the growing need for digital transformation in healthcare. More and more, the healthcare industry is going digital, which is driving demand for next-generation consumer interaction platforms. Moreover, the demand for life sciences businesses to effectively communicate with patients and healthcare providers through digital channels is expanding as electronic health records (EHRs), telemedicine, and other digital health technologies become more widely used.

Furthermore, the importance of incorporating virtual health services into customer engagement platforms has grown with the advent of telemedicine and virtual care. These systems provide patients with convenient and all-inclusive healthcare experiences by integrating digital health coaching, remote monitoring, and virtual consultations.

The life sciences next-gen customer engagement platform market is segmented as per the Component, Application, and end user. The component segment includes Software and Services. Based on Application segment, the market is divided into Customer Experience Management, Social Media Management, Brand Management, Compliance Management, and Others. By End User, the market is segmented into Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), Research Institutes, and Others.

The services category is expected to hold a major share in the global life sciences next-gen customer engagement platform market. This is so because the software serves as the backbone of the technological platform, enabling a range of features like real-time engagement, content management, multichannel integration, and data analytics. Additionally, it is anticipated that during the forecast period, the services segment will develop at the quickest rate. Services are essential to the implementation, customization, integration, and upkeep of customer interaction platforms that are tailored to the unique requirements of life sciences organizations.

The customer experience management segment is estimated to grow rapidly in the global life sciences next-gen customer engagement platform market. This market is critical since businesses are placing a high priority on creating lasting bonds and providing customers with enhanced experiences. A range of actions are included in customer experience management to improve the general experience of patients, healthcare providers, and other stakeholders when they deal with life sciences enterprises.

The North American life sciences next-gen customer engagement platform market is expected to register the highest market revenue share in the near future. The main drivers of the growth of the life sciences next-gen customer engagement platform market in North America are the growing use of digital technologies in healthcare, the demand for more customized healthcare solutions, and the stringent regulations requiring compliant communication channels. In addition, Asia Pacific is likely to grow at a rapid rate in the global life sciences next-gen customer engagement platform market.

The region's healthcare system is digitizing quickly due to the growing usage of cell phones, the internet, and government programs that support e-health solutions. Technologies for life sciences next-gen customer interaction platforms enable better patient outcomes by facilitating improved medication adherence, remote monitoring, and patient education.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 12.5% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Component, Application, and End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Veeva, IQVIA, Salesforce, Pitcher, Exeevo, ACTO, Viseven, Aktana, Seismic, Allego, Trueblue, WhizAI, ODAIA, Bigtincan, Tellius and other prominent players. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Life Sciences Next-gen Customer Engagement Platform Market By Component-

Life Sciences Next-gen Customer Engagement Platform Market By Application-

Life Sciences Next-gen Customer Engagement Platform Market By End User-

Life Sciences Next-gen Customer Engagement Platform Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.