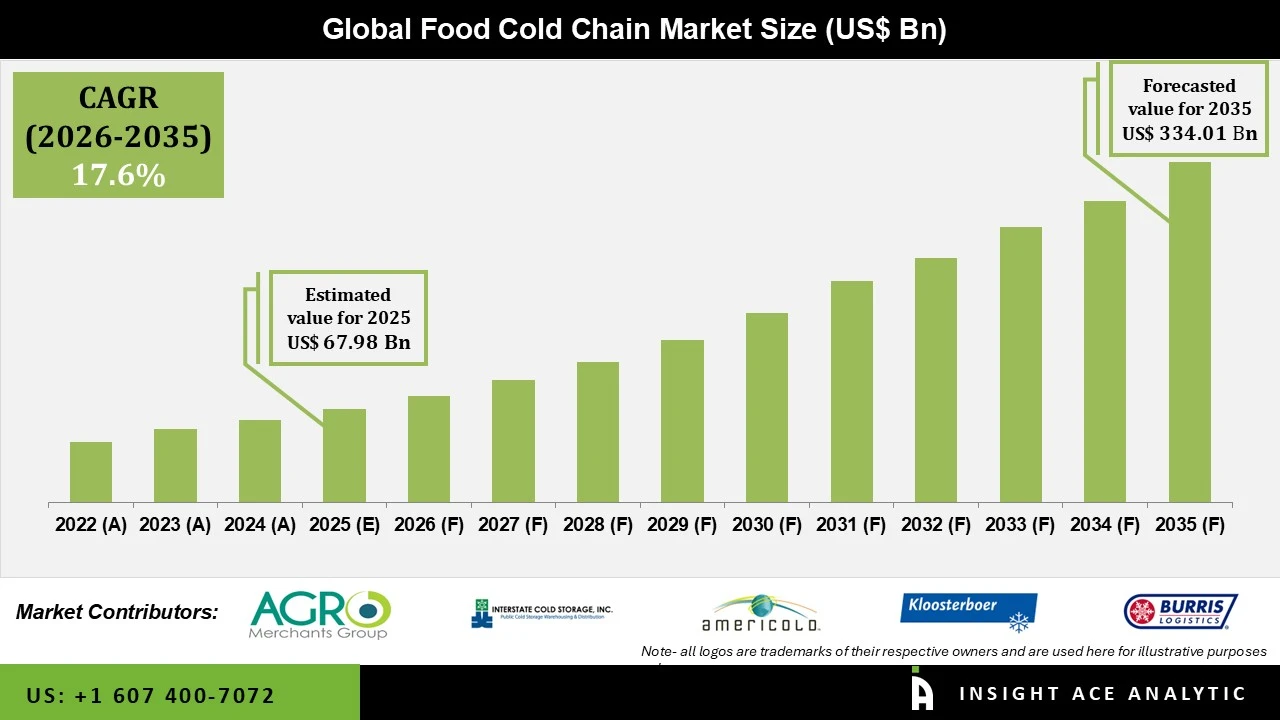

Food Cold Chain Market Size is valued at US$ 67.98 Bn in 2025 and is predicted to reach US$ 334.01 Bn by the year 2035 at an 17.6% CAGR during the forecast period for 2026 to 2035.

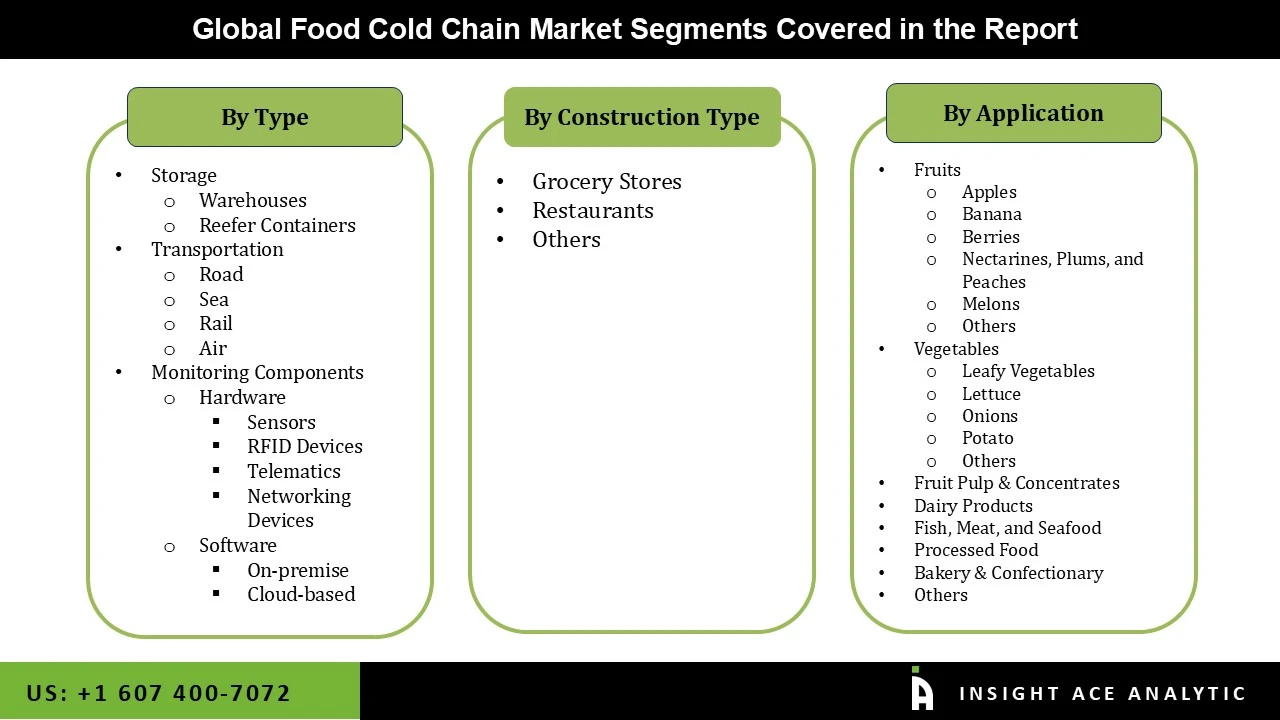

Food Cold Chain Market Size, Share & Trends Analysis Distribution By Type (Storage, Transportation, Monitoring Components), By Construction Type (Grocery Stores, Restaurants), By Application (Fruits, Vegetables, Fruit Pulp & Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Bakery & Confectionary, Others), By Region, and Segment Forecasts, 2026 to 2035

Key Industry Insights & Findings from the Report:

The cold chain is a valuable method for protecting temperature-sensitive commodities during transport by using refrigerated and thermal packaging. The global food and beverage industry commonly uses the cold chain to protect products against thermal deterioration. Due to growing consumer knowledge, diets high in protein replace those high in carbohydrates in developing economies. Due to a shift in the economy that consumers are driving, nations like China are predicted to show a strong growth rate in the upcoming years. The market is projected to rise in developing countries due to increasing technological developments in refrigerated transportation and warehouse management.

Additionally, rising government subsidies have allowed service providers to enter these burgeoning markets with creative transportation-related solutions. Cold chain services are designed for products that need to be transported and stored under optimal temperatures. The growth of retail chains in supermarkets, hypermarkets, and convenience stores is one of the main factors affecting the development of the cold chain business. As a result of the expansion of retail chains, some producers now have their own internal chilled storage facilities. Ample food retail chains are expanding their shops in developed countries like the UK, the US, and Germany, as well as emerging economies like China, Brazil, and Argentina.

Furthermore, the advent of such large merchants and their expanding operations in international trade are creating market expansion potential for chilled warehousing and chilled transportation. Governments in various nations are attempting to reduce food and agricultural waste by setting legislation about food waste and providing support to businesses involved in the food industry, such as the cold chain sector. The e-commerce-based food and beverage delivery industry have seen a considerable increase due to the rising demand for perishable goods and the need for quick delivery.

The food cold chain market is segmented by type, construction type, application. By type, the market is segmented into storage, transportation, and monitoring component. storage is sub segmented into warehouses and reefer containers. Transportation is sub segmented into road, sea, rail, air. Monitoring component is sub segmented into hardware (sensors, RFID devices, telematics, networking devices) and software (on-premise, cloud-based). By construction type market is segmented into grocery stores, restaurants, others. By application market is segmented into fruits, vegetables, fruit pulp & concentrates, dairy products, fish, meat, and seafood, processed food, bakery & confectionary, others. Fruits is sub segmented into apples, banana, berries, nectarines, plums, peaches, melons, others. Vegetables is sub segmented into leafy vegetables, lettuce, onions, potato, and others.

The storage segment—particularly cold storage facilities and refrigerated warehousing—is at the forefront of the Food Cold Chain Market as it is the backbone of food logistics, maintaining safe storage of perishables. Increased demand for fresh, organic, and ready-to-eat foods, combined with the online grocery and meal delivery boom, has fueled the demand for increased, accurate cold storage. Operators are investing in capacity, embracing automation, energy-efficient systems, and sustainability initiatives to increase efficiency, transparency, and resilience in managing increasing food volumes.

The grocery stores segment is witnessing robust growth in the Food Cold Chain Market as a result of increasing consumer demand for perishables such as fresh produce, dairy, meat, and frozen foods, all of which need dependable temperature control. Growth in organized retail and supermarket chains, especially in emerging markets, is fueling investments in in-store cold storage and refrigeration. Moreover, the growth of online grocery shopping and e-commerce has increased the demand for effective cold chain logistics to preserve freshness from warehouse to doorstep. In order to fulfill these requirements, grocery retailers are implementing state-of-the-art refrigeration systems, automated storage, and IoT-based monitoring to improve temperature management and reduce spoilage.

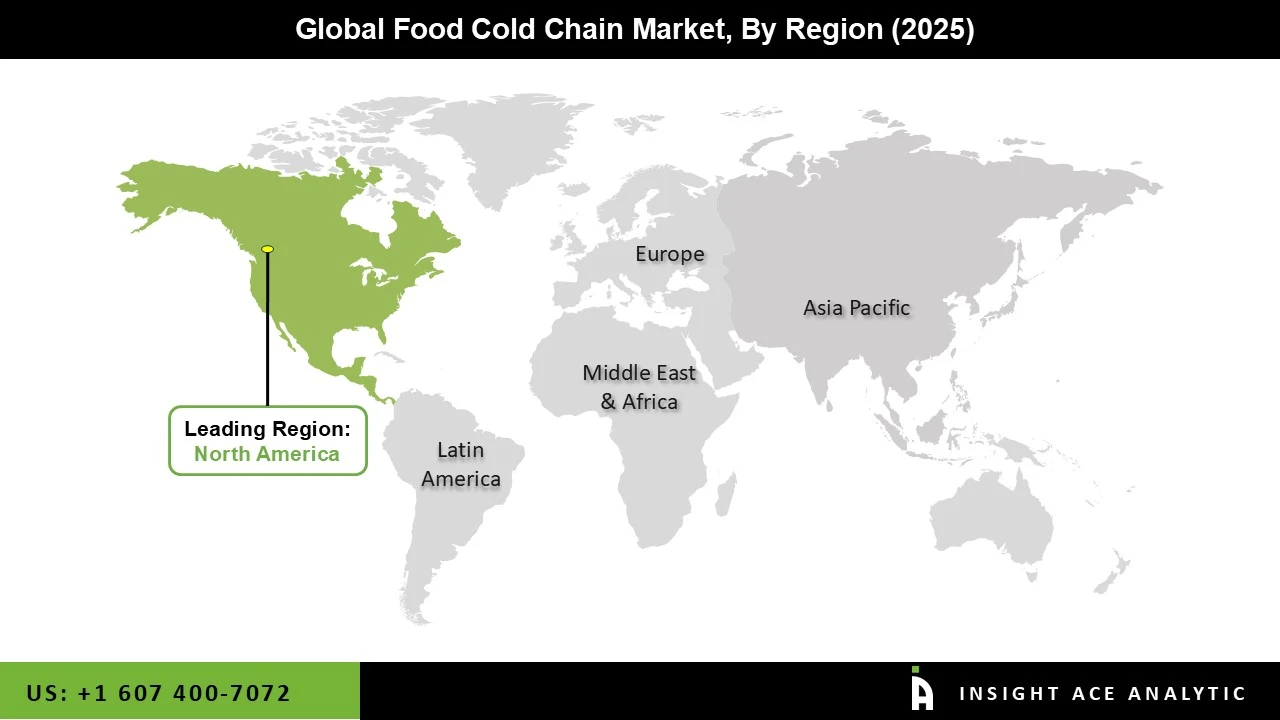

North America dominates the Food Cold Chain Market due to high demand from consumers, advanced infrastructure, and supportive regulation. Increased consumption of frozen and processed food products, e.g., ready meals, vegetarian dishes, and out-of-season supply of seasonal products—has boosted the demand for strong cold chains. The rise in organized retail and burgeoning e-commerce only fuels this demand further, particularly in ensuring product integrity during the last-mile delivery. Moreover, North America leads in the use of advanced technologies such as automation, IoT-based tracking, and RFID monitoring, which improve efficiency, traceability, and regulatory compliance throughout the cold chain network.

| Report Attribute | Specifications |

| Market Size Value In 2025 | USD 67.98 Bn |

| Revenue Forecast In 2035 | USD 334.01 Bn |

| Growth Rate CAGR | CAGR of 17.6% from 2026 to 2035 |

| Quantitative Units | Representation of revenue in US$ Bn and CAGR from 2026 to 2035 |

| Historic Year | 2022 to 2025 |

| Forecast Year | 2026-2035 |

| Report Coverage | The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

| Segments Covered | By Type, Construction Type, Application and By Region |

| Regional Scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country Scope | U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico; France; Italy; Spain; South Korea; Southeast Asia; |

| Competitive Landscape | Americold Logistics LLC, Agro Merchant Group, Burris Logistics, Inc., Henningsen Cold Storage Company, Lineage Logistics, LLC, Nordic Logistics, Preferred Freezer, Wabash National, Cold Chain Technologies, Inc., Cryopak Industries Inc., Creopack, Cold Box Express, Inc., Intelsius, Nilkamal Limited, Sofrigam, Softbox Systems Ltd., Sonoco ThermoSafe, Valor Industries, va Q tec AG |

| Customization Scope | Free customization report with the procurement of the report, Modifications to the regional and segment scope. Geographic competitive landscape. |

| Pricing and Available Payment Methods | Explore pricing alternatives that are customized to your particular study requirements. |

Food Cold Chain Market by Type -

Food Cold Chain Market by Construction Type -

Food Cold Chain Market by Application -

Global Food Cold Chain Market, by Region,

Global Food Cold Chain Market, by Region,

North America Food Cold Chain Market, by Country,

Europe Food Cold Chain Market, by Country,

Asia Pacific Food Cold Chain Market, by Country,

Latin America Food Cold Chain Market, by Country,

Middle East & Africa Food Cold Chain Market, by Country,

This study employed a multi-step, mixed-method research approach that integrates:

This approach ensures a balanced and validated understanding of both macro- and micro-level market factors influencing the market.

Secondary research for this study involved the collection, review, and analysis of publicly available and paid data sources to build the initial fact base, understand historical market behaviour, identify data gaps, and refine the hypotheses for primary research.

Secondary data for the market study was gathered from multiple credible sources, including:

These sources were used to compile historical data, market volumes/prices, industry trends, technological developments, and competitive insights.

Primary research was conducted to validate secondary data, understand real-time market dynamics, capture price points and adoption trends, and verify the assumptions used in the market modelling.

Primary interviews for this study involved:

Interviews were conducted via:

Primary insights were incorporated into demand modelling, pricing analysis, technology evaluation, and market share estimation.

All collected data were processed and normalized to ensure consistency and comparability across regions and time frames.

The data validation process included:

This ensured that the dataset used for modelling was clean, robust, and reliable.

The bottom-up approach involved aggregating segment-level data, such as:

This method was primarily used when detailed micro-level market data were available.

The top-down approach used macro-level indicators:

This approach was used for segments where granular data were limited or inconsistent.

To ensure accuracy, a triangulated hybrid model was used. This included:

This multi-angle validation yielded the final market size.

Market forecasts were developed using a combination of time-series modelling, adoption curve analysis, and driver-based forecasting tools.

Given inherent uncertainties, three scenarios were constructed:

Sensitivity testing was conducted on key variables, including pricing, demand elasticity, and regional adoption.