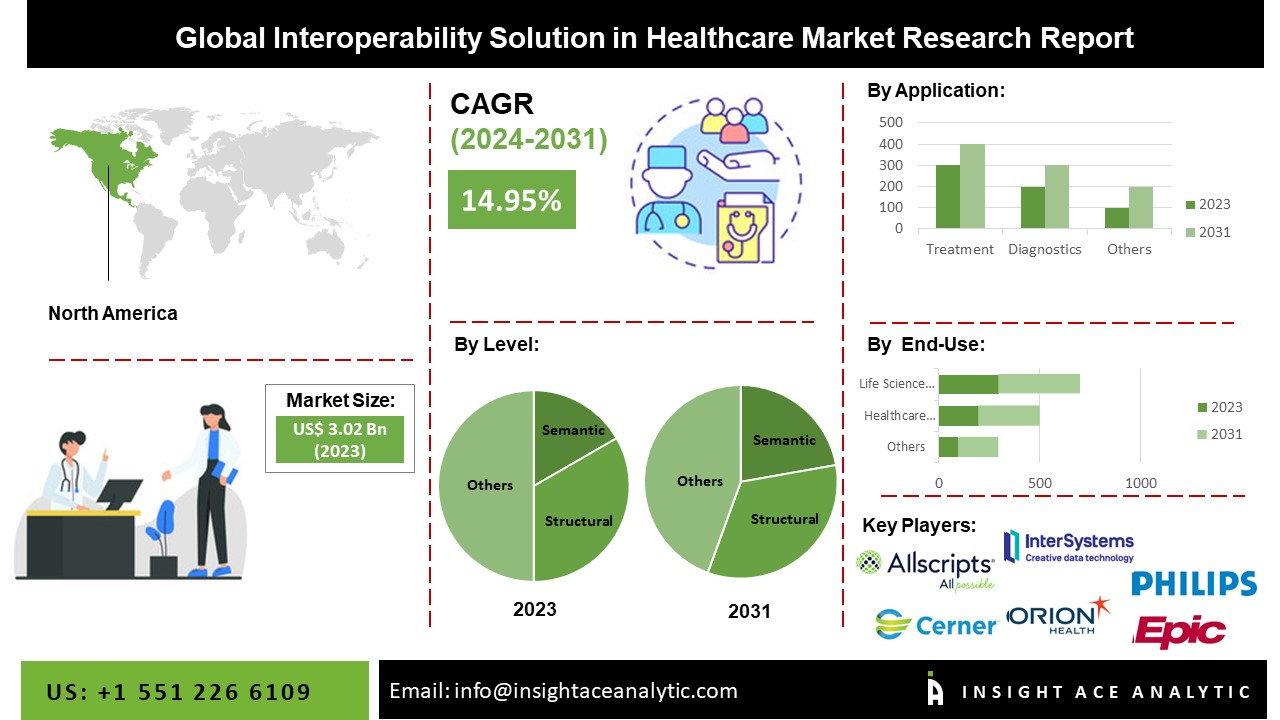

The Interoperability Solution in Healthcare Market Size is valued at USD 3.02 Billion in 2023 and is predicted to reach USD 9.08 Billion by the year 2031 at a 14.95 % CAGR during the forecast period for 2024-2031.

Key Industry Insights & Findings from the Report:

Interoperability in healthcare refers to integrating and utilizing electronic health data and fast and secure access to enhance individual and population health outcomes. The healthcare sector is currently heavily focused on improving operational efficiency and the quality of healthcare facilities, reducing medical errors during various medical procedures, and keeping costs to a minimum. Once the data is received, these solutions can use to share health information across two or more systems.

Key drivers influencing market revenue growth include rising healthcare costs, growing demand to lower these costs, government measures to improve safety and quality of care, and more. Healthcare companies are increasingly using big data analytics for sales and marketing initiatives, which is anticipated to fuel market revenue growth. The demand for interoperability solutions in healthcare among healthcare providers and healthcare payers is accelerating due to the increase in the price of various medical procedures and the decrease in reimbursements for laboratory services.

The federal government's investment in encouraging the use of these methods has a further impact on the market. The market for interoperability solutions in healthcare is also benefited from the rise in healthcare spending, improvements in the healthcare infrastructure, and rising demand for extended care delivery. However, the lack of qualified personnel to operate interoperability solutions in the healthcare market, worries about data security and privacy, and the high cost and complexity of implementing healthcare analytics solutions, and these factors are all anticipated to restrain market revenue growth throughout the forecast period.

The interoperability solution in the healthcare market is segmented on level, product type, application and end-use. Based on level, the market is segmented into semantic, foundational and structural. Based on the product type, the market is segmented into services and solutions. Based on the application, the market is segmented into treatments, diagnostics and others. Based on the end-user, the market is segmented into healthcare providers, healthcare payers and life science companies.

The semantic category dominated the market in 2021 as it permits fundamental data and system compatibility between two systems. This application makes it difficult for computers to retain, reconcile, translate and upgrade data and slows segmental progress. The sort of interoperability strategy that is now available on the market and allows for the use of more than two pathways for information sharing is semantic interoperability. Semantic interoperability enables online communication of medical details between different authorized parties and physicians across potentially incompatible electronic health records (EHR) and other platforms to improve healthcare delivery capacity, consistency, protection and efficacy.

The service category dominated the market in 2021. As healthcare analytics systems grow, so does the demand for services such as maintenance, implementation and consulting. This will likely boost revenue growth in the segment during the forecast period. The solution sector is predicted to rise rapidly during the forecast period, owing to the growing demand for healthcare analytics solutions to improve the efficiency of organizational operations in healthcare facilities.

The North American interoperability solution in the healthcare market is expected to register the highest market share in revenue in the near future due to the region's extensive network of healthcare facilities and important vital actors. The usage of EHRs is expanding, and government rules on clinical care are becoming more stringent to lower healthcare costs and improve patient care in hospitals around the region. These elements are influencing the region's adoption of interoperability solutions. In addition, Asia Pacific is projected to grow rapidly in the global interoperability solution in the healthcare market due to quick advancements in healthcare and information technology, increased data collection in developed countries, and rising expenditures to support the use of advanced analytics solutions. Other trends include increased government eHealth initiatives, growing medical tourism, increased high-quality healthcare demand, and increased demand for medical equipment installation and healthcare information technology (HCIT) solutions integration to give patients access to cost-effective, high-quality care. Using these solutions to simplify healthcare procedures and lower healthcare expenses is also helping the Asia Pacific market's revenue growth.

| Report Attribute | Specifications |

| Market Size Value In 2023 | USD 3.02 Billion |

| Revenue Forecast In 2031 | USD 9.08 Billion |

| Growth Rate CAGR | CAGR of 14.95% from 2024 to 2031 |

| Quantitative Units | Representation of revenue in US$ Million and CAGR from 2024 to 2031 |

| Historic Year | 2019 to 2023 |

| Forecast Year | 2024-2031 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Level, Application, Product Type, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | InterSystems Corporation, Allscripts Healthcare Solutions, Cerner Corporation Inc., Orion Health Group Limited, Koninklijke Philips N.V., Epic Systems Corporation, ViSolve Inc., Infor Inc, iNTERFACEWARE and Quality Systems Inc. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Level-

By Product Type-

By Application-

By End-Use-

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.