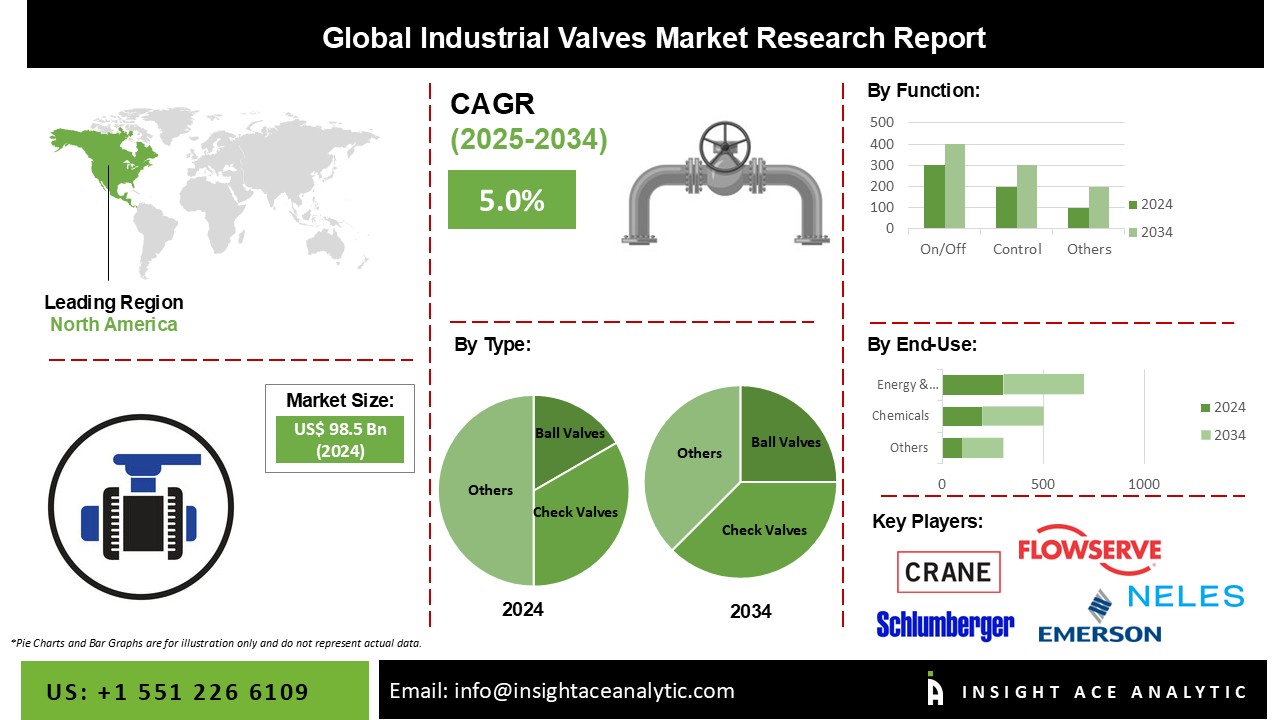

Industrial Valves Market Size is valued at 98.5 billion in 2024 and is predicted to reach 158.6 billion by the year 2034 at a 5.0% CAGR during the forecast period for 2025-2034.

Over the forecast period, rising automation brought on by growing industrialization and facility development is anticipated to drive the market. Increasing consumer demand for flow control equipment will positively affect market expansion. Intelligent control systems for smart valves are expected to become very important, which is anticipated to speed up their development. During the next seven years, demand will be driven by increased diagnostics and intelligent technologies in industrial valves for monitoring process variables such as upstream and downstream pressure stem position, temperature, and flow rate.

The use of coal is being demonized, and traditional coal-fired plants are being shut down, among other things, which could impede growth. Price changes for raw materials could slow down the use and uptake of the technology. Moreover, the expansion of the conventional power industry may need to be improved by compliance with onerous government restrictions.

The Industrial Valves market is segmented based on type, material, component, function , size and end-user. Based on type, the market is segmented as ball valves, check valves, butterfly valves, plug valves, globe valves, gate valves, diaphragm valves, and safety valves. The component segment includes actuators, valve bodies, and other components. By function, the market is segmented into on/off, and control. The material segment includes steel, cast iron, alloy-based, cryogenic, plastic, and other materials. The size segment includes <1, 1" to 6", 7" to 25", 26" to 50", and>50".

The End-user industry includes chemicals, energy & power, oil & gas, water & wastewater treatment, building & construction, paper & pulp, metal & mining, agriculture, semiconductor, pharmaceutical, food & beverage, and others.

The market for check valves is expected to continue expanding steadily. These valves are unidirectional, preventing the process flow from damaging the equipment or interrupting the flow, by preventing it from returning to the system. The demand across sectors has been positively impacted by rising automation and the need for refineries to control fluid flow.

The majority of total income was accounted for by the oil and gas segment. The market for industrial valves has grown as a result of rising demand for deeper wells, longer pipelines, and lower production costs as well as technological advancements in processing, production, and transportation. Furthermore, the requirement for monitoring and regulating from a centralized location and growing pipeline installations have boosted the industry's output and demand for smart valves.

The market's largest region was Asia Pacific. Production across the region is predicted to benefit from the expanding construction activity and increasing chemical consumption. The demand is also anticipated to be fueled by increasing capacity additions at petroleum refineries and the development of new nuclear power plants. For example, China is planning to invest in the development of brand-new coal-fired and scrubber power plants.

| Report Attribute | Specifications |

| Market size value in 2024 | USD 98.5 Bn |

| Revenue forecast in 2034 | USD 158.6 Bn |

| Growth rate CAGR | CAGR of 5.0% from 2025 to 2034 |

| Quantitative units | Representation of revenue in US$ Million, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market statistics, growth prospects, and trends |

| Segments covered | Type, Material, Component, Function, Size And End-user |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; The UK; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Emerson, Flowserve Corporation, Sclumberger Limited, Crane Co., Neles, KITZ Corporatin, IMI PLC, KSB SE & Co, & KGaA, Bray International, and Spirax-Sarco Engineering PLC. |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Industrial Valves Market By Type-

Industrial Valves Market By Component-

Industrial Valves Market By Function-

Industrial Valves Market By Material-

Industrial Valves Market By Size-

Industrial Valves Market By End-User Industry-

Industrial Valves Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.