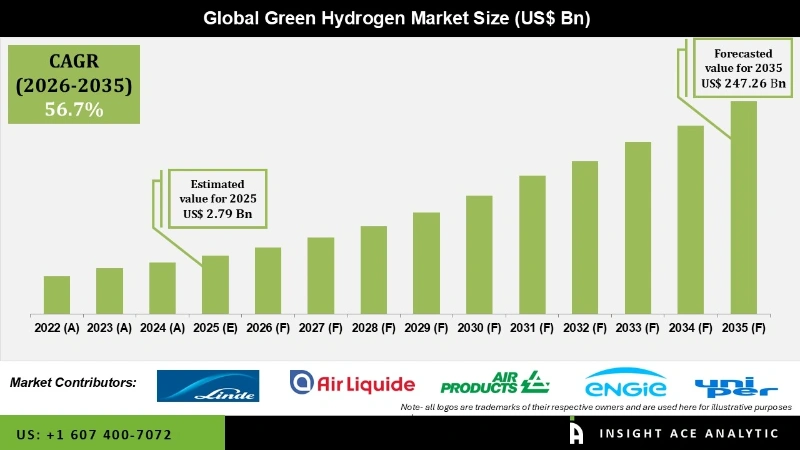

Global Green Hydrogen Market Size is valued at USD 2.79 Billion in 2025 and is predicted to reach USD 247.26 Billion by the year 2035 at a 56.7% CAGR during the forecast period for 2026 to 2035.

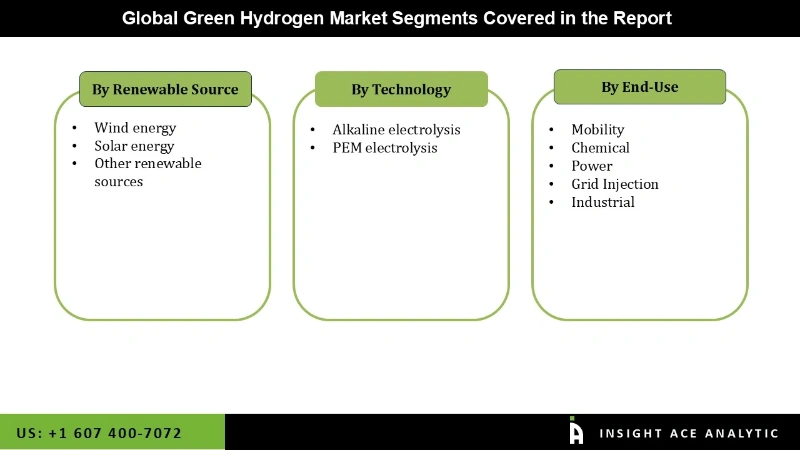

Green Hydrogen Market Size, Share & Trends Analysis Report By renewable source(wind energy, solar energy, other renewable sources), by technology (alkaline electrolysis, PEM electrolysis), by end-use (mobility, chemical, power, grid injection, and industrial), By Region, And Segment Forecasts, 2026 to 2035.

The green hydrogen industry expands as nuclear and green hydrogen fuel utilization rises. The main factor influencing the worldwide market for green hydrogen is the rising desire for alternative sources of electricity. The market will increase due to escalating environmental concerns highlighting the necessity of producing clean energy to minimize emissions.

Key Industry Insights & Findings from the report:

Furthermore, there will be many chances for green hydrogen due to the ubiquitous usage of hydrogen across many industries. The market for green hydrogen will experience an increase in revenue as regulations and laws supporting green hydrogen in the energy sector increase.

In addition, environmental concerns over rising carbon emissions from the usage of fossil fuels are intensifying. The growing number of hydrogen projects will also increase the market's international reach. The capacity to efficiently store green hydrogen and use it later will further fuel the market's expansion during the projected period. Wind farms make extensive use of green hydrogen. Wind turbines are frequently found both onshore and offshore. Offshore plants produce consistently all year long in contrast to onshore installations. Costs of renewable power have decreased over the past few decades, and this element has improved wind energy's adoption as a green hydrogen source. Both onshore and offshore wind farms now produce power to produce green hydrogen products.

However, the most significant problems preventing the expansion of the green hydrogen market are the initial investment necessary to build up hydrogen infrastructure and the prohibitive maintenance expenses.

The Green Hydrogen market is segmented by renewable source, technology, and the end-use industry. Based on renewable source, the market is segmented as wind energy, solar energy, other renewable sources. The market is segmented by technology as alkaline electrolysis, PEM electrolysis. The market is segmented by end-use industry as mobility, chemical, power, grid injection, and industrial.

Proton Exchange Membrane (PEM) electrolysis is on the rise as the greenest growing technology in the green hydrogen industry, revolutionizing clean hydrogen production. This technology possesses some benefits over classical alkaline electrolysis like better efficiency and smaller system that easily integrate with renewable energy sources. This renders it more desirable for industries and governments looking for sustainable energy options. While governments globally make efforts to cut down carbon emissions and shift towards a sustainable energy age, PEM electrolysis is expected to be an important driver for the development of the green hydrogen market.

The power industry is the fastest-growing end-use segment in the green hydrogen market, driven by its ability to store excess renewable energy and serve as a clean fuel for power generation. Produced from renewable sources like solar and wind, green hydrogen aligns with the industry's shift toward sustainable energy solutions. Government initiatives supporting renewable energy and carbon emission reduction further accelerate its adoption in the power sector. This trend highlights a broader transition to cleaner energy sources, positioning green hydrogen as a key player in the global energy landscape.

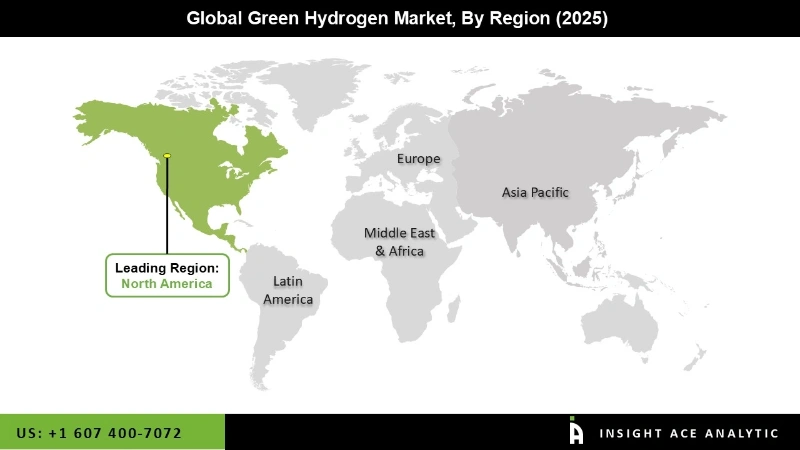

The North American green hydrogen market is expected to record the highest market share in revenue soon. This is because more investments have been made in creating renewable technologies for generating electricity, such as solar and wind. Players have implemented approaches such as upgrading and expanding the scope of green hydrogen projects globally through tie-ups, developing contemporary and cleaner energy systems through contractual partnership provisions, concentrating on joint venture agreements, and investigating the production of green hydrogen through collaborative relationships in this region. In addition, Europe is projected to grow rapidly in the global green hydrogen market. This increase is a result of governments' increased efforts to hasten the adoption of green hydrogen in their economies. The cost of producing renewable energy is also decreasing, yet another factor is promoting its rise. Furthermore, significant R&D spending in the hydrogen sector is anticipated to support the expansion of the green hydrogen market in Europe.

| Report Attribute | Specifications |

| Market size value in 2025 | USD 2.79 Billion |

| Revenue forecast in 2035 | USD 247.26 Billion |

| Growth rate CAGR | CAGR of 56.7% from 2026 to 2035 |

| Quantitative units | Representation of revenue in US$ Bn, CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026 -2035 |

| Report coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments covered | Renewable source, Technology and End-Use Industry |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia |

| Competitive Landscape | Linde, Air Liquide, Air Products Inc., ENGIE, Uniper SE, Siemens Energy, Green Hydrogen, Cummins Inc., Toshiba Energy Systems & Solutions Corporation, Nel ASA, SGH2 Energy Global, LLC, PLUG POWER INC., Loop Energy Inc., Ergosup, Ballard Power Systems |

| Customization scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing and available payment methods | Explore pricing alternatives that are customized to your particular study requirements. |

Green Hydrogen Market By Renewable Source-

Green Hydrogen Market By Technology-

Green Hydrogen Market By End-Use Industry:

Green Hydrogen Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.