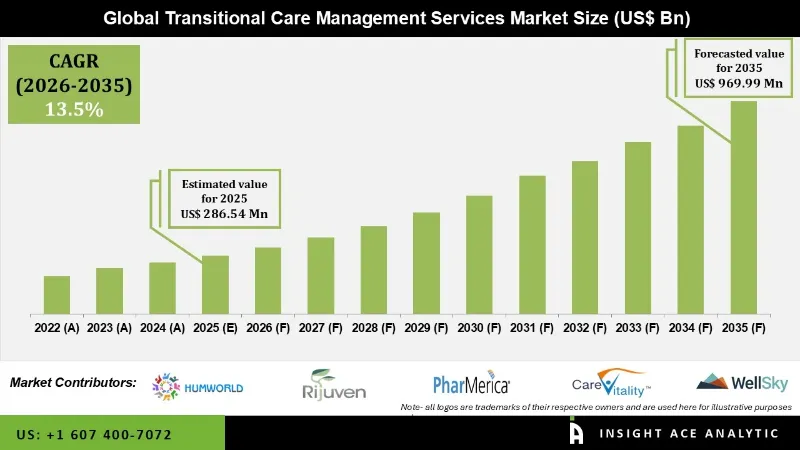

Transitional Care Management Services Market Size is valued at USD 286.54 Mn in 2025 and is predicted to reach USD 959.99 Mn by the year 2035 at a 13.5% CAGR during the forecast period for 2026 to 2035.

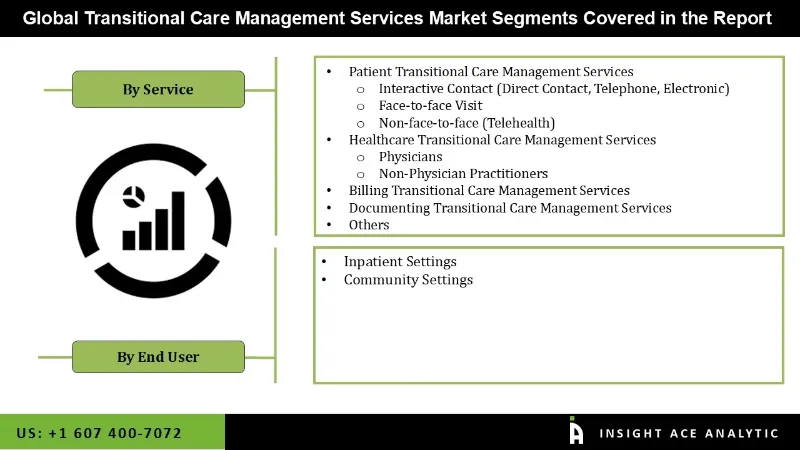

Transitional Care Management Services Market Size, Share & Trends Analysis Report By Service(Patient Transitional Care Management Services, Healthcare Transitional Care Management Services, Billing Transitional Care Management Services, Others), By End-Use, By Region, And Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

Transitional Care Management (TCM) services target transitioning from an inpatient to a supportive environment. The patient may be dealing with a health emergency, a new diagnosis, or a change in pharmaceutical management following hospitalisation or other inpatient facility stay (e.g., in a skilled nursing home). Family doctors frequently manage transitional care. Growing government healthcare spending, increased demand for high-quality care, growing use of care management, and an aging population are all driving factors in the transitional care management services market. As individuals become more conscious of the need for better healthcare, the transitional care management services market will continue to rise.

However, there are major problems restricting the growth of the global market for transitional care management services, such as a lack of highly skilled workers and excessive costs. Many people could not access transitional care management (transitional care management) services early in the COVID-19 outbreak due to lockdowns and safety concerns. Additionally, transitional care management therapies were delivered through telehealth, which increased the need for telemedicine. Following COVID-19, there has been an increase in demand for transitional care services, notably from the senior population. The adoption of transitional care management services results from the growth in market participants and the increased consumer demand for better patient care. The aging population, an increase in illnesses, accidents, surgeries, and the demand for post-discharge facilities are all projected to contribute to the market's healthy expansion.

The transitional care management services market is segmented on the service and end-use. Based on service, the market is segmented into patient transitional care management services, interactive contact (direct contact, telephone, electronic), a face-to-face visits, non-face-to-face (telehealth), healthcare transitional care management services, CM services, documenting transitional care management services and others. Based on end-use, the transitional care management services market is segmented into inpatient and community settings.

The market's leading segment is billing transitional care management services. Healthcare transitional care management service providers account for a significant portion of the billing for transitional care management services. These transitional care management services review the patient's discharge process and payment information, which may include the need for tests, treatment, and any necessary follow-up care.

Community settings grabbed the highest revenue share, and it is anticipated that they will continue to hold that position during the anticipated time. Half of the post-discharge care interventions take place in community settings. These facilities present an opportunity to enhance patient care and quality of life while lowering overall hospital costs and decreasing the likelihood of readmission. Community centers are viewed as a convenient option for patient recovery from life-threatening traumas, particularly in the case of geriatric patients as they lower the risk of hospital readmission, reduce the complications related to the transfer of care, and improve overall patient satisfaction, drive the segment.

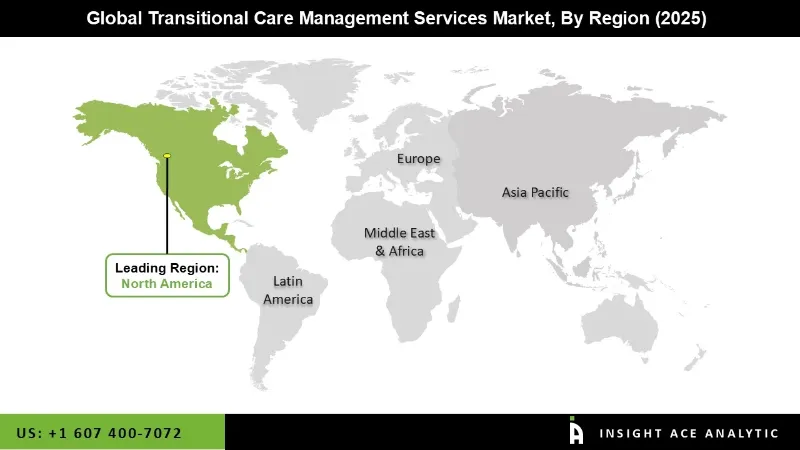

The North American transitional care management services market is expected to register the highest market share in revenue soon because of the development of IT solutions and the desire for scalable, inexpensive solutions to reduce healthcare expenses. As a result of technological development, rising cloud-based solution acceptability, and rising patient care management awareness, the regional market is expanding. In addition, Asia Pacific is projected to grow rapidly in the global transitional care management services market. The prevalence of chronic diseases among the elderly is fueling the expansion of the transitional care management solutions market due to the escalating demand for high-quality care for the older population.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 286.54 Mn |

| Revenue Forecast In 2035 | USD 959.99 Mn |

| Growth Rate CAGR | CAGR of 13.5% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn,and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Service, End-Use |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Humworld Inc.; Rijuven Corp.; PharMerica Corporation; CareVitality; ACT Health Solutions; Medsien; Wellsky; Nextgen Healthcare; Prohealth Select; Well Living Initiative (WLI). |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

By Service

By End-use

By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.