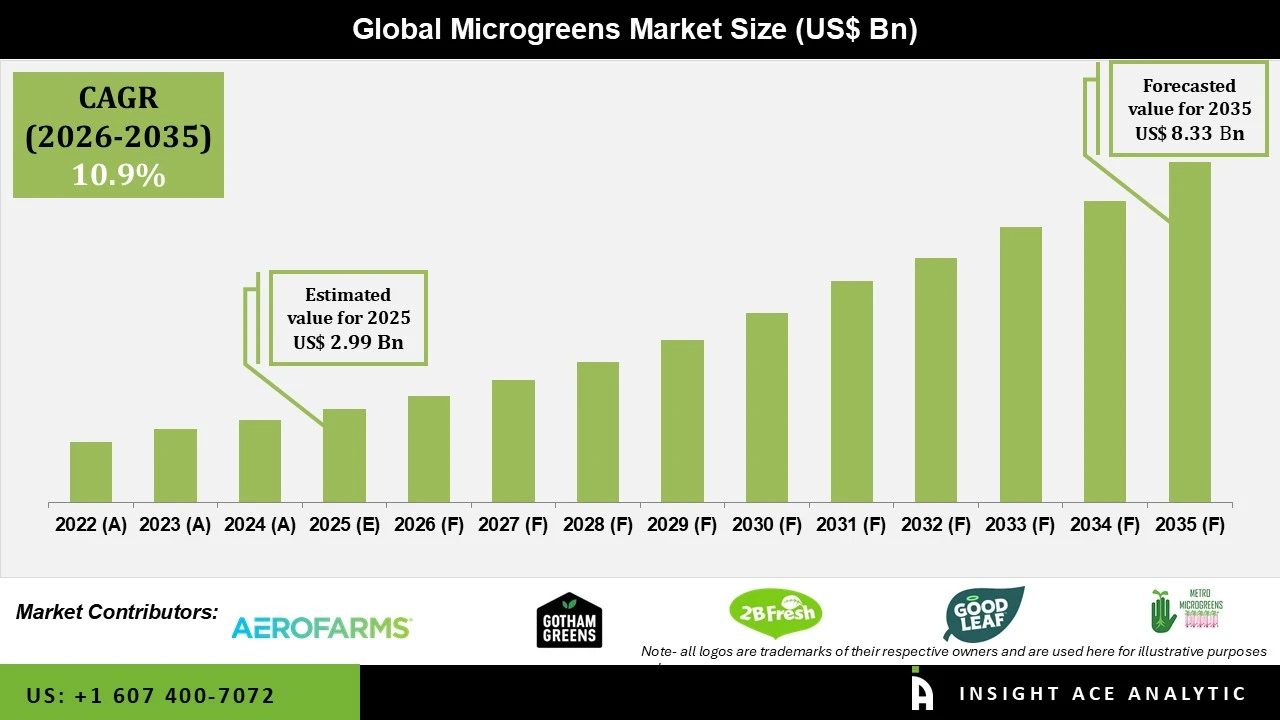

Microgreens Market Size is valued at USD 2.99 Bn in 2025 and is predicted to reach USD 8.33 Bn by the year 2035 at a 10.9% CAGR during the forecast period for 2026 to 2035.

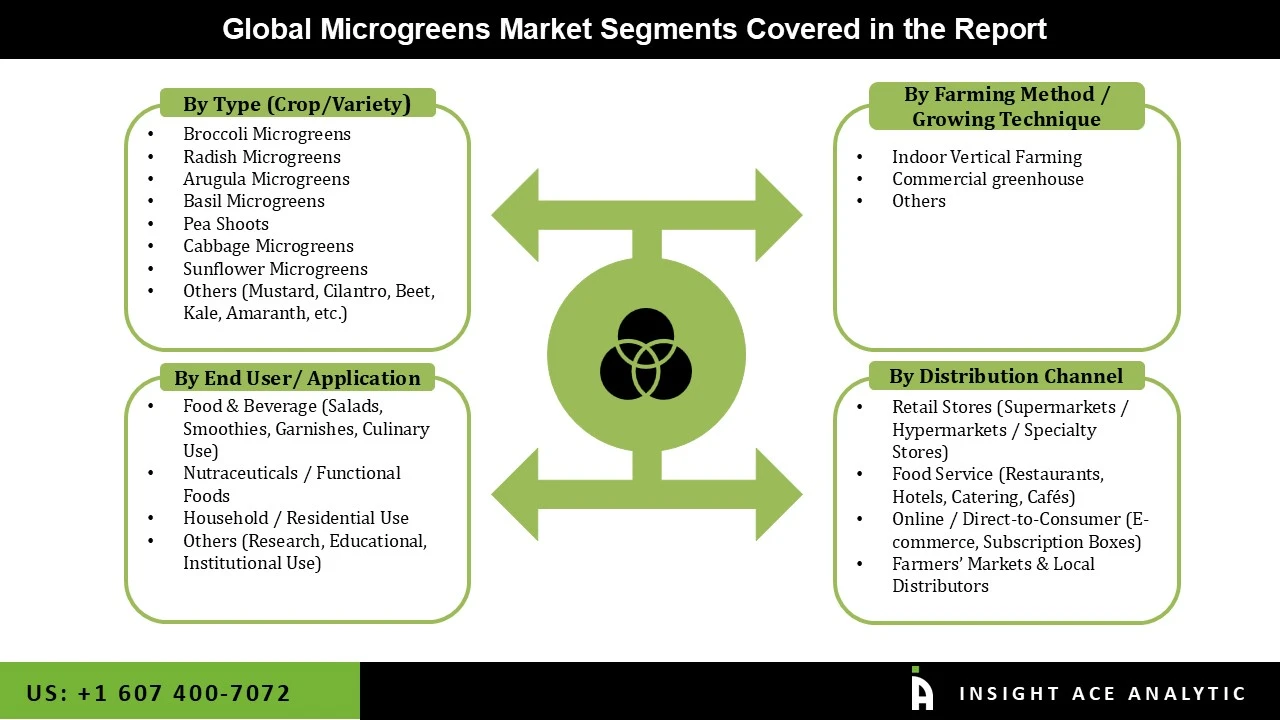

Microgreens Market Size, Share & Trends Analysis Report By Type (Crop / Variety)(Broccoli Microgreens, Radish Microgreens, Arugula Microgreens, Basil Microgreens, Pea Shoots, Cabbage Microgreens, Sunflower Microgreens Others (Mustard, Cilantro, Beet, Kale, Amaranth, etc.)), By Farming Method / Growing Technique (Indoor Vertical Farming, Commercial Greenhouses, Hydroponics, Soil-based Cultivation, Others (Aeroponics, Hybrid Systems)),By Distribution Channel (Retail Stores (Supermarkets / Hypermarkets / Specialty Stores), Food Service (Restaurants, Hotels, Catering, Cafés), Online / Direct-to-Consumer (E-commerce, Subscription Boxes), Farmers’ Markets & Local Distributors), By End Use / Application, By Region and By Segments Forecasts, 2026 to 2035.

Microgreens are little, fragile vegetable greens that grow to a height of 1-3 inches. They are collected 7-14 days after germination and comprise two completely formed cotyledon leaves. One of the primary factor driving market expansion is the increasing adoption of novel vertical and indoor farming practices. Consumers are rapidly adopting these environmentally friendly hydroponics, aeroponics, and aquaponics technologies to increase the yield and quality of value-added crops while using fewer resources such as nutrients, water, electricity, and space. The increased health consciousness among the general public is propelling market expansion.

Furthermore, greenhouse vegetable production, especially microgreens, has been gradually expanding, and the multi-decade pattern of growth is projected to continue shortly. The development of greenhouse technology is strengthening the microgreens sector. As a result of improved demand, revenue has stabilized, aiding market expansion. The retail sector is quickly increasing, and internet stores are displacing traditional brick-and-mortar establishments.

Online retailers must boost their inventory more than ever before to keep up with the product demand. This creates a massive market for microgreens. The key obstacles inhibiting the growth of the microgreen market are high initial investments, high production costs, and a lack of distribution channels. Other factors, such as implementing favorable government regulations promoting sustainable agriculture methods and rising consumer spending power on expensive, efficient, and nutrient-rich food products, are expected to boost market growth.

The microgreens market is segmented by type, farming and end-use. Based on type, the market is segmented into broccoli, cabbage, cauliflower, arugula, peas, basil, radish, cress, and others. Based on farming, the microgreens market is segmented into indoor vertical farming and commercial greenhouses. Based on end-use, the microgreens market is segmented into retail, food services and others.

The commercial greenhouse segment is expected to hold a significant market share. Commercial greenhouses are built to grow crops, vegetables, and fruits in a controlled environment, allowing farmers and businesses to produce larger yields all year round than traditional farming methods. Greenhouses rely mostly on sunlight and necessitate a horizontal arrangement of plants to ensure equal exposure to sunshine. This implies they require a lot of room and are best suited for rural or suburban settings. The greenhouse has obtained a major portion of the microgreens production market and is likely to maintain its dominant position during the forecast period.

Brocolli grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. Broccoli eating has several health benefits, including inflammation reduction, cancer prevention, enhanced heart health, and improved digestion. As a result, the growing popularity of broccoli microgreens' health benefits and the use of roof gardens and park gardens to grow microgreens are likely to drive up demand for microgreens of the broccoli microgreens variety.

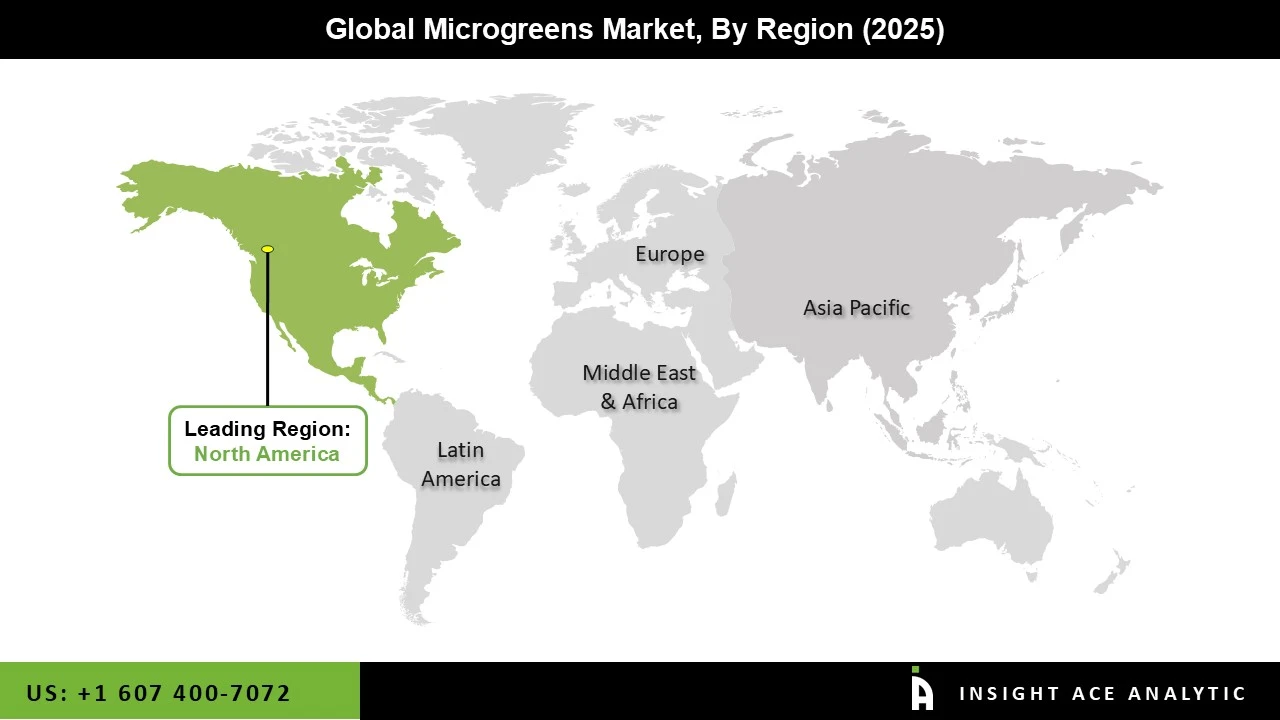

The North American microgreens market is expected to register the highest market share. Microgreens are in high demand from chefs in the United States as flavor enhancers and colorful garnishes on hotel and restaurant dishes, which is why organic vegetable growers are entering the microgreens market. Furthermore, because microgreens are a new and undeveloped sector, these organic vegetable growers are capitalizing on the market's minimal competition. Besides, Asia-Pacific is the fastest-growing microgreens market, and the demand for functional and healthful food items is skyrocketing. This is due to increased health-conscious consumers, increased spending on functional foods, and increased demand for organic veggies. This is also due to the rapid advancement of technology in indoor vertical farming and its rapid acceptance by vegetable and microgreens growers.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 2.99 Billion |

| Revenue Forecast In 2035 | USD 8.33 Billion |

| Growth Rate CAGR | CAGR of 10.9% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Type, Farming, Distribution Channel and End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | AeroFarms, Fresh Origins, Gotham Greens, 2BFresh, GoodLeaf Farms, Metro Microgreens, The Chef’s Garden, Inc., Living Earth Farm, Badia Farms, Ibiza Microgreens, Madar Farms, Farmbox Greens, 80 Acres Farms, Infarm, React Green, mU Greens and Greens, JGBC Farms, Greenu, True Leaf Market, Rock Garden Herbs, MingaGreens GmbH, Eat Your Microgreens, Italian Sprout, Ball Horticultural Company and Others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Microgreens Market By Type (Crop/Variety)-

Microgreens Market By Farming Method / Growing Technique-

Microgreens Market By End User/ Apllication-

Microgreens Market By Distribution Channel-

Microgreens Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.