Global Protein Snacks Market Size is valued at USD 24.0 Bn in 2024 and is predicted to reach USD 74.1 Bn by the year 2034 at an 12.1% CAGR during the forecast period for 2025-2034.

High-quality protein snacks can be made from various sources, including poultry, fish, beef, and lentils, and plant-based sources like seeds and lentils fortified with protein. The primary health advantages of excessive intake include rapid and sustained weight loss, improved blood glucose levels, and a decreased risk of hypertension.

The demand for protein snacks is expected to rise as consumers become more conscious of developing chronic health problems, including obesity and heart illnesses resulting from consuming unhealthy food products. The market's accessibility of plant-based and meat-based protein snacks, which cater to the dietary choices of various populations, is also anticipated to accelerate the uptake of protein snacks.

The market share for protein snacks is expected to grow significantly since foods high in protein offer anti-ageing properties and give consumers in the geriatric population energy. In the upcoming days, the demand for protein snacks is expected to increase as millennial consumers taste products made from naturally produced and organic ingredients and with the highest nutritional value increases.

The global market for protein snacks is expected to grow due to the increasing demand for protein snack options, such as protein bars and powder. However, protein snack sales are projected to decline due to the high production costs, which increase the end product's price. Additionally, the expansion of the protein snacks industry is projected to be hampered by intense cost competition between small- and large-scale manufacturers.

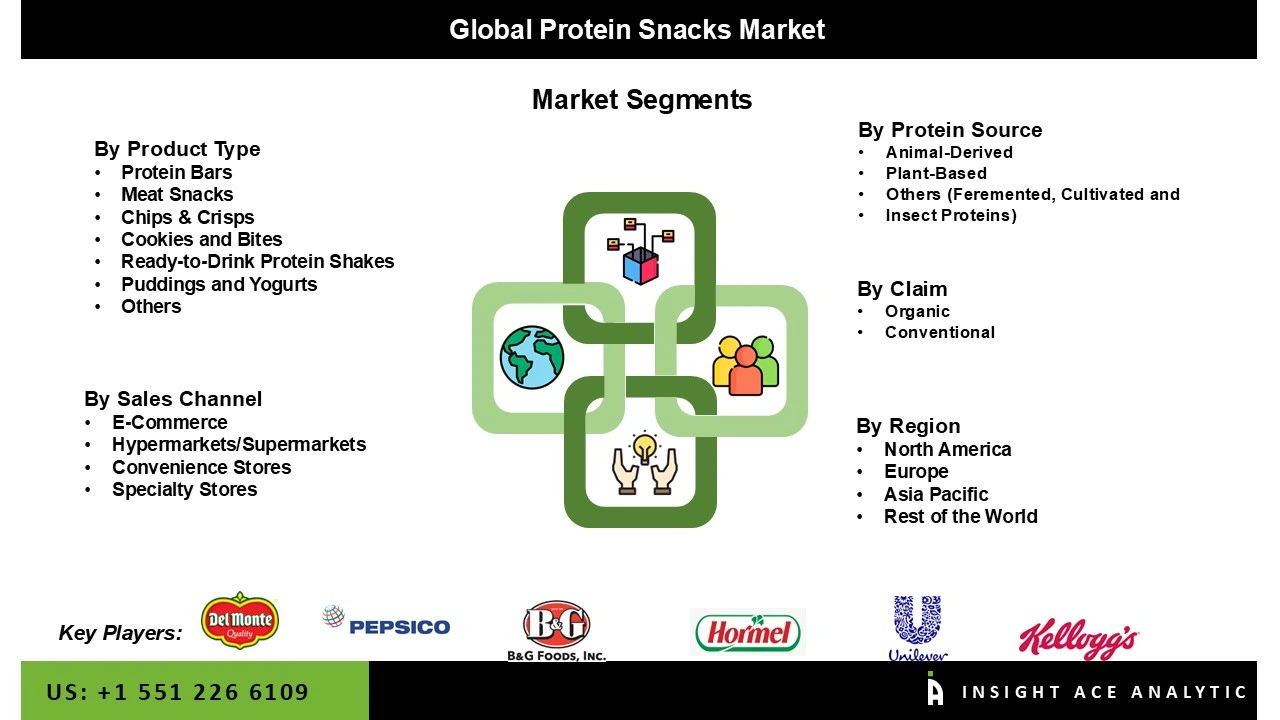

The Protein Snacks market is segmented on the product type and sales channel. Based on product type, the market is segmented into Protein Bars, Protein Cookies, Protein Flakes, Jerky, Granola, Yogurt, Protein Frinks and Others. Based on sales channel, Protein Snacks are segmented into E-commerce, Hypermarkets/Supermarkets, Convenience Stores and Specialty Stores.

In revenue share in 2021, the segment for protein bars came in first. This is due to consumers' growing preference for portable convenience foods. Additionally, the continued popularity of fitness trends drives demand for protein bars. This results from customers choosing these wholesome goods that can offer a balanced diet as part of weight management programs. Additionally, protein bars, rather than completing meals, boost daily protein intake while lowering calorie intake from unneeded sources, increasing the number of vital proteins and nutrients and, in turn, boosting market revenue growth.

In 2021, the E-commerce segment contributed a sizeable portion of total income. Since they recognize channel potential, manufacturers are opening online storefronts to meet consumer wants better while boosting profit margins. To accommodate the increase in e-commerce demand, companies that operate as sales channels, such as Amazon, Walmart, NuGO Natures Basket, and many more, have grown their direct-to-consumer businesses. Due to COVID-19's stay-at-home orders, which lasted for about a year and a half, e-commerce stores have become a viable choice for most purchase types worldwide.

The North American Protein Snacks market is expected to register the highest market share in revenue in the near future. As consumers' attention has switched to eating wholesome snacks to reduce the health hazards associated with excessive unhealthy snacking, the market for protein snacks is anticipated to increase in the United States. Convenience stores are collaborating with delivery firms to strengthen their online presence. To reach a larger worldwide audience and increase consumer awareness of the benefits of the products, businesses are showcasing their product lines on e-commerce sites other than retail institutions, which is predicted to increase sales of protein snacks. In addition, Asia Pacific is projected to grow rapidly in the global Protein Snacks market. This region's sales of protein snacks are predicted to rise due to the rising awareness of the advantages of healthy snacking and the influence of the western lifestyle. The popularity of protein snacks is anticipated to increase due to ongoing research and development efforts to steadily improve the flavour and texture of protein-based food products while keeping the pricing low. Therefore, it is projected that the availability of worldwide brands in the regional market and the rise of new essential players in this region will drive up demand for protein snacks.

| Report Attribute | Specifications |

| Market Size Value In 2024 | USD 24.0 Bn |

| Revenue Forecast In 2034 | USD 74.1 Bn |

| Growth Rate CAGR | CAGR of 12.1% from 2025 to 2034 |

| Quantitative Units | Representation of revenue in US$ Mn, and CAGR from 2025 to 2034 |

| Historic Year | 2021 to 2024 |

| Forecast Year | 2025-2034 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | Product Type, Protein Source, Claims and Sales Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Arla Foods amba, B&G Foods, Inc., Bolthouse Farms, Inc., Clif Bar & Company, Chobani, LLC, Conagra Brands, Inc., Danone S.A., Del Monte Foods, Inc., General Mills Inc., Hormel Foods Corporation, Kellanova, Kellogg Co., Link Snacks Inc., Mars, Incorporated, Mondelez International, Naturell India Pvt. Ltd., Nestle S.A., PepsiCo Inc., Simply Good Foods Company, The Coca-Cola Company, THG PLC, Vitamin Well Group, Wilde Brands, Unilever, Other |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Protein Snacks Market By Product Type-

Protein Snacks Market By Protein Source-

Protein Snacks Market By Claim-

Protein Snacks Market By Sales Channel-

Protein Snacks Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.