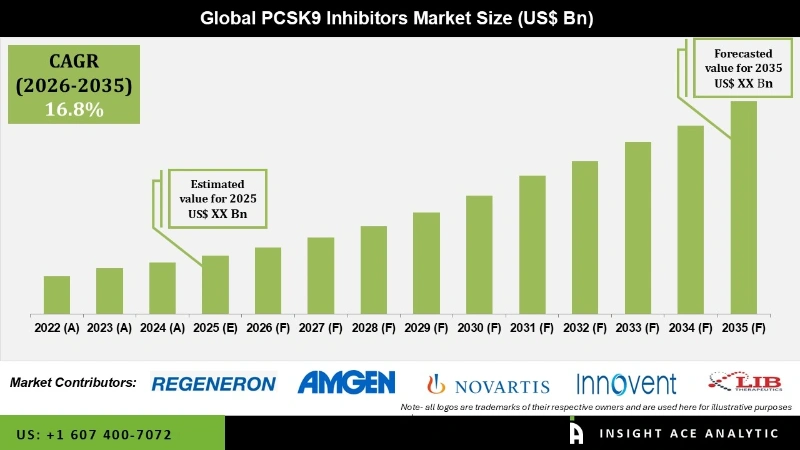

Global PCSK9 Inhibitors Market is expected to grow at a 16.8% CAGR during the forecast period for 2026 to 2035.

PCSK9 Inhibitors Market Size, Share & Trends Analysis Report By Product Type (Repatha (Evolocumab), Praluent (Alirocumab), Bococizumab, Others), By Application (Clinical Application, Drug Development, Other), By Region, And By Segment Forecasts, 2026 to 2035.

Key Industry Insights & Findings from the Report:

Low-density lipoprotein (LDL) receptor degradation is controlled by the proprotein convertase subtilisin/Kexin type 9 serine protease (PCSK9), which reduces the clearance of circulating LDL particles. PCSK9 inhibitors have been developed as a consequence of controlling PSCK9 levels. LDL clearance from the blood is inhibited by PCSK9's attachment to low-density lipoprotein receptors (LDLRs), which causes blood levels of LDL to increase. The PCSK9 enzyme is now inhibited with the use of a PCSK9 inhibitor, which increases the number of LDL receptors that can remove LDL from circulation.

Due to a number of factors, comprising an increase in global healthcare spending, a rise in statin resistance among patients with familial hypercholesterolemia, an increase in the risk of cardiovascular diseases like myocardial infarction and coronary revascularization, etc., the PCSK9 Inhibitors market dynamics are anticipated to change in the upcoming years. The market for PCSK9 Inhibitors will grow significantly if PCSK9 inhibition is used as a preventative approach to reduce the burden of CVD. The market for PCSK9 inhibitors is also expected to expand due to the effects of these drugs in new therapeutic fields.

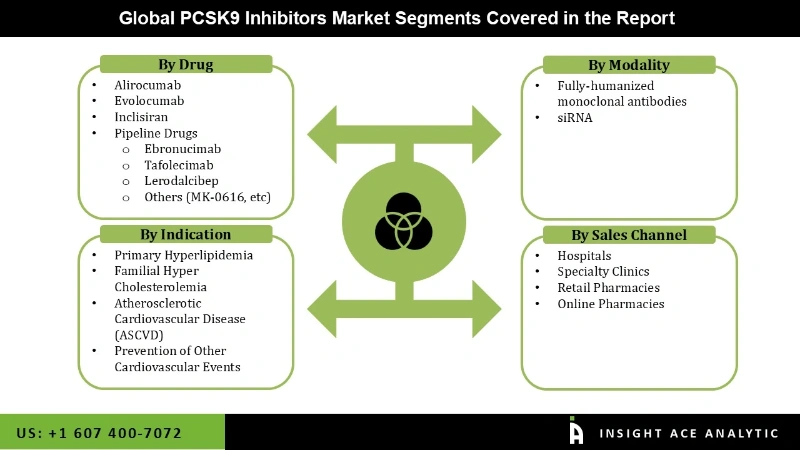

Despite the fact that monoclonal antibodies have shown to be the most therapeutically effective PCSK9 inhibitors, additional novel medications are now undergoing various phases of research and will soon be on the market for PCSK9 inhibitors.

The PCSK9 Inhibitors Market is segmented based on Drug, Modality, Indication and Sales Channel. The Drug Segment comprises Alirocumab, Evolocumab, Inclisiran, Pipeline Drugs (Ebronucimab, Tafolecimab, Lerodalcibep, Others (MK-0616, etc))). The Modality segment includes Fully-humanized monoclonal antibodies, siRNA. The Indication segment categorises into Primary Hyperlipidemia, Familial Hyper Cholesterolemia, Atherosclerotic Cardiovascular Disease (ASCVD), and Prevention of Other Cardiovascular Events. By Sales Channel, the market is segmented into Hospitals, Specialty Clinics, Retail Pharmacies, Online Pharmacies.

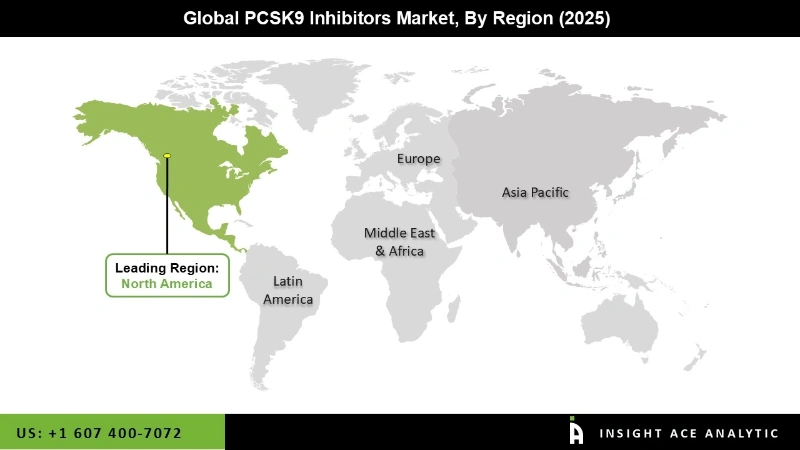

North America is likely to account for a substantial portion of the global PCSK9 inhibitors market during the forecast period because of the presence of well-established enterprises producing and marketing PCSK9 inhibitors. According to the US Department of Health and Human Services, around 805,000 Americans have a heart attack each year. This highlights the importance of medications like PCSK9 inhibitors in lowering cholesterol and preventing heart disease at an early stage. The region's high prevalence of cardiovascular illnesses, combined with new product releases, will drive PCSK9 inhibitor growth in the region. Furthermore, expanding R&D activities and increased awareness and prevalence of risk factors such as diabetes in the general population are expected to drive the North American market during the forecast period.

| Report Attribute | Specifications |

| Growth Rate CAGR | CAGR of 16.8% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Mn, and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Drug, Modality, Indication and Sales Channel |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; South East Asia |

| Competitive Landscape | Amgen, Eli Lilly, Sanofi, Pfizer, Novartis, Roche, Merck, Alnylam, AstraZeneca, Affiris, BMS, Ionis Pharmaceuticals, Cyon Therapeutics, and Daiichi Sankyo |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

PCSK9 Inhibitors Market By Drug

PCSK9 Inhibitors MarketBy Modality

PCSK9 Inhibitors MarketBy Indication

PCSK9 Inhibitors MarketBy Sales Channel

PCSK9 Inhibitors Market By Region-

North America-

Europe-

Asia-Pacific-

Latin America-

Middle East & Africa-

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.