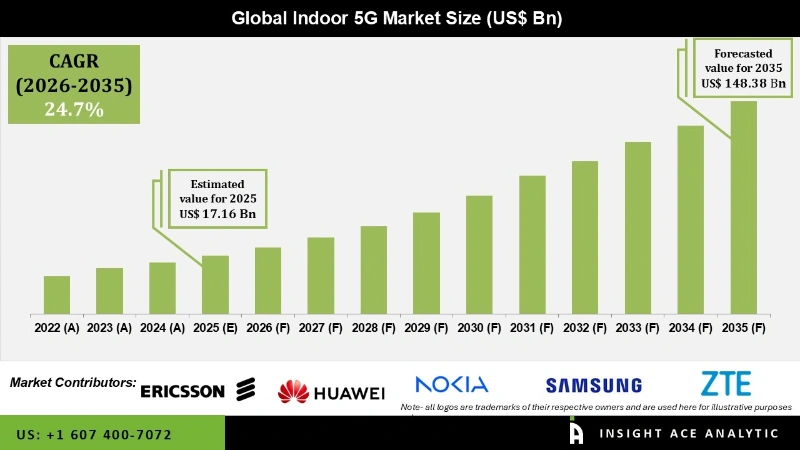

Global Indoor 5G Market Market Size is valued at USD 17.16 Bn in 2025 and is predicted to reach USD 148.38 Bn by the year 2035 at a 24.7% CAGR during the forecast period for 2026 to 2035.

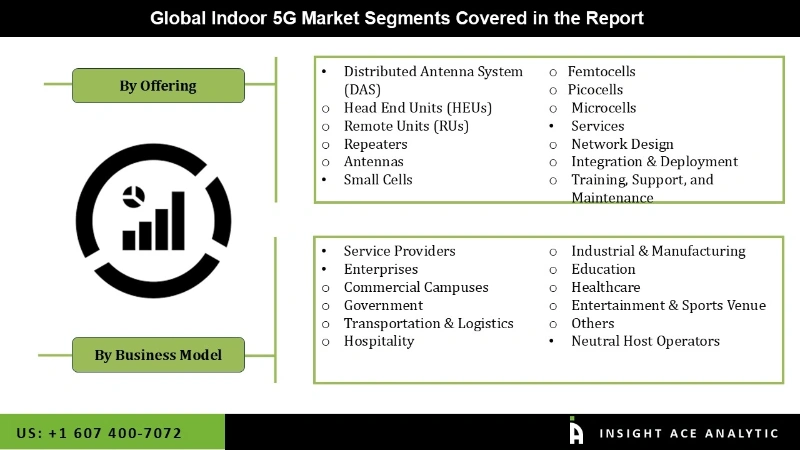

Indoor 5G Market Size, Share & Trends Analysis Report By Offerings (Distributed Antenna System (DAS), Small Cells, Services), Business Models (Service Provider, Enterprises (Transportation & Logistics, Commercial Campuses, Government, Healthcare, Hospitality, Industrial& Manufacturing), and Neutral Host Operators),, By Region, And By Segment Forecasts, 2026 to 2035.

The next phase of hyper-connectivity across industries is enabled by 5G, a telecommunications innovation. With its ultra-low latency, high data throughput, and seamless connectivity capabilities, indoor 5G has emerged as a critical component of the digital world, with substantial implications for enterprise IT, healthcare, education, retail, and manufacturing.The true consequences of 5G become more noticeable indoors, where Wi-Fi and legacy networks are ineffective. For carrying load-critical, uncommon, and advanced user applications, the majority of the features provide low latency and network slicing in addition to high device density support.

One of the main forces behind governments and businesses implementing 5G is the growing demand for emergency response and real-time situational awareness in indoor spaces to improve public safety. This will guarantee quicker, more intelligent, and better-coordinated public safety solutions. A significant driver of the indoor 5G market is dependable inside wireless coverage, particularly for public safety. Additionally, over the last decade, there has been a notable surge in laws requiring public safety communication systems in buildings, such as high-rise structures, tunnels, shopping centers, parking garages, and airports, where emergency responders depend on communications to protect public safety. In addition, indoor 5G demand is driven by public safety, particularly in high-density and vital infrastructure areas such as government buildings, hospitals, airports, and schools.

Despite its promising development potential, the market for 5G indoor solutions has a number of challenges that may prevent it from expanding. The expensive cost of establishing 5G infrastructure is one key impediment. Furthermore, issues with spectrum allocation and regulations may impede industry growth. The deployment of 5G technology is subject to differing regulations in different countries, which can make implementation more challenging.

Some Major Key Players In The Indoor 5G Market are:

The Indoor 5G market is segmented based on offering and business model. Based on offering, the market is segmented into distributed antenna system (DAS) (head end units (HEUs), Remote Units (RUs), Repeaters, Antennas), small cells (Femtocells, Picocells, Microcells) and services (network design, integration & deployment, training, support, and maintenance). By business model, the market is segmented into service providers and enterprises (commercial campuses, government, transportation & logistics, hospitality, industrial & manufacturing, education, healthcare, entertainment & sports venue, others), and neutral host operators.

The adult Indoor 5G market is expected to hold a major global market share in 2021 because of the slow global push to achieve seamless, fast, and low-latency connectivity in small or densely populated indoor areas, usually depending on traditional macro networks for performance that is generally reliable. Offices, shopping centers, hospitals, industrial facilities, and other locations aimed at enhancing indoor 5G coverage and capacity can all benefit from the easy deployment of small cells due to their good, aesthetically pleasing form factor. Additionally, the growth of small-cell technology is being aided by the adoption of private networks and edge computing environments, which give businesses more control, security, and network-slicing capabilities for use cases like remote diagnostics, smart surveillance, and autonomous robotics.

One important end-user category is enterprises, which are using indoor 5G to boost operational efficiency and assist digital transformation programs. To allow cutting-edge applications like IoT, AR, VR, and cloud computing, companies across a variety of industries, including manufacturing, healthcare, retail, and education, are using 5G small cells. These technologies are essential to enterprise IT infrastructure because they demand dependable, fast connectivity, which tiny cells offer.

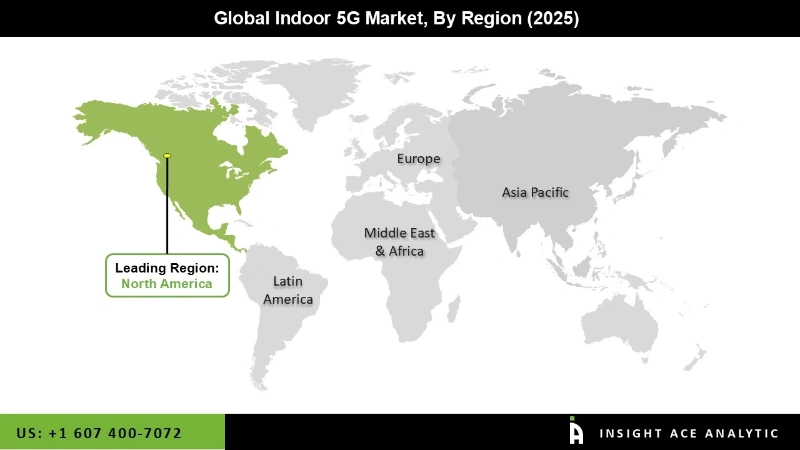

The North American Indoor 5G market is expected to register the highest market share in revenue in the near future. The industry is growing as a result of the region's robust telecommunications infrastructure, high rate of advanced technology adoption, and large investments made by major telecom carriers. Additionally, as companies and individuals look to take advantage of 5G technology, there is a growing need for dependable indoor connectivity in both residential and commercial settings. In addition, Asia Pacific is projected to grow rapidly in the global Indoor 5G market. This rise is a result of the region's fast urbanization, rising smartphone adoption, and large investments in 5G infrastructure. With strong government backing and ambitious ambitions for network growth, nations like China, Japan, and South Korea are leading the way in the rollout of 5G.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 17.16 Bn |

| Revenue Forecast In 2035 | USD 148.38 Bn |

| Growth Rate CAGR | CAGR of 24.7 % from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Offering, and Business Models |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South East Asia; South Korea |

| Competitive Landscape | Ericsson, Huawei, Nokia, Samsung, ZTE, CommScope, Corning, Comba Telecom, AT&T, Airspan, SOLID, Dali Wireless, Nextivity, JMA Wireless, Proptivity, LitePoint, ALCAN, Extenet Systems, LITEON Technology, Mavenir, Maven Wireless, Boingo Wireless, Fujitsu, BTI Wireless, Sercomm, PCTEL, and Huber+Suhner. |

| Customization Scope | Free customization report with the procurement of the report and modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Segmentation of Indoor 5G Market-

Indoor 5G Market By Offering-

Indoor 5G Market By Business Model-

Indoor 5G Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.