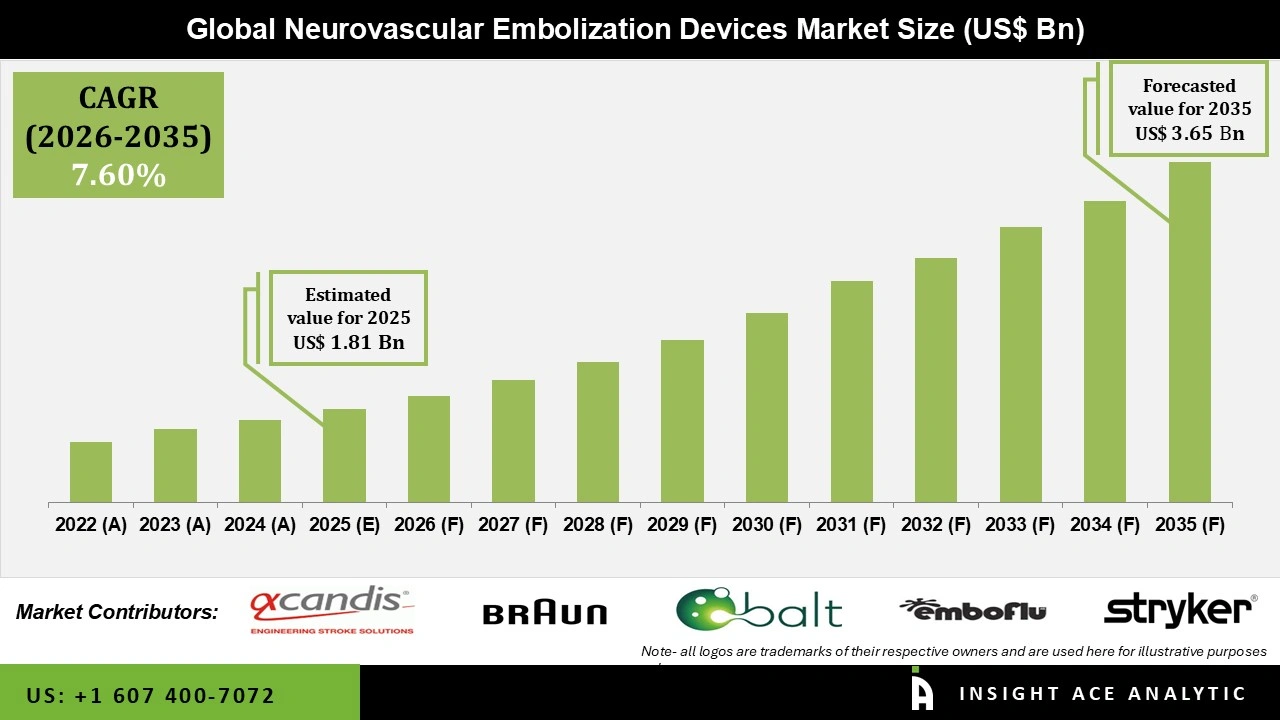

Gloabal Neurovascular Embolization Devices Market Size is valued at USD 1.81 Billion in 2025 and is predicted to reach USD 3.65 Billion by the year 2035 at a 7.6% CAGR during the forecast period for 2026 to 2035.

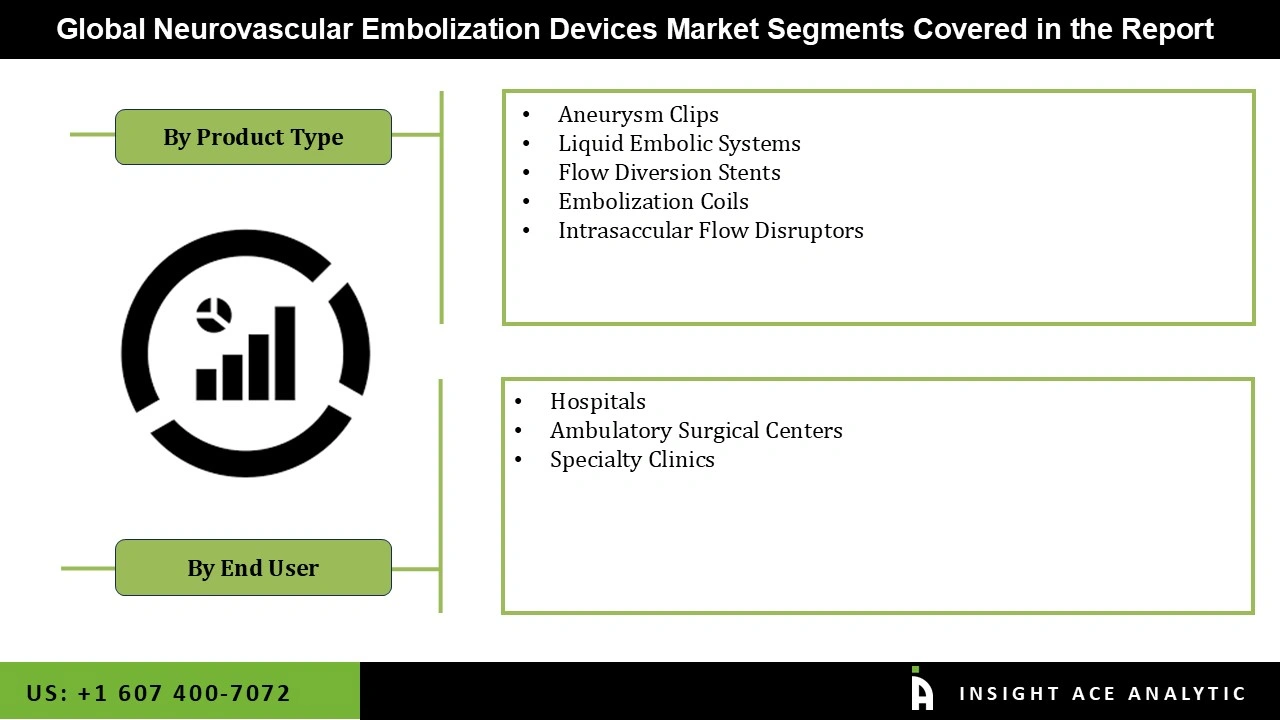

Neurovascular Embolization Devices Market Size, Share & Trends Analysis Report By Product Type (Aneurysm Clips, Liquid Embolic Systems, Flow Diversion Stents, Embolization Coils, Intrasaccular Flow Disruptors), By End-User, By Region, and By Segment Forecasts, 2026 to 2035.

These coils are prescription equipment implanted into the aneurysm sac by a physician to block blood flow and promote thrombosis. Since coil-treated aneurysms may have residual filling or recur, placing the patient at risk for late hemorrhage, follow-up imaging is done when post-procedure is required. Digital Subtraction Angiography (DSA) was traditionally the method used after coiling to imagine aneurysms. However, since improvements in image clarity and usability of MRA, many health care providers can opt to use MRA instead of DSA, so patients are not vulnerable to an embolic stroke or ionizing radiation hazards.

With the help of embolization coils and liquid embolic systems, healthcare companies in the neurovascular embolization devices (neurology) market have successfully laid a solid foundation for treatment options. However, with some health problems, such as wide-neck bifurcated aneurysms, specific therapeutic methods pose particular difficulties. Manufacturers are introducing monotherapy saccular implants to overcome this challenge. Centered on the same principle, healthcare companies are designing Woven EndoBridge (WEB) aneurysm embolization solutions in the neurovascular embolization devices (neurology) industry that resolve the complications associated with coil-assist devices and surgical clippings.

The neurovascular embolization devices market is a segment based on product type, end-user, and geography. In terms of product type, the global market is segregated into aneurysm clips, liquid embolic systems, flow diversion stents, embolization coils, and intravascular flow disruptors. The embolization coils product segment is expected to dominate the global neurovascular embolization devices (neurology) during the forecast period. The rapid acceptance and growing demand for embolization coils, since they are one of the oldest recognized embolization instruments, and well-trained interventional radiologists in conducting embolization procedures with these instruments since opposed to others, make them essential for specific embolization procedures.

Based on end-user, the global neurovascular embolization devices market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. Globally, the increase in the prevalence of stroke is projected to drive the global market for neurovascular embolization devices (neurology) during the forecast period. About 33 million people globally suffer from stroke, according to WHO, last year. In comparison, in low- and middle-income economies, 70 per cent of stroke and 87% of stroke-related injuries and mortalities exist. In addition, stroke incidence rates in low- and middle-income countries have more than doubled in the last four decades. Stroke is the second-largest cause of mortality and the third-largest cause of disability worldwide. The increase in prevalence and burden of stroke will drive the need for surgery, which is expected to accelerate the growth of the global market for neurovascular embolization devices (neurology) in the coming years.

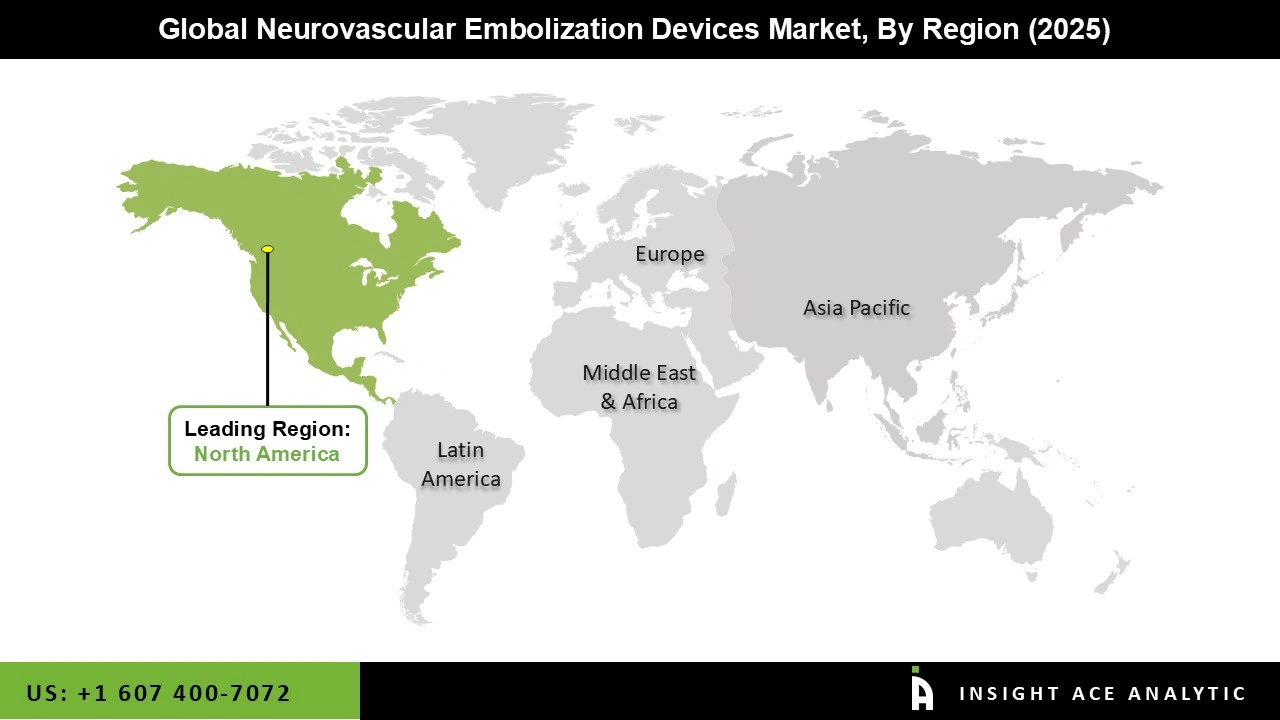

Based on geography, the global neurovascular embolization devices market has been segmented into North America, Asia Pacific, Latin America, Europe, and Middle East & Africa. In terms of revenue, over the forecast period, North America is expected to account for a leading share of the global market for neurovascular embolization devices (neurology), owing to a rise in occurrence levels of neurovascular diseases, especially brain aneurysm, in the United States. According to the Brain Aneurysm Foundation, the brain aneurysm has been unbroken by 1 in 50 people, or 6 million individuals in the U.S. Every year around 30,000 people in the country suffer from rupture of cerebral aneurysm. That, in turn, is expected to drive the country’s demand for neurovascular embolization devices (neurology).

The Asia Pacific demand for neurovascular embolization devices (neurology) is expected to expand at a fast pace in the near future. Given the high prevalence of cerebrovascular disorders, unhealthy lifestyle choices such as smoking, bad diets, and high incidence of diabetes and hypertension, India and China are projected to be attractive markets during the forecast period,

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 1.81 Billion |

| Revenue Forecast In 2035 | USD 3.65 Billion |

| Growth Rate CAGR | CAGR of 7.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Billion, volume (units) and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Product Type, By End-User |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico ;The UK; France; Italy; Spain; China; Japan; India; South Korea; South East Asia; South Korea; South East Asia |

| Competitive Landscape | Acandis GmBH, B. Braun, BALT Extrusion, Emboflu, Stryker, Johnson & Johnson (Cerenovus), KLS Martin, Medtronic Plc, Mizuho Medical, Peter Lazic GmBH, Phenox GmBH, Spartan Micro, Terumo Corporation (MicroVention) among others. |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Particular Geographic competitive landscape. |

| Pricing And Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.