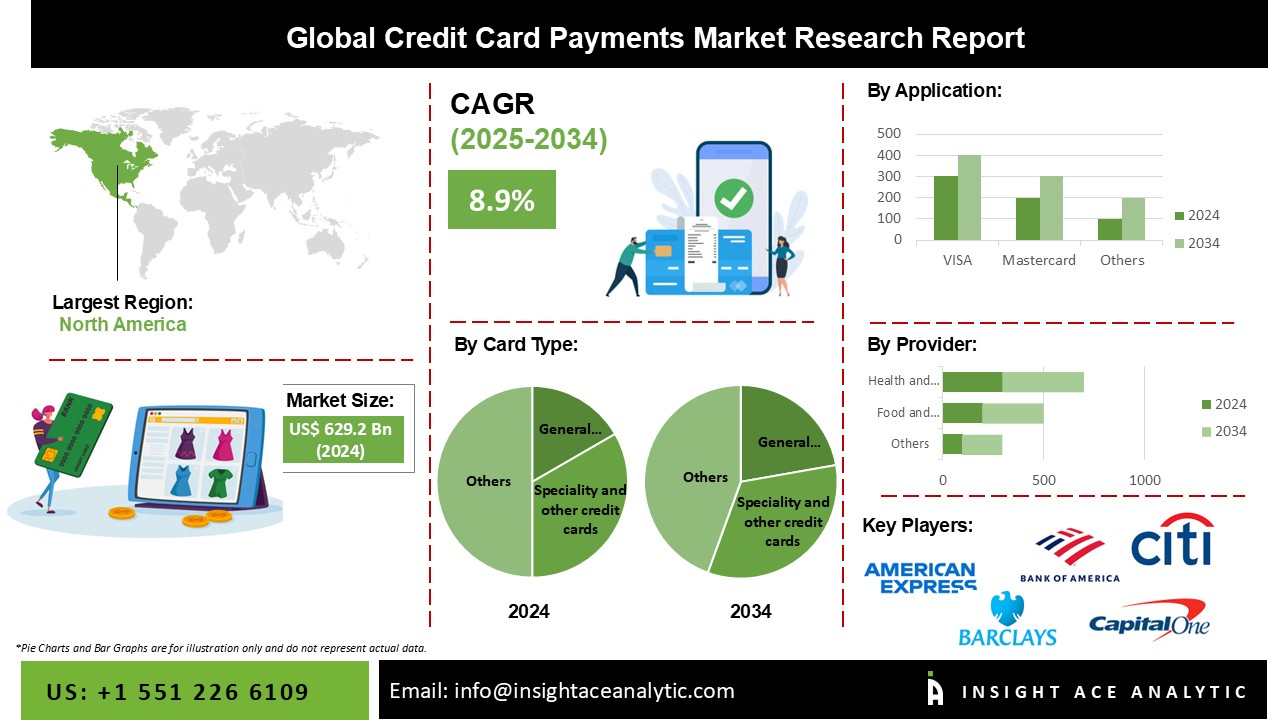

Credit Card Payments Market Size is valued at 629.2 billion in 2024 and is predicted to reach 1,459.10 billion by the year 2034 at a 8.9% CAGR during the forecast period for 2025-2034

Key Industry Insights & Findings from the Report:

The use of a credit card sized in place of cash or checks to pay for products and services is known as credit card payment. Customers can use a credit card to make transactions without instantly disclosing their bank account information. Customers who wish to avoid carrying large amounts of cash and have to wait days to receive their monies favor this payment method.

Furthermore, because more and more businesses are using electronic banking, the market for credit card payment systems has been growing significantly over the past few years. Due to growing demand from e-commerce enterprises and other organizations implementing this means of payment to enhance their consumer base, this trend is anticipated to continue over the projection period.

Additionally, the market for credit card payments is growing due to the numerous businesses offering significant points, rewards, and cashback to their customers in developing nations to enhance their market share. However, high prices connected with these alternatives and a consumer's need for knowledge about the advantages of utilizing credit cards limit market growth throughout the projection period.

Some of the the Credit Card Payments market players are:

The credit card payments market is segmented based on card type, application and provider. By card type, the market is categorized into general-purpose credit cards, specialty credit cards, and others. Based on the provider, the market is segmented as visa, master card, and others. Based on application, the credit card payments market is bifurcated into food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel and tourism, and others.

The visa category is expected to hold a major share of the global credit card payments market in 2021. An increase in foreign travelers and a decrease in airport latency issues drive the demand for visas. E-visas save travelers and airport security personnel time, allowing them to concentrate more on suspect passengers. The visa market is also expanding because of the advantages they offer, including high security, flexibility in use, and privacy protection, as well as a rise in the number of people traveling internationally.

The general purpose card type segment is projected to grow rapidly in the global credit card payments market. , general purpose credit cards are anticipated to keep their dominance in the next years due to the numerous distinct incentives and benefits they offer, which encourage many credit card users to convert to premium cards. The all-purpose cards can be deposited into online accounts and used as debit cards at shops.

The North America Credit Card Payments market is expected to record the highest market share in revenue soon. The most popular destination for both business and leisure visitors is the United States. The spread of the regional e-visa market has been facilitated by the issuance of the electronic system for travel authorization (ESTA) by the United States, the electronic travel authorization (ETA) by Canada, and the worldwide e-visa by Mexico.

The United States holds the greatest market share in the North American e-visa market. In addition, Asia Pacific is anticipated to expand at a rapid rate in the global credit card payments market. Increased expansion chances are created by favorable economic circumstances and the proliferation of mobile wallets in various retail uses, which spurs the growth of the Asia Pacific market. During the forecast period, the administration of Japan's endeavors to convert banking services into a digital platform is anticipated to propel the growth of the electronic payments market.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 629.2 Bn |

| Revenue forecast in 2034 | USD 1,459.10 Bn |

| Growth rate CAGR | CAGR of 8.9% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Billion, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Card Type, Application And Provider |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; Japan; Brazil; Mexico; The UK; France; Italy; Spain; India; South Korea; Southeast Asia |

| Competitive Landscape | American Express, Bank of America Corporation, Barclays PLC, Capital One, Citigroup Inc., JPMorgan Chase & Co, MasterCard, Synchrony, The PNC Financial Services Group, Inc., and USAA. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Credit Card Payments Market By Card Type

Credit Card Payments Market By Application

Credit Card Payments Market By Provider

Credit Card Payments Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumptions

Chapter 2. Executive Summary

Chapter 3. Global Credit Card Payments Market Snapshot

Chapter 4. Global Credit Card Payments Market Variables, Trends & Scope

4.1. Market Segmentation & Scope

4.2. Drivers

4.3. Challenges

4.4. Trends

4.5. Investment and Funding Analysis

4.6. Industry Analysis – Porter’s Five Forces Analysis

4.7. Competitive Landscape & Market Share Analysis

4.8. Impact of Covid-19 Analysis

Chapter 5. Market Segmentation 1: by Card Type Estimates & Trend Analysis

5.1. by Card Type & Market Share, 2024 & 2034

5.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Card Type:

5.2.1. General Purpose Credit Cards

5.2.2. Specialty & Other Credit Cards

Chapter 6. Market Segmentation 2: by Application Estimates & Trend Analysis

6.1. by Application & Market Share, 2024 & 2034

6.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Application:

6.2.1. Food & Groceries

6.2.2. Health & Pharmacy

6.2.3. Restaurants & Bars

6.2.4. Consumer Electronics

6.2.5. Media & Entertainment

6.2.6. Travel & Tourism

6.2.7. Others

Chapter 7. Market Segmentation 3: by Provider Estimates & Trend Analysis

7.1. by Provider & Market Share, 2024 & 2034

7.2. Market Size (Value (US$ Mn)) & Forecasts and Trend Analyses, 2021 to 2034 for the following by Provider:

7.2.1. Visa

7.2.2. Mastercard

7.2.3. Others

Chapter 8. Credit Card Payments Market Segmentation 4: Regional Estimates & Trend Analysis

8.1. North America

8.1.1. North America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Card Type, 2021-2034

8.1.2. North America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.1.3. North America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Provider, 2021-2034

8.1.4. North America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.2. Europe

8.2.1. Europe Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Card Type, 2021-2034

8.2.2. Europe Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.2.3. Europe Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Provider, 2021-2034

8.2.4. Europe Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.3. Asia Pacific

8.3.1. Asia Pacific Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Card Type, 2021-2034

8.3.2. Asia Pacific Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.3.3. Asia-Pacific Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Provider, 2021-2034

8.3.4. Asia Pacific Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.4. Latin America

8.4.1. Latin America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Card Type, 2021-2034

8.4.2. Latin America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.4.3. Latin America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Provider, 2021-2034

8.4.4. Latin America Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

8.5. Middle East & Africa

8.5.1. Middle East & Africa Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Card Type, 2021-2034

8.5.2. Middle East & Africa Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Application, 2021-2034

8.5.3. Middle East & Africa Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by Provider, 2021-2034

8.5.4. Middle East & Africa Credit Card Payments Market Revenue (US$ Million) Estimates and Forecasts by country, 2021-2034

Chapter 9. Competitive Landscape

9.1. Major Mergers and Acquisitions/Strategic Alliances

9.2. Company Profiles

9.2.1. American Express

9.2.2. Bank of America Corporation

9.2.3. Barclays PLC

9.2.4. Capital One

9.2.5. Citigroup Inc.

9.2.6. JPMorgan Chase & Co

9.2.7. MasterCard

9.2.8. Synchrony

9.2.9. The PNC Financial Services Group, Inc.

9.2.10. United Services Automobile Association

9.2.11. Visa Inc.

9.2.12. Other Prominent Players